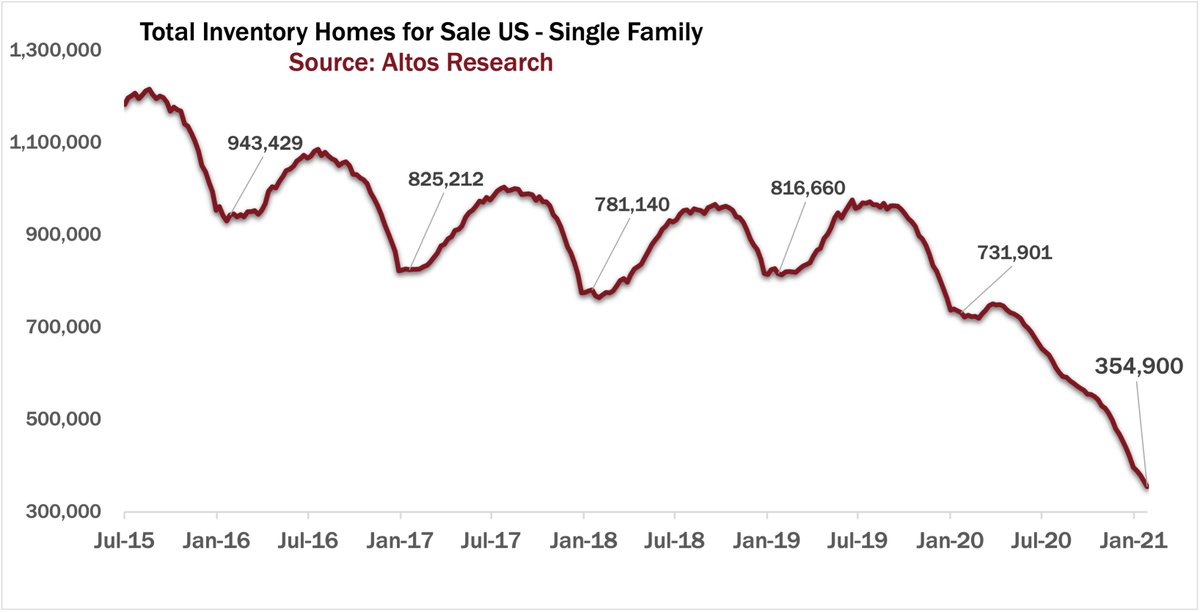

Inventory drops another couple percent this week. Only 344,000 houses on the market *in the whole country*.

No bottom in sight yet. Thousands of homes going directly into contract bypassing the active inventory numbers altogether.

2/5

No bottom in sight yet. Thousands of homes going directly into contract bypassing the active inventory numbers altogether.

2/5

Prices are up 10% year over year. This massive price appreciation seems likely to continue for the whole year. Median home price in the US is $345,499 this week.

YoY price changes will jump in a month when the first 2020 lockdown comparisons kick in.

3/5

YoY price changes will jump in a month when the first 2020 lockdown comparisons kick in.

3/5

You can really measure the insane levels of demand by tracking percent of the market with price reductions. Normally 30-35%, demand has been high in recent years.

Now everything is going so fast, with multiple offers, nationwide, only 18% need a price cut

4/5

Now everything is going so fast, with multiple offers, nationwide, only 18% need a price cut

4/5

Weekly @altosresearch video with the US real estate details is here:

5/5

(Zoom recording bug, so you don't get to see my smiling face this week. Will try to fix for next week🤷♂️)

5/5

(Zoom recording bug, so you don't get to see my smiling face this week. Will try to fix for next week🤷♂️)

Plug: If you're a Realtor, visit AltosResearch.com and book a demo to work with our team on how you can use data in your business. People need your help now more than ever!

6/5

6/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh