1. Extreme winter weather is causing rolling blackouts in Texas which may continue through Monday and potentially Tuesday.

@ERCOT_ISO declared an EEA 3. This is a very dangerous grid event, so please don’t rush to judgment about causes. It is complex

@ERCOT_ISO declared an EEA 3. This is a very dangerous grid event, so please don’t rush to judgment about causes. It is complex

https://twitter.com/ERCOT_ISO/status/1361265260217446402

2. When California suffered rolling blackouts last summer, @MBazilian and I cautioned that such events are complex.

Invoking pre-existing beliefs about energy market design, capacity markets, and fuel types are not necessarily correct (and insensitive) utilitydive.com/news/californi…

Invoking pre-existing beliefs about energy market design, capacity markets, and fuel types are not necessarily correct (and insensitive) utilitydive.com/news/californi…

3. The proximate cause for rolling outages is extreme winter weather, the worst winter storm in Texas in decades.

The energy system in Texas is built to meet summer peaks, not rare winter storms of this severity @joshdr83 @Caitlin0903 forbes.com/sites/joshuarh…

The energy system in Texas is built to meet summer peaks, not rare winter storms of this severity @joshdr83 @Caitlin0903 forbes.com/sites/joshuarh…

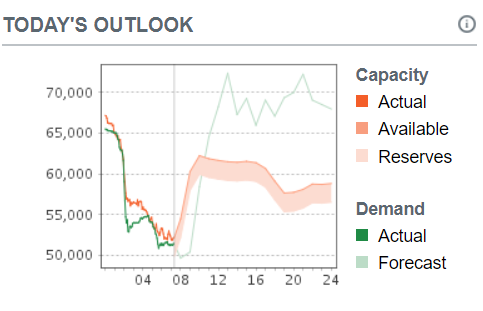

4. This has led to electric demand projections for Monday as high as 74 GW. This would be an all-time record high electric demand, even compared to summer. However, it probably won’t be realized because of insufficient electric supply (source ercot.com)

5. This very high demand has led to very high day-ahead and real-time electric prices throughout the state over the weekend and through Tuesday. Prices are 50 times or so more than normal

6. The first place to start analysis is with the final winter Seasonal Assessment of Resource Adequacy.

Two things emerge. First, current conditions are much worse than the extreme weather case. Second, outages may be worse than their worse case scenario ercot.com/news/releases/…

Two things emerge. First, current conditions are much worse than the extreme weather case. Second, outages may be worse than their worse case scenario ercot.com/news/releases/…

7. The vast majority of the time, reliability issues are caused by transmission and/or distribution disruptions.

Undoubtedly there will be distribution disruptions but the current event is one of the few where supply disruptions are primary drivers

Undoubtedly there will be distribution disruptions but the current event is one of the few where supply disruptions are primary drivers

8. Put simply, there are not enough power plants operating to meet electric demand. While some will claim this is because of poor renewables, not enough nuclear, or coal retirements, the reality is it is a system-level issue

9. As Texas rarely sees such temperatures, electric and energy systems are generally not weatherized to handle such events.

Wind turbines are icing because they need special preparation for cold weather conditions, rarely experienced in ERCOT nrcan.gc.ca/energy/energy-…

Wind turbines are icing because they need special preparation for cold weather conditions, rarely experienced in ERCOT nrcan.gc.ca/energy/energy-…

10. Natural gas prices have already soared because winter energy demand means that pipelines are full. One unappreciated part of the coal-to-gas transition is that the power sector took advantage of empty pipelines paid for by winter heating customers naturalgasintel.com/natural-gas-ma…

11. This means that most power plants do not have firm contracts for gas delivery and, in winter cases such as this, don’t necessarily have supply. From a resource perspective, this is still a fossil dominated system, and a natural gas one at that.

https://twitter.com/emilygrubert/status/1361011767439220748

12. Both nuclear and coal are maxed out on generation and its still not helping. Nuclear capacity in Texas is less than 10% of current demand, and it is not a peaking resource, which is the challenge here.

Coal is vulnerable to frozen coal piles and other weatherization issues

Coal is vulnerable to frozen coal piles and other weatherization issues

13. These blackouts will immediately ignite a long-standing debate about capacity markets versus energy-only markets with high scarcity pricing @gavinbade utilitydive.com/news/the-great…

14. It is way too early to say anything about that. Beyond market design choices, the bigger decision is the target reserve margin (i.e. how much extra capacity do you have compared to demand). ERCOT typically has the lowest in the country

https://twitter.com/jacob_mays/status/1360904424600850433

15. It is not clear that either a capacity market or an energy only market would be able to address two of the primary causes of the current event: a lack of power plant level weatherization and electric planning that does not account for gas delivery limitations

16. These issues are potentially exacerbated because ERCOT’s electric grid is essentially isolated from the rest of the country. Greater integration generally reduces risks of events like these

17. However, in this case, extreme weather is also occurring in adjacent ISOs SPP and MISO. It is possible that those areas suffer from energy supply limitations as well

18. For me, there are three things to watch for: First, can the system maintain power with rolling outages? This is a public health and safety emergency and people may die if there is an uncontrolled blackout

19. Second, can energy conversation, induced by very high prices and consumer electric conservation, help reduce the severity of the blackouts on Monday and Tuesday? Over the summer, we saw this happen in California once people understood the challenge

20. Third, what is the rate of forced outages and the primary causes, particularly for gas plants? If gas plants aren’t operating due to a lack of pipeline availability in the oil and gas capital of the U.S., we need to reevaluate fuel supply as a risk to resource adequacy

• • •

Missing some Tweet in this thread? You can try to

force a refresh