I know this story first circulated a few days ago, but I want to point something interesting out (see thread)-

"Alex Rodriguez' SPAC Files For $500 Million IPO":

zerohedge.com/markets/alex-r…

"Alex Rodriguez' SPAC Files For $500 Million IPO":

zerohedge.com/markets/alex-r…

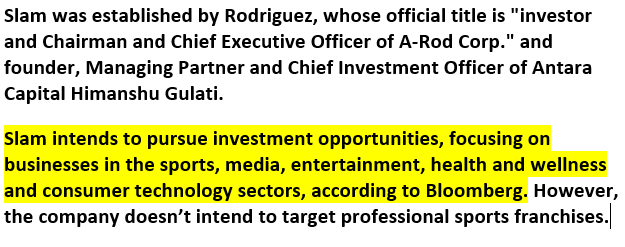

Notice the vague description of the potential business activities that A-Rod's "Slam" intends to pursue (see below).

I highly doubt that they've developed business plans for all those pursuits.

Who needs that when investors are just throwing you money?!

I highly doubt that they've developed business plans for all those pursuits.

Who needs that when investors are just throwing you money?!

The current SPAC bubble has many parallels with the South Sea Bubble of 1720: en.wikipedia.org/wiki/South_Sea…

During that bubble, countless companies were formed to raise capital for whimsical ventures. Many were frauds.

They were called "bubbles" (that's where the term comes from!)

During that bubble, countless companies were formed to raise capital for whimsical ventures. Many were frauds.

They were called "bubbles" (that's where the term comes from!)

Read more about these "bubble" companies that formed during the South Sea Bubble:

en.wikipedia.org/wiki/South_Sea…

en.wikipedia.org/wiki/South_Sea…

During the South Sea Bubble, there was even a company that raised capital "for carrying out an undertaking of great advantage, but nobody to know what it is"!

Uh, hello! What does that sound like? That's today's SPACs!

SPACs in 2020/2021 = Bubble Companies of 1720!

Uh, hello! What does that sound like? That's today's SPACs!

SPACs in 2020/2021 = Bubble Companies of 1720!

So, we're making many of the same mistakes that they made 300 years ago.

We don't learn! What is wrong with us?

We need to study history, people!

"Those who cannot remember the past are condemned to repeat it.” - George Santayana

We don't learn! What is wrong with us?

We need to study history, people!

"Those who cannot remember the past are condemned to repeat it.” - George Santayana

Make no mistake: a very high percentage of today's SPACs will prove to be malinvestments (i.e., will go kaput).

wiki.mises.org/wiki/Malinvest…

Everyone is being fooled by central banks and I'm sick of it.

I want all of you to wake up!!!

wiki.mises.org/wiki/Malinvest…

Everyone is being fooled by central banks and I'm sick of it.

I want all of you to wake up!!!

23-year-old trader bros are getting FOMO if they don't trade SPACs.

Those guys are a bunch of bone-heads. They're as dumb as a box of rocks. They don't know history.

They sure as hell have never heard of the South Sea Bubble of 1720!

Those guys are a bunch of bone-heads. They're as dumb as a box of rocks. They don't know history.

They sure as hell have never heard of the South Sea Bubble of 1720!

https://twitter.com/TheBubbleBubble/status/1356320741285896194?s=20

Global firms raise $546 billion in January as SPAC frenzy continues. That's an absolute disaster waiting to happen.

There's nothing good about that (it would be if we had sound money & no central banks, but that ain't the case).

There's nothing good about that (it would be if we had sound money & no central banks, but that ain't the case).

https://twitter.com/TheBubbleBubble/status/1357133738723995650

• • •

Missing some Tweet in this thread? You can try to

force a refresh