GoGold, a compelling acquisition target for First Majestic

$AG $GGD.TO

As per KN’s recent interview (w/ MSE), FM currently considering M&A. Looking for “bigger things”, scouring world for “chunky assets” & maintaining silver focus. “Finding good silver mine v. difficult”.

1/21

$AG $GGD.TO

As per KN’s recent interview (w/ MSE), FM currently considering M&A. Looking for “bigger things”, scouring world for “chunky assets” & maintaining silver focus. “Finding good silver mine v. difficult”.

1/21

Let’s explore.

FM’s goal: To become world’s largest primary #silver producer. Silver reserves ⬇️ & silver % of rev ⬇️. GGD offers immediate pdn at Parral (>2Moz AgEq/yr) and its crown jewel, Los Ricos, a HQ dev’t project in Mexico, wd substantially bolster FM’s pipeline.

2/21

FM’s goal: To become world’s largest primary #silver producer. Silver reserves ⬇️ & silver % of rev ⬇️. GGD offers immediate pdn at Parral (>2Moz AgEq/yr) and its crown jewel, Los Ricos, a HQ dev’t project in Mexico, wd substantially bolster FM’s pipeline.

2/21

$AG

Rsvs/Res.

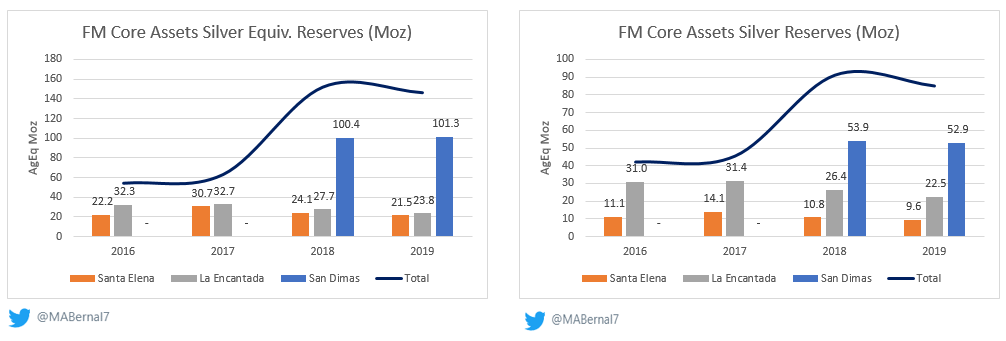

Declining Silver Reserves at Core Assets

-Santa Elena (SE), La Encantada (LE) and San Dimas (SD) aggregate reserves fell 5.7Moz AgEq (6.1Moz Ag) in 2019 and 9.3Moz AgEq (10Moz Ag) since YE2016 (ex-San Dimas [acq. 2018]).

-Since 2013, 2P relatively unch.

3/21

Rsvs/Res.

Declining Silver Reserves at Core Assets

-Santa Elena (SE), La Encantada (LE) and San Dimas (SD) aggregate reserves fell 5.7Moz AgEq (6.1Moz Ag) in 2019 and 9.3Moz AgEq (10Moz Ag) since YE2016 (ex-San Dimas [acq. 2018]).

-Since 2013, 2P relatively unch.

3/21

Reserves/Resources Cont'd:

-SE’s discovery, Ermitaño adds Indicated + Inferred: 67.9Moz AgEq (11.7Moz Ag ➡️ 17% silver). Effectively a high-grade gold project.

4/21

-SE’s discovery, Ermitaño adds Indicated + Inferred: 67.9Moz AgEq (11.7Moz Ag ➡️ 17% silver). Effectively a high-grade gold project.

4/21

LOM

-Based on 2021 Ag pdn, SE has <5 yrs of reserves and <14yrs of resources. LE has 6.3yrs of reserves and 12.5yrs on resources. SD 7yrs of reserves and <18yrs on resources.

-SE has significant gold resources (adds ~9yrs on AgEq basis to resources)

5/21

-Based on 2021 Ag pdn, SE has <5 yrs of reserves and <14yrs of resources. LE has 6.3yrs of reserves and 12.5yrs on resources. SD 7yrs of reserves and <18yrs on resources.

-SE has significant gold resources (adds ~9yrs on AgEq basis to resources)

5/21

Pdn/AISC

-2020 pdn was down from peak of 2019 as FM looks to divest non-core assets, but Ermitaño and other ops efficiencies should boost pdn slightly in the near-term

-2021E pdn est. 20.6-22.9 Moz AgEq @ $14.81-$15.99/oz AgEq AISC

6/21

-2020 pdn was down from peak of 2019 as FM looks to divest non-core assets, but Ermitaño and other ops efficiencies should boost pdn slightly in the near-term

-2021E pdn est. 20.6-22.9 Moz AgEq @ $14.81-$15.99/oz AgEq AISC

6/21

Pdn/AISC Cont'd:

-Gold increasing in pdn/revenue mix through 2020s as Ermitaño comes online.

-After Ermitaño closet looks quite bare.

7/21

-Gold increasing in pdn/revenue mix through 2020s as Ermitaño comes online.

-After Ermitaño closet looks quite bare.

7/21

Balance Sheet (latest)

-Cash: $238.6M

-Debt: $169.3M (*Currently ITM on $140M converts – redeemable >Mar. 6/21 if SP>$12.47 for 20/30 trading days)

-Total avail. liquidity: $331.7M (Sep.30/20)

8/21

-Cash: $238.6M

-Debt: $169.3M (*Currently ITM on $140M converts – redeemable >Mar. 6/21 if SP>$12.47 for 20/30 trading days)

-Total avail. liquidity: $331.7M (Sep.30/20)

8/21

Cash Flow, Capex, Val'n

FCF @ spot ($1845/oz Au / $26.98/oz Ag)

-2021E: ~$31M

-2022E): $282M

Source: Scotia

2021E capex guide: $168M

Other considerations:

-Potential divestitures (non-core assets). Scotia values at ~$60M in total

Valuation

-P/NAV >3.5x @ spot (Scotia)

9/21

FCF @ spot ($1845/oz Au / $26.98/oz Ag)

-2021E: ~$31M

-2022E): $282M

Source: Scotia

2021E capex guide: $168M

Other considerations:

-Potential divestitures (non-core assets). Scotia values at ~$60M in total

Valuation

-P/NAV >3.5x @ spot (Scotia)

9/21

$GGD.TO (~C$700M M/C)

Resources

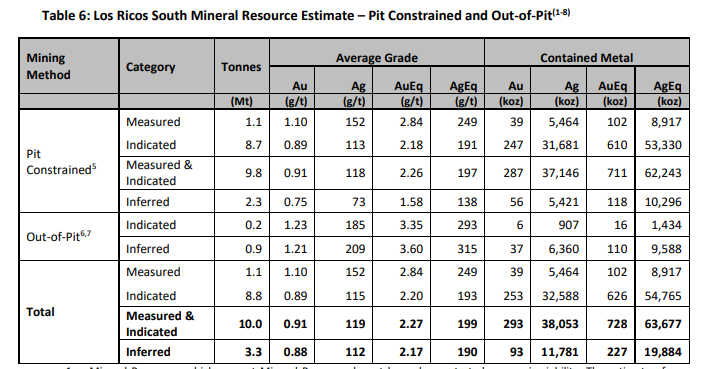

-Maiden Resource at Los Ricos South (LRS) of 83.6 Moz at ~195g/t AgEq (M&I+I) and a total of 45.9 Moz (M&I) at Parral (2P: 31.6 Moz AgEq at 64 g/t AgEq) and Esmeralda.

10/21

Resources

-Maiden Resource at Los Ricos South (LRS) of 83.6 Moz at ~195g/t AgEq (M&I+I) and a total of 45.9 Moz (M&I) at Parral (2P: 31.6 Moz AgEq at 64 g/t AgEq) and Esmeralda.

10/21

LOM

-LRS: 11yr est. (PEA)

--First pdn: 2H/2025 (my assumption: 3yr for PFS, FS, permit + 18m build)

-Parral: 8yrs of reserves remaining (as per Brad (CEO) in latest Crux YT video)

11/21

-LRS: 11yr est. (PEA)

--First pdn: 2H/2025 (my assumption: 3yr for PFS, FS, permit + 18m build)

-Parral: 8yrs of reserves remaining (as per Brad (CEO) in latest Crux YT video)

11/21

Pdn/AISC

-LRS (PEA): Mostly OP - 6.3 Moz/yr AgEq (61% Ag) @ $11.35/oz AgEq AISC

-Parral (in pdn): >2Moz/yr AgEq (57% Ag in 2020) @ $14.72/oz AISC ➡️ >$2M/m of FCF @ spot prices

12/21

-LRS (PEA): Mostly OP - 6.3 Moz/yr AgEq (61% Ag) @ $11.35/oz AgEq AISC

-Parral (in pdn): >2Moz/yr AgEq (57% Ag in 2020) @ $14.72/oz AISC ➡️ >$2M/m of FCF @ spot prices

12/21

LRS Economics (PEA)

-Modest LRS capex: $125M (initial) and $63M in sustaining capital LOM

-After-tax LRS NPV(5%): $295M ($1550/oz Au, $21/oz Ag)

-IRR: 45.8%

-After-tax payback: 2yrs

-At spot prices, NPV/IRR: >$400M & IRR: 58%

13/21

-Modest LRS capex: $125M (initial) and $63M in sustaining capital LOM

-After-tax LRS NPV(5%): $295M ($1550/oz Au, $21/oz Ag)

-IRR: 45.8%

-After-tax payback: 2yrs

-At spot prices, NPV/IRR: >$400M & IRR: 58%

13/21

Exploration

-Los Ricos North (LRN - massive upside potential): 100,000m drill program in 2021 w/ >100 targets – IMO likely much bigger than LRS

--LRN's El Favor and El Orito deposits are already providing a glimpse at the enormous potential of LRN (still early on)

14/21

-Los Ricos North (LRN - massive upside potential): 100,000m drill program in 2021 w/ >100 targets – IMO likely much bigger than LRS

--LRN's El Favor and El Orito deposits are already providing a glimpse at the enormous potential of LRN (still early on)

14/21

What's it worth?

-Very rough calculation: FCF of $2M/m at spot prices annualized = $24M. An 8yr NPV(5%) = ~$155M for Parral or conservatively, $100M assuming lower prices.

-As per PEA, LRS is $295M (NPV5%) at base case prices

-Total: $395M or C$502M

15/21

-Very rough calculation: FCF of $2M/m at spot prices annualized = $24M. An 8yr NPV(5%) = ~$155M for Parral or conservatively, $100M assuming lower prices.

-As per PEA, LRS is $295M (NPV5%) at base case prices

-Total: $395M or C$502M

15/21

LRN I believe cd be substantially bigger than LRS and likely w/ similar operational and cost parameters. Thus, I believe the current market value ascribed to LRN of ~C$200M is appropriate for now, but likely to grow substantially on further exploration and de-risking.

16/21

16/21

The value mix could vary, some investors may ascribe higher value to Parral vs. LRS/N. However, GGD is relatively attractive versus Mexican silver peers IMO, particularly given the quality of its assets, exploration potential, FCF generation and strong balance sheet.

17/21

17/21

Considerations/terms:

-Likely combination of cash and shares

-Would probably require significant premium

-Brad L. (CEO) 2nd largest SH (>15Msh/~5.8%)

-Cd attract multiple bidders

-GGD might not seriously entertain offers until it realizes more value for LRN

18/21

-Likely combination of cash and shares

-Would probably require significant premium

-Brad L. (CEO) 2nd largest SH (>15Msh/~5.8%)

-Cd attract multiple bidders

-GGD might not seriously entertain offers until it realizes more value for LRN

18/21

I believe there is merit to consider GGD a viable candidate for $AG $FR.TO. I am positioned long $GGD.TO not only for a takeout (inevitable IMO), but b/c of the scarcity of HQ primary silver projects, aggressive exploration at LRN (funded by Parral) and mgmt. expertise.

19/21

19/21

Would love to hear everyone's thoughts and comments on this idea. I'm not an expert on First Majestic Silver and could've missed some pertinent details.

#silver #mintwit $SILJ $SIL

20/21

#silver #mintwit $SILJ $SIL

20/21

Main Sources:

bit.ly/2YYjrON - $AG PPT

bit.ly/3aTC7ot - $GGD.TO PEA NR

bit.ly/3tHrFst - Crux Investor GGD Interview (Jan. 27/21)

bit.ly/3q7S2FQ - MSE w/ FM Interview (Jan. 28/21)

FR & GGD FS/MD&A

21/21

bit.ly/2YYjrON - $AG PPT

bit.ly/3aTC7ot - $GGD.TO PEA NR

bit.ly/3tHrFst - Crux Investor GGD Interview (Jan. 27/21)

bit.ly/3q7S2FQ - MSE w/ FM Interview (Jan. 28/21)

FR & GGD FS/MD&A

21/21

• • •

Missing some Tweet in this thread? You can try to

force a refresh