Whatever you think about large publishers or the Australian legislative, Facebook blocking news content is an unprecedented abuse of power.

As a utility-scale platform, this is like a declaration of war on democracy and public debate.

about.fb.com/news/2021/02/c…

As a utility-scale platform, this is like a declaration of war on democracy and public debate.

about.fb.com/news/2021/02/c…

I mean, FB must just cease to exist.

https://twitter.com/fromonemum/status/1362159277238935553

I'm also in favor of taxing platform giants in a much more comprehensive way rather than introducing special interest legislation.

Whatever. FB simply went FAR too far here.

Not to mention it didn't even bother to take care about who they actually block.

Whatever. FB simply went FAR too far here.

Not to mention it didn't even bother to take care about who they actually block.

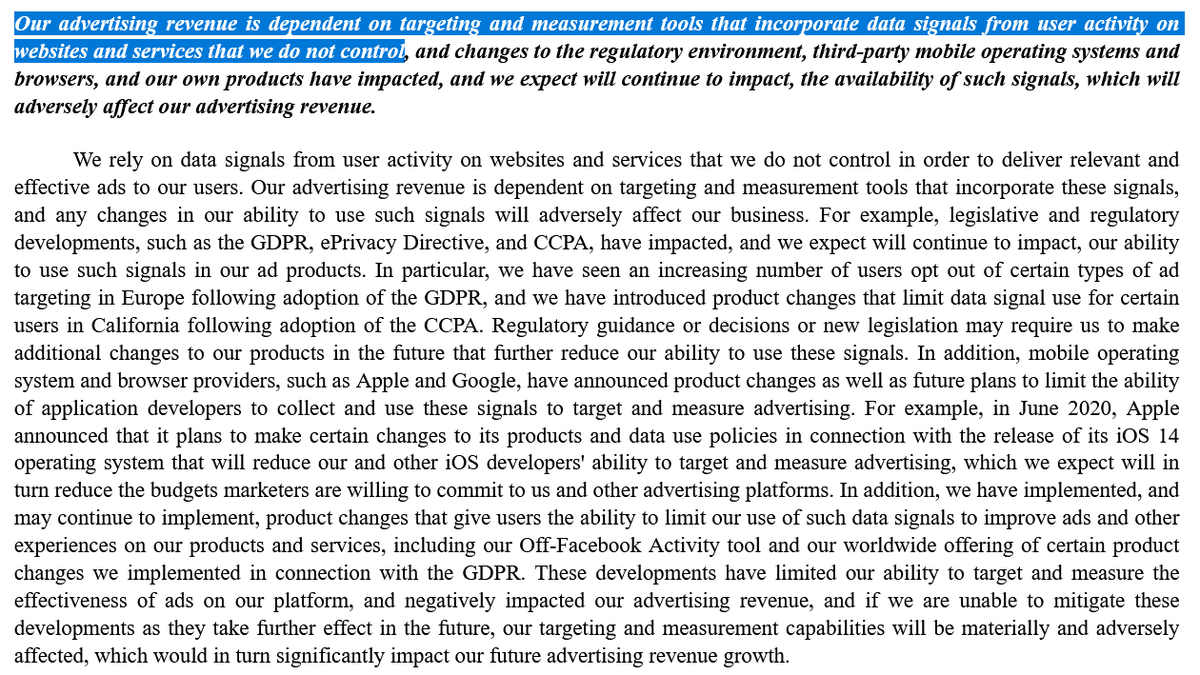

https://twitter.com/WolfieChristl/status/1300754453289631744

Imagine there's a food safety law that affects supermarket chains and benefits other industry players. Everyone agrees it's not the perfect fix as a more comprehensive approach is required.

To stop the law supermarket chains start refusing to provide non-toxic food to everyone.

To stop the law supermarket chains start refusing to provide non-toxic food to everyone.

Facebook just didn't take care on anything.

https://twitter.com/FBoversight/status/1362188333212909577

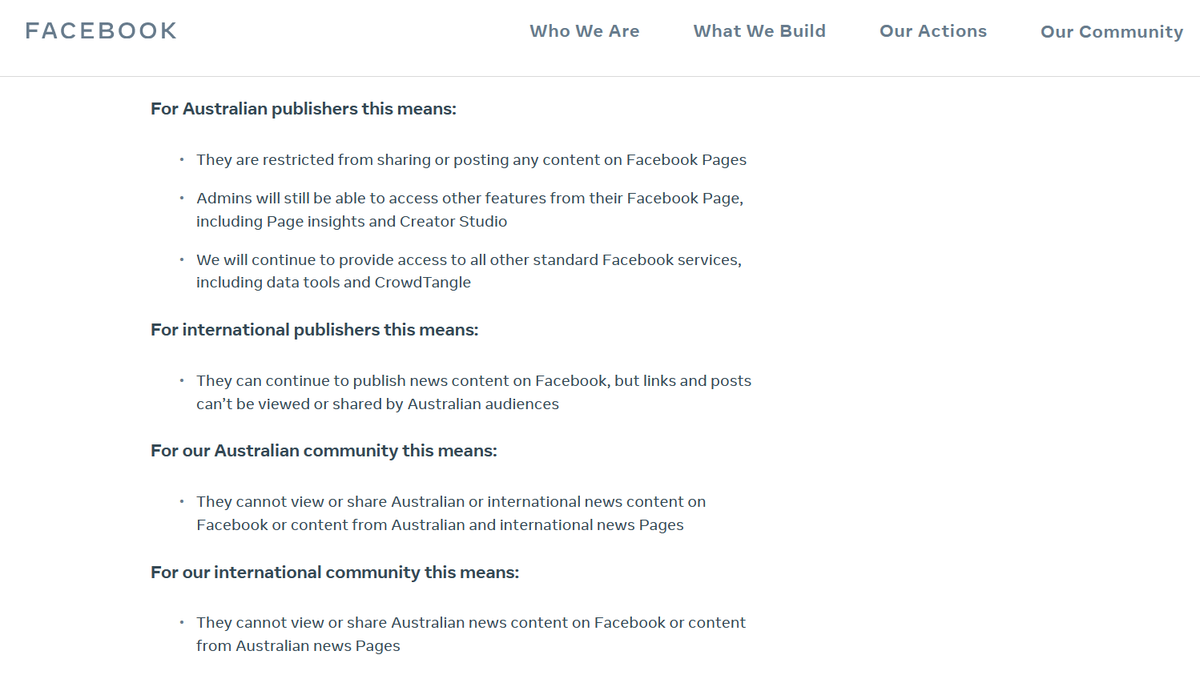

Facebook blocking the sharing of news in Australia and blocking the world from sharing Australian news is the main issue.

Facebook not taking any precautions and actually mass blocking random stuff just comes on top of that.

Facebook not taking any precautions and actually mass blocking random stuff just comes on top of that.

https://twitter.com/cog_ink/status/1362173998696566790

Some argue it's not an abuse of power. I have the impression they have either long accepted platforms as private governments, or they lack an understanding of 'infrastructure' and the economy of platform power.

I dislike Murdoch, but FB taking a country hostage is unacceptable.

I dislike Murdoch, but FB taking a country hostage is unacceptable.

• • •

Missing some Tweet in this thread? You can try to

force a refresh