Global debt has soared to a record high.

The only reason why we're not in a full-blown global depression right now is because governments have binged even further on debt.

Don't be fooled by the soaring stock market; this is an extremely artificial environment.

$TLT $IEF

The only reason why we're not in a full-blown global depression right now is because governments have binged even further on debt.

Don't be fooled by the soaring stock market; this is an extremely artificial environment.

$TLT $IEF

Don't be fooled or impressed by our soaring stock market.

Instead of a sign of health, this is a sign of an extremely unhealthy artificial economy.

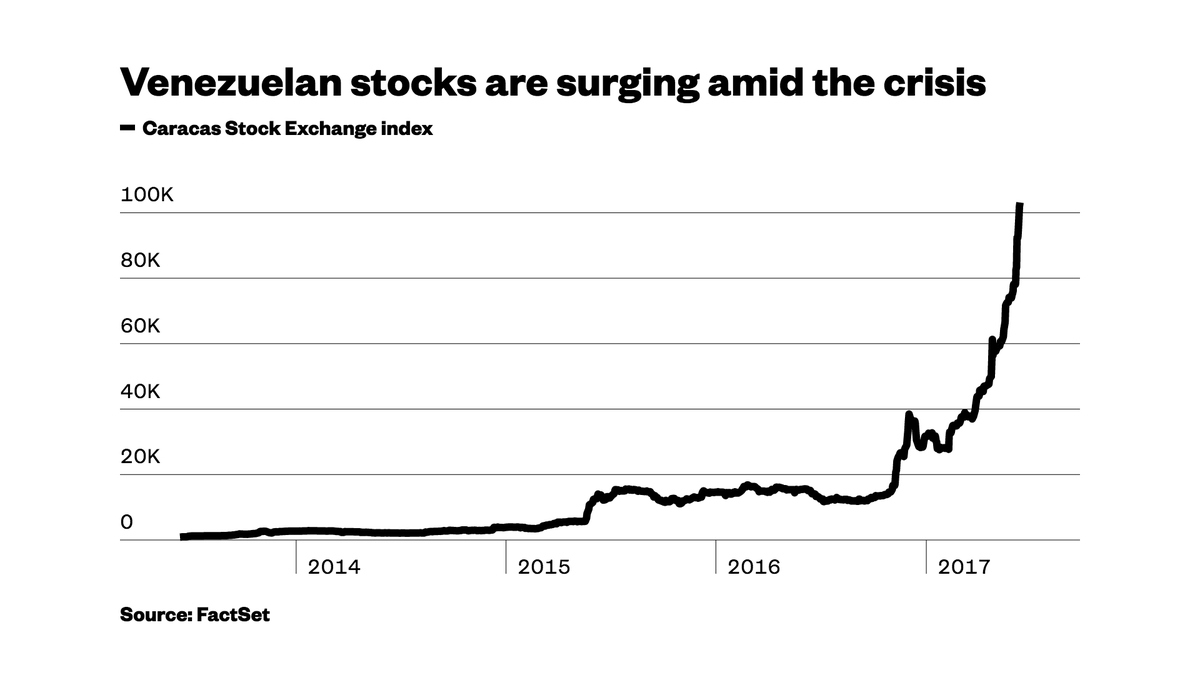

Remember, Venezuela's stock market soared as people were starving.

Instead of a sign of health, this is a sign of an extremely unhealthy artificial economy.

Remember, Venezuela's stock market soared as people were starving.

Here's what's fueling the current speculative mania (RobinHood, Gamestop, SPACs, cryptos, etc.):

The U.S. M1 money supply has increased by an jaw-dropping 75% in the past year alone. This is happening globally, too.

All that liquidity is sloshing around looking for a home.

The U.S. M1 money supply has increased by an jaw-dropping 75% in the past year alone. This is happening globally, too.

All that liquidity is sloshing around looking for a home.

Germany's stock market soared during the Weimar Republic hyperinflation of the 1920s.

Again, the reason was the surging money supply, which is why Venezuela's stock market soared while people were starving.

The U.S. stock market is experiencing a smaller scale version of this.

Again, the reason was the surging money supply, which is why Venezuela's stock market soared while people were starving.

The U.S. stock market is experiencing a smaller scale version of this.

In the early stages of Germany's hyperinflation, almost everyone was playing the market with increasing amounts of "funny money" - rapidly devaluing paper money.

The same phenomenon is happening right now in America on a smaller scale (for now!).

recision.files.wordpress.com/2010/12/jens-p…

The same phenomenon is happening right now in America on a smaller scale (for now!).

recision.files.wordpress.com/2010/12/jens-p…

• • •

Missing some Tweet in this thread? You can try to

force a refresh