The different outcomes for FB and Google in Australia related to the country's impending news publishing law underscore the fundamental differences between their operating models that any successful regulatory treatment must recognize (1/X)

2/ @benthompson's daily update is the best starting point for background on the topic. @benedictevans also provides trenchant analysis. Essentially: Google capitulated & cut a deal with News Corp, FB simply called the Australian govt's bluff ben-evans.com/benedictevans/…

3/ Google indexes information for search and discovery and FB operates a network of users that allows them to share content. Both monetize with advertising but that's really a superficial similarity. The businesses' core use cases are fundamentally dissimilar

4/ Of course, it's easy to be reductive here, as these companies each comprise multiple businesses. But foundationally, Google indexes data, Facebook connects people. This explains why Facebook could walk away from the Australian market and Google needed to take it more seriously

5/ All content on FB is effectively UGC. If users can't share certain classes of content, it doesnt reduce the effectiveness of FB's advertising placements around them (or in them). Placing limitations on any specific class of content, even a large one like news, doesnt hurt FB

6/ It does hurt Google, because Google indexes that content and directs people to it when they seek it out. If Google cant provide the content that people are specifically searching for, it cant monetize that content. It needs to be able to index *everything*

7/ FB on the other hand can limit the entire universe of shareable content classes at the margins and not face any immediate monetization loss. Platform (and ad) engagement isnt dependent on any given piece of content but rather interactions facilitated by connections

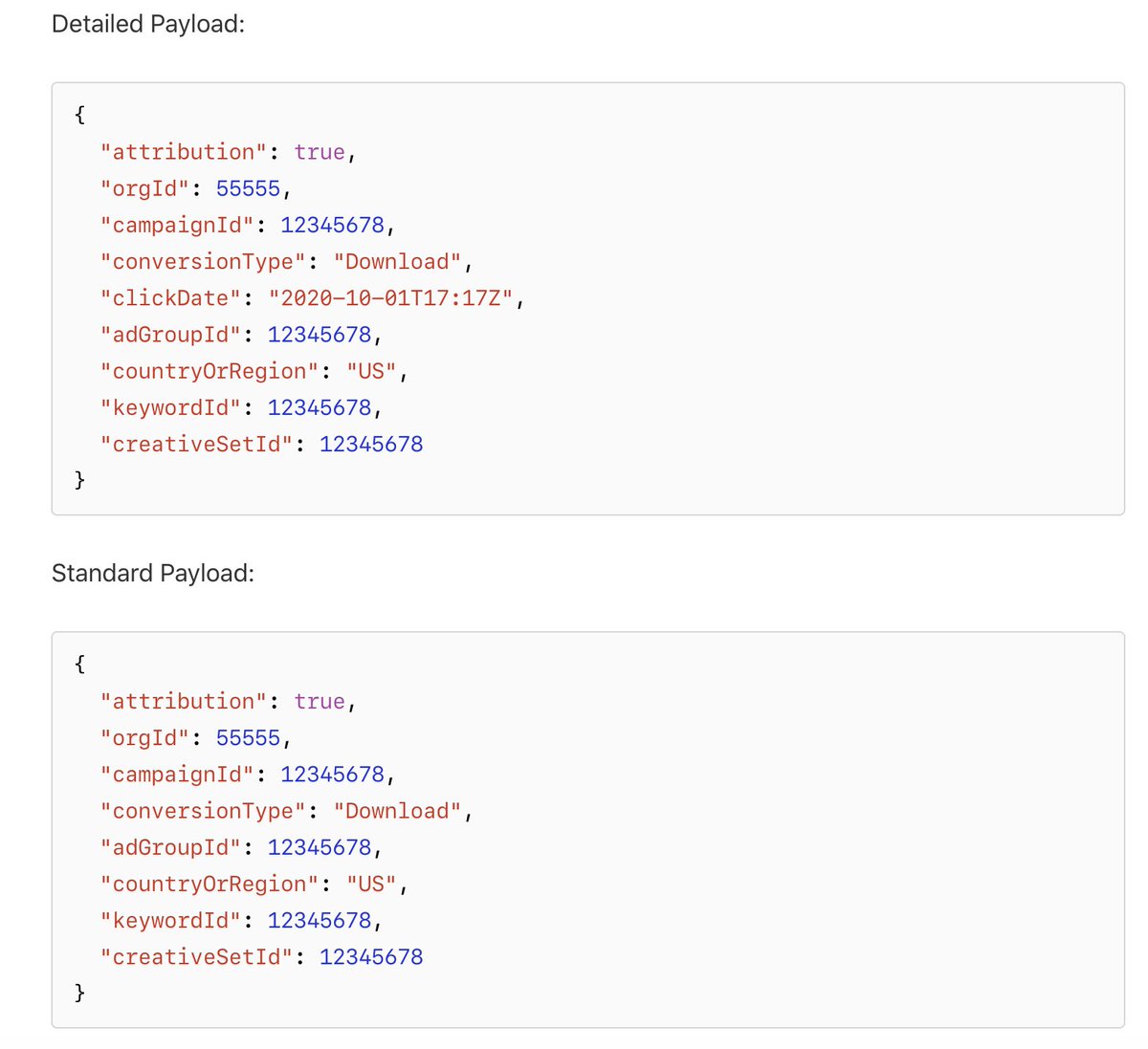

8/ It's interesting to note the differences in consequence because we see them highlighted elsewhere. Australia's rev share "tax" on news hurts Google but FB can ignore it. Meanwhile, ATT impacts Facebook more than Google because of these structural differences

9/ This is all to say: any regulation may disproportionately impair one company relative to others because "Big Tech that Monetizes via Advertising" is a meaningless distinction. This gets even fuzzier given commercial interactions eg. Google/Apple, Google/FB

• • •

Missing some Tweet in this thread? You can try to

force a refresh