Why should we be careful when talking about a “jobs bounce-back” in South Africa? - A THREAD.

You don’t get better labour market economists in South Africa than the @NIDS_CRAM team, but the main finding of an “employment bounce-back” seems counterintuitive. What’s going on? 1/n

You don’t get better labour market economists in South Africa than the @NIDS_CRAM team, but the main finding of an “employment bounce-back” seems counterintuitive. What’s going on? 1/n

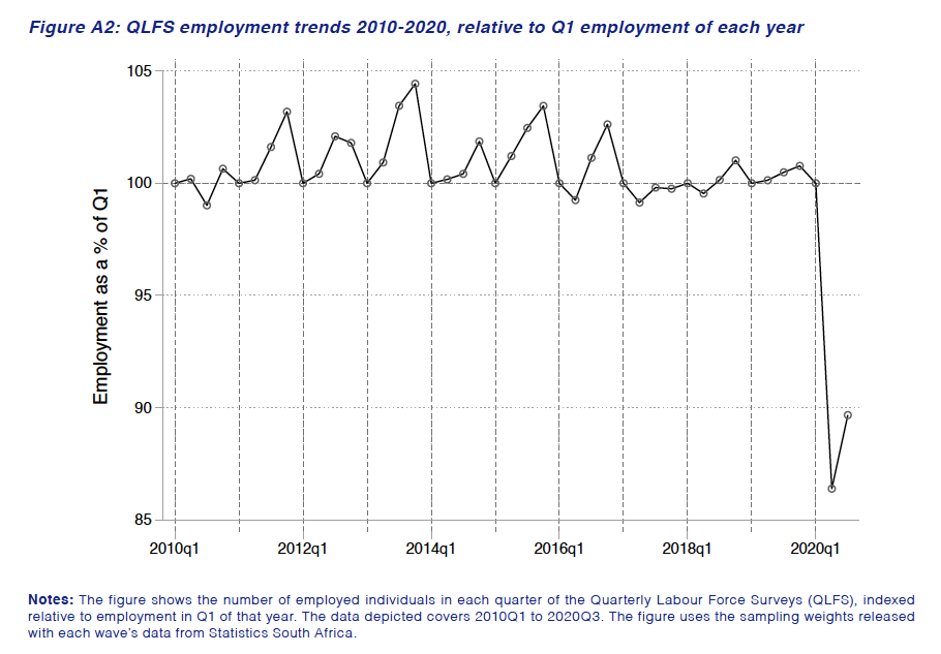

NIDS-CRAM does NOT show a rebound to pre-COVID employment levels. They report 700,000 job lost between Feb and Oct 2020, this is massive = 3.85% fall (broad definition). The authors of the employment paper say this could be as high as 5.3% or 960,000 jobs. dailymaverick.co.za/article/2021-0…

The authors @joshbudlender @ihsaanbassier (+ Rocco) also show that Oct employment is normally higher than Feb employment, super roughly Oct is plausibly around 102% of Feb. This means it’s plausible 360,000 jobs would have been gained between Feb-Oct *anyway*.

This would mean - within the study parameters - it’s possible COVID has caused up to (an outer outer limit) of 1.32 million job losses when comparing Oct 2020 with what we would have expected it to be in normal times. This is a total disaster in the context of the SA economy.

This is roughly what we should expect from the StatsSA QLFS. This showed 2.2 million jobs lost in first half of 2020, and 543,000 regained in Q3, meaning a loss of just under 1.7 million jobs in first 9 months. We’d definitely expect some more jobs regained in Oct-Dec.

This also represents up to an upper 7.3% gap between what we would have expected in Oct 2020 and what we actually got. Or a “real” gap of 7.3% if we were to adjust the Oct 2019 numbers for the usual employment growth and changes. Super rough.

So this means we have somewhere between a 3.9% and 7.3% “real” fall in employment. We’re now reaching levels that seem congruent with what else we know about the economy.

The IMF has projected a 7.5% fall in GDP in SA in 2020. Generally GDP and employment track each other.

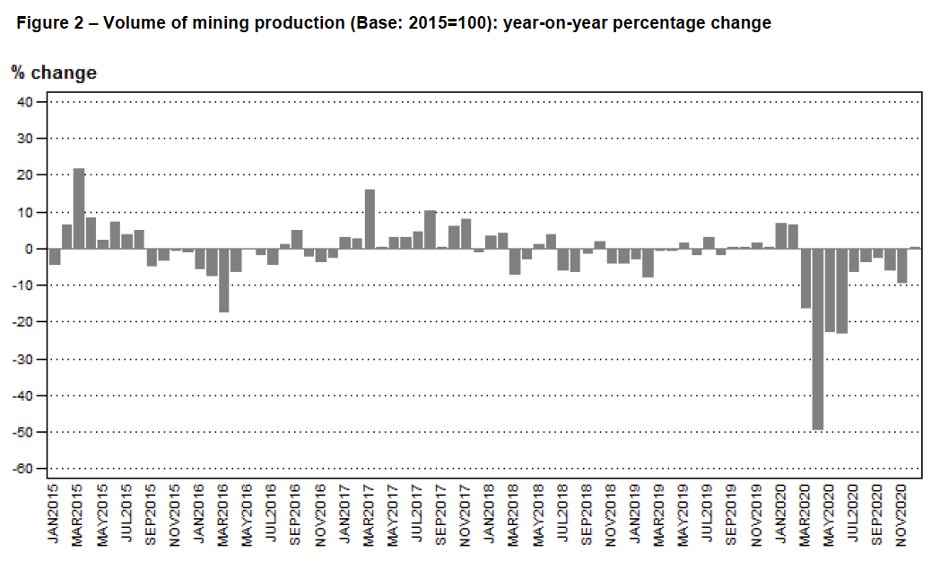

We are also now closer to other data we have.

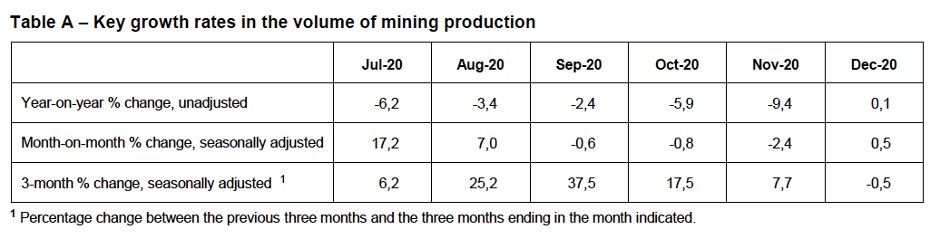

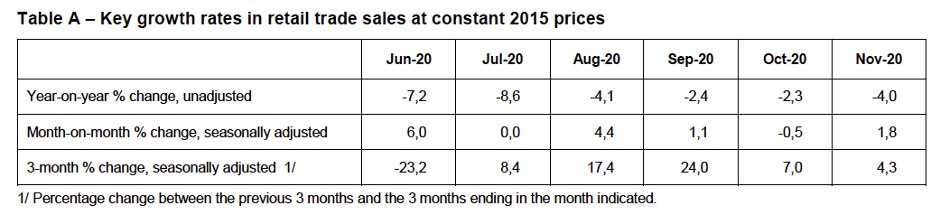

In Oct 2020 vs. Oct 2019:

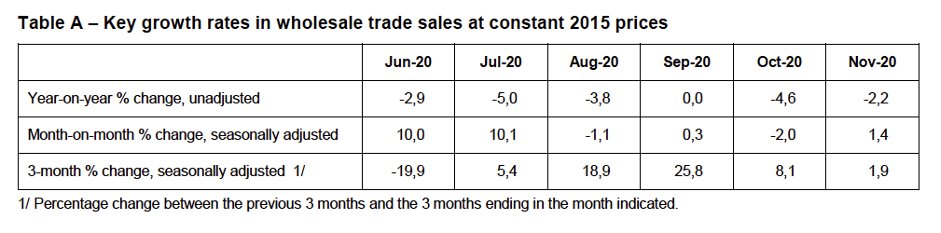

→ Retail sales down 2.3%

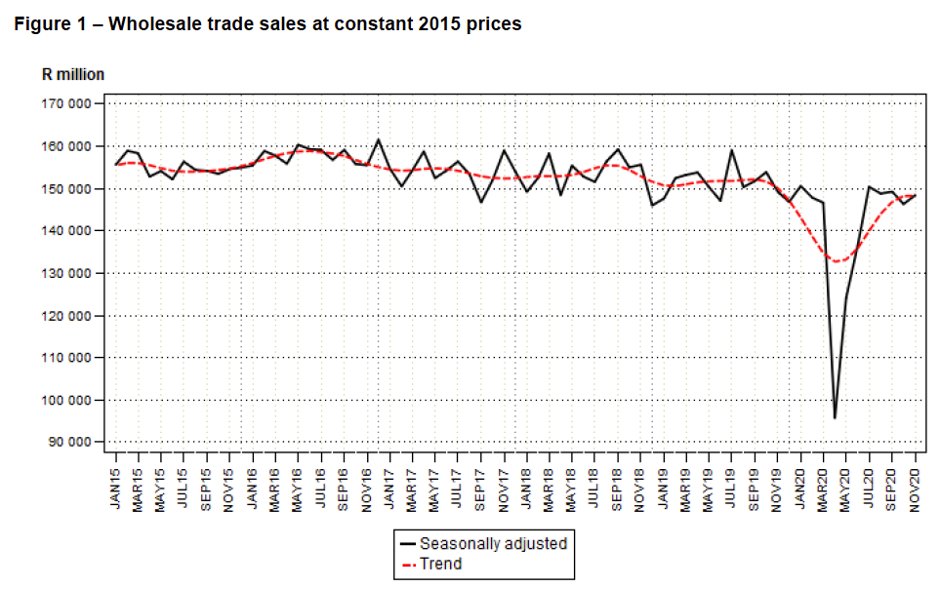

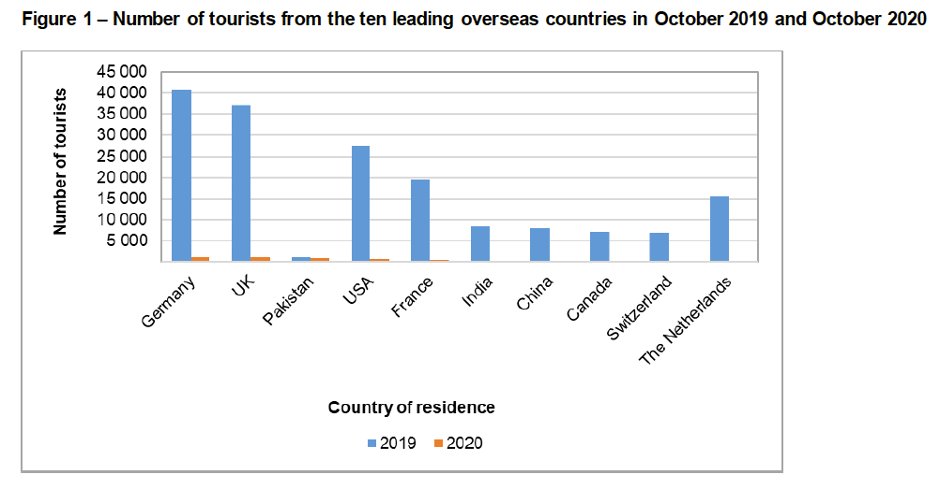

→ Wholesale sales down 4.6%

In Oct 2020 vs. Oct 2019:

→ Retail sales down 2.3%

→ Wholesale sales down 4.6%

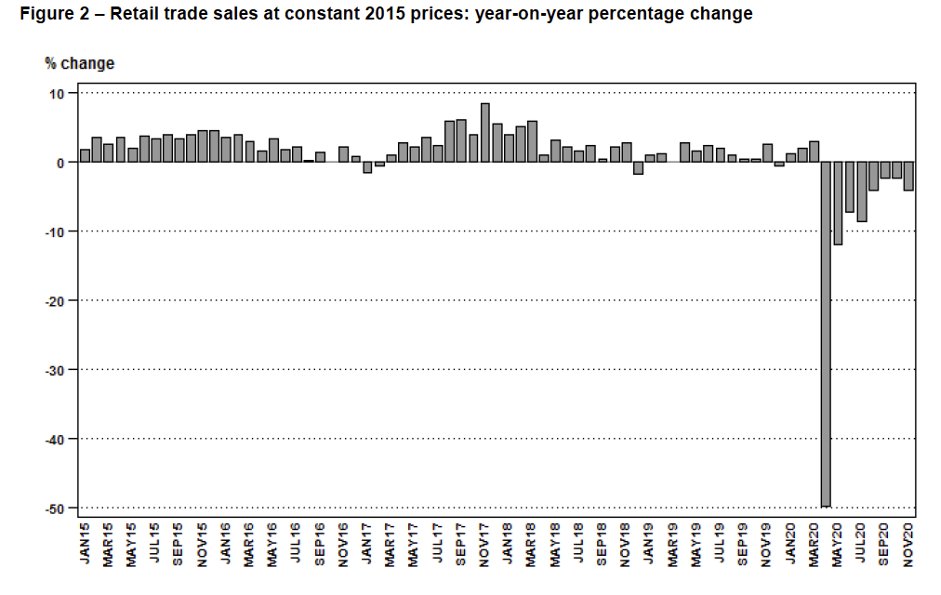

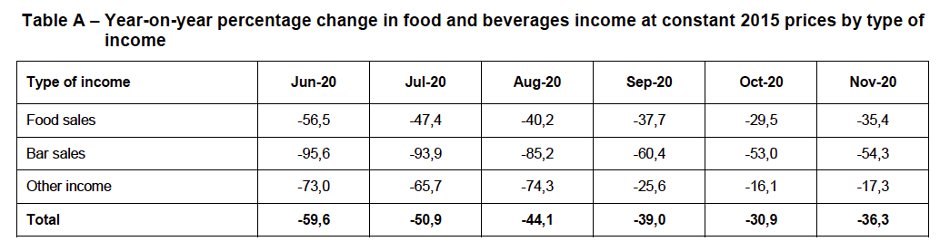

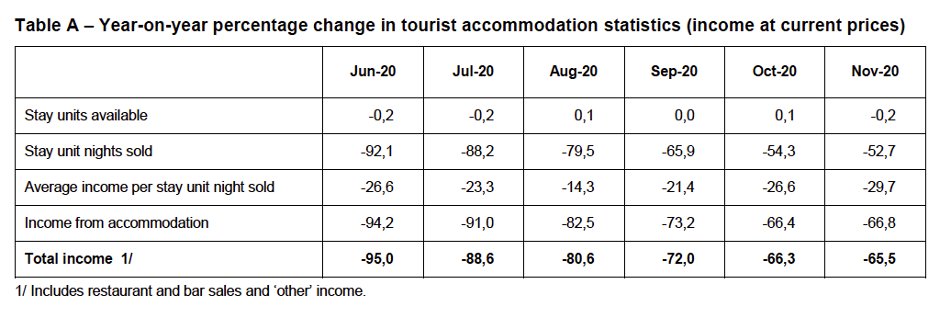

In tourism + entertainment in Oct 2020:

→ The number of tourists from overseas was almost zero

→ Income for the tourist accommodation fell 66.4% based on 54% decrease in the no of nights sold + sold at lower price

→ Food and beverage income down 39%

→ The number of tourists from overseas was almost zero

→ Income for the tourist accommodation fell 66.4% based on 54% decrease in the no of nights sold + sold at lower price

→ Food and beverage income down 39%

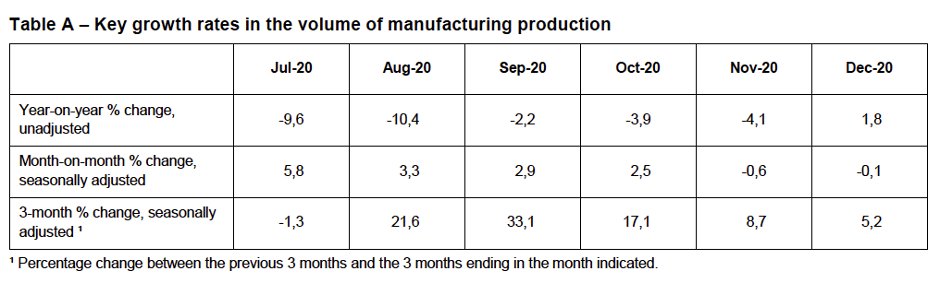

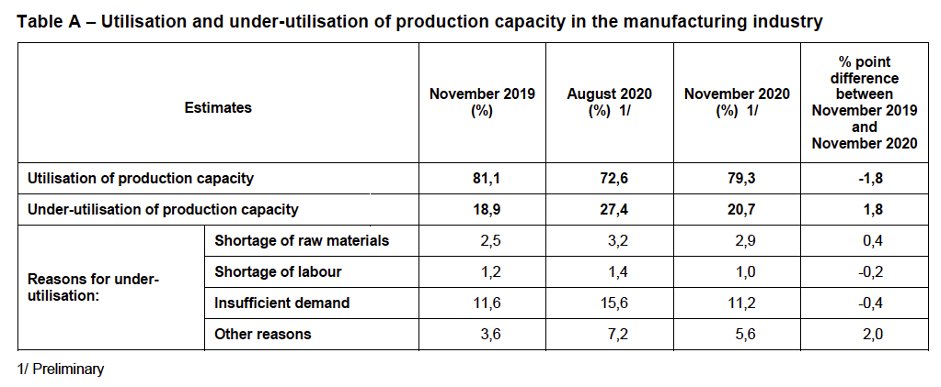

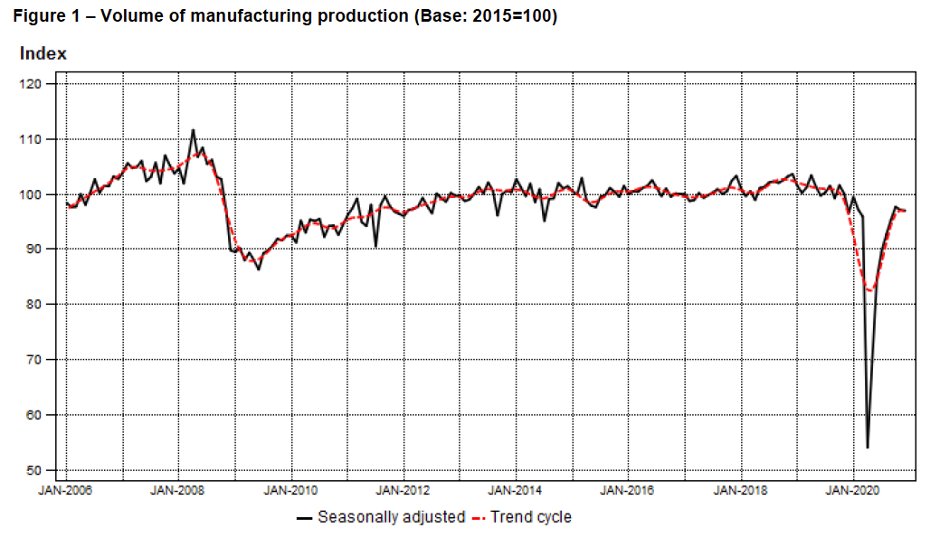

Manufacturing also. Oct 2020 vs 2019:

→ Volume of manu production down 3.9%

→ Manu sales down 0.9%

→ Capacity utilisation down.

→ Freight transport down 8.7%

→ Volume of manu production down 3.9%

→ Manu sales down 0.9%

→ Capacity utilisation down.

→ Freight transport down 8.7%

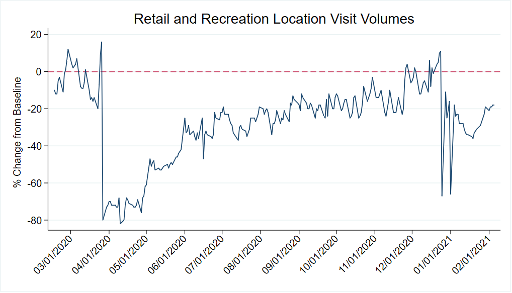

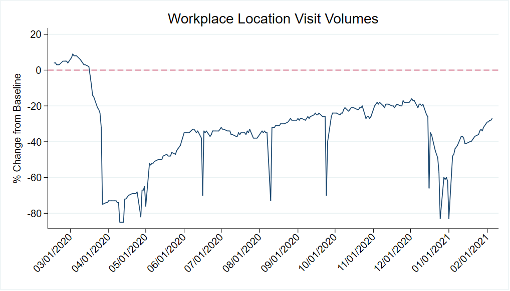

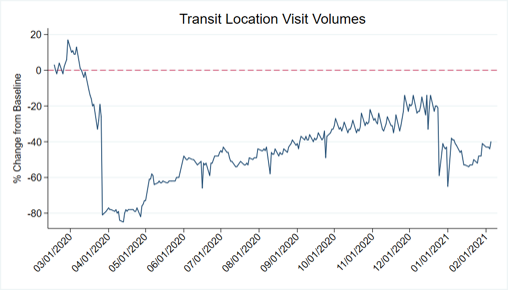

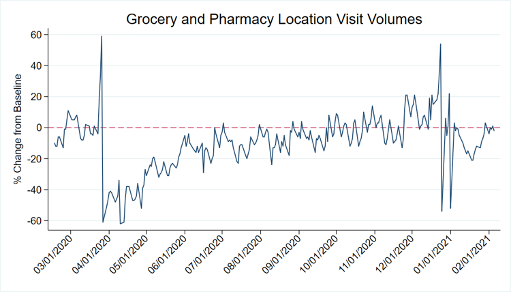

High frequency data tracks immediate changes in behaviour. Oct 2020 vs pre-COVID:

→ Retail and recreation down average 16%

→ Grocery and pharmacy down average 1%

→ Transit stations down average 31%

→ Workplaces down average 18%

(Tx @EconTwitJosh for this data)

→ Retail and recreation down average 16%

→ Grocery and pharmacy down average 1%

→ Transit stations down average 31%

→ Workplaces down average 18%

(Tx @EconTwitJosh for this data)

The upper half of this 3.9 - 7.3% and 700,000 - 1.32 million range also much more closely matches the rest of the world. There’s no reason to believe that the moribund SA economy would have bounced back MORE than elsewhere!

As pointed out by @IlanStrauss

As pointed out by @IlanStrauss

It’s important to make explicit NIDS-CRAM is Feb vs. Oct 2020. So this doesn’t account for the subsequent lockdowns. Employment has yo-yoed during 2020 all over the place. So this could be an “October spike” also.

All of this assumes there are no problems with the underlying NIDS-CRAM data, which could still oversell the bounce-back due to sampling or other issues. Admittedly, above makes some VERY broad estimates. E.g. in normal times employment might not grow between Oct 2019 and 2020.

But all of this shows that it would be EXTREMELY irresponsible to interpret the NIDS-CRAM data to be showing the economy is rebounding. Hunger is up, women’s employment is growing more slowly, and a huge amount of jobs have been shed. We need renewed rescue measures urgently! END

I'd love to hear from authors @NicSpaull @ihsaanbassier @joshbudlender @NIDS_CRAM @MurrayLeibbrand @VimalRanchhod and others on this! And I may have made errors so please correct.

• • •

Missing some Tweet in this thread? You can try to

force a refresh