1/ It was exactly a year ago today, on Valentine's day 2020 that the market topped and eventually bled into the March 12th Black Thursday sell-off.

2/ A lot has changed in the year since - one of the most important being the unprecedented amount of liquidity global central banks have pumped into the system, single-handedly lifting every financial asset to record proportions

3/ We have witnessed the largest and swiftest asset price inflation in world history, and with it also the biggest disconnect between markets and the real economy in modern times

4/ Evidence of this is the real estate market, supposedly the most rooted of all assets in the real economy, breaking all-time record after record in most global cities even as economies teeter on the brink of recession

5/ Against this backdrop it's easy to understand how crypto, a super speculative instrument class, has itself had the most mind-boggling 13x rally this past year

6/ It’s clear that regardless of how this liquidity finds its way into the crypto market - be it retail investors, hedge funds or corporate institutions, the underlying driver of this is the wall of cheap liquidity

7/ The channel through which this liquidity enters the crypto market determines the nature of the price move - retail investors have far less sticky capital and generate shorter-term two-way markets...

8/ ... while hedge funds tend to have larger allocations and comparatively stickier capital, generating longer-lasting moves. Corporates and other similar institutions however are slow moving behemoths that allocate and deploy slowly but will drive a long lasting multi-year trend

9/ With the increased adoption across all segments of the market, the many layers of asset managers from mutual funds, ETPs, up to sovereign wealth funds represent derivatives between the hedge fund and corporate classification...

10/ ...Central banks of course remain the holy grail, but are a remote possibility apart from a few small insignificant ones.

11/Given the relatively small market size and increased adoption across all market segments, BTC price today is not unreasonable as long as central banks keep printing. The "bubble" is not so much current price of BTC itself, but rather the markets projections of future BTC price

12/ It was estimated by an asset manager that if all the S&P 500 companies allocated 10% of their cash piles to BTC today it would send the BTC price to $400,000...

13/ ...putting that with Bridgewater’s forecast of BTC price assuming half the Gold speculators switch to BTC today ($160,000 forecast), we can see how rich the backend BTC calls are

14/ Put simply, the market is pricing a 10% chance of $400,000 by year’s end, 15% chance of $300,000, 30% chance of $160,000 and close to a 50/50 chance of higher than $100,000

15/ In our view the curves are too steep and the long-term implied vols are too high, but this combination is also the reason for the incredible market-neutral yields that are available in crypto and nowhere else

16/ With the development of large-scale publicly listed corporates joining the fold (meaning quick access to potential capital raises a la Microstrategy), focusing on earning BTC theta (especially downside) could be a decent play

17/ In the near-term however, we have to trade between the 3 segments of market participants - retail, hedge funds and corporates. We continue to see the retail chase and get stopped out on any short-term momentum breaks, and this can extend into a quick $3,000-$5,000 washout...

18/ ...like the one we had this morning, and why we like gamma around here. For hedge funds and large quants, we expect them to be leaning heavily on the parabolic that has supported this rally since Oct

19/ To break the 50k we need a fresh large corporate involvement, and we like selling theta into this on the expectation that large scale decisions will take some time

20/ As a specific structure we like a long end-Mar 48k/56k 1x2 call spread for positive premium, with the intention to trade the gamma on the 48k call down to 42k & 40k potentially multiple times

21/ With every rally thus far having been matched with an even steeper futures basis, this also gives us confidence in shorting near-date higher delta calls outright due its ease in rolling higher on any breakouts

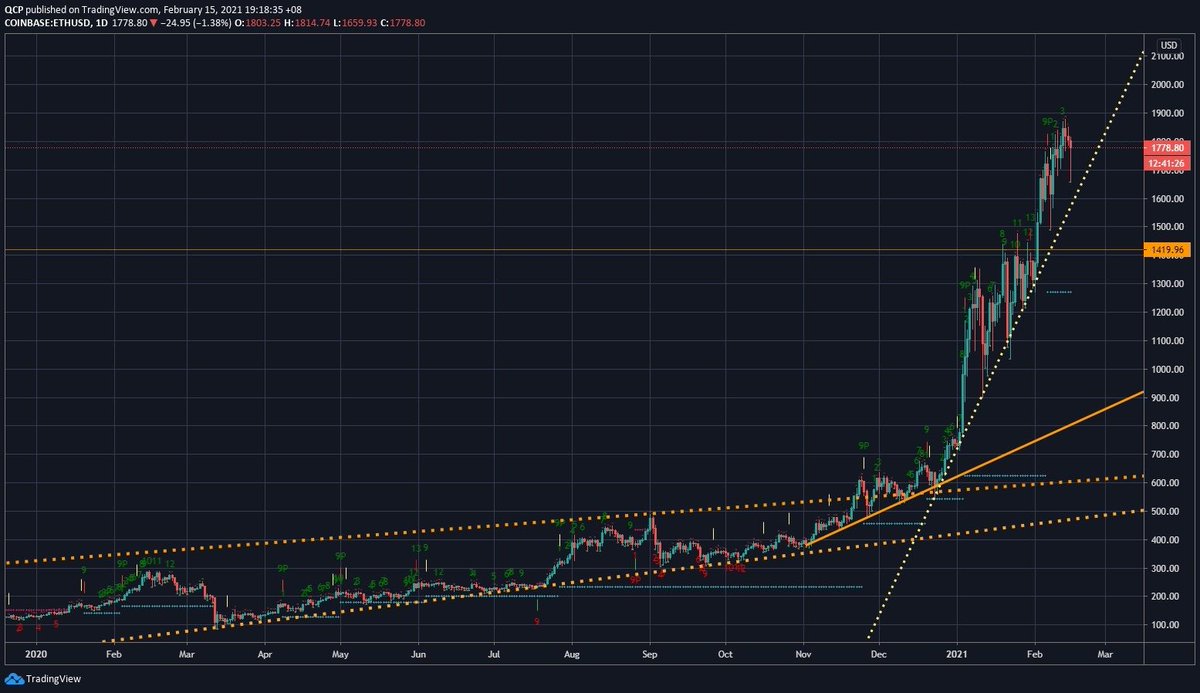

22/ For ETH we continue to watch the trendline that has supported us since the upward move from $600 in Dec, and we like selling higher delta shorter-date puts to chase this trend higher until the trendline breaks

23/ Nevertheless the longer BTC stalls here without a fresh catalyst, the more we will be looking for a longer-lasting downside into March

24/ As we’ve highlighted before, seasonality of March downside followed by April upside is the strongest and most consistent pattern in BTC and likely to be tax-related. The increase in global crypto tax regulation will likely further solidify this seasonality going forward

25/ It's still too early now for us but into end-Feb if vols drop further we will be looking for some end-Mar downside protection.

26/ Full update here qcpcapital.medium.com/market-update-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh