My 🔟 Biggest Investing Mistakes 🧵

1⃣Only looking at the share price

I bought penny stocks at the start

My logic: 100 shares of $1 stock > 1 share of $100 stock

WRONG!

The price of 1 share is meaningless!

What matters is how great the company is!

I bought penny stocks at the start

My logic: 100 shares of $1 stock > 1 share of $100 stock

WRONG!

The price of 1 share is meaningless!

What matters is how great the company is!

2⃣Only looking at dividend yield

I bought stocks with 10%+ yields

My logic: 10% yield > 1% yield

WRONG!

The dividend got cut and the share price dropped -- a double-whammy!

A high yield is Wall Street's way of saying "this yield is not sustainable, watch out"

I bought stocks with 10%+ yields

My logic: 10% yield > 1% yield

WRONG!

The dividend got cut and the share price dropped -- a double-whammy!

A high yield is Wall Street's way of saying "this yield is not sustainable, watch out"

3⃣Selling a great stock early

I bought $DXCM in 2007 for ~$6

I sold it 1 month later after a 15% gain

Current price: $412.58

I was in a rush to take profits, so I missed out on HUGE upside

If the opportunity is huge, hold!

I bought $DXCM in 2007 for ~$6

I sold it 1 month later after a 15% gain

Current price: $412.58

I was in a rush to take profits, so I missed out on HUGE upside

If the opportunity is huge, hold!

4⃣Not buying a great stock due to valuation

I've made this mistake over and over again

I didn't buy $ZM at $80 because the valuation was "insane"

Current price: $455

If you like everything about the company except the valuation, but some

Even if it's just a little bit

I've made this mistake over and over again

I didn't buy $ZM at $80 because the valuation was "insane"

Current price: $455

If you like everything about the company except the valuation, but some

Even if it's just a little bit

5⃣Buying too much of a "sure thing"

I thought $KMI was a SURE THING in 2014

I made it my largest position at $35

$KMI fell 70% in 2015

70%!!!!!!

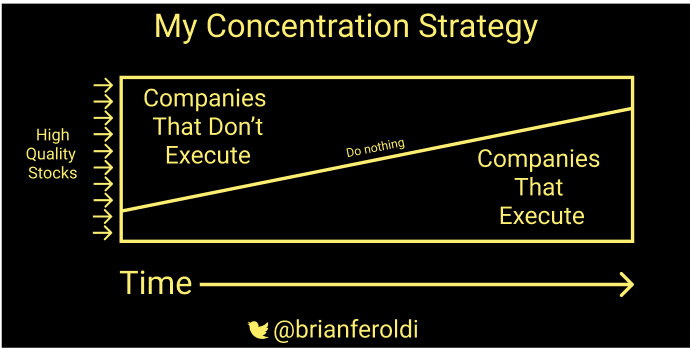

Lesson: Cap your exposure, NO MATTER YOUR CONVICTION, and let your portfolio concentrate itself

I thought $KMI was a SURE THING in 2014

I made it my largest position at $35

$KMI fell 70% in 2015

70%!!!!!!

Lesson: Cap your exposure, NO MATTER YOUR CONVICTION, and let your portfolio concentrate itself

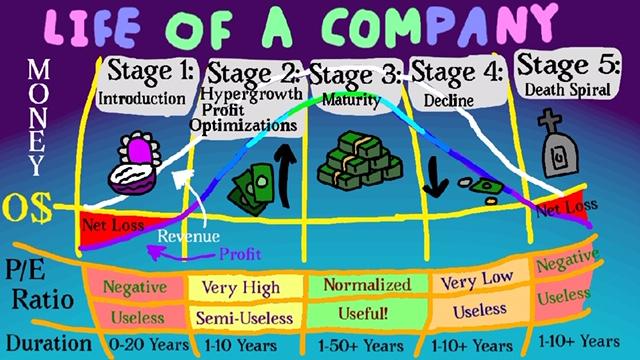

6⃣Only looking at P/E ratio

I use to apply the P/E ratio to ALL stocks

I didn't buy $CRM in 2005 at $5 cause its P/E ratio was >100

Current price: $240

Lesson: P/E ratio only works on stocks that are OPTIMIZED FOR EARNINGS

Don't use it on companies in phase 1, 2, 4, 5

I use to apply the P/E ratio to ALL stocks

I didn't buy $CRM in 2005 at $5 cause its P/E ratio was >100

Current price: $240

Lesson: P/E ratio only works on stocks that are OPTIMIZED FOR EARNINGS

Don't use it on companies in phase 1, 2, 4, 5

7⃣Thinking "I Missed It"

Great companies can win for years and years and years!

I haven't bought lots of great stocks because I thought the good times were over

If it's a great company, you can get in late, and still win big

Great companies can win for years and years and years!

I haven't bought lots of great stocks because I thought the good times were over

If it's a great company, you can get in late, and still win big

8⃣Comparing myself to other investors

I have a bad habit of comparing myself against other successful investors

but, if other investors are doing better than me, SO WHAT?? That doesn't matter!

What matters is how I am doing compared to my goals!

Comparison is the thief of joy

I have a bad habit of comparing myself against other successful investors

but, if other investors are doing better than me, SO WHAT?? That doesn't matter!

What matters is how I am doing compared to my goals!

Comparison is the thief of joy

9⃣Not listening to people I trust

I have ignored buy recommendations on $SHOP, $NFLX, $NVDA, $ZM, $MTCH, $IDXX, $TWLO, $ADBE

FOR YEARS

Even though they were recommended by @DavidGFool @TomGardnerFool and @FoolJeffFischer

All of whom are much better investors than me!

I have ignored buy recommendations on $SHOP, $NFLX, $NVDA, $ZM, $MTCH, $IDXX, $TWLO, $ADBE

FOR YEARS

Even though they were recommended by @DavidGFool @TomGardnerFool and @FoolJeffFischer

All of whom are much better investors than me!

🔟 Repeating the same mistakes

I have a habit of learning investments lessons the hard way AND slowly

I can all but guarantee that I'll repeat some of these mistakes again (especially the "not buying on high valuation" mistake)

What can I say - I'm human

I have a habit of learning investments lessons the hard way AND slowly

I can all but guarantee that I'll repeat some of these mistakes again (especially the "not buying on high valuation" mistake)

What can I say - I'm human

• • •

Missing some Tweet in this thread? You can try to

force a refresh