🔎 $RTP/@hippo_insurance: SaaS harnessing AI to revolutionize the home insurance industry 🦛🏠

- Everything you need to know

- One-stop-shop for all things smart/connected home

- Higher growth & revenue than closest public competitor $LMND/@Lemonade_Inc

Time for a thread 🧵⬇️

- Everything you need to know

- One-stop-shop for all things smart/connected home

- Higher growth & revenue than closest public competitor $LMND/@Lemonade_Inc

Time for a thread 🧵⬇️

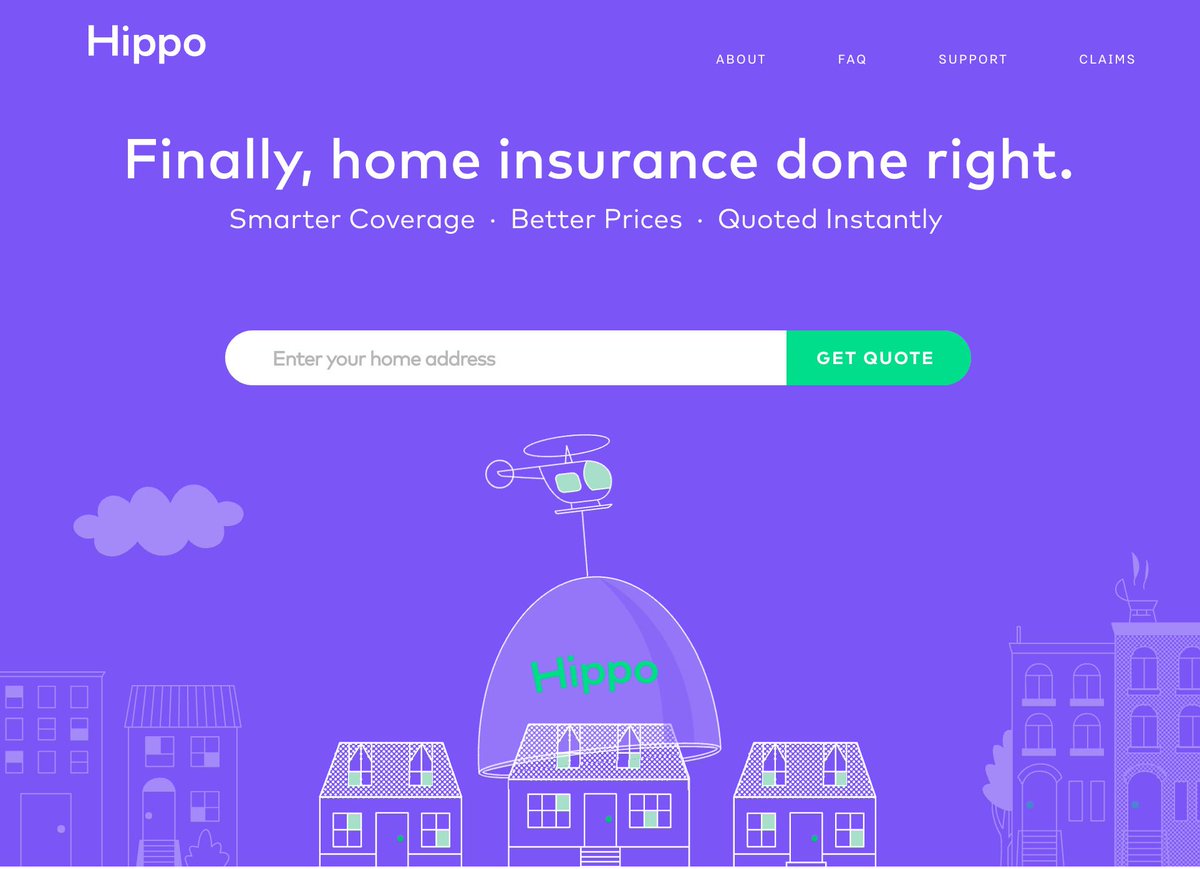

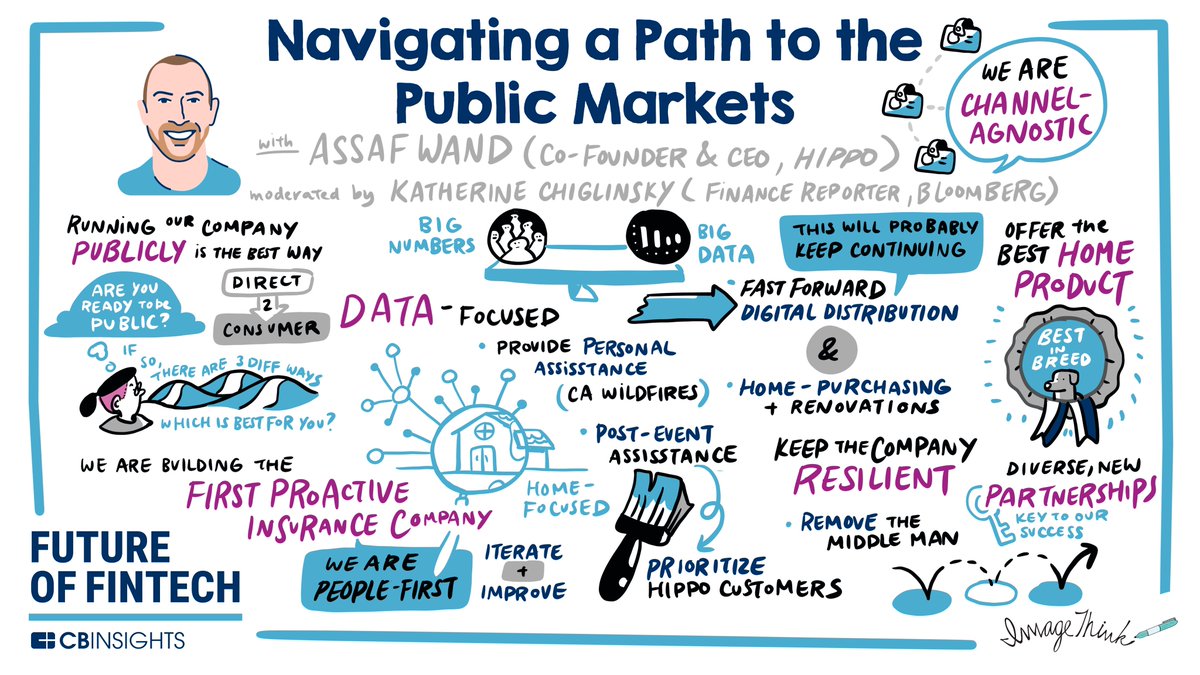

Hippo was founded in 2015 by Assaf Wand, an ex-McKinsey consultant and Eyal Navon, serial entreprenuer and software engineer.

Wand's interest in insurance was inspired by his father's lengthy career in the "antiquated" insurance industry. $RTP

Wand's interest in insurance was inspired by his father's lengthy career in the "antiquated" insurance industry. $RTP

After two years of R&D, fundraising, and product development, Hippo launched in April 2017 in California.

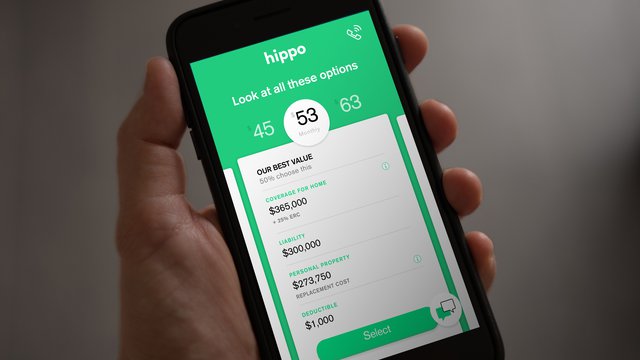

The company's marketing was centered on the delivery of a 60-sec quote for insurance policies, transparent process, and smart home integration.

techcrunch.com/2017/04/26/sta… $RTP

The company's marketing was centered on the delivery of a 60-sec quote for insurance policies, transparent process, and smart home integration.

techcrunch.com/2017/04/26/sta… $RTP

By March 2019, with Hippo insurance available to more than 50% of the homeowners in the US, the company reported a 25% month-over-month sales growth and total insured property value of more than $50 billion, with a 93% customer retention rate.

statesman.com/news/20190405/… $RTP

statesman.com/news/20190405/… $RTP

Hippo is going after a slightly different market. Most of the new insurance companies have pitched services to renters and city dwellers made up of the mostly millennial demographic, while Hippo is aiming its services squarely at homeowners. $RTP

fastcompany.com/90124021/what-…

fastcompany.com/90124021/what-…

Hippo not only uses its technology to optimize pricing for potential policyholders, but offers tech-enabled devices like leak detectors & other IOT tools to monitor homes and ensure their upkeep. They also use thermal & satellite imagery to help track changes to properties. $RTP

Their 60-second quoting application is a drastic improvement over industry giants like State Farm, Liberty, Geico, which can require 126 questions to get a quote.

Hippo offers a more comprehensive package than most standard home insurance policies. $RTP

Hippo offers a more comprehensive package than most standard home insurance policies. $RTP

https://twitter.com/k_cardinalli/status/1308539299306987521

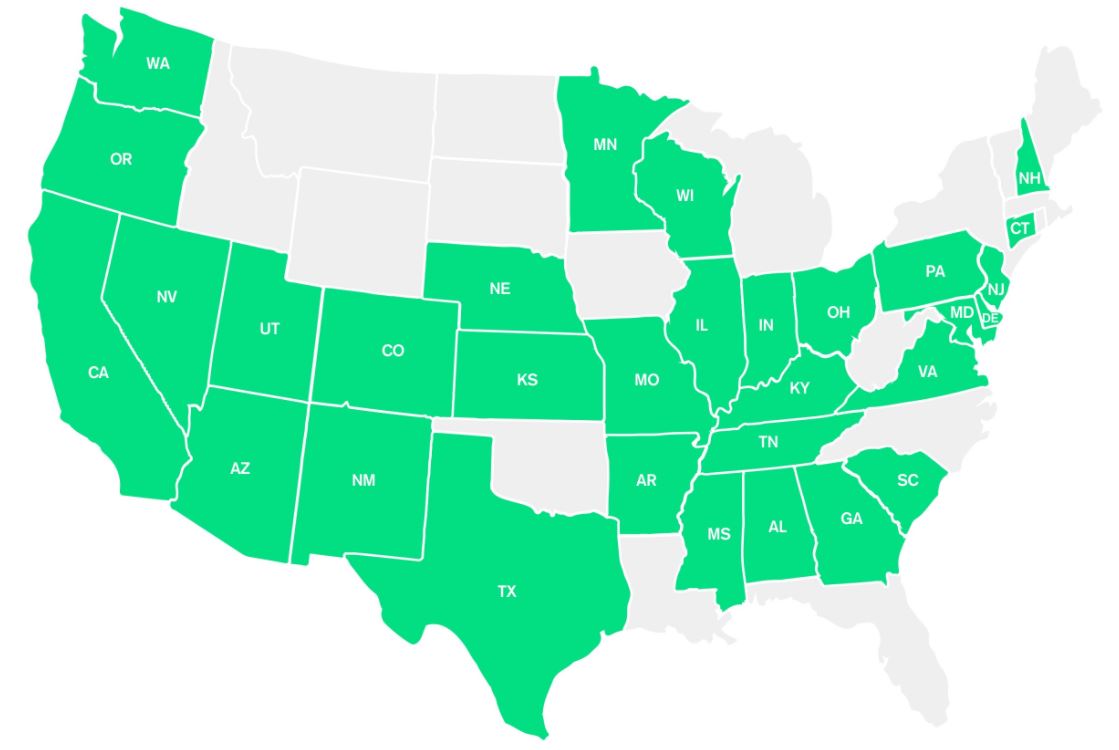

While Hippo offers features to its coverage that are hard to find, it currently only provides insurance in 31 states. Among the states not covered are Florida, Louisiana, New York, and Oklahoma.

More room for further growth! $RTP

More room for further growth! $RTP

Hippo's growth has been explosive over the past two years, which is seen from the fundraising rounds they've held.

Nov 2018: Hippo raised $70m

July 2019: Hippo raised $100m

July 2020: Hippo raised $150m

Nov 2020: Hippo raised $350m

reuters.com/article/us-hip… $RTP

Nov 2018: Hippo raised $70m

July 2019: Hippo raised $100m

July 2020: Hippo raised $150m

Nov 2020: Hippo raised $350m

reuters.com/article/us-hip… $RTP

Hippo intends to use the latest round of fundraising (+ goig public) to roll out in new states, helping Hippo get to its goal of reaching 95 percent of U.S. homeowners in 2021.

They currently offer insurance products to more than 70 percent of homeowners in the country. $RTP

They currently offer insurance products to more than 70 percent of homeowners in the country. $RTP

November 2020:

“The opportunities that stand before us are so vast and so big we wanted to double down,” said co-founder and CEO Assaf Wand. $RTP

“The opportunities that stand before us are so vast and so big we wanted to double down,” said co-founder and CEO Assaf Wand. $RTP

Hippo's investors include:

FinTLV Ventures, Ribbit, Dragoneer, Innovius Capital, Bond, Comcast Ventures, Felicis Ventures, Fifth Wall, Horizons Ventures, ICONIQ, Lennar Corp., Pipeline Capital, Propel Venture Partners, RPM Ventures, Standard Industries and Zeev Ventures. $RTP

FinTLV Ventures, Ribbit, Dragoneer, Innovius Capital, Bond, Comcast Ventures, Felicis Ventures, Fifth Wall, Horizons Ventures, ICONIQ, Lennar Corp., Pipeline Capital, Propel Venture Partners, RPM Ventures, Standard Industries and Zeev Ventures. $RTP

The company has been doing heavy M&A/partnerships activity in 2019/20.

June 2019: Hippo Partners with Xfinity to Expand Reach Across the U.S.

medium.com/comcast-ventur…

June 2019: Hippo Partners with Xfinity to Expand Reach Across the U.S.

medium.com/comcast-ventur…

The company has been doing heavy M&A/partnerships activity in 2019/20.

Nov 2019: Hippo acquired Sheltr to to beef up its digital home insurance services for clients, with Sheltr's enabled services designed to provide home wellness checkups.

carriermanagement.com/news/2019/11/2… $RTP

Nov 2019: Hippo acquired Sheltr to to beef up its digital home insurance services for clients, with Sheltr's enabled services designed to provide home wellness checkups.

carriermanagement.com/news/2019/11/2… $RTP

March 2020: Hippo and SimpliSafe announced a partnership that will provide homeowners more options when it comes to protecting their homes to include professionally monitored devices from SimpliSafe, which protects more than 3 million people today.

coverager.com/hippo-partners… $RTP

coverager.com/hippo-partners… $RTP

June 2020: Hippo acquired Spinnaker Insurance to expand the geographical reach of its modern home insurance policies, which also include smart home monitoring kits.

carriermanagement.com/news/2020/06/0… $RTP

carriermanagement.com/news/2020/06/0… $RTP

Nov 2020: Hippo partners with Kangaroo to provide home security options.

The partnership expands the suite of smart device kits available within Hippo’s smart home program to include a self-monitored smart home security kit from Kangaroo.

iireporter.com/hippo-partners… $RTP

The partnership expands the suite of smart device kits available within Hippo’s smart home program to include a self-monitored smart home security kit from Kangaroo.

iireporter.com/hippo-partners… $RTP

Nov 2020: Hippo partners with Sumitomo Mitsui (Japanese insurance giant).

Sumitomo Mitsui is looking to tap the "insurtech" startup's expertise in artificial intelligence to help policyholders minimize damages from fires and other disasters.

asia.nikkei.com/Business/Compa… $RTP

Sumitomo Mitsui is looking to tap the "insurtech" startup's expertise in artificial intelligence to help policyholders minimize damages from fires and other disasters.

asia.nikkei.com/Business/Compa… $RTP

Hippo CEO: More Than Just Insurance, We Want To Be The ‘1-800 Number’ For The Home

"Looking ahead for 2021, Wand said, Hippo will “deepen” its presence inside the home, with an eye, perhaps, on appliance warranties and even payments."

pymnts.com/real-estate/20… $RTP

"Looking ahead for 2021, Wand said, Hippo will “deepen” its presence inside the home, with an eye, perhaps, on appliance warranties and even payments."

pymnts.com/real-estate/20… $RTP

Hippo was #8 in Forbes Top 10 US-Based AI Companies for 2019.

"This information is then used to by their AI system to preemptively answer questions that otherwise would be asked by the insurance specialist."

forbes.com/sites/jilliand…

"This information is then used to by their AI system to preemptively answer questions that otherwise would be asked by the insurance specialist."

forbes.com/sites/jilliand…

Hippo was one of 6 insurtech companies that made the Forbes Fintech 50 in 2020

forbes.com/sites/ashleaeb… $RTP

forbes.com/sites/ashleaeb… $RTP

Hippo is ranked in the top 5 best homeowners insurance companies in 2021 by Nerd Wallet.

The list includes giants such as Nationwide, State Farm, Amica, Chubb and more.

nerdwallet.com/blog/insurance… $RTP

The list includes giants such as Nationwide, State Farm, Amica, Chubb and more.

nerdwallet.com/blog/insurance… $RTP

Hippo vs Lemonade $LMND

Gross written premium in 2019 (the value of insurance products sold, before certain deductions)

Hippo: $270 million (140% increase)

Lemonade: $116 million (148% increase)

techcrunch.com/2020/07/23/und… $RTP

Gross written premium in 2019 (the value of insurance products sold, before certain deductions)

Hippo: $270 million (140% increase)

Lemonade: $116 million (148% increase)

techcrunch.com/2020/07/23/und… $RTP

Hippo is on track reach over $100 million in revenue in the next year.

Lemonade 2020 Q3 Earnings: Expecting revenues of 91-93M$ and negative income

housingwire.com/articles/home-…

Lemonade 2020 Q3 Earnings: Expecting revenues of 91-93M$ and negative income

housingwire.com/articles/home-…

$LMND = $144 (MC $8.7bn)

$ROOT = $22 (MC 5.46bn)

$RTP = 13 (MC ????)

This article breaks down the competition quite well between Hippo, Lemonade $LMND, and Root $ROOT

seekingalpha.com/article/438684…

$ROOT = $22 (MC 5.46bn)

$RTP = 13 (MC ????)

This article breaks down the competition quite well between Hippo, Lemonade $LMND, and Root $ROOT

seekingalpha.com/article/438684…

Hippo isn't just an insurance company, it’s the all inclusive home platform that connects everything.

Insurance is just the way to get in/connected. Reid Hoffman isn’t an insurance guy, he builds new markets and finds verticals to scale even further.

sloanreview.mit.edu/article/using-…

Insurance is just the way to get in/connected. Reid Hoffman isn’t an insurance guy, he builds new markets and finds verticals to scale even further.

sloanreview.mit.edu/article/using-…

Disclaimer: Nothing contained in this thread should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific profit $RTP

• • •

Missing some Tweet in this thread? You can try to

force a refresh