Amcor $AMCR $AMC.AX $AMC is a dual #ASX #NYSE listed global leader in consumer packaging. Tracing its routes to 1860 in Australia, more recently it has become known as a Dividend Artisocrat after its Bemis acquisition. Is boring really beautiful? Let’s take a deep dive. 👇

Disclaimer – if you accidentally are reading this because you think I have some deep insight into AMC Entertainment about to 🚀🚀🚀to Mars - sorry folks, but I don’t do memes and stonks, just good ‘ol fashioned value-based investing. Ciao.

1. Investment thesis: A stalwart, in a growing market, with a long history, a target IRR of 10-15%, at a good valuation, and with shareholder-empathetic management. Put simply, a buy and hold as part of the core portfolio.

2. Macro. Favourable tailwinds. Closing the loop in the FMCG sector between packaging and recycling is a mega trend for social, environmental and economic purposes. This is a win-win-win, the most durable of mega trends, that Amcor will benefit from.

3. Macro. Packaging sector is expected to grow at 4.8% CAGR, increasing to 6% CAGR for recycled packaging in FMCG. Not bad. Let’s compare: baked beans 3.5% CAGR, renewable energy 5% CAGR.. Okay Semis are 10% CAGR, but still better than baked beans,

4. Fragmented Market. McKinsey report that the top 30 companies in packaging sector accounts for only 25% of the market. Consolidation creates a narrow moat of economies of scale for the lowest cost producers.

5. Amcor’s Positioning. Amcor is now the global leader in flexibles and rigid packaging ($12.5bn in revenue), with footprints in key markets (US, Europe and APAC) and all key sectors (Food, beverages, healthcare, etc.).

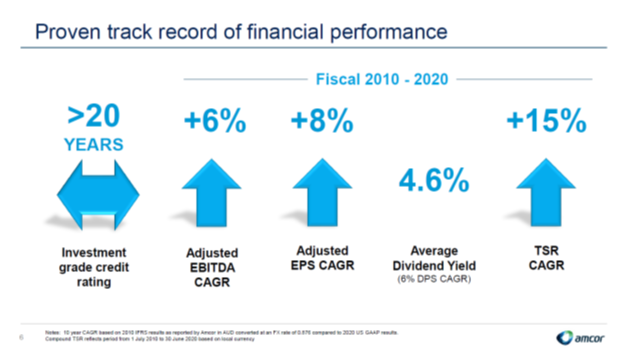

6. Shareholder focused. Every shareholder's favourite slide, management puts a strong emphasis on creating value via M&A, organic growth, dividends and buy-backs. Their targets more than meet my 10% hurdle, with ROE averaging 14% in the past 5yrs.

7. Bemis acquisition. Amcor had a Market cap/sales of 2:1, and Bemis was 1:1; the addition of $4bn revenue translates to +45%; and over $180m pa synergies by FY22 (likely to be more, currently at ~$150m p/a well ahead of plans). This is yet to be fully factored in by the market.

8. Amcor knows how to acquire, and divest. Since 2010 it has undertaken 20 major acquisitions, and divested 3 non-core / lower margin assets. During this time it has grown EPS at 8% CAGR while paying out 4.6%. The runway for M&A is long.

9. Competitive Advantage. They have cost advantages, are better at M&A, have a strong balance sheet ($29bn EV, 30% debt) compared to $WRK ($22bn, 50%), $BRY ($18bn, 60%), $SEE ($11bn, 20%) or $STERV.HE ($15bn, 15%)

10. Secure Revenue. Amcor’s largest client is Pepsi $PEP, which is <10% of total revenue. Diverse set of customers across different industries, and barriers to switching, gives them a highly secure revenue base.

11. Environmental tailwinds. Amcor’s pledge is for 100% of packaging to be reusable or recyclable by 2025. This is probably the tail wagging the dog, but they are recognized by FTSE ESG list since 2006 and Dow Jones Sustainability List since 2014.

12. Dividend Aristocrat. The combined history of Amcor and Bemis promoted them to ‘Aristocrat’ in 2020. Check out @SureDividend that did a good write up. suredividend.com/dividend-arist…

13. Surprising to the Upside. Recent results have demonstrated that Bemis synergies, health packaging sales, FCF, and EPS have all beaten expectations. EPS growth is forecast for 10-14%, and dividend yield increased recently to 4.7%.

14. Valuation. The PE ratio is 15.6 based on the lower estimate of FY21 earnings, though this drops to <14 for FY22 when you factor in synergies and expected growth. P/FCF is a miserly 0.4. Historically it is trading in AUD at 2015 prices and arguably is relatively cheap.

15. Consensus is a moderately optimistic outlook. My most optimistic intrinsic value is +36% by end of FY22 including dividends and share buy backs, though a benchmark is +23% in line with analysts.

16. Risks: AUD / USD currency movements has put significant downward pressure on $AMC.AX; though at $0.80c arguable the Aussie is slightly above the long term average. Within the range of $0.60-$0.90c, I try to avoid forex based decisions.

17. Bear Argument. Reduced plastic demands in future could impact the top line; increased competition could further erode margins; and acquisitions come with risks. All of these are long term issues to monitor, but not reasons to avoid Amcor.

18. Overall, I am happy to accumulate in a core portfolio at current ($14.40AUD) prices, though will keep some powder dry in the event it goes to <$13.76 or <$12.93 based on my margin of safety / weighting limits.

If you enjoyed this, bash the like / retweet / follow buttons.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DYOR.

Disclaimer, I'm long AMC.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DYOR.

Disclaimer, I'm long AMC.

• • •

Missing some Tweet in this thread? You can try to

force a refresh