#OptionsTrading thread that may save you!

Now a days we started seeing MTM for Crs & some people call it fake, but I see them as real & possible BUT its not as simple as they show it.

Simple Reason:

When asked about open risk & position sizing no one answered.

1/n

Now a days we started seeing MTM for Crs & some people call it fake, but I see them as real & possible BUT its not as simple as they show it.

Simple Reason:

When asked about open risk & position sizing no one answered.

1/n

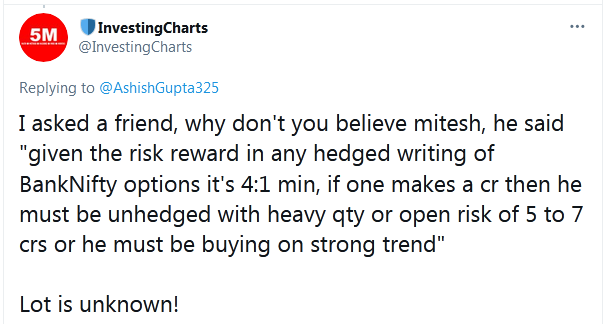

A friend clearly putted it saying "lot is unknown" as no one will share their pains & secrets on #socialmedia

Which lead to do some simple calculations that how things really look while writing #options using different styles.

2/n

Which lead to do some simple calculations that how things really look while writing #options using different styles.

2/n

Ac size 1cr

Naked positional option writing

1% risk

Qty arrived keeping total premium received as stoploss

means we are ready to lose 1rs to gain 1rs to start

Out of expiry days these guys write 25 to 30 rs options. Next day if those open as ATM then the %hit on ac👇

3/n

Naked positional option writing

1% risk

Qty arrived keeping total premium received as stoploss

means we are ready to lose 1rs to gain 1rs to start

Out of expiry days these guys write 25 to 30 rs options. Next day if those open as ATM then the %hit on ac👇

3/n

This is obvious that they are aware & willing to lose anything from 2% to 15% or even more for their reward of 1% case of an drastic event, will you do this?

Ofcourse such events may not come daily but they do come & u may lose 6m/1yr efforts. Are you ready with a mindset?

4/n

Ofcourse such events may not come daily but they do come & u may lose 6m/1yr efforts. Are you ready with a mindset?

4/n

The above calculation is simply on when they have position to make just 1% profits, if they wrote targeting more then an event can wipe them out!

How? check what if on 10% gap against their direction. No both side writing save them. If they risked 5% at any distance, Burst!

5/n

How? check what if on 10% gap against their direction. No both side writing save them. If they risked 5% at any distance, Burst!

5/n

So, What if they hedge & create credit spreads on their positional writing trades?

It's clear that further you go with strikes your RRR is lowest means if you made a 1cr then you could have risked bare min 2crs, to make 1cr at a 5% strike u may end up using entire margin.

6/n

It's clear that further you go with strikes your RRR is lowest means if you made a 1cr then you could have risked bare min 2crs, to make 1cr at a 5% strike u may end up using entire margin.

6/n

This state that these guys are not in favor of credit spread all the time but hedge long distance strikes or simply depend on other side writing. Which may not be of great help if things goes wrong.

They are using LARGE Qty to earn Crs as they themself show on MTM pics

7/n

They are using LARGE Qty to earn Crs as they themself show on MTM pics

7/n

They are all making good money, over shooting others fear that they lose it all one day, that day may or may not come but wise must always prefer to survive through knowledge rather than die by experience.

Because you will have new experiences throughout your life.

8/n

Because you will have new experiences throughout your life.

8/n

No doubt that fortune favors the brave at #stockmarkts BUT historically it’s evident that if anyone lost all that they had or made, then it’s due to over trading & huge qty only & nothing else!

Stay within your limits when it comes to qty & let them face their MTM battles!

n/n

Stay within your limits when it comes to qty & let them face their MTM battles!

n/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh