Pat Dorsey's "The Five Rules for Successful Stock Market Investing" is a must read for long-term investors in Individual stocks. A quick great summary of that book.

medium.com/@christophertz…

medium.com/@christophertz…

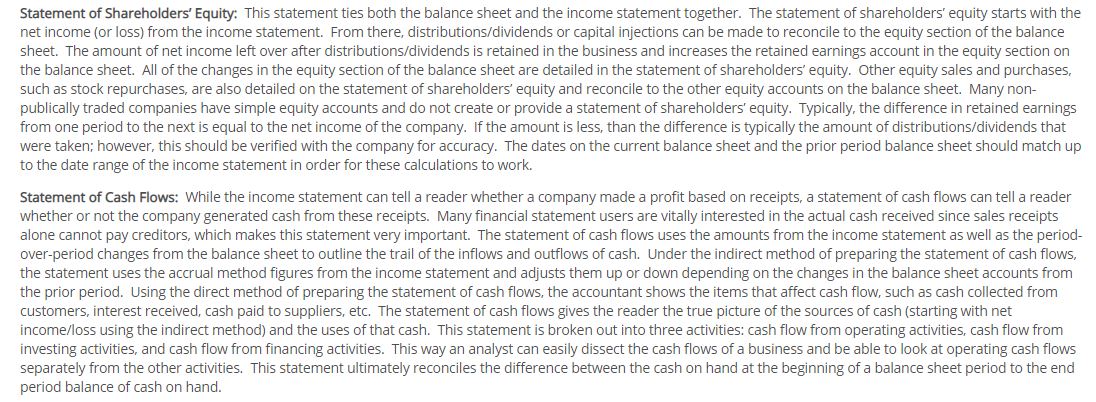

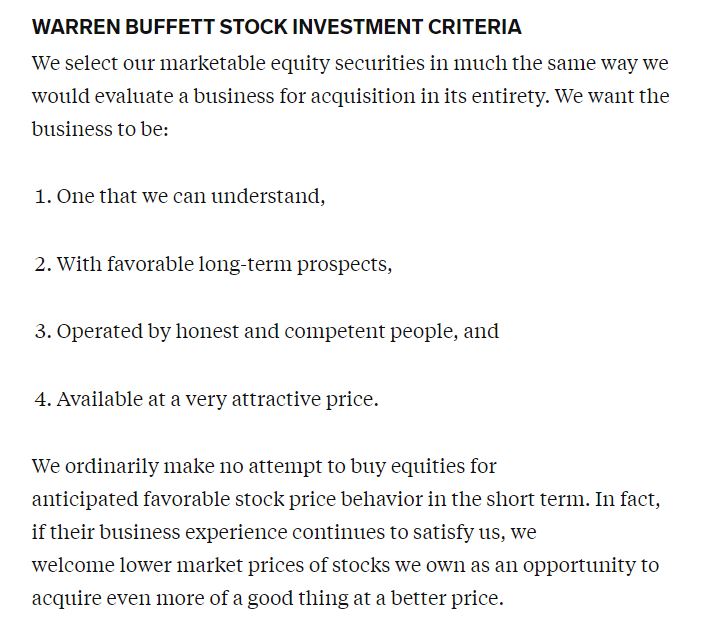

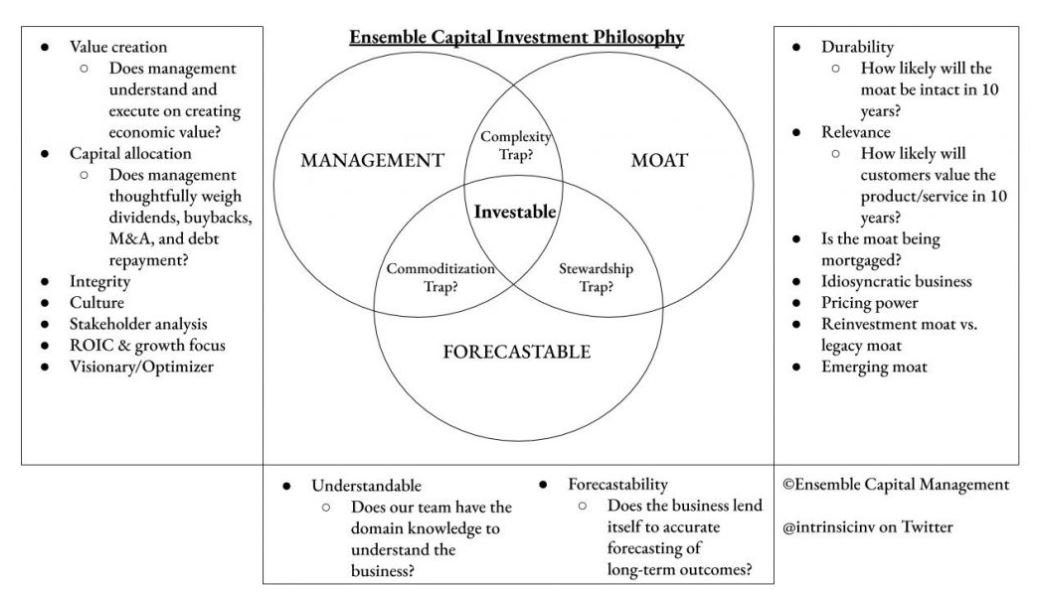

The quick 10 min test to decide whether this Company goes in the "Bad", "Too hard" pile or "Interesting" pile.

This applies more for stable and already profitable Co's. You will have to tweak it a little for hyper growth & (intentionally) unprofitable but high quality Co's.

This applies more for stable and already profitable Co's. You will have to tweak it a little for hyper growth & (intentionally) unprofitable but high quality Co's.

Look beyond the recent Revenue growth and stock gains, so that you get into quality companies that can survive and thrive over the long-term.

• • •

Missing some Tweet in this thread? You can try to

force a refresh