1/16 Attention PSLV owners. We have seen a lot of news over the weekend with the prospectus changes in the silver ETFs. When investing in securities like ETFs, trusts, and structured products it is vital to read and understand the terms.

2/16 Please keep in mind, the following is meant to be educational and informative. I can not stress enough the importance of physical metal over any paper claim. Even when these paper claims are held in high regard.

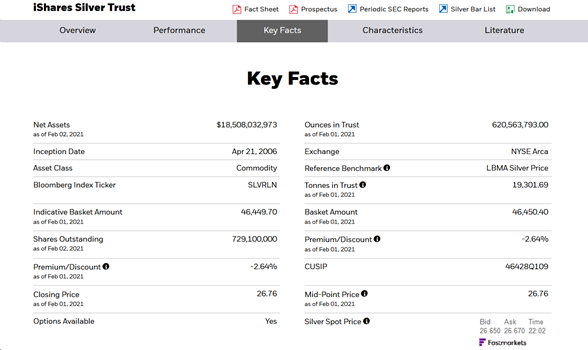

3/16 I noticed something very strange which absolutely no one has picked up on. Many have cited the SPROTT PHYSICAL SILVER TRUST “PSLV” as an alternative to SLV or other ETFs. PSLV has been announcing additional deliveries of silver into the trust recently.

4/16 I wanted to understand how a closed end fund is buying and adding new units on a consistent basis. What are the actual costs of owning this fund?

5/16 On 10-21-2020, the trust expanded its “at-the-market” equity program which offers new trust units in the amount up to $1.218 Billion. sprott.com/investment-str…

6/16With these new units, the trust can purchase more silver. However with each new placement unit sold into the market, the selling agent raising the capital is paid 3% of the aggregate gross proceeds of the sale. This is listed on page 37 of 39 of the Amended and Restated Sales

7/16 Agreement dated 10-21-2020. lawinsider.com/contracts/gr3H…

8/16 In addition, there is a cost to obtain the physical metal. What this means is that only 97% of the capital from buyers of new trust units goes to the trust. How does this 3% commission get offset?

9/16 Possibly by suppressing the market value of the share price so the share price becomes a discount to Net Asset Value (NAV). The individual buying new units at a discount to NAV neutralizes the sales commission.

10/16 And since October 2020, the discount has stayed around a 3% discount to NAV. The 6 month chart below illustrates the constant discount as new units may have been issued.

12/16 Why is this bad? One has an opportunity to buy something at a discount to NAV? I understand that point of view. However, when buying any publicly traded instrument versus the actual underlying asset, there is no guarantee that paper vehicle will perform similarly

13/16 to the underlying asset. In this case the trust is offering over a billion dollars of new units. Does this mean from time to time the share price may underperform in relation to investor expectations or market prices of the actual metal?

14/16 Is this activity fair to existing share owners who may have to liquidate and not see the full value for their holdings recognized?

15/16 I am simply pointing out the considerations one has to employ when investing. Take the time to fully understand the risks and other factors that may affect your investment.

16/16 Please feel free to comment or retweet on whether this helps you understand PSLV as an alternative to physical. Allowing the metals community to become better educated will only make us stronger in the end.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh