1/ If you turned on CNBC last week, you've likely heard a talking head mention Treasury bond yields

before your eyes gloss over from boredom, stick with us

we're going to explain what treasury bonds are, why their yields are going up, and why you should care about them

before your eyes gloss over from boredom, stick with us

we're going to explain what treasury bonds are, why their yields are going up, and why you should care about them

2/ First, a quick definition of a treasury bond

think of it as a way for the US government to fund itself

when you buy a 10-year Treasury bond, you are the one loaning the government money

think of it as a way for the US government to fund itself

when you buy a 10-year Treasury bond, you are the one loaning the government money

3/ Why would someone purchase a treasury bond?

say you have 1 million dollars

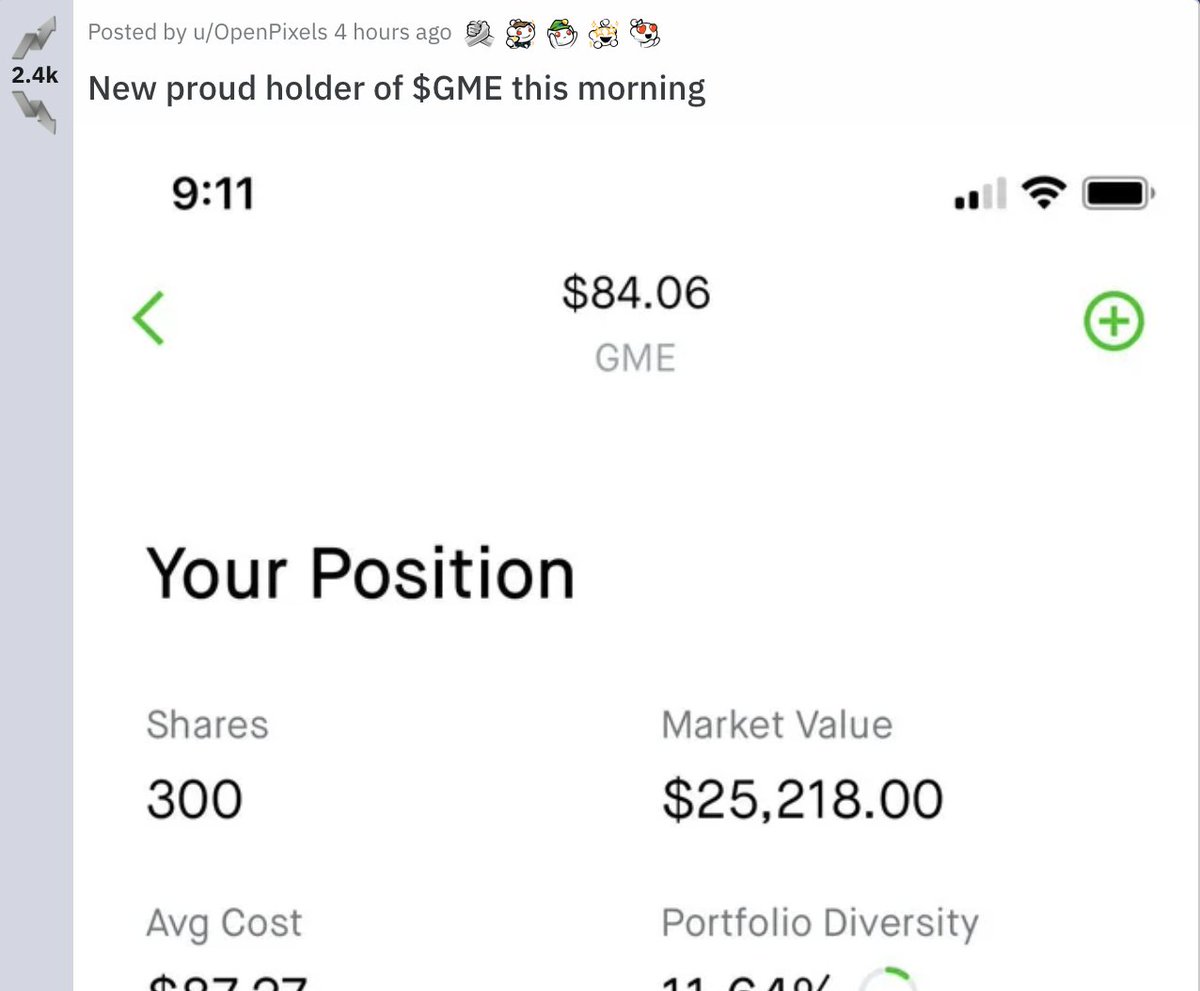

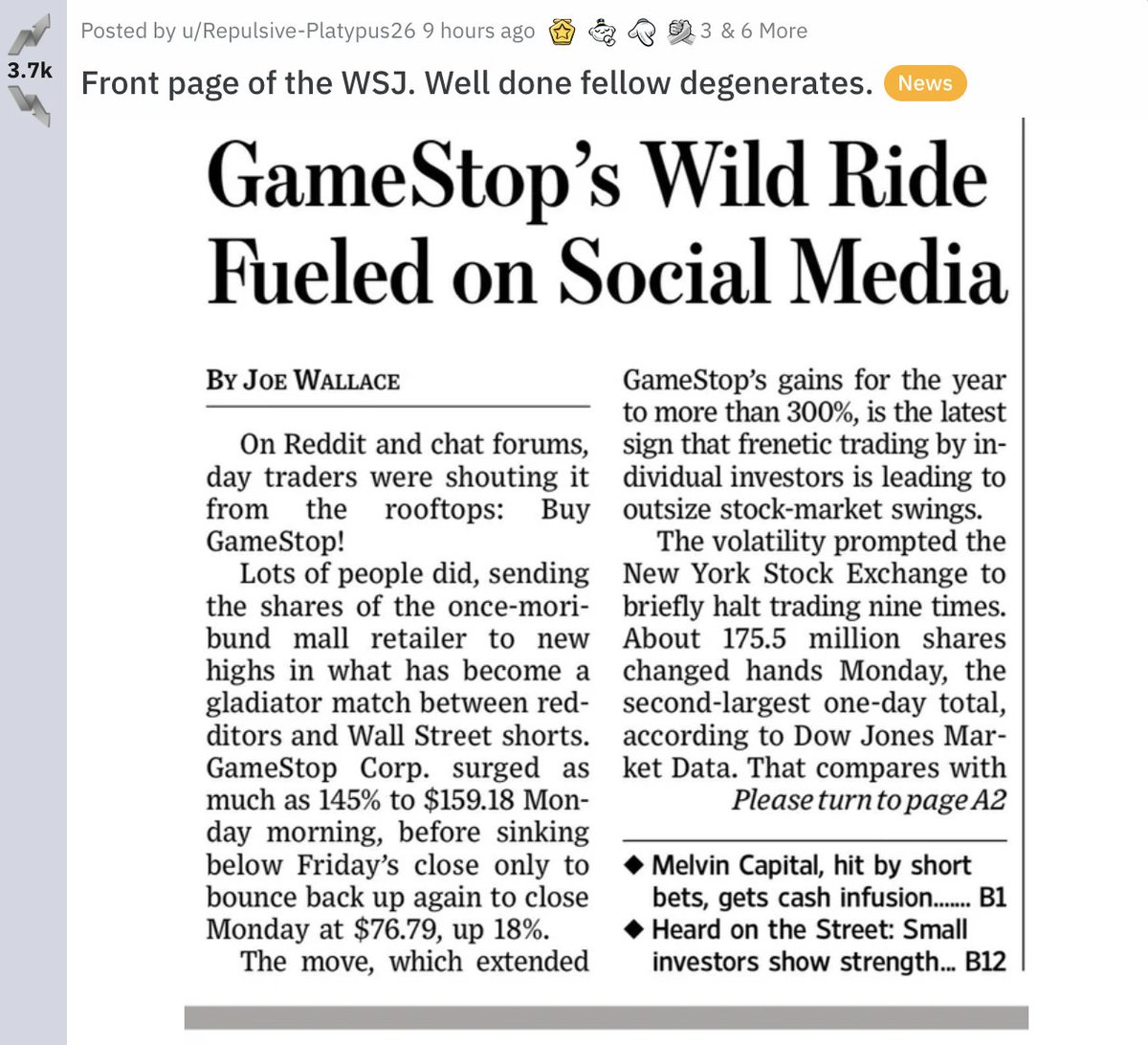

on a scale of stuffing-it-under-your-bed to investing it in GameStop

buying a treasury bond is about the safest thing you can do

say you have 1 million dollars

on a scale of stuffing-it-under-your-bed to investing it in GameStop

buying a treasury bond is about the safest thing you can do

4/ If you buy a treasury bond with that million you can trust that

1. The government will pay back the million you loaned them at the end of the term of the bond

2. The government will pay you interest (yield) on that loan until the end of the term of the bond

1. The government will pay back the million you loaned them at the end of the term of the bond

2. The government will pay you interest (yield) on that loan until the end of the term of the bond

5/ Treasuries, which can mature in as little as 1 year or as long as 30 years, are looked at as a nearly risk-free place to park your money

and the amount of interest that a bond "yields" is used as a benchmark for other investments you can make

and the amount of interest that a bond "yields" is used as a benchmark for other investments you can make

6/ So what makes bond yields go up or down?

Supply and demand, just like anything else in a free market

the more traders who want the risk free returns that bonds offer, the higher bond prices go, and vice versa

Supply and demand, just like anything else in a free market

the more traders who want the risk free returns that bonds offer, the higher bond prices go, and vice versa

7/ But here's the most important tweet in this whole thread

as bond prices go UP, bond yields go DOWN

as bond prices go DOWN, bond yields go UP

bond prices and bond yields are inversely correlated

as bond prices go UP, bond yields go DOWN

as bond prices go DOWN, bond yields go UP

bond prices and bond yields are inversely correlated

8/ One example of the above point, because it's so important

say you park your million in a Treasury bond that yields 2%

but investors think there's gonna be another Covid flareup that might shut down the economy again

suddenly that risk-free yield is wayyy more desirable

say you park your million in a Treasury bond that yields 2%

but investors think there's gonna be another Covid flareup that might shut down the economy again

suddenly that risk-free yield is wayyy more desirable

9/ Now, if you wanted to sell the bond, the safety it provides is worth more

since the bond is more desirable, the price will go up and yields will go down

bond yields were super low at the beginning of the pandemic because of how much uncertainty there was in the market

since the bond is more desirable, the price will go up and yields will go down

bond yields were super low at the beginning of the pandemic because of how much uncertainty there was in the market

10/ Say it with us:

as bond prices go UP, yields go DOWN

as bond prices go DOWN, yields go UP

as bond prices go UP, yields go DOWN

as bond prices go DOWN, yields go UP

11/ There is one last factor in this complicated calculus to contend with: inflation

Inflation essentially means "rising prices"

it’s the reason why people in 1950 paid $0.50 for a loaf of bread while we pay $3.50

Inflation essentially means "rising prices"

it’s the reason why people in 1950 paid $0.50 for a loaf of bread while we pay $3.50

12/ Massive economic growth is actually potential kindling for inflation

signs of inflation often show up in a hot job market where wages are rising

plus, throw in some stimulus efforts and we've got a potent inflationary mix on our hands

signs of inflation often show up in a hot job market where wages are rising

plus, throw in some stimulus efforts and we've got a potent inflationary mix on our hands

13/ The way the Fed has dealt with inflation in the past is by raising interest rates

as interest rates are increased, consumers tend to spend less and save more since returns from savings are higher

with less people spending money, the economy slows and inflation decreases

as interest rates are increased, consumers tend to spend less and save more since returns from savings are higher

with less people spending money, the economy slows and inflation decreases

14/ The prospect of raising rates always sends bond prices down because a bond yielding 1.5% is less attractive if putting your money in savings nets you 2%

📸 SEC

📸 SEC

15/ To sum it all up, 10-year Treasury bond yields are hitting yearly highs because

1. investors are optimistic that more stimulus + vaccines will lead to rapid economic growth

2. investors are a liiiiittle scared of inflation and a potential hike in interest rates

1. investors are optimistic that more stimulus + vaccines will lead to rapid economic growth

2. investors are a liiiiittle scared of inflation and a potential hike in interest rates

If you like threads like this, go follow these people. They all tweet about Treasuries on a fairly regular basis

@awealthofcs

@lisaabramowicz1

@TheStalwart

@conorsen

@LynAldenContact

@awealthofcs

@lisaabramowicz1

@TheStalwart

@conorsen

@LynAldenContact

• • •

Missing some Tweet in this thread? You can try to

force a refresh