1/ About a decade ago, MIT professor Andrew Lo lost 6 people (incl. his mother) to cancer over a 4yr span.

These losses spurred Lo to find a new financing model to cure diseases. One student used Lo's research to start a biotech firm that is now worth $8B.

Here's the story🧵

These losses spurred Lo to find a new financing model to cure diseases. One student used Lo's research to start a biotech firm that is now worth $8B.

Here's the story🧵

2/ First, meet @AndrewWLo.

The director of MIT's Financial Engineering lab, he has taught a generation of Wall St.'s leading quants.

He created the "Adaptive Market Hypothesis" and was a Time 100 recipient in 2012 -- the mag described him as "Charles Darwin meets Adam Smith".

The director of MIT's Financial Engineering lab, he has taught a generation of Wall St.'s leading quants.

He created the "Adaptive Market Hypothesis" and was a Time 100 recipient in 2012 -- the mag described him as "Charles Darwin meets Adam Smith".

3/ In studying the biotech industry, Lo discovered a "valley of death" where startups couldn't get $.

It had to do w/ the drug discovery process.

A new drug might cost $200m to make w/ a 5% chance of success. Even if success = $2B/yr for 10yrs, most investors balk at the risk.

It had to do w/ the drug discovery process.

A new drug might cost $200m to make w/ a 5% chance of success. Even if success = $2B/yr for 10yrs, most investors balk at the risk.

4/ To de-risk the drug funding, Lo proposed a model familiar to most of us: diversifying the portfolio.

Specifically, he suggested raising a $30B fund to back 150 biotech startups ($200m each).

How to raise $30B, though?

Specifically, he suggested raising a $30B fund to back 150 biotech startups ($200m each).

How to raise $30B, though?

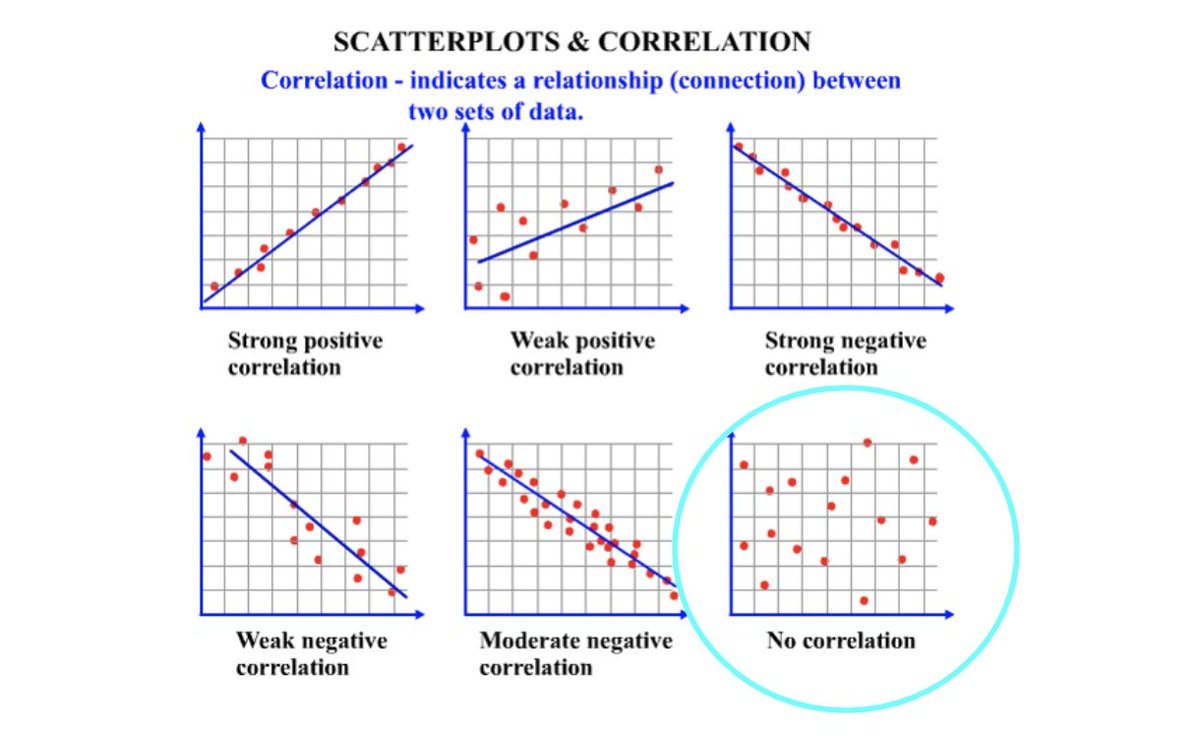

5/ The key insight Lo found was that each of the 150 biotech startups had to be uncorrelated with each other.

In other words, the biotech startups each had to have a different disease to attack so that failure by one startup had zero impact/relation to another one.

In other words, the biotech startups each had to have a different disease to attack so that failure by one startup had zero impact/relation to another one.

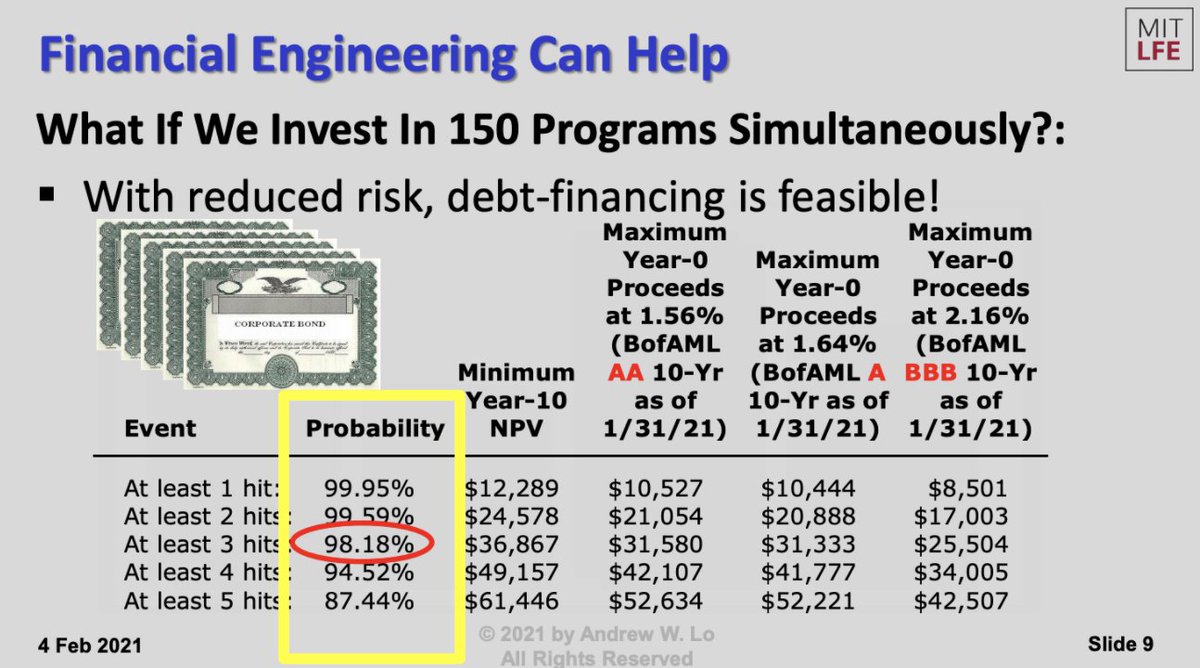

6/ Lo found that in an uncorrelated portfolio of 150 biotech startups, the odds of finding ONE blockbuster drug is 99.9% while finding FIVE is 87.4%.

These odds are no longer "risky", even for conservative investors. The model created a path to attract big money for rare drugs.

These odds are no longer "risky", even for conservative investors. The model created a path to attract big money for rare drugs.

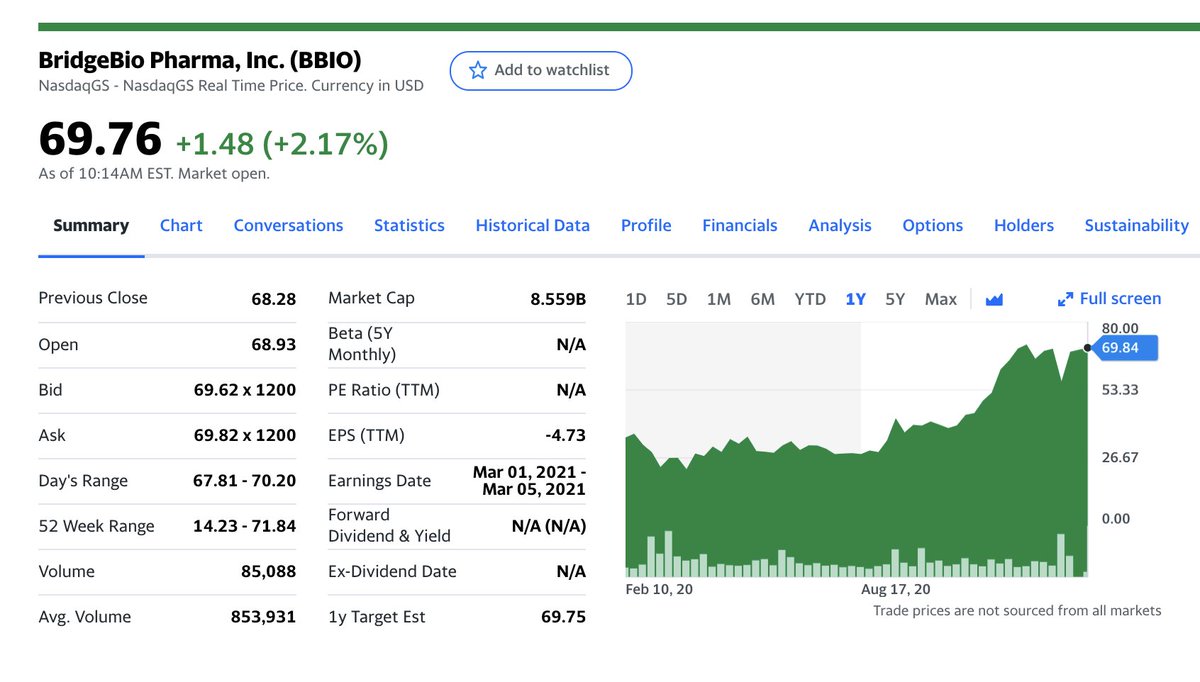

7/ In 2015, one of Lo's students (Neil Kumar) launched BridgBio Pharma ( $BBIO) to implement the diversification model.

Kumar targeted unique diseases to ensure they were uncorrelated: orphan diseases (with single-gene defects) and cancers (with clear genetics drivers).

Kumar targeted unique diseases to ensure they were uncorrelated: orphan diseases (with single-gene defects) and cancers (with clear genetics drivers).

8/ The BridgeBio team refers to its strategy as the "Andrew Model", which centralizes resources and an R&D platform but spins out each drug into its own subsidiary.

Lo made a small investment in the company while PE giant KKR and VC firm Sequoia poured in hundreds of millions.

Lo made a small investment in the company while PE giant KKR and VC firm Sequoia poured in hundreds of millions.

9/ Today, BridgeBio has 20 rare disease projects in the pipeline and 4 are in phase 3 trials.

With approval for these drugs forecasted for end-2021 and 2022, $BBIO is on a roll.

It went public in summer 2019 and has seen its value rise to $8B+, 4x March 2020 lows.

With approval for these drugs forecasted for end-2021 and 2022, $BBIO is on a roll.

It went public in summer 2019 and has seen its value rise to $8B+, 4x March 2020 lows.

10/ $BBIO is an example of "Financial engineering" -- which often gets a negative association -- doing good.

"The more financing that comes into the industry, the faster is the scientific progress we're going to make," says Lo.

Where else can we see the "Andrew model"?

"The more financing that comes into the industry, the faster is the scientific progress we're going to make," says Lo.

Where else can we see the "Andrew model"?

11/ If you like business stories like this (or dumb memes), smash that FOLLOW FOLLOW FOLLOW.

Other threads you might like:

trungtphan.com/top-trungtphan…

Original source:

bloomberg.com/news/articles/…

Other threads you might like:

trungtphan.com/top-trungtphan…

Original source:

bloomberg.com/news/articles/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh