I have been fascinated by this NFT project, @TheHashmasks since its launch one week ago. I think it is one of the best executed projects so far and contains many interesting Easter Eggs, some yet to be discovered, and will continue surprising us in the days and weeks to come.

Here's a summary of what it is so far:

Hashmasks was launched on 28 Jan 2021 and is a digital art created by 70 (still) unknown artists globally. A total of 16,384 digital art were represented as Non-Fungible Tokens (NFT) on Ethereum and hosted on IPFS (decentralized storage).

Hashmasks was launched on 28 Jan 2021 and is a digital art created by 70 (still) unknown artists globally. A total of 16,384 digital art were represented as Non-Fungible Tokens (NFT) on Ethereum and hosted on IPFS (decentralized storage).

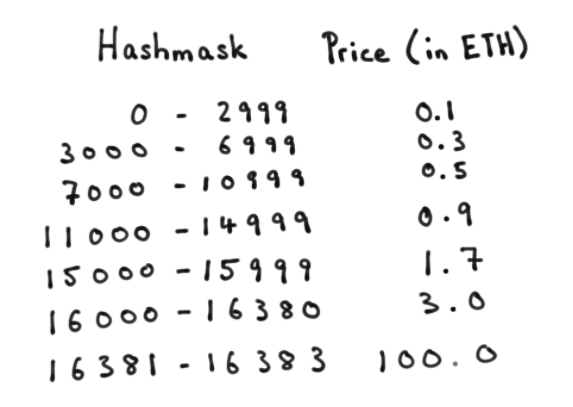

I really like that the team chose to distribute these NFTs fairly. No one knew which NFT they will get during the initial sale. Price was set on a bonding curve. The first 3000 NFTs were sold for 0.1 ETH and the price went up till the final 3 NFTs were to be sold at 100 ETH each.

The sale was supposed to last for 14 days at which point the NFTs will be revealed but it was sold out after roughly 4.5 days on 2 Feb. Even though the final 3 masks were to be sold for 100 ETH each, there was a price slippage clause and users can avoid paying this full price.

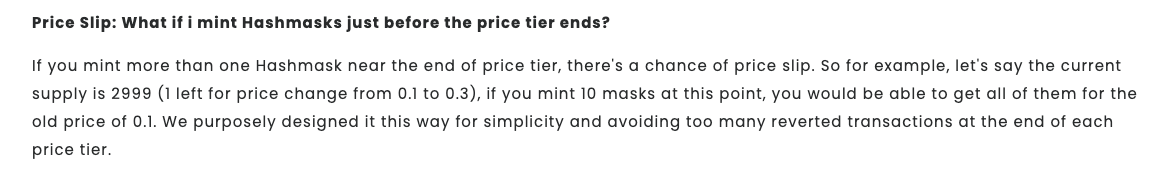

Despite the slippage rule, the final NFT was sold for the full 100 ETH. It was aptly named "Too Rich". To name an NFT, one needs to use a fungible token called Name Changing Token (NCT). There can only be one unique name for each art piece and NCT is burned for each name change.

A name change costs 1830 NCT. A total of 3660 NCT (2 name changes) comes with each NFT purchase. This is really smart because it allows initial purchasers to easily cash out the fungible portion earlier if they want to. NCT has gone up 10x and back since. coingecko.com/en/coins/name-…

Each Hashmask you own will generate 10 NCT/day. NCTs will be emitted for 10 years. After that, no new NCT will be generated. If you hold Hashmask for 1 year, you will get 3650 NCT. If price stays constant ($0.07/NCT, $1623/ETH, assuming 0.9ETH/NFT), you are looking at 18% yield!

The concept of an income generating NFT is very interesting and is certainly a primitive that is not fully explored yet. I anticipate more NFT projects to make use of these income generating element making NFTs more attractive for purchasers in the coming years.

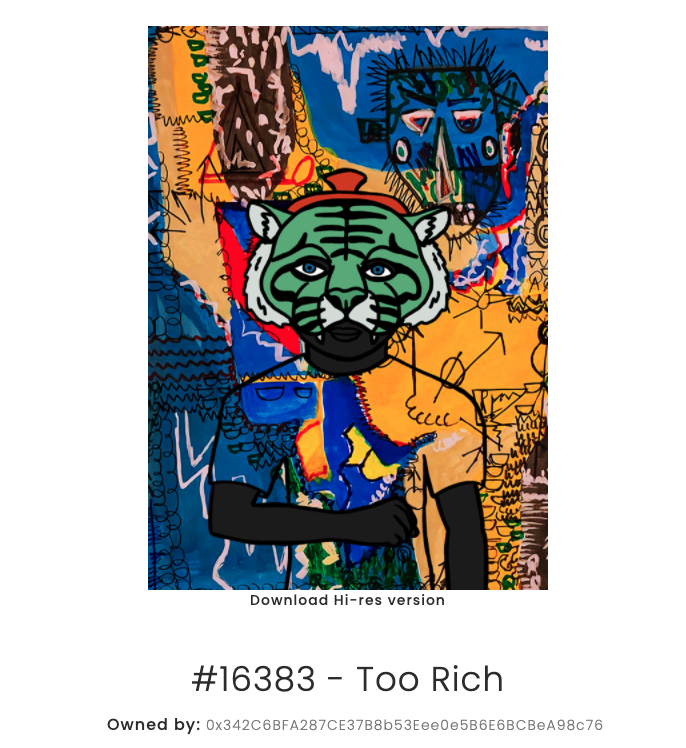

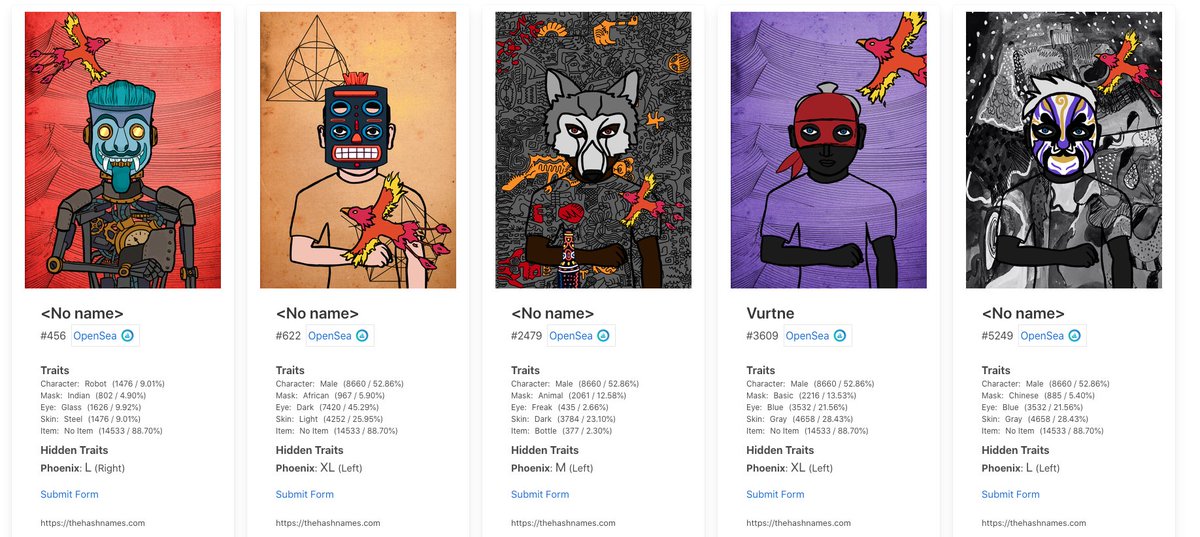

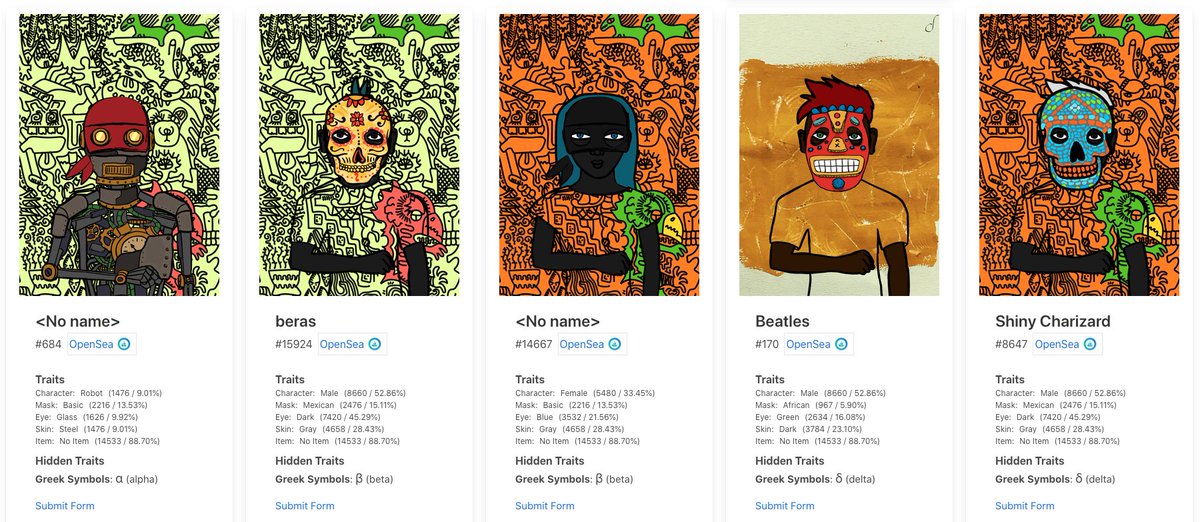

Let's now look at the art itself and go through some of the known attributes. There are 5 publicized traits - character, mask, eye, skin, and item. Each of these have its own rarity. You can see a breakdown of them on this site built by @philipplgh - thehashnames.com/#/dashboard

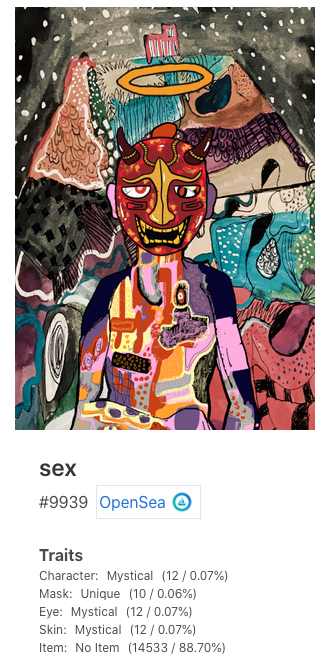

This NFT #9939 named "sex" was purchased by @seedphrase for 420 ETH ($650k)! It is a Mystical character (only 12) with a Unique mask (only 10), Mystical eyes (only 12) and Mystical skin (only 12). Whoever got it first, made a massive fortune flipping this.

https://twitter.com/seedphrase/status/1356733326673895425

Known attributes are not the only interesting thing. The creators have hidden many traits in the artwork generated, sparking groups of users to coordinate on Telegram/Discord to work together to discover these hidden traits. One rare hidden trait is the phoenix.

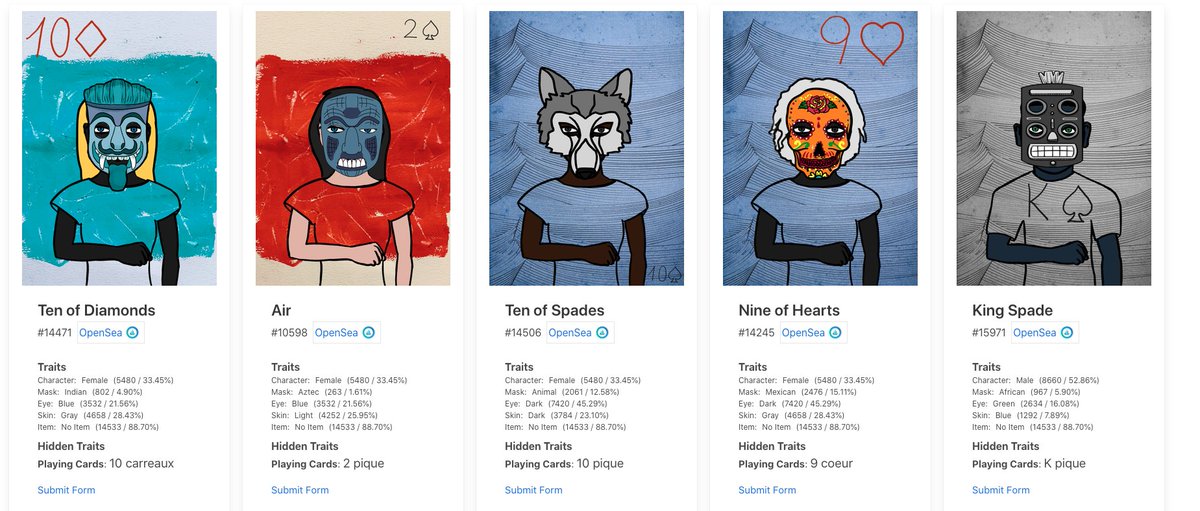

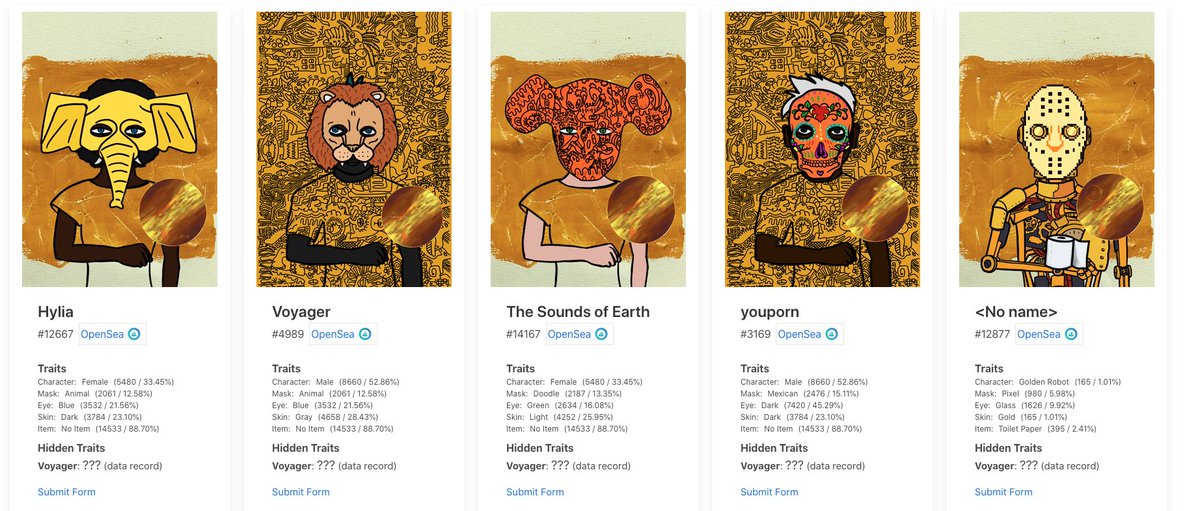

There are also voyager disks, playing cards, and greek symbols (alpha, beta, delta symbols on the top right). What do they mean, nobody knows yet. Users are still discovering the various hidden marks and as their rarity is discovered, will only further enhance value to these NFTs

There are also hidden Chinese characters that users have discovered form a poem named Quiet Night Thought by an ancient Chinese poet, Li Bai.

Some others have discovered musical notes and claimed that it forms part of Beethoven's Fur Elise.

https://twitter.com/randomwk0/status/1357894224746807297

Some others have discovered musical notes and claimed that it forms part of Beethoven's Fur Elise.

Users are trying to decipher the meaning and the uniqueness of each background. Maybe the puzzles can be pieced together as suggested by @spencecoin

Also, there were some hashing error that resulted in twins (#9934 and #3550). thehashmasks.medium.com/the-curious-ta…

https://twitter.com/spencecoin/status/1356816149053284352

Also, there were some hashing error that resulted in twins (#9934 and #3550). thehashmasks.medium.com/the-curious-ta…

In another sign of the financialization of NFTs, @nftx_ has created a Hashmask Index (MASK) where users can wrap their NFT. This sets a floor price (~0.8 ETH/NFT) and users who wants exposure without the low liquidity of NFT can hold ownership of MASK.

coingecko.com/en/coins/nftx-…

coingecko.com/en/coins/nftx-…

So far there is no fractional ownership of Hashmask yet but it will not be long before a rare NFT like the "sex" NFT above will be fractionalized on @NIFTEXdotcom. It will trade even higher as more users can now hold fractional ownership of it. (Disclosure: I invested in NIFTEX.)

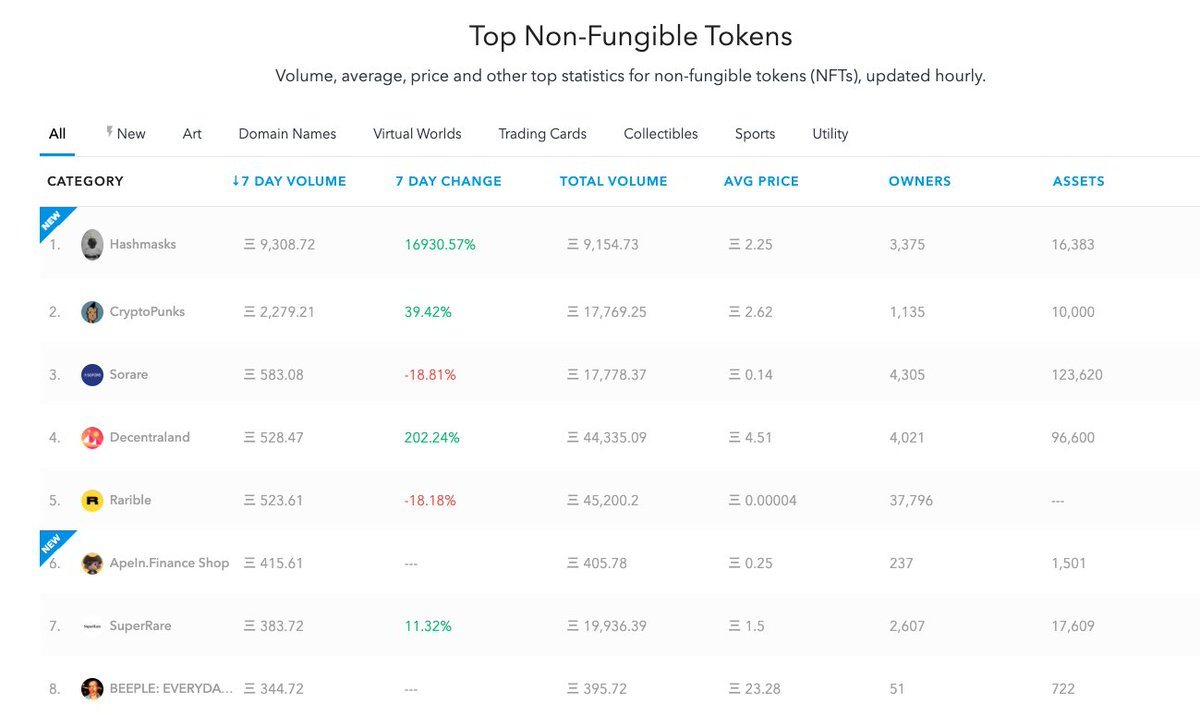

Hashmasks have become the most actively traded NFT in the OpenSea secondary marketplace. Over 9,308 ETH have been traded in the past 7 day with an average transaction price of 2.25 ETH. The 7 days volume is roughly 4x higher than Cryptopunks.

I personally own a few Hashmasks and have been following things closely. I have been trying to find some rare NFTs to buy but they are being priced way above my budget. One of my colleagues managed to buy a really rare NFT for a very low cost in the hours after it was revealed.

If Hashmask continues with its trajectory, I think it will be quite valuable in the coming years. Cryptopunks and Axie Infinity NFTs have grown quite significantly in the past few years. The verdict is still out on where it will be but this will be an interesting space to watch!

• • •

Missing some Tweet in this thread? You can try to

force a refresh