1/OK folks, let's talk about BITCOIN!!

Many many people have proclaimed the death of Bitcoin over the years, but it looks like it's here to stay.

noahpinion.substack.com/p/triumph-of-t…

Many many people have proclaimed the death of Bitcoin over the years, but it looks like it's here to stay.

noahpinion.substack.com/p/triumph-of-t…

2/Remember the big Bitcoin bubble and crash of late 2017/2018?

Well if you bought at the TOP of that bubble, you've now TRIPLED your investment.

Well if you bought at the TOP of that bubble, you've now TRIPLED your investment.

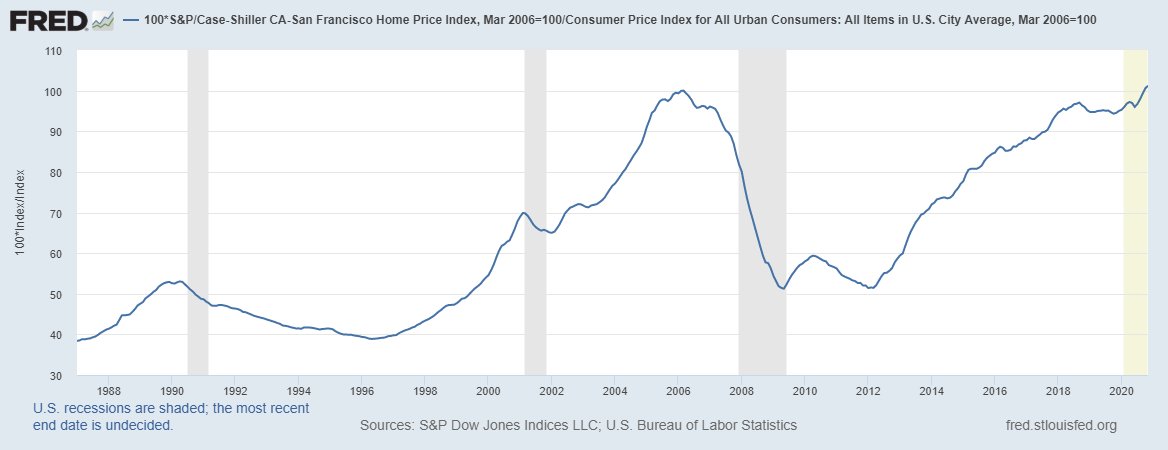

3/In fact, this is typical. Asset classes that experience bubbles and crashes usually recover.

Here's the NASDAQ (in inflation-adjusted terms). It's way past its 2000 bubble peak!

Here's the NASDAQ (in inflation-adjusted terms). It's way past its 2000 bubble peak!

5/In fact, the Bitcoin bubble of 2017 wasn't the first Bitcoin bubble! (By my count it was the third.)

Here was the first, in 2011. After Bitcoin crashed, people said it was dead.

If you bought at the top and held...er, HODLed...you're now up 160,000 percent.

Here was the first, in 2011. After Bitcoin crashed, people said it was dead.

If you bought at the top and held...er, HODLed...you're now up 160,000 percent.

6/Now that doesn't mean bubbles are rational or efficient...they aren't.

noahpinion.substack.com/p/what-kind-of…

noahpinion.substack.com/p/what-kind-of…

7/But over the long run, we should see bubbles as just another manifestation of ASSET PRICE VOLATILITY.

And in an efficient market, volatility (as long as it's not diversifiable) is correlated with hire expected returns.

investopedia.com/terms/r/riskre…

And in an efficient market, volatility (as long as it's not diversifiable) is correlated with hire expected returns.

investopedia.com/terms/r/riskre…

8/The more bubbles Bitcoin recovers from, the more people realize that it's for real. And the more people will be comfortable having a little of their wealth in crypto. And thus the price will rise, and volatility will be compensated by higher long-term returns!

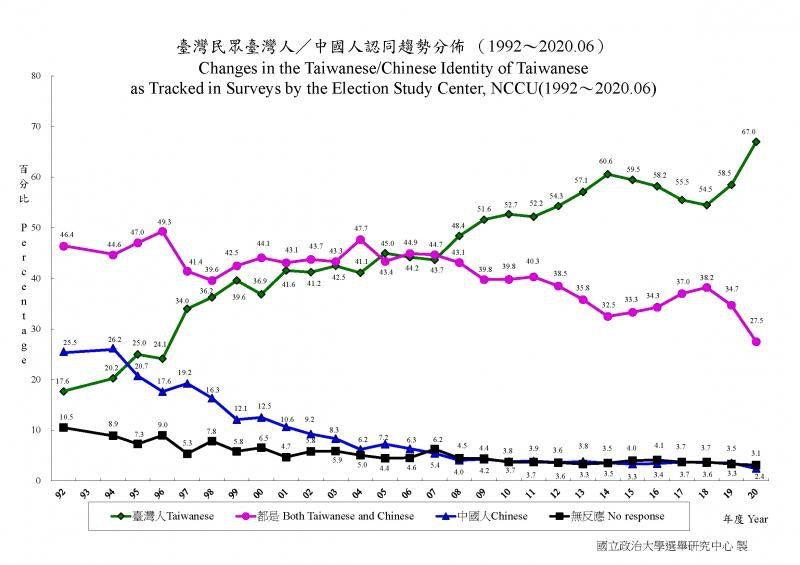

9/So what about the long-term price of Bitcoin? Where does its fundamental value come from?

Bitcoin is "digital gold"...people view it as a hedge against the breakdown of the global financial/regulatory system.

ft.com/content/d4fc86…

Bitcoin is "digital gold"...people view it as a hedge against the breakdown of the global financial/regulatory system.

ft.com/content/d4fc86…

11/You can use it if you live in a country where the system has broken down!

forbes.com/sites/tatianak…

forbes.com/sites/tatianak…

13/Basically, these uses give Bitcoin a fundamental value. Bubbles deter people (temporarily) from recognizing that value. But as they eventually stop worrying about the next bubble, the market value rises, and provides a positive expected return.

14/Could Bitcoin ever die? Yes, in theory. The technology could turn out to have unexpected flaws.

nber.org/papers/w24717

nber.org/papers/w24717

15/Or governments could unite and criminalize Bitcoin!

Seems very unlikely but the possibility should be mentioned.

Seems very unlikely but the possibility should be mentioned.

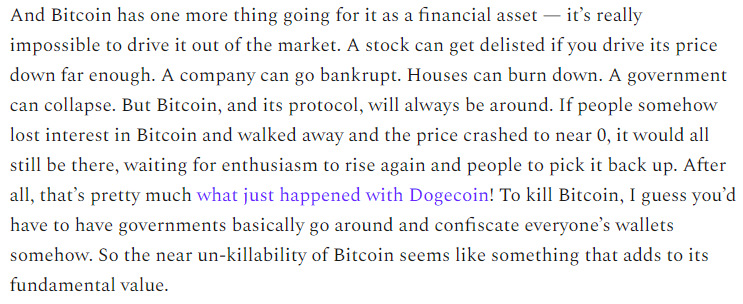

16/NO financial asset in the world is safe from the risk of ruin. But barring these unlikely events, Bitcoin is basically unkillable. If its price goes down temporarily, it can just come back when people get interested in it again.

17/This is why you can't shitpost or denounce Bitcoin into oblivion. If you drive down its price with angry posts, it'll just bounce back at some point.

And that will redistribute money from people who listened to you to people who ignored you!

And that will redistribute money from people who listened to you to people who ignored you!

18/This is why I urge people NOT to think about Bitcoin in political terms. Do NOT view it as an evil libertarian plot to bring down government.

antipope.org/charlie/blog-s…

antipope.org/charlie/blog-s…

19/First of all, as the great @ritholtz teaches us, you should not let politics cloud your judgement when investing.

ritholtz.com/politics-inves…

ritholtz.com/politics-inves…

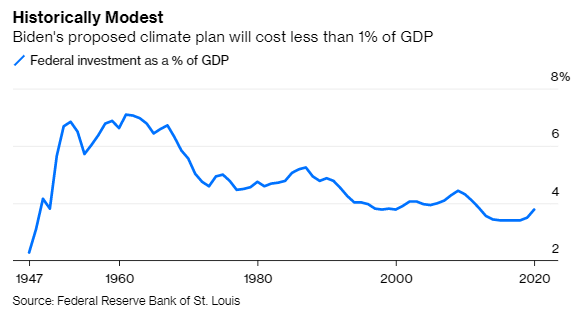

20/Also, you should not worry about Bitcoin bringing down governments! It's a hedge against system failure; it will not cause system failure.

21/Of course there are POLICY challenges associated with Bitcoin, such as electricity usage.

These need to be solved! But they don't make Bitcoin POLITICAL.

uk.finance.yahoo.com/news/bitcoin-c…

These need to be solved! But they don't make Bitcoin POLITICAL.

uk.finance.yahoo.com/news/bitcoin-c…

22/So Bitcoin -- and cryptocurrency in general -- appear to be here to stay. It's a new asset class, like digital gold. It's risky for sure, but bubbles will not kill it.

(end)

noahpinion.substack.com/p/triumph-of-t…

(end)

noahpinion.substack.com/p/triumph-of-t…

Anyway, if you like this sort of content, remember to sign up for my free email list! 😊

noahpinion.substack.com

noahpinion.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh