February’s @ONS labour market statistics release. A thread. 👇

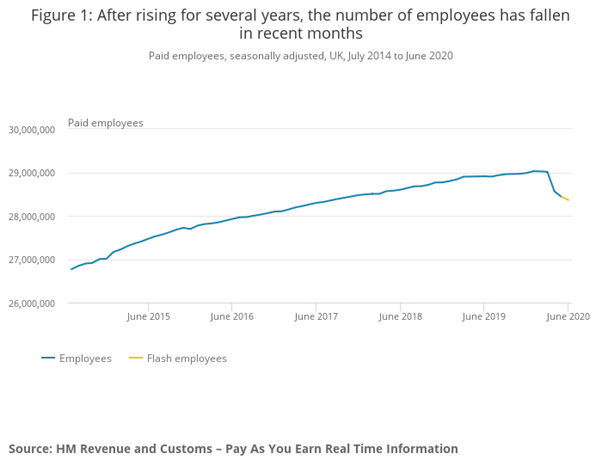

There is some encouraging news: the number of employees on the payroll has stopped falling and grown in both December and January. This might suggest we are seeing the labour market begin to stabilise (though only two months’ data). (1/n)

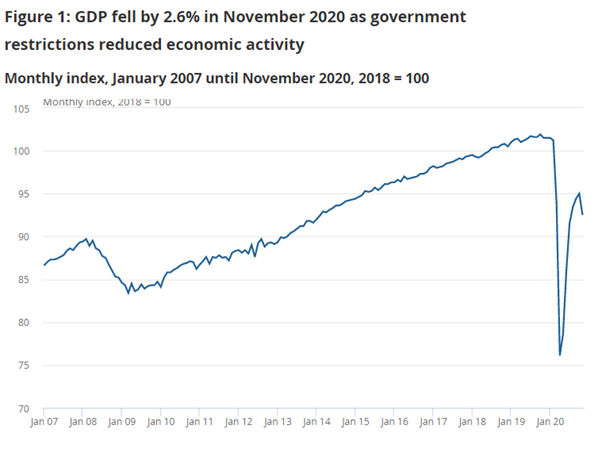

However, we need to put this in context, as over the last year we have still seen a weak labour market, with the number of employees on the payroll down 700k compared to pre-pandemic. In addition, unemployment rose sharply through 2020. (2/n)

And we are far from out of the woods as there are still millions of people who are furloughed. Last week’s BICS survey suggested 20% of the workforce, around 6.4m were on furlough at the start of February. (3/n)

ons.gov.uk/peoplepopulati…

ons.gov.uk/peoplepopulati…

The makes interpreting the figures difficult and means if there is a stabilisation in the labour market it might only be temporary: we just don’t know at the moment. (4/n)

So who has lost their jobs in the pandemic so far? Importantly there appears to be a strong age dimension, with younger people seeing biggest falls in employment than older workers. (5/n)

On some measures more than half of the fall in employees has been among those aged 25 or under. (6/n)

In terms of gender, it is still men who are seeing bigger falls in employment than women - men’s employment rate down 2.4pp on the year compared to 0.6pp for women. (7/n)

(Though this only covers the formal labour market and not unpaid work. There is some evidence that women are picking up more of the burden of homeschooling compared to men.) (8/n)

ons.gov.uk/peoplepopulati…

ons.gov.uk/peoplepopulati…

And more of those men appear to be flowing into 'economic inactivity' compared to women. The economically inactive are either not looking or available for work, so are less connected to the labour market. (9/n)

Vacancies is used as a measure of labour demand, and we can see a pick up in vacancies following a big fall earlier in the pandemic. Though vacancies remain well below their pre-pandemic levels. (10/n)

Finally, earnings. On the face of it, earnings are growing strongly in the most recent months. But we need to be careful here. Our measure of earnings – Average Weekly Earnings (AWE) – is just what it says, the average (mean) of all people being paid. (11/n)

This means that if lower paid people lose their jobs, the average wage measured by AWE will rise. These compositional effects are quite marked at the moment as sectors shedding jobs such as hospitality tend to be lower paid. (12/n)

So the average earnings figures are flattering the position somewhat. We that around 2.8 percentage points of the growth is down to compositional effects. More detail in the release. (13/n)

• • •

Missing some Tweet in this thread? You can try to

force a refresh