(26/50)

With FDI inflows increasing, the GoE begins hiring engineers, irrigation technique counselors, contracting out developers and suppliers and restructures Kamali’s current irrigation channel.

Let’s enter back into Kamali’s world:

With FDI inflows increasing, the GoE begins hiring engineers, irrigation technique counselors, contracting out developers and suppliers and restructures Kamali’s current irrigation channel.

Let’s enter back into Kamali’s world:

(27/50)

You have been having your best production yields you have ever had; you have been building your credit up and are now financing your own electrically powered irrigation pump that has much better access to water due to larger irrigation installments upstream.

You have been having your best production yields you have ever had; you have been building your credit up and are now financing your own electrically powered irrigation pump that has much better access to water due to larger irrigation installments upstream.

(28/50)

You are now able to expand the amount of wheat coverage from .5 hectares to all 1.75 hectares that you own, but that means your input costs will increase by 250%. The financial institutions aren't yet comfortable issuing an unsecured credit voucher to you of that size.

You are now able to expand the amount of wheat coverage from .5 hectares to all 1.75 hectares that you own, but that means your input costs will increase by 250%. The financial institutions aren't yet comfortable issuing an unsecured credit voucher to you of that size.

(29/50)

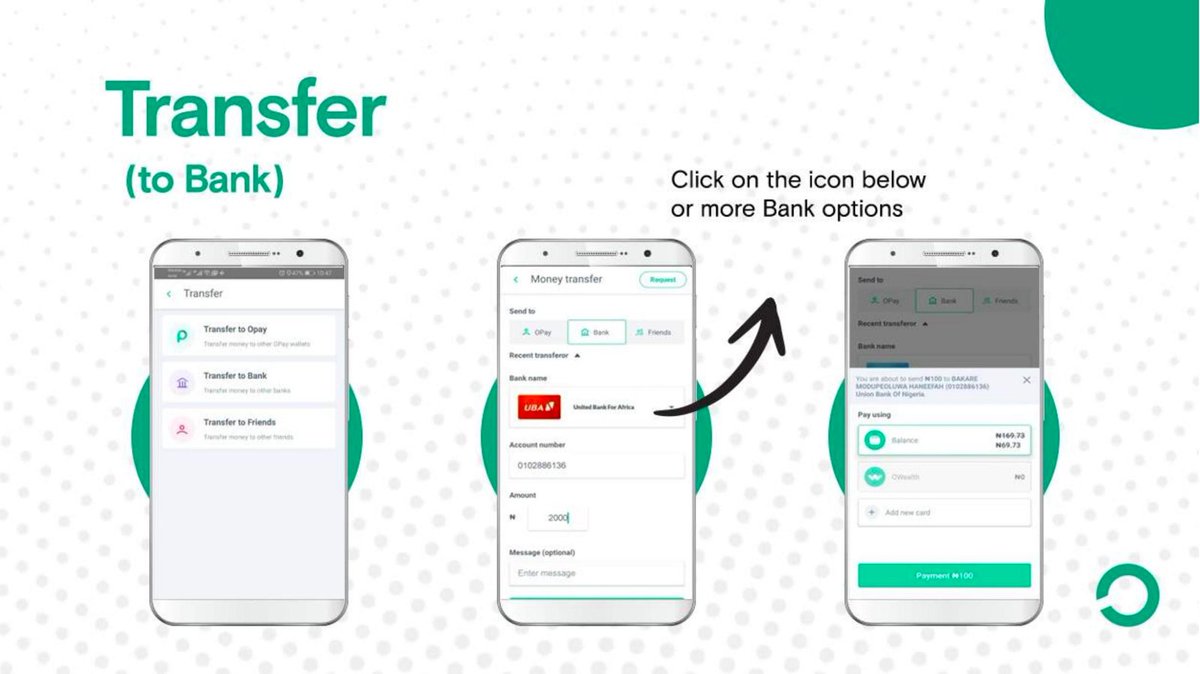

Your alternative is to outsource a loan from the current Web 2 CeFi infrastructure via mobile app, Opay, a borrow/lending platform in Ethiopia. Opay was demanded to be taken off of Google Play Store for predatory lending as their practices included:

Your alternative is to outsource a loan from the current Web 2 CeFi infrastructure via mobile app, Opay, a borrow/lending platform in Ethiopia. Opay was demanded to be taken off of Google Play Store for predatory lending as their practices included:

(30/50)

- Massive data privacy breach

1) internet browser history

2) social media

3) SMS and call history

4) location data

- high loan origination fee (upwards of 22%)

- massive APR (upwards of 300%)

- short term fixed duration (not suitable for farmers)

- Massive data privacy breach

1) internet browser history

2) social media

3) SMS and call history

4) location data

- high loan origination fee (upwards of 22%)

- massive APR (upwards of 300%)

- short term fixed duration (not suitable for farmers)

(31/50)

You cannot afford a 22% loan origination fee and don't want to consent to such invasive privacy access, you seem to be out of options.

Enter @liqwidfinance.

You cannot afford a 22% loan origination fee and don't want to consent to such invasive privacy access, you seem to be out of options.

Enter @liqwidfinance.

(32/50)

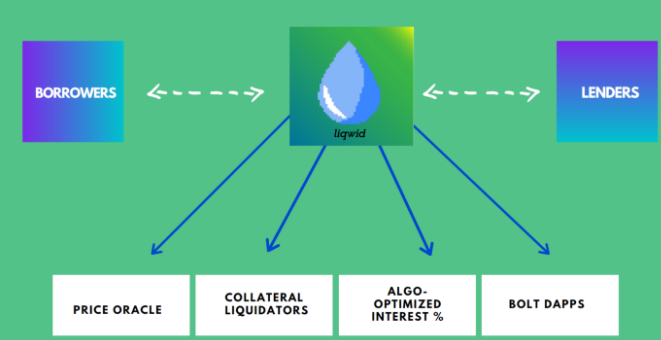

@liqwidfinance will be the first money market borrow/lending on-chain application on #Cardano. This will enable anyone with $ADA or on-chain stable coin to engage as a lender/supplier in the market to earn interest or to borrow against their assets.

@liqwidfinance will be the first money market borrow/lending on-chain application on #Cardano. This will enable anyone with $ADA or on-chain stable coin to engage as a lender/supplier in the market to earn interest or to borrow against their assets.

(33/50)

This is only a high-level view as I will post a separate thread digging into the details and technology behind @liqwidfinance.

The removal of custody, settlement, and escrow with their heavy fixed costs built into the legacy CeFi system

This is only a high-level view as I will post a separate thread digging into the details and technology behind @liqwidfinance.

The removal of custody, settlement, and escrow with their heavy fixed costs built into the legacy CeFi system

(34/50)

and the introduction to algorithmically optimized money, like @liqwidfinance lowers the fees charged to perform key banking actions.

What this looks like for Kamali is a loan origination fee ~100x smaller than her current CeFi incumbent, Opay – currently 22% – at .25%.

and the introduction to algorithmically optimized money, like @liqwidfinance lowers the fees charged to perform key banking actions.

What this looks like for Kamali is a loan origination fee ~100x smaller than her current CeFi incumbent, Opay – currently 22% – at .25%.

(35/50)

@liqwidfinance will be working on ‘credit concepts’ that will enable a completely decentralized, on-chain credit scoring system which will allow for dynamic, algorithmically set interest rates that will incentivize borrowers like Kamali to make her loan payments on time.

@liqwidfinance will be working on ‘credit concepts’ that will enable a completely decentralized, on-chain credit scoring system which will allow for dynamic, algorithmically set interest rates that will incentivize borrowers like Kamali to make her loan payments on time.

(36/50)

To do this, it would be important for @iohk to open-source Atala PRISM to applications like @liqwidfinance as it is the most robust identity solution framework.

Lets jump back in with Kamali:

To do this, it would be important for @iohk to open-source Atala PRISM to applications like @liqwidfinance as it is the most robust identity solution framework.

Lets jump back in with Kamali:

(37/50)

You have now secured financing and can borrow against your new found liquidity to obtain the credit voucher you were previously denied by the financial institution; the credit voucher allows you to pay a subsidized rate for inputs, usually 60%.

You have now secured financing and can borrow against your new found liquidity to obtain the credit voucher you were previously denied by the financial institution; the credit voucher allows you to pay a subsidized rate for inputs, usually 60%.

(38/50)

Your demand for expansion has now been met and you begin harvesting wheat and other crops on all 1.75 hectares, and guess what? Your entire village and other villages around you start taking the same approach.

Your demand for expansion has now been met and you begin harvesting wheat and other crops on all 1.75 hectares, and guess what? Your entire village and other villages around you start taking the same approach.

(39/50)

Now the aggro-dealers are struggling keeping up with the new demand as their source of funding (financial institution + regional government) doesn't have the capital to pay importers, suppliers and input producers.

Now the aggro-dealers are struggling keeping up with the new demand as their source of funding (financial institution + regional government) doesn't have the capital to pay importers, suppliers and input producers.

(40/50)

With FDI already at all time highs, how and where do we introduce more liquidity to keep up with growing input demand?

While the financial bottle necking in Ethiopia forces illiquidity and further expands financial exclusion from capital on-ramps across the globe,

With FDI already at all time highs, how and where do we introduce more liquidity to keep up with growing input demand?

While the financial bottle necking in Ethiopia forces illiquidity and further expands financial exclusion from capital on-ramps across the globe,

(41/50)

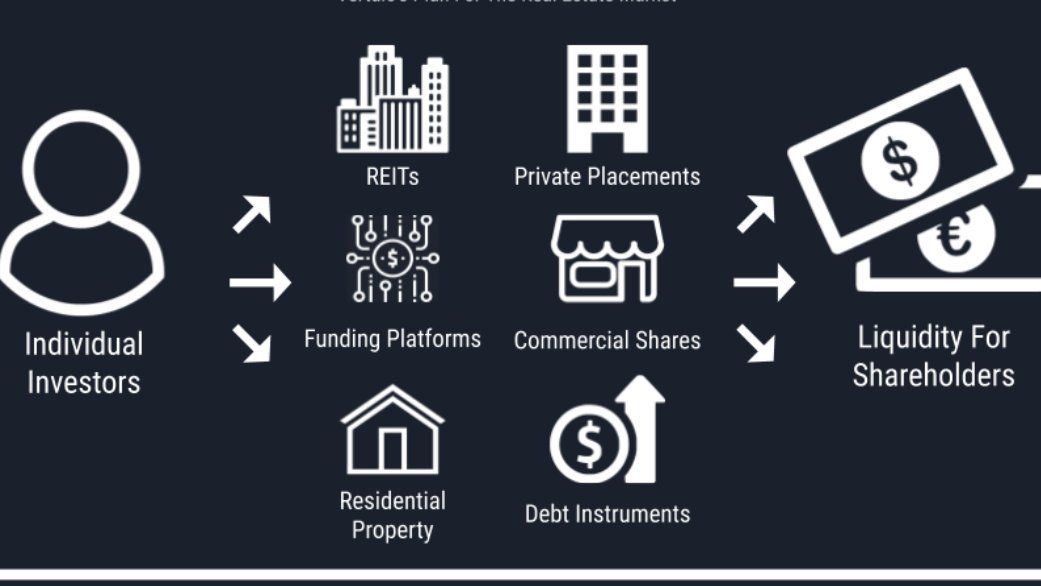

the bridge to this is being built in DeFi and with the introduction of tokenization could provide liquidity to the near 5 trillion dollars in illiquidity that exists in Africa.

the bridge to this is being built in DeFi and with the introduction of tokenization could provide liquidity to the near 5 trillion dollars in illiquidity that exists in Africa.

(42/50)

Currently, the financial institutions that distribute credit vouchers are backed by regional governments through the Commercial Bank of Ethiopia but most credit and cash sales are collected and facilitated by the financial institutions

Currently, the financial institutions that distribute credit vouchers are backed by regional governments through the Commercial Bank of Ethiopia but most credit and cash sales are collected and facilitated by the financial institutions

(43/50)

themselves therefore mitigating budget risks for regional governments. These individual vouchers are 100% sovereign-backed and have a 90% repayment rate with a 15% interest.

While these vouchers are small individually, what if it was possible to tokenize them,

themselves therefore mitigating budget risks for regional governments. These individual vouchers are 100% sovereign-backed and have a 90% repayment rate with a 15% interest.

While these vouchers are small individually, what if it was possible to tokenize them,

(44/50)

aggregate them, then create tranches based off of crop, harvest-rate and seasonal production which have maturation dates built in to provide investors varied risk profiling. You could call these debt instruments tABS’s or (tokenized asset-backed securities)

aggregate them, then create tranches based off of crop, harvest-rate and seasonal production which have maturation dates built in to provide investors varied risk profiling. You could call these debt instruments tABS’s or (tokenized asset-backed securities)

(45/50)

and they would live on the #Cardano blockchain and could be sold to hedge funds, investment banks, or individual investors in the #Cardano ecosystem.

Lets jump back into Africa:

and they would live on the #Cardano blockchain and could be sold to hedge funds, investment banks, or individual investors in the #Cardano ecosystem.

Lets jump back into Africa:

(46/50)

Capital inflows into the financial institutions are pouring in and they can now fund the growing demand for agricultural inputs from suppliers. Agro-dealers and cooperatives have sufficient supply for small-hold farmers and production beings to see exponential growth.

Capital inflows into the financial institutions are pouring in and they can now fund the growing demand for agricultural inputs from suppliers. Agro-dealers and cooperatives have sufficient supply for small-hold farmers and production beings to see exponential growth.

(47/50)

Kamali has leveraged an emerging product that allowed her to set a new precedence for her community members. They begin to copy her business model, and word gets out and now her strategy has cascaded internationally throughout all of Sub-Saharan Africa.

Kamali has leveraged an emerging product that allowed her to set a new precedence for her community members. They begin to copy her business model, and word gets out and now her strategy has cascaded internationally throughout all of Sub-Saharan Africa.

(48/50)

There are many more problems that exist within this example, for instance post-harvest strategy, lack of storage-infrastructure, predatory agricultural brokers, road/railway infrastructure, and current import/export protocols

There are many more problems that exist within this example, for instance post-harvest strategy, lack of storage-infrastructure, predatory agricultural brokers, road/railway infrastructure, and current import/export protocols

(49/50)

that could easily be solved by #Cardano and products like Atala TRACE, but for the sake of brevity, we will stop here.

that could easily be solved by #Cardano and products like Atala TRACE, but for the sake of brevity, we will stop here.

(50/50)

I hope by reading this you were able to place yourselves in a world entirely unlike your own and recognize just how massive some barriers can be and how important it is for something as disruptive and necessary as #Cardano is to the world.

I hope by reading this you were able to place yourselves in a world entirely unlike your own and recognize just how massive some barriers can be and how important it is for something as disruptive and necessary as #Cardano is to the world.

@EyeOfTheKing1

@Beastlyorion

@GenZod7

@cryptorecruitr

@_Cardano_ADA

@CardanoEffect

@IvanOnTech

@RealSaidov

@jasonappleton

@CryptoGainzz

@CryptoIRELAND1

@nierop_pieter

@KingCardano

@JRNYcrypto

@NewsAsset

@AltcoinDailyio

@CardanoBuzz

@Dr_shwetaPHD

@Ahjira

@RichardMcCrackn

@Beastlyorion

@GenZod7

@cryptorecruitr

@_Cardano_ADA

@CardanoEffect

@IvanOnTech

@RealSaidov

@jasonappleton

@CryptoGainzz

@CryptoIRELAND1

@nierop_pieter

@KingCardano

@JRNYcrypto

@NewsAsset

@AltcoinDailyio

@CardanoBuzz

@Dr_shwetaPHD

@Ahjira

@RichardMcCrackn

• • •

Missing some Tweet in this thread? You can try to

force a refresh