Compilation of the best learnings from @BankniftyA through his tweets.

Have compiled his:

1. Expiry day trading.

2. Trade logics.

3. Multiple Charts analysis.

3. BTST criteria for stocks.

Share if you find it helpful so that everyone can benefit.

Have compiled his:

1. Expiry day trading.

2. Trade logics.

3. Multiple Charts analysis.

3. BTST criteria for stocks.

Share if you find it helpful so that everyone can benefit.

A pdf of his moneycontrol article where you can read about his journey and how he trades.

https://twitter.com/HarshAsserts/status/1304407396018655232?s=19

Advice on how to not let your mood influence your decisions.

https://twitter.com/BankniftyA/status/1211193918345244672?s=19

Expiry day Trading:

How to become better?

When I had spoken to him on phone he advised me to backtest all expiries and rigorously practice them again and again to develop conviction. Superb advice!

How to become better?

When I had spoken to him on phone he advised me to backtest all expiries and rigorously practice them again and again to develop conviction. Superb advice!

https://twitter.com/BankniftyA/status/1324326308491358210?s=19

Acts based on support and resistance levels from charts 📊

https://twitter.com/BankniftyA/status/1207671800227934209?s=19

What premiums he sells and how he manages his quantity.

https://twitter.com/BankniftyA/status/1245438409243373569?s=19

What kind of stop loss isn't ideal and what premiums to sell on expiry day.

https://twitter.com/BankniftyA/status/1176581614492512258?s=19

Expiry day sole focus is just to find strikes which will be zero. 0️⃣

https://twitter.com/BankniftyA/status/1184797607115145216?s=19

Gives more emphasis to intra day trend than OI data

https://twitter.com/BankniftyA/status/1143883182866960384?s=19

How to take risks after getting some profit for further returns.

https://twitter.com/BankniftyA/status/1156957193175887872?s=19

How an option seller can make profit inspite of risking more than what he'll make.

https://twitter.com/BankniftyA/status/1182244104781975552?s=19

Reanalyze loss making trades and never repeat them to improve accuracy.

https://twitter.com/BankniftyA/status/1195100712759263232?s=19

Form a list of stocks where you're expecting movement and then look for surge in volumes.

https://twitter.com/BankniftyA/status/1207411169641869312?s=19

Some trade logics of his now:

1. If there is heavy call writing and the next day you see huge volumes buying going on, market likely to trap call sellers and close at day high.

1. If there is heavy call writing and the next day you see huge volumes buying going on, market likely to trap call sellers and close at day high.

https://twitter.com/BankniftyA/status/1212681988127088640?s=19

2. How he survived a trap day. He had sold calls, market gapped up next day and sustained.

https://twitter.com/BankniftyA/status/1215305192314298369?s=19

3. Never hold short positions whenever market closes at day high.

https://twitter.com/BankniftyA/status/1269194406093041666?s=19

4. Avoid short strangles/straddles whenever market closes at day low/high as the probability of a big gap up/down is really high.

https://twitter.com/BankniftyA/status/1269147733274660864?s=19

5. Higher High/Higher Low formations enable him to predict market ending at day high/low.

https://twitter.com/BankniftyA/status/1271434687030779909?s=19

6. OI going down and price going up in Bank Nifty futures causing further short covering.

https://twitter.com/BankniftyA/status/1295449224549560322?s=19

7. Another example of OI down price up leading to further short covering.

https://twitter.com/BankniftyA/status/1299317488425922560?s=19

8. Price going up and consolidating means preparing for further upmove.

https://twitter.com/BankniftyA/status/1306191023190814720?s=19

Some analysis of charts by his logics.

https://twitter.com/BankniftyA/status/1304040407718715399?s=19

https://twitter.com/BankniftyA/status/1319696374338732032?s=19

https://twitter.com/BankniftyA/status/1327216555373981697?s=19

https://twitter.com/BankniftyA/status/1327603908441632769?s=19

https://twitter.com/BankniftyA/status/1328436077091115008?s=19

BTST criteria for him.

https://twitter.com/BankniftyA/status/1304488680006930432?s=19

https://twitter.com/BankniftyA/status/1309939228805967873?s=19

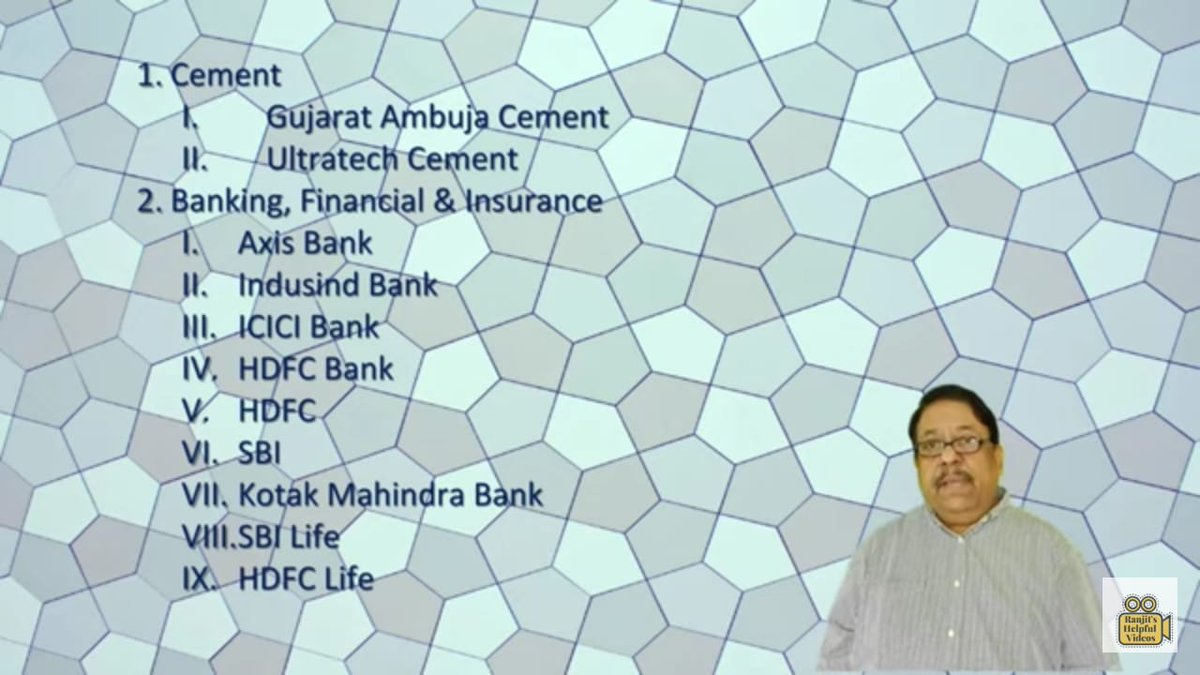

Stocks you can pick to build your portfolio in.

Thank you @BankniftyA

You have great content on your timeline for people to learn from. ✌👍

THE END

__________________________________

Thank you @BankniftyA

You have great content on your timeline for people to learn from. ✌👍

THE END

__________________________________

https://twitter.com/BankniftyA/status/1304999813742620672?s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh