1/ Six months ago, I launched MBI Deep Dives. I publish one deep dive of a publicly listed company every month for $10/month or $100/yr.

Subscribers receive only one/two email each month, and each deep dive is ~8-10k worded piece.

Here's how it went. A thread.

Subscribers receive only one/two email each month, and each deep dive is ~8-10k worded piece.

Here's how it went. A thread.

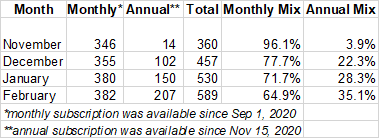

2/ After 6 months, I have 589 paid subs. Although I started in September last year, I started monetizing from November 15, 2020.

I am glad with how things have gone so far, but of course, what happens after 60 months is much more important than 6 months.

I am glad with how things have gone so far, but of course, what happens after 60 months is much more important than 6 months.

3/ I will be the first to admit that MBI Deep Dives has been greatly benefited by the bull market.

I have no clue what will happen to stock price in 3-6 months, but price action probably played a role in convincing at least some to subscribe to my work.

I have no clue what will happen to stock price in 3-6 months, but price action probably played a role in convincing at least some to subscribe to my work.

4/ What was surprising in the last 6 months was subs was not stacked in just few days here and there.

It is, strangely, a very steady stream of 3-4 subs almost every day. This makes me hopeful that there is still a long tail of potential subs out there who want to read my work.

It is, strangely, a very steady stream of 3-4 subs almost every day. This makes me hopeful that there is still a long tail of potential subs out there who want to read my work.

5/ If it were just stacked 30-40 subs on some days and hardly anything on other days, I would be more worried and feel pressured to write more frequently.

Perhaps writing more frequently would lead to more subs, but it would also likely affect the quality of my work.

Perhaps writing more frequently would lead to more subs, but it would also likely affect the quality of my work.

6/ These six months convinced me that if (a big if) I am a good analyst, there will be thousands of people who would want to read my work.

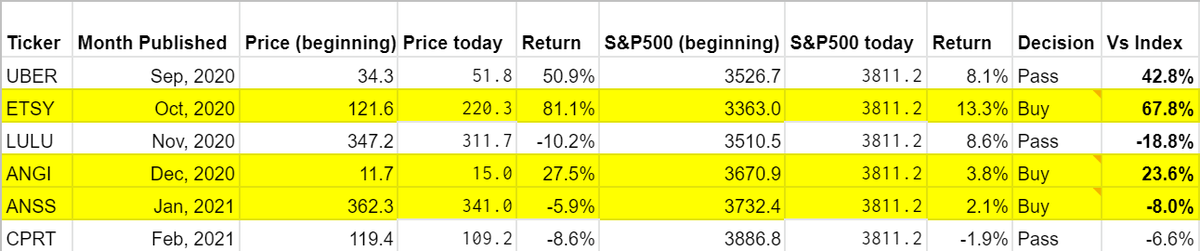

I don't know whether I am a good analyst/investor, nor can I claim myself based on short-term performance or return during bull market.

I don't know whether I am a good analyst/investor, nor can I claim myself based on short-term performance or return during bull market.

7/It will probably take years and multiple market cycles for most of you to evaluate whether all of these have been just fluke or I really do have what it takes to be a good analyst.

8/ Because there is such a delayed feedback loop, I encourage people to subscribe if they want to learn about interesting companies along the way, and decide for themselves whether they share my bullish or bearish sentiment on a particular company.

9/ Since I manage my own money and invest based on my own deep dives, I do have skin in the game.

I do not say this lightly, but I feel a deep sense of gratitude to fintwit community. I owe it to this community and I will try my absolute best to be a good analyst.

I do not say this lightly, but I feel a deep sense of gratitude to fintwit community. I owe it to this community and I will try my absolute best to be a good analyst.

End/ If this is something that intrigues you, you can subscribe here: mbi-deepdives.com/plans/subscrib…

• • •

Missing some Tweet in this thread? You can try to

force a refresh