1/ On President’s Day, we reflect on the legacy of the world’s most powerful public office. And with the recent changing of the guard in the Oval Office, many of our investors have been left wondering what the incoming Biden administration means for the #oil and #natgas industry.

2/ However, history shows that, despite the power of the Presidential office, the energy cycle often operates independently of the political cycle. Older generations might recall that the energy politics of yesteryear centered around achieving American “energy independence.”

3/ The idea was born from the 1970s #oil shock, after which President Richard Nixon proclaimed: “At the end of this decade, in the year 1980, the United States will not be dependent on any other country for the energy we need.” That was 1974, when America imported 36% of its oil.

4/ For the next three decades, every subsequent President made similar promises. However, the politicians were powerless to stop two powerful market trends: Americans consuming more $oil and producing less of it.

5/ Widespread depletion across conventional fields caused U.S. #oil production to peak in the early 1970s, and then enter into steady decline for the next four decades. By 2009, imports made up a record 66% of U.S. oil consumption - the year Barack Obama entered the Oval Office.

6/ By then, the political winds had shifted. “Clean Energy” had replaced the "Energy Independence" agenda. Together with the Democratically controlled congress, Obama passed a record sized energy bill that included a $90 billion investment into solar, wind and other renewables.

7/ Obama’s energy approach reflected the polar opposite of his predecessors George Bush, a verified oilman from West Texas, and Vice President Dick Cheney, the former Halliburton CEO. By all accounts, the Bush/Cheney administration was all-in on the fossil fuel industry.

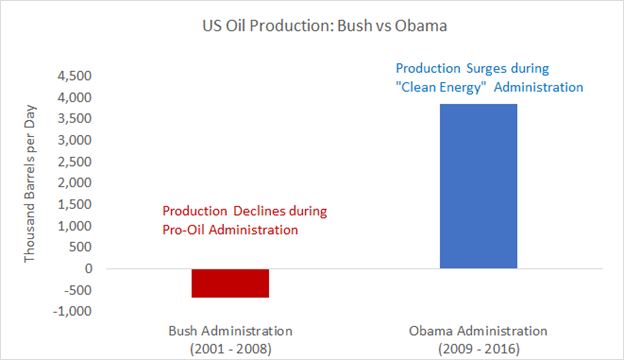

8/ Despite these 180 degree opposing views, a strange thing happened: U.S. #oil and #natgas production declined under the Bush administration, and then increased by the most on record during Obama’s tenure:

9/ What happened here? In two words: Shale Revolution. Many people seem to forget that the shale industry was born and developed under the “clean energy” Obama administration – not because of his political agenda, but despite it.

10/ So it wasn’t politicians that reversed America’s declining oil production - despite their promises over more than four decades. Instead, it was entrepreneurs working in the free market who developed incredible new innovations, like horizontal drilling and hydraulic fracturing

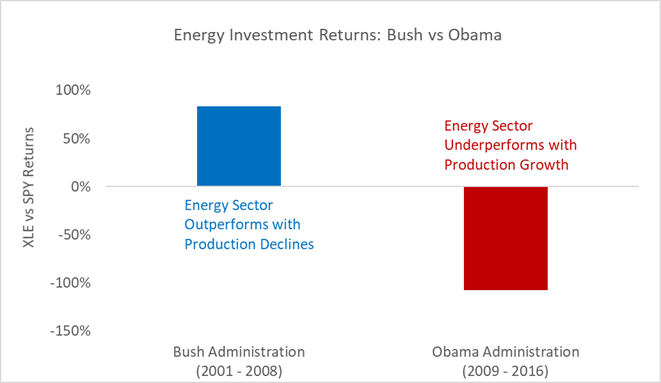

11/ But in another ironic twist of fate, the bonanza in new #oil and #natgas production during the shale era backfired on investors - resulting in a lost decade of capital incineration. Conversely, investors enjoyed stellar returns during the Bush Era of declining production:

12/ The lesson from history is that politics takes a back seat to the free market forces in the energy industry. And the outcomes are often counter-intuitive, and even run opposite from what you might expect listening to the headline noise.

13/ Going forward, despite the growing popularity of narratives like the "Death of Fossil Fuels", we believe investors will benefit from focusing on the fundamentals beyond the hype.

14/ And if the millions of U.S. consumers going without power and heat this last week has shown anything, it's that the world still relies on the critical energy and heating fuel sources provided by fossil fuels, like #natgas.

15/ Yes, the world should and will continue moving towards cleaner energy sources over time. But a rational analysis of the global energy consumption trends reveals the ongoing need for hydrocarbons as a key bridge to the other side of the new energy economy.

16/ At a time when the growing consensus is moving away from #oil and #natgas investing, we believe the stage is set for the remaining investors to benefit from fulfilling the world's continued demand for the cheap and reliable energy provided by hydrocarbons.

• • •

Missing some Tweet in this thread? You can try to

force a refresh