Andrew Bailey facing the @CommonsTreasury . Observations, tagging @TheFCA and @hmtreasury and @bankofengland @BoE_PressOffice @APPGbanking @appgonpbandffs ......

Bailey already veering down the route he wants to take this, as opposed to addressing the issues before him. The failings were not reliant upon 'core' changes to address. The failings were basic.

You don't need structural reform or change to address many of the failings. Simply upholding the codes and taking appropriate action, which is the FCA's role, is a basic and minimum standard.

611 incoming calls about LC&F and Bailey had no idea of the existence of LC&F until it's collapse? Really?

Bailey blames the call handling for failures to escalate reports of LC&F. This is false. I reported the same issues concerning the Blackmore Bond to the FCA whistleblower team. Dodd of the whistleblower team confirms he escalated to the relevant team AND STILL NO ACTION TAKEN....

Bailey cannot be permitted to put forward defences that are blatantly untrue. Reports direct to FCA whistleblower teams by multiple persons covering multiple products and asset classes all also escalated to relevant teams by the FCA whistleblower team, all of which were ignored

Bailey losing his cool, and flapping as he tries to wriggle out of the attempt to have Dame Elizabeth Gloster conceal the names of those involved or responsible.

It's inconceivable that concealment was not the intent. Just because he involved a QC to find a way to 'legitimise' this concealment, does not alter the fact that it was an attempt to conceal

Here we go. Blame the callers. This is tried and tested playbook of banks and FCA particularly by the FCA Press Office to gain a moral high ground when there is no other defence. Claim 'abuse' or 'threat' when none exists so as to justify ending contact & ignoring the reports...

Internal emails show that Bailey himself tried to use this tactic against me. However, same internal emails show an FCA employee 'correcting' Bailey's knowingly false interpretation and informing him that there was nothing wrong with anything I'd said......

Internal documentation and written witness testimony demonstrates that despite this the FCA press office, however, would force the whistleblower team to refuse further contact with me using the same knowingly false interpretations that Bailey had tried to use.

If Bailey's claims as to no knowledge of LC&F until its collapse is true, then it proves that he was aware of the Blackmore Bond before LC&F and a full 2.5 years before the Blackmore Bond collapse, or he is lying......

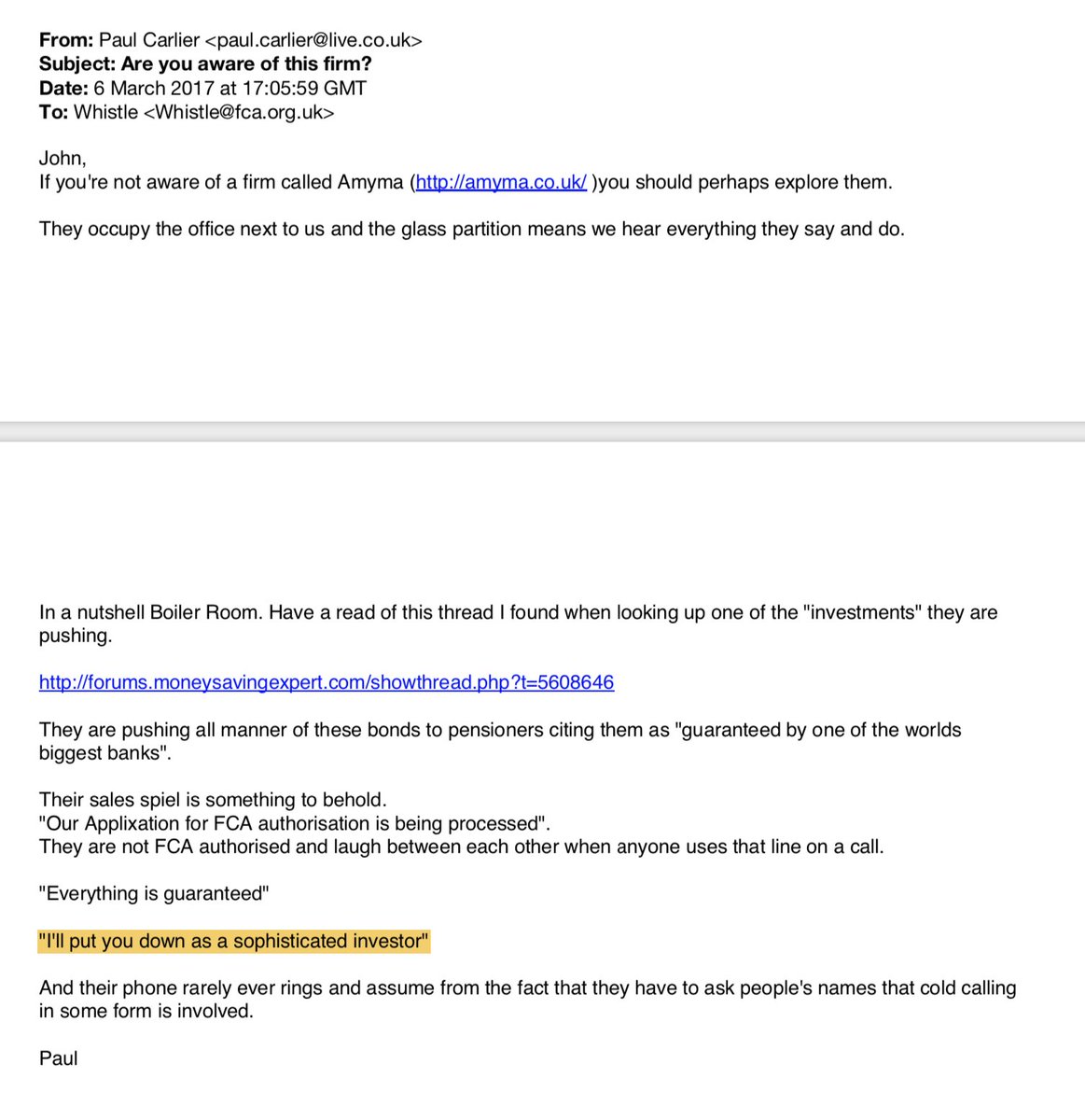

Here is my email to Bailey personally and Mark Steward, Jane Attwood and John Dodd of the FCA whistleblower team. On 30/08/2018 I forward Bailey and Co. my reports of March 2017 and summarise and reassert my concerns. How can he claim non-awareness of this type of product?...

So, even if he wasn't aware of LC&F and its products as of August 2018, he was aware of the Blackmore Bond as of that date. Bailey and Steward did nothing and Blackmore collapsed in 2020 with pensioners losing all £45mio invested in it. No hindsight required....

and has nothing whatsoever to do with failings in the contact centre. I got the information to him, Steward and Jane Attwood (Head of FCA Intelligence and responsible for all incoming intelligence and investigations) personally, and they did.... nothing.

Bailey now mentions whistleblowing and claims they prioritised whistleblowing. False. In the last 6 months Mark Steward and executive in FCA whistleblower team have lied to me. They claimed that under 2016 FCA rules, the FCA did not have to treat me as a whistleblower in 2020...

Despite banks being forced to treat anyone 'making a reportable concern' as a whistleblower. WHEREAS, when contacting FCA anonymously, two different FCA executives confirmed that the FCA did have to treat me as a whistleblower under these circumstances...

Mr Bailey claims that no concerns were raised as to investors sophistication being manipulated by LC&F, and falsely uses this as a reason as to why it wasn't investigated. I reported exactly this in March 2017 in respect to Blackmore and they still did nothing.

Bailey asked "Is the FCA gun shy?" Paper Tigers can't see a gun, hold a gun, much less fire one

It is incredibly hard for me to listen to Bailey's testimony, and his attempts to worm his and the FCA's way out of responsibility. I can only imagine what it's like for those that have lost life savings in LC&F and Blackmore.

It was only a matter of time before he blamed Brexit

Why is @SteveBakerHW helping Bailey divert blame on to consumers? Mr Baker knows that consumers were being wrongly classified as 'sophisticated' because of false guarantees being put to them. How is it the consumer's responsibility?

@SteveBakerHW consumers and pensioners were lied to by LC&F and Blackmore. This was known and well documented to the FCA. Interest and Principal was 'guaranteed' and the firms either claimed or implied FCA regulation. How is that consumers fault, and why did FCA ignore this?

@SteveBakerHW You allow Bailey to claim that the FCA couldn't go around accusing firms of fraud without evidence to justify no action, yet the evidence of lies and falsification of consumer sophistication was known and was sufficient for the FCA to act and publish these facts...

I presume none of your constituents were victims of this?

I'm sorry but it's entirely dishonest for Bailey to claim that his FCA prioritised whistle blowing. There is substantial evidence to prove that on his watch, that the @TheFCA themselves abused and failed to protect whistleblowers, and concealed same historic abuses.

• • •

Missing some Tweet in this thread? You can try to

force a refresh