1/🧵

In today’s episode we’ll take a deeper look at INTANGIBLE COSTS; what they mean for companies, what are the trends, and how they are preferred by the tax code by using some well-known companies as examples.

Time for a thread 👇👇👇

In today’s episode we’ll take a deeper look at INTANGIBLE COSTS; what they mean for companies, what are the trends, and how they are preferred by the tax code by using some well-known companies as examples.

Time for a thread 👇👇👇

2/🧵

Back in the day mills, factories, railroads, smelters, and other icons of 1800s industrial revolution required a lot of capital to be invested in TANGIBLE ASSETS – things you can touch.

The more you had equipment, the wealthier you became (think Andrew Carnegie).

Back in the day mills, factories, railroads, smelters, and other icons of 1800s industrial revolution required a lot of capital to be invested in TANGIBLE ASSETS – things you can touch.

The more you had equipment, the wealthier you became (think Andrew Carnegie).

3/🧵

In such environment, costs are expensed differently. Here’s what @FT / @mjmauboussin article had to say:

“Intangible investments are treated as an expense on the income statement. Tangible investments are recorded as assets on the balance sheet...."

ft.com/content/01ac1d…

In such environment, costs are expensed differently. Here’s what @FT / @mjmauboussin article had to say:

“Intangible investments are treated as an expense on the income statement. Tangible investments are recorded as assets on the balance sheet...."

ft.com/content/01ac1d…

4/🧵

..."That means a company that invests in intangible assets will have lower earnings and book value than one that invests an equivalent amount in tangible assets, even if their cash flows are identical.”

ft.com/content/01ac1d…

..."That means a company that invests in intangible assets will have lower earnings and book value than one that invests an equivalent amount in tangible assets, even if their cash flows are identical.”

ft.com/content/01ac1d…

5/🧵

As @pmarca wrote in 2011, software has been since eating the world.

Expenses are different compared to a factory; people (talent) are the biggest asset and other capital requirements limited. Growth scales and its cost structure is very different

a16z.com/2011/08/20/why…

As @pmarca wrote in 2011, software has been since eating the world.

Expenses are different compared to a factory; people (talent) are the biggest asset and other capital requirements limited. Growth scales and its cost structure is very different

a16z.com/2011/08/20/why…

6/🧵

And, boy, changed the companies have.

In 1975, intangibles accounted for 17% of SP500 assets. In 2018, the figure had risen to 84%. EIGHTY FOUR PERCENT!

aon.com/getmedia/60fbb…

And, boy, changed the companies have.

In 1975, intangibles accounted for 17% of SP500 assets. In 2018, the figure had risen to 84%. EIGHTY FOUR PERCENT!

aon.com/getmedia/60fbb…

7/🧵

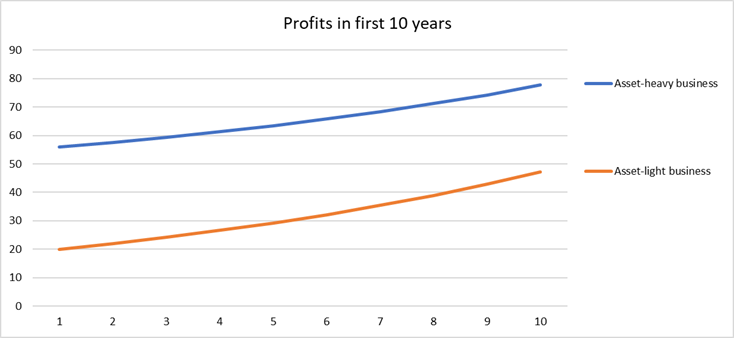

Take two companies with the exact same business characteristics:

-revenues of 100 growing 10% per year

-annual cash costs of 80% of revenues

But here’s the twist: asset-HEAVY business has CAPEX/OPEX distribution of 40%/40%, while asset-LIGHT business 0%/80%.

Take two companies with the exact same business characteristics:

-revenues of 100 growing 10% per year

-annual cash costs of 80% of revenues

But here’s the twist: asset-HEAVY business has CAPEX/OPEX distribution of 40%/40%, while asset-LIGHT business 0%/80%.

8/🧵

As we can see from these results, the end results differ materially.

Due to how depreciation works, asset-heavy business LOOKS more profitable, thus ending up paying more in taxes. Asset-light business has higher share of OPEX, hence tax burden lower and cash flow higher.

As we can see from these results, the end results differ materially.

Due to how depreciation works, asset-heavy business LOOKS more profitable, thus ending up paying more in taxes. Asset-light business has higher share of OPEX, hence tax burden lower and cash flow higher.

9/🧵

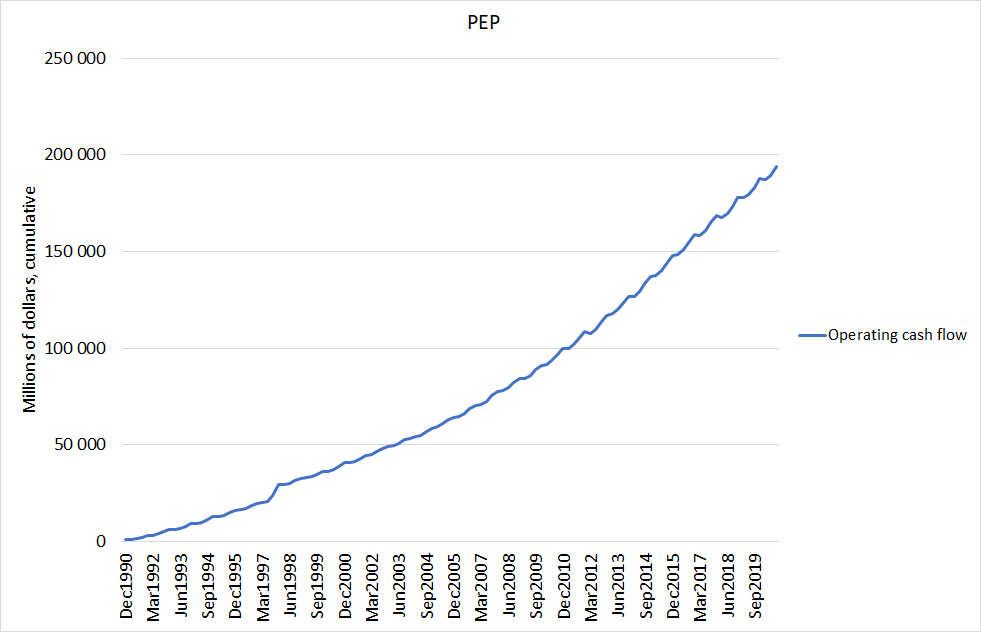

In other words, modern companies with heavy intangible cost and growth component – thanks to accounting – do not appear as profitable “as they should”.

So, let’s level the playing field and depreciate operating expenses just like investments – over 10 yrs in this example.

In other words, modern companies with heavy intangible cost and growth component – thanks to accounting – do not appear as profitable “as they should”.

So, let’s level the playing field and depreciate operating expenses just like investments – over 10 yrs in this example.

10/🧵

If we start with tangible-heavy and/or low growth businesses, we see little difference between regular operating income and the adjusted one; there is fewer intangible expenses to be adjusted for.

Here’s visualization for McDonalds, Boeing, IBM, and General Motors.

If we start with tangible-heavy and/or low growth businesses, we see little difference between regular operating income and the adjusted one; there is fewer intangible expenses to be adjusted for.

Here’s visualization for McDonalds, Boeing, IBM, and General Motors.

11/🧵

But the story changes, when we take a look at high-growth companies that have a high share of intangible costs.

Here’s visualization for Fortinet, Amazon, Google, and Booking.com

But the story changes, when we take a look at high-growth companies that have a high share of intangible costs.

Here’s visualization for Fortinet, Amazon, Google, and Booking.com

12/🧵

As we can see, for some companies profits can be largely understated.

This approach allows us to take a look at companies through a new, adjusted valuation lens. Take Amazon and Fortinet that invest (intangibles) heavily so they greatly “benefit” from adjustments.

As we can see, for some companies profits can be largely understated.

This approach allows us to take a look at companies through a new, adjusted valuation lens. Take Amazon and Fortinet that invest (intangibles) heavily so they greatly “benefit” from adjustments.

13/🧵

By no means is this a perfect approach but provides interesting new angles when looking at companies that may be difficult to understand otherwise.

By no means is this a perfect approach but provides interesting new angles when looking at companies that may be difficult to understand otherwise.

14/🧵

This thread was inspired by recent thought-provoking memo by @HowardMarksBook in which differences of stereotypical “value” and “growth” companies were beautifully laid out.

oaktreecapital.com/docs/default-s…

Have a nice weekend! 🙏🙂

This thread was inspired by recent thought-provoking memo by @HowardMarksBook in which differences of stereotypical “value” and “growth” companies were beautifully laid out.

oaktreecapital.com/docs/default-s…

Have a nice weekend! 🙏🙂

• • •

Missing some Tweet in this thread? You can try to

force a refresh