1/ How to review quarterly earnings 🧵

A step by step guide using $DXCM as an example

⬇️

A step by step guide using $DXCM as an example

⬇️

2/ The BIG question: Is the thesis on track❓

Other question:

❓Is revenue growing?

❓Are margins stable/expanding?

❓Profits?

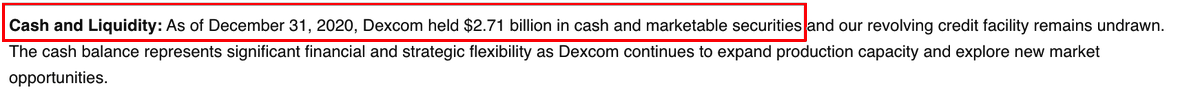

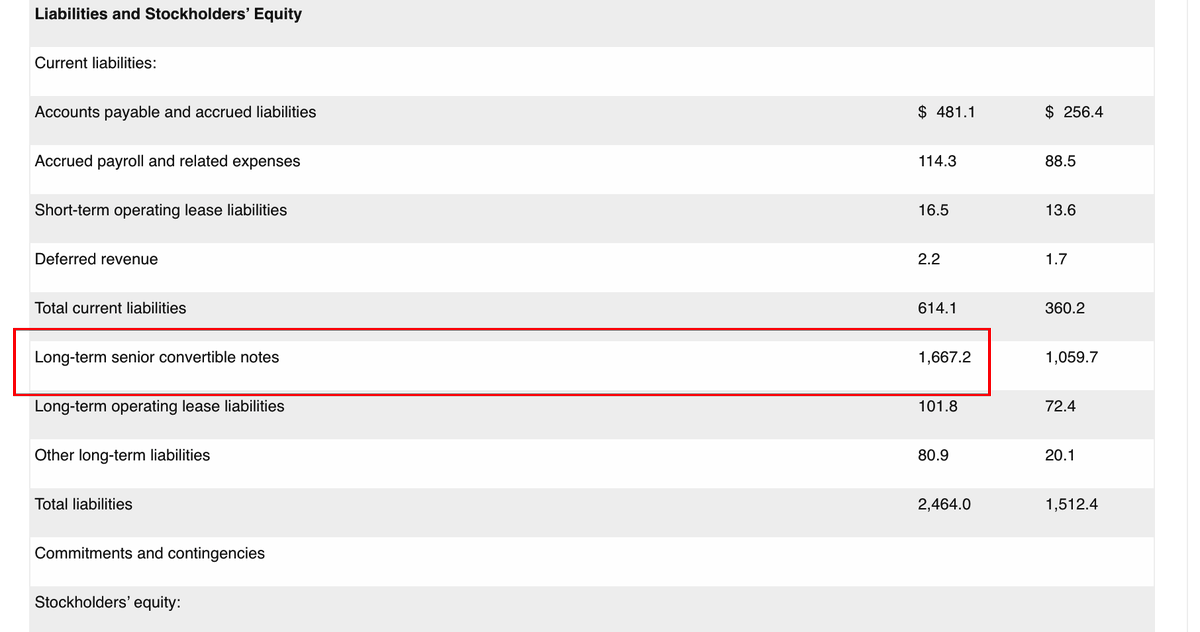

❓Balance sheet?

❓New opportunities?

❓New threats?

Other question:

❓Is revenue growing?

❓Are margins stable/expanding?

❓Profits?

❓Balance sheet?

❓New opportunities?

❓New threats?

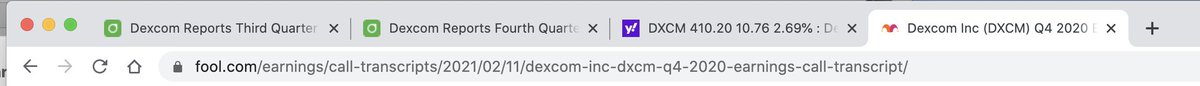

3/ I open 4 browser tabs

Tab 1 - Current company earnings report / shareholder letter

Tab 2 - Previous company earnings report / shareholder letter (check guidance)

Tab 3 - Analyst estimates

Tab 4 - Call Transcript

Tab 1 - Current company earnings report / shareholder letter

Tab 2 - Previous company earnings report / shareholder letter (check guidance)

Tab 3 - Analyst estimates

Tab 4 - Call Transcript

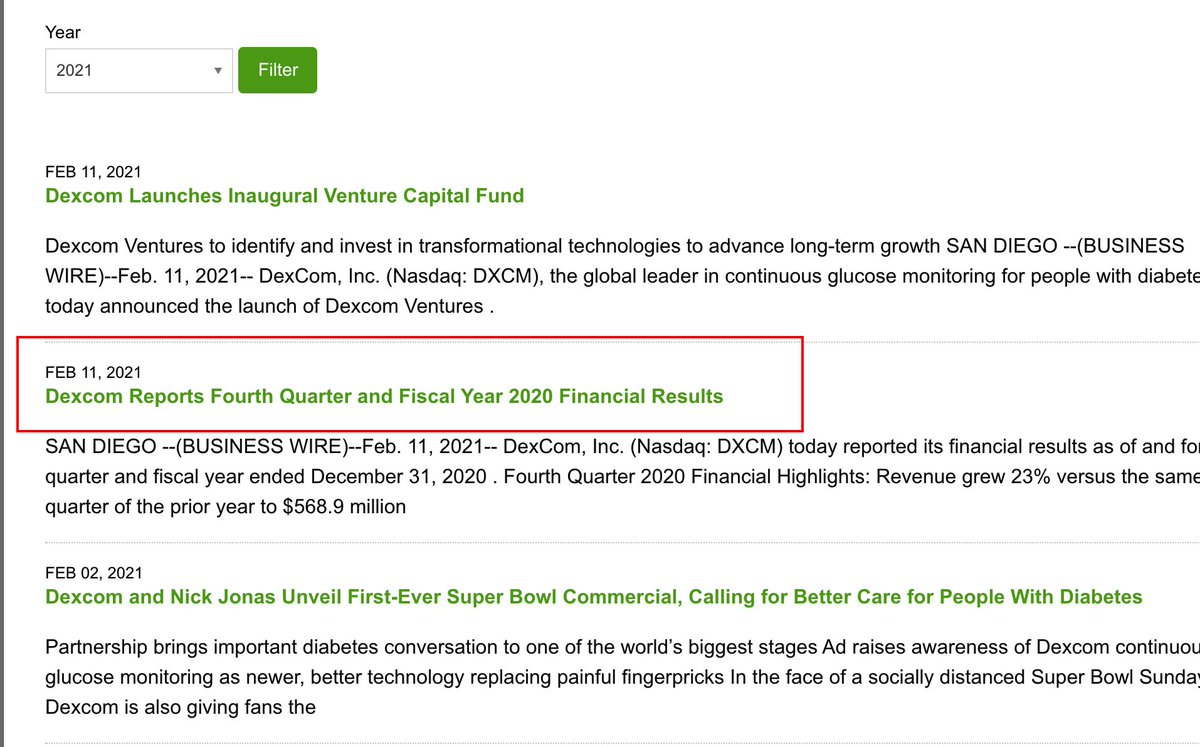

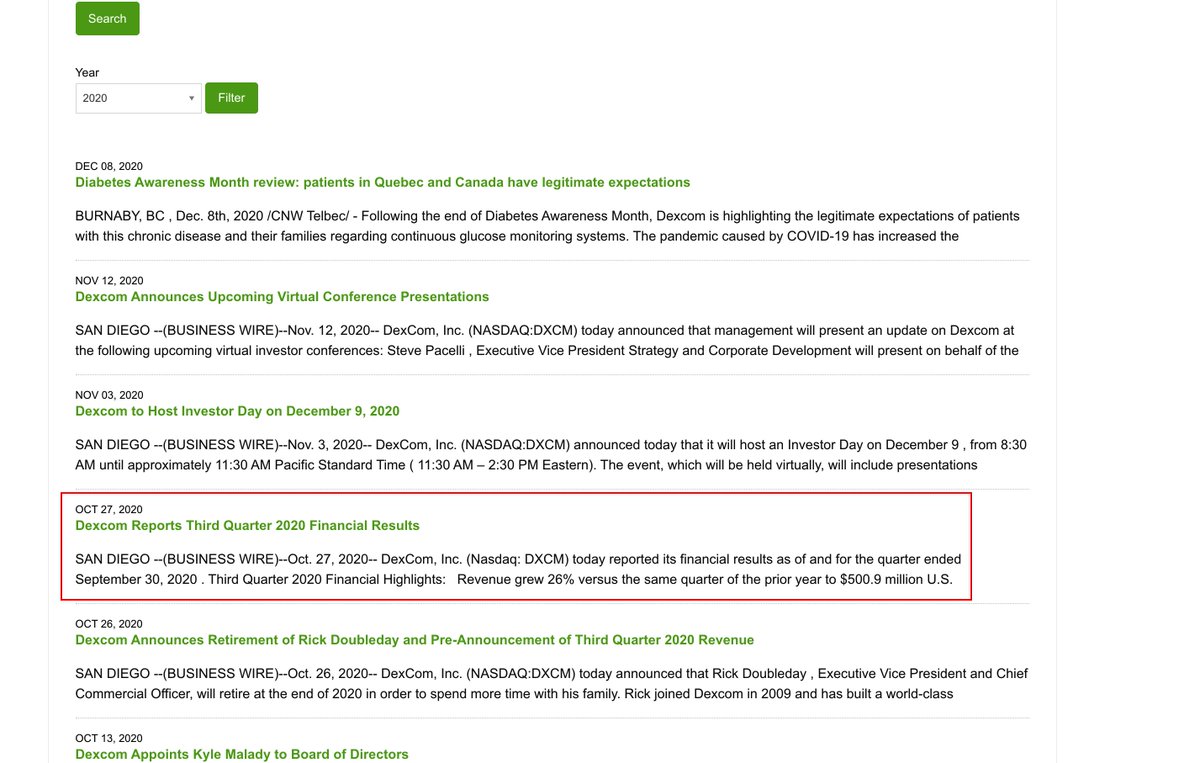

4/ Tabs 1 & 2 - Find the current & previous earnings report

I search "Dexcom Investor Relations"

I click on "press release"

Open the newest quarterly earnings report and last quarter

It can also be a shareholder letter/presentation

I search "Dexcom Investor Relations"

I click on "press release"

Open the newest quarterly earnings report and last quarter

It can also be a shareholder letter/presentation

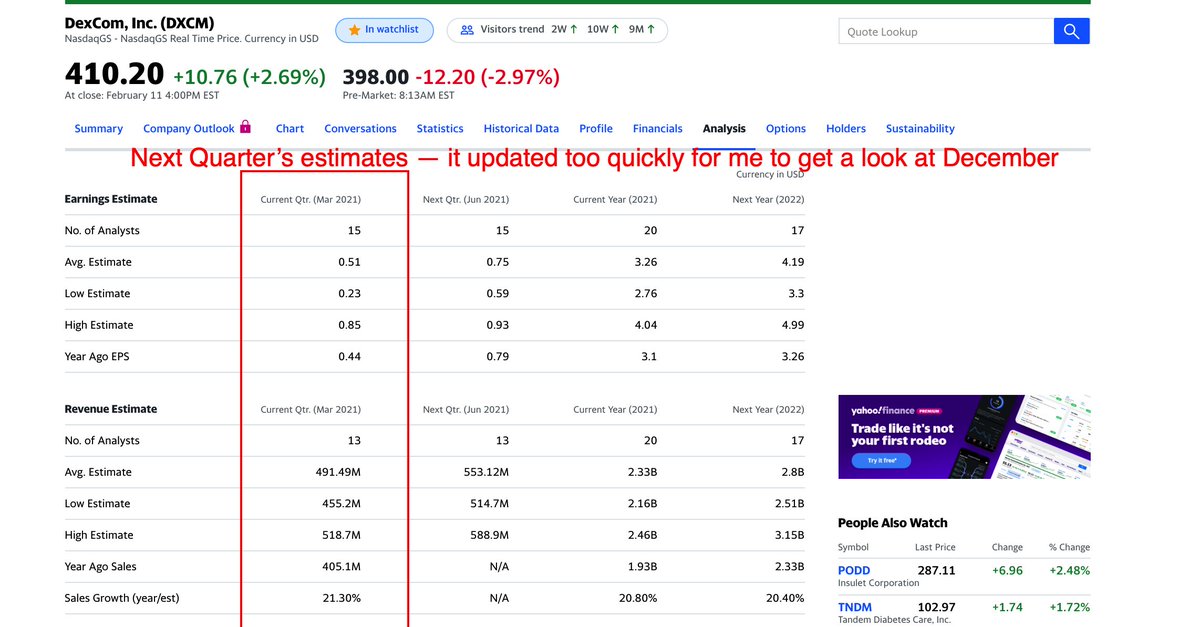

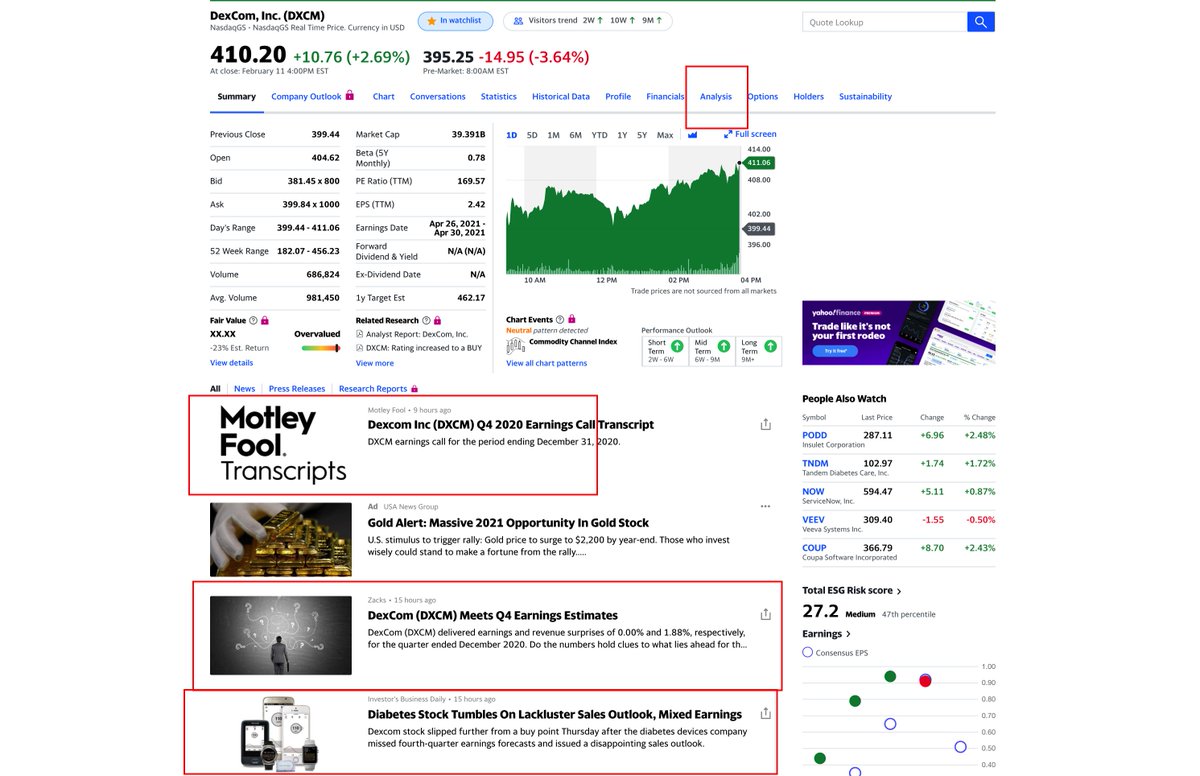

5/ Tab 3 - Find the quarterly analyst estimates

Open up $DXCM in yahoo finance

The "news" section usually has a link to reports on whether the company beat/met estimates

The "analysis" tab is a good source, but sometimes it updates to the next quarter too quickly

Open up $DXCM in yahoo finance

The "news" section usually has a link to reports on whether the company beat/met estimates

The "analysis" tab is a good source, but sometimes it updates to the next quarter too quickly

6/ Tab 4 - Find a transcript of the earnings call

@themotleyfool transcripts are best

Sometimes links are on Yahoo Finance news

Search "Fool DXCM Transcript" if not

Seekingalpha / NASDAQ are two other free sources

@themotleyfool transcripts are best

Sometimes links are on Yahoo Finance news

Search "Fool DXCM Transcript" if not

Seekingalpha / NASDAQ are two other free sources

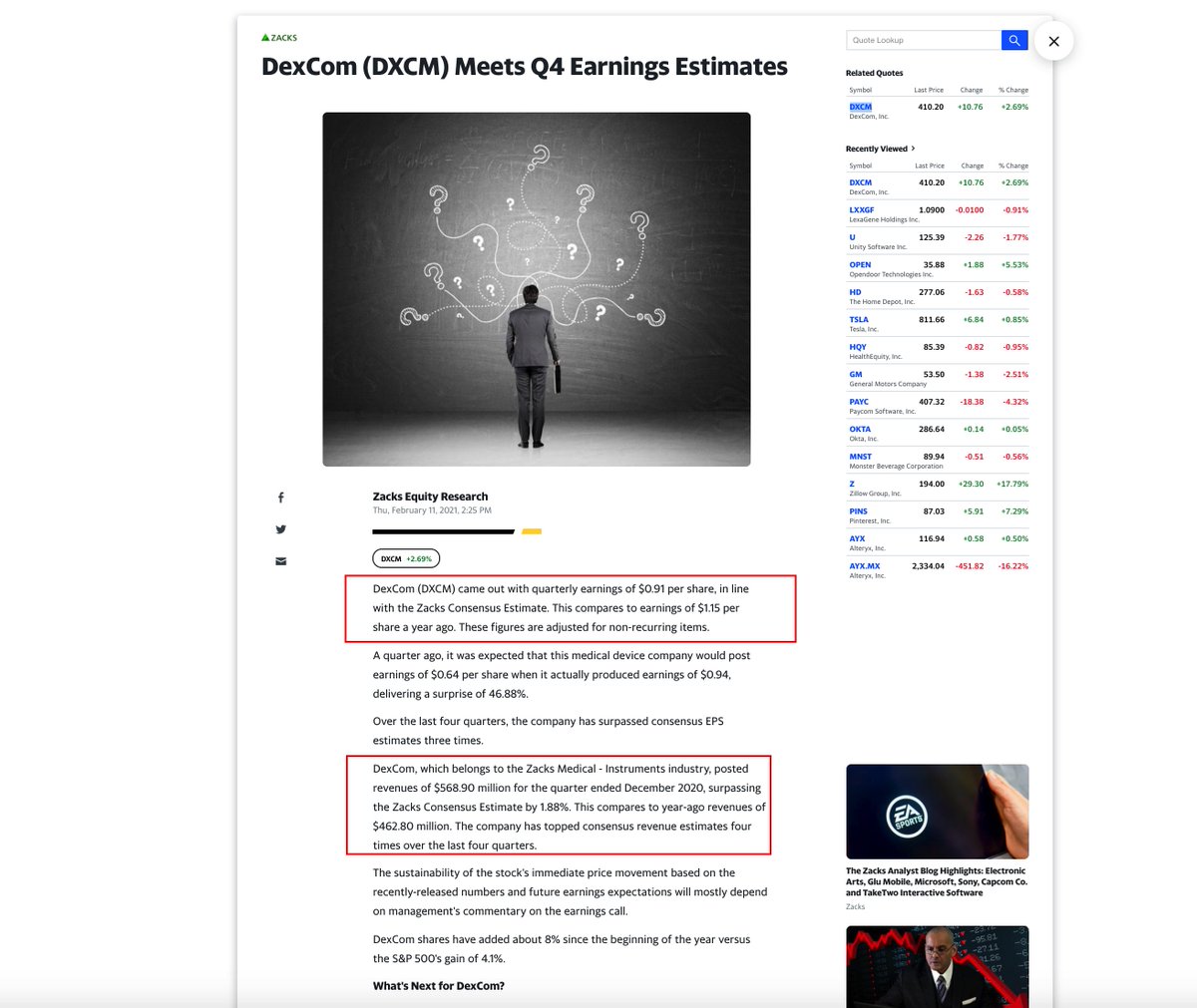

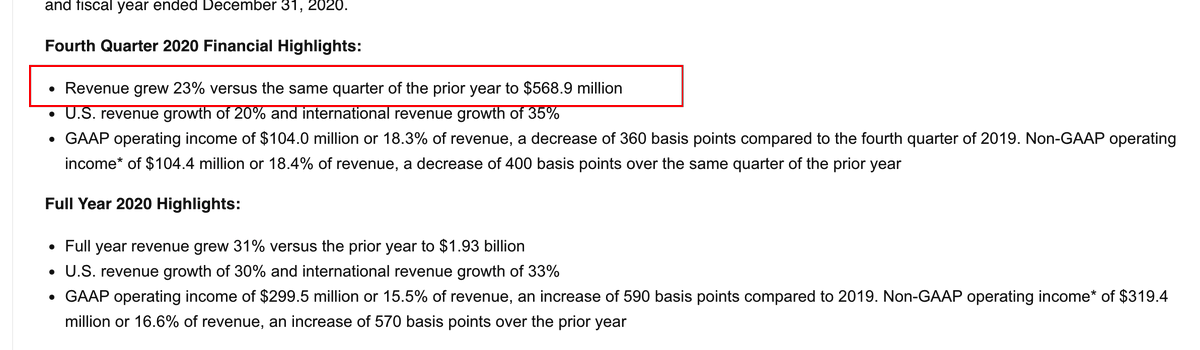

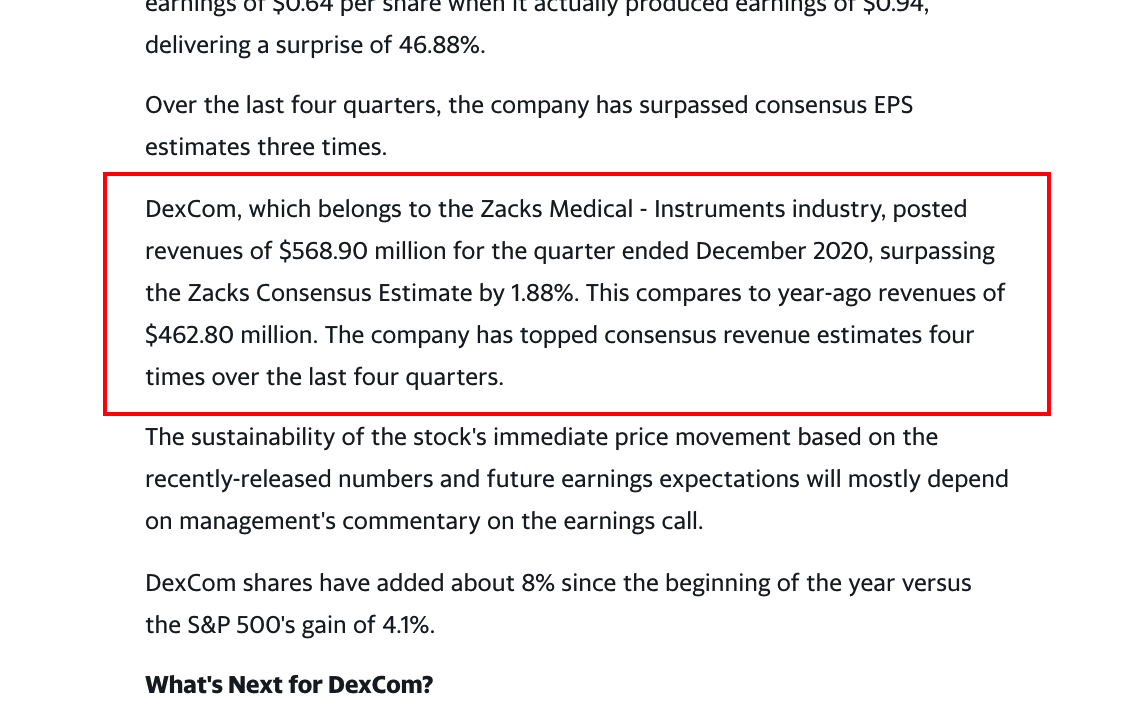

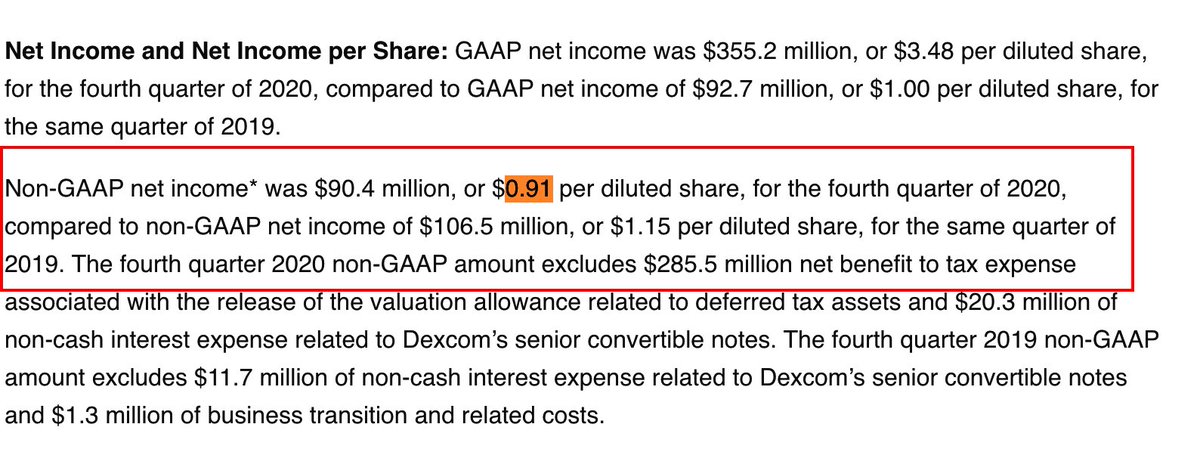

7/ In most recent earnings, I check the headline numbers:

Revenue growth: 23% to $569 million

Revenue vs. Wall Street expectations (beat by 1.88%)✅

non-gaap EPS growth: -21% to $0.91

EPS vs. Wall Street expectations (meet expectation)✅

Revenue growth: 23% to $569 million

Revenue vs. Wall Street expectations (beat by 1.88%)✅

non-gaap EPS growth: -21% to $0.91

EPS vs. Wall Street expectations (meet expectation)✅

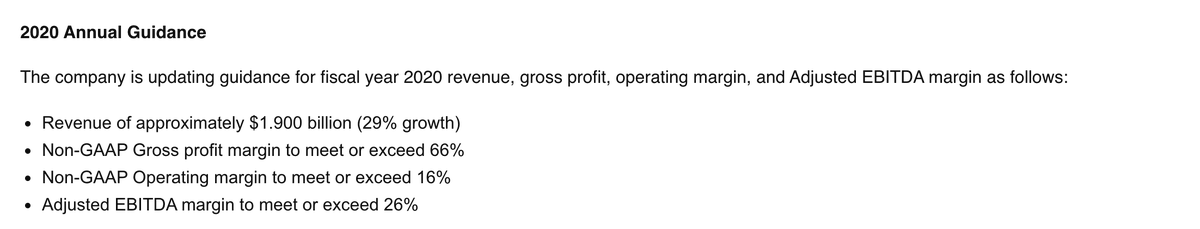

8/ Results vs. guidance

Management issued yearly guidance for 2020 in Q3 2020

Revenue +29% to $1.9 billion (actual +31% to $1.93 billion)✅

Non-GAAP Gross margin 66% (actual 66.7%)✅

Non-GAAP Operating margin 16% (actual 16.5%)✅

Management issued yearly guidance for 2020 in Q3 2020

Revenue +29% to $1.9 billion (actual +31% to $1.93 billion)✅

Non-GAAP Gross margin 66% (actual 66.7%)✅

Non-GAAP Operating margin 16% (actual 16.5%)✅

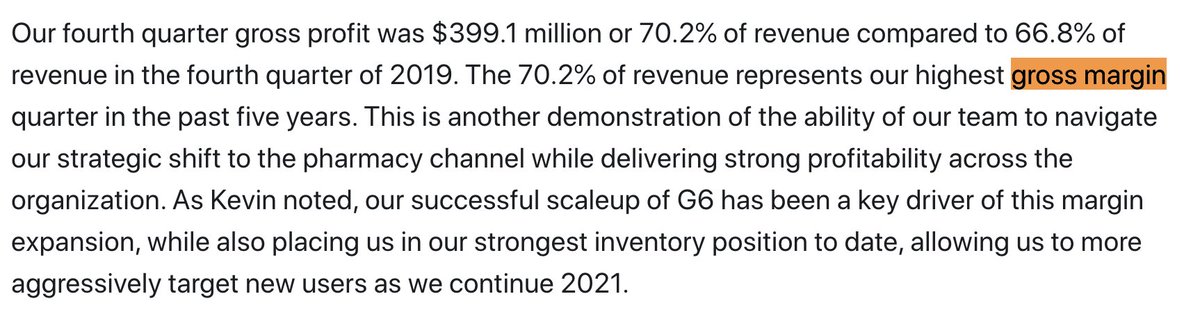

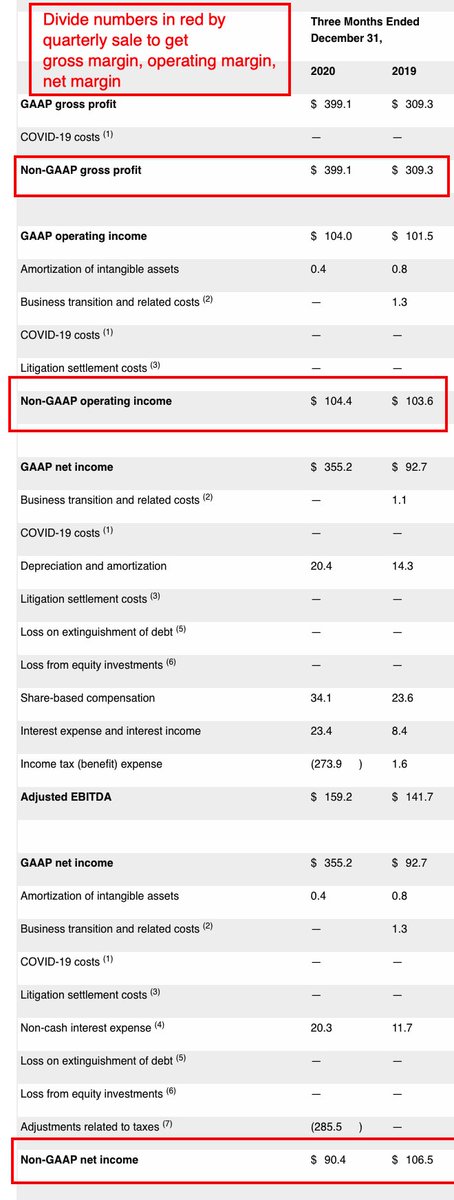

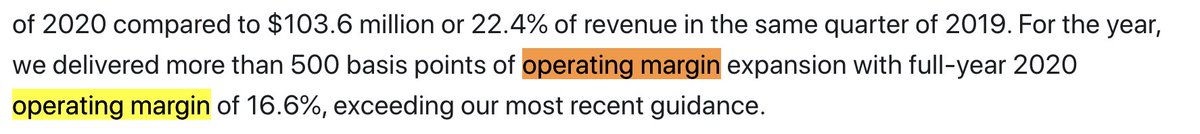

10/

Margins

Use transcript / press release / or calculate yourself

Gross 70.2% vs. 66.8% (gross profit grew faster than revenue)

Non-gaap Operating: 18.3% vs. 22.5% (investigate!)

non-gaap Net: 15.8% vs. 22.9% (investigate!)

Margins

Use transcript / press release / or calculate yourself

Gross 70.2% vs. 66.8% (gross profit grew faster than revenue)

Non-gaap Operating: 18.3% vs. 22.5% (investigate!)

non-gaap Net: 15.8% vs. 22.9% (investigate!)

11/

News from press release?

✅Building out salesforce (explains operating margin & net margin drop)

✅Reimbursement in France

News from press release?

✅Building out salesforce (explains operating margin & net margin drop)

✅Reimbursement in France

12/

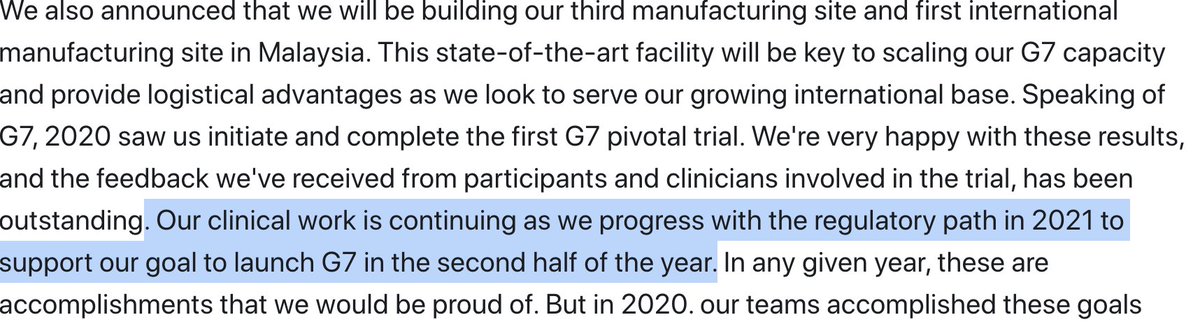

Read through transcript:

✅Gross margin ⬆️ from new manufacturing facility

✅Super bowl commerical

✅New service center in Lithuania

✅New manufacturing site in Malaysia

✅New sensor launching in 2nd half 2021

✅Enter VC space

Read through transcript:

✅Gross margin ⬆️ from new manufacturing facility

✅Super bowl commerical

✅New service center in Lithuania

✅New manufacturing site in Malaysia

✅New sensor launching in 2nd half 2021

✅Enter VC space

13/ Transcript

✅50% of sales now coming through pharmacy

✅International sales 35% of revenue

✅International DTC campaign launching

✅50% of sales now coming through pharmacy

✅International sales 35% of revenue

✅International DTC campaign launching

14/

2021 Guidance:

Revenue:

Management expects 15% to 20% growth

Wall Street expects 21%

Margins:

Gross ⬇️ to 65%

Operating ⬇️ 13%

2021 Guidance:

Revenue:

Management expects 15% to 20% growth

Wall Street expects 21%

Margins:

Gross ⬇️ to 65%

Operating ⬇️ 13%

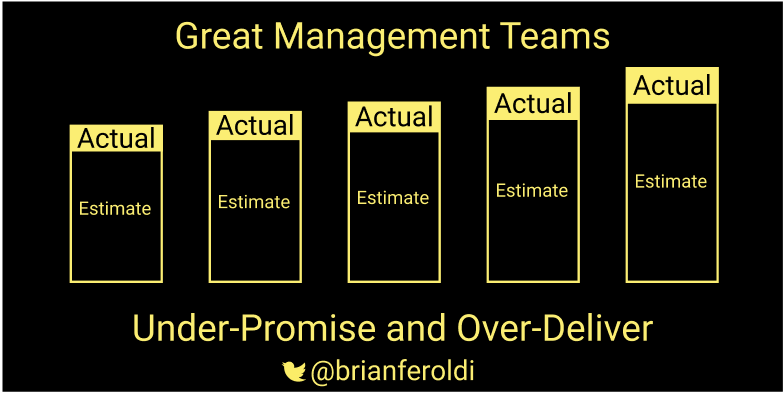

15/

Management has a long history of under-promising & over-delivering, so I view these numbers as the floor, not the ceiling

Management has a long history of under-promising & over-delivering, so I view these numbers as the floor, not the ceiling

16/

My big takeaways:

✅Revenue growing

✅Gross margin expanding

✅International expansion

✅Reinvestment year causing bottom-line to look worse

🛑2021 Margins will be weak

✅Move to pharmacy working

✅G7 launching in 2021

✅VC fund adds optionality

THESIS ON TRACK

My big takeaways:

✅Revenue growing

✅Gross margin expanding

✅International expansion

✅Reinvestment year causing bottom-line to look worse

🛑2021 Margins will be weak

✅Move to pharmacy working

✅G7 launching in 2021

✅VC fund adds optionality

THESIS ON TRACK

• • •

Missing some Tweet in this thread? You can try to

force a refresh