Read this great article;

The Algebra Of Wealth (aka How to get rich)

By Scott Galloway; Professor of Marketing at the NYU Stern School of Business.

I share key notes I took.

Enjoy.

The Algebra Of Wealth (aka How to get rich)

By Scott Galloway; Professor of Marketing at the NYU Stern School of Business.

I share key notes I took.

Enjoy.

"Rich is having passive income greater than your burn."

"The strongest signal of future success is your perseverance and resilience"

"Don't mistake focus for your "passion." People who tell you to follow your passion are already rich: Follow your talent"

"The strongest signal of future success is your perseverance and resilience"

"Don't mistake focus for your "passion." People who tell you to follow your passion are already rich: Follow your talent"

FOCUS

"Focus on putting yourself in a position to be financially successful. Get certified"

"In a digital world, the corporate world decides whether to swipe right or left based on the logos (aspirational universities/firms, vocational certifications,) on your LinkedIn"

"Focus on putting yourself in a position to be financially successful. Get certified"

"In a digital world, the corporate world decides whether to swipe right or left based on the logos (aspirational universities/firms, vocational certifications,) on your LinkedIn"

FOCUS 2.

"Sector dynamics will trump your talent (I realize how awful that sounds). However, someone of average talent at Google has done better over the last decade than someone great at General Motors

Look for the best wave to ride."

"Sector dynamics will trump your talent (I realize how awful that sounds). However, someone of average talent at Google has done better over the last decade than someone great at General Motors

Look for the best wave to ride."

Focus 3

"Focus on your relationships. Married people grow their net worth 77 percent more than single people'"

"Focus on your relationships. Married people grow their net worth 77 percent more than single people'"

STOICISM 1

"Determine what you can and can't control. You can control your reactions to temptation - a lack of discipline is the antichrist to economic security."

"Determine what you can and can't control. You can control your reactions to temptation - a lack of discipline is the antichrist to economic security."

STOICISM 2

"The upgrade from economy to premium to business to first class to private jet can seem like an investment in yourself - it's not.

The most powerful forward-looking indicator of your financial freedom is not how much you earn, but how much you save."

"The upgrade from economy to premium to business to first class to private jet can seem like an investment in yourself - it's not.

The most powerful forward-looking indicator of your financial freedom is not how much you earn, but how much you save."

STOICISM 3

"Trading - distinct from "investing" - can feel like work and productivity. It's not. It's gambling, but without free drinks and with worse odds.

One study found that over a 12-year period, only 5 percent of active retail traders made any profit at all."

"Trading - distinct from "investing" - can feel like work and productivity. It's not. It's gambling, but without free drinks and with worse odds.

One study found that over a 12-year period, only 5 percent of active retail traders made any profit at all."

STOICISM 4

"Between 80 and 85% of day traders are men, and 23% of men who gamble become addicted (as opposed to seven%of women).

Most of us can gamble without becoming addicted, just as most of us can drink without becoming an alcoholic - but, know the risks."

"Between 80 and 85% of day traders are men, and 23% of men who gamble become addicted (as opposed to seven%of women).

Most of us can gamble without becoming addicted, just as most of us can drink without becoming an alcoholic - but, know the risks."

DIVERSIFICATION 1

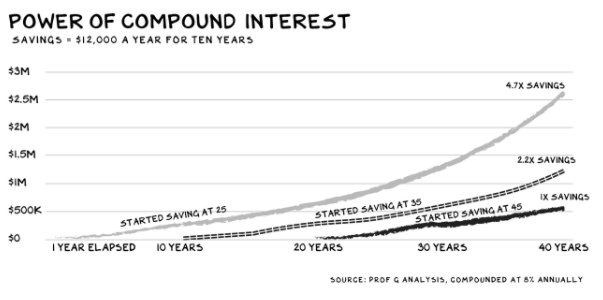

"Investing over the long term pays out, but there are always dips along the way. Diversification is the kevlar that protects you - with it, bad decisions will still hurt, but they won't prove fatal. Diversification, in other words, is your bulletproof vest."

"Investing over the long term pays out, but there are always dips along the way. Diversification is the kevlar that protects you - with it, bad decisions will still hurt, but they won't prove fatal. Diversification, in other words, is your bulletproof vest."

Focus on what matters. Be a Stoic in the face of temptation. Use Time to your advantage. Diversify your investments.

• • •

Missing some Tweet in this thread? You can try to

force a refresh