I've been ranting about this for almost 2 months now.

To answer all those who are asking "how can I arbitrage this", the answer is, you can't.

Because the SEC doesn't want a Bitcoin ETF, it only allowed $GBTC to exist with one huge caveat: it's a closed-end fund.

To answer all those who are asking "how can I arbitrage this", the answer is, you can't.

Because the SEC doesn't want a Bitcoin ETF, it only allowed $GBTC to exist with one huge caveat: it's a closed-end fund.

https://twitter.com/TheStalwart/status/1367798597828435971

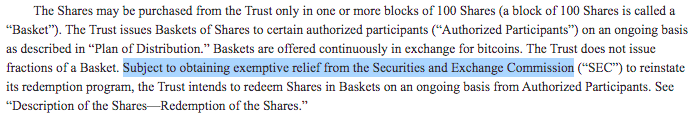

A consequence of that is that $GBTC can't redeem shares. They never got that "exemptive relief" from the SEC (excerpt from their IPO prospectus below). Which means that you can buy $GBTC at a discount to NAV feeling smug, but what are you going to do if the discount goes to -30%?

The only way to milk a discount is to buy a very large stake in $GBTC, and then vote to liquidate the trust in the next shareholder GA - you'll then get your bags of Bitcoin. But then the market will know that you got a crapload of Bitcoin that you probably intend to sell.

There's no way on earth you'll ever get the liquidity to sell those Bitcoins. We're currently talking about $30B worth. Unless you get something like a 80%-90% discount on that bag, it's not even worth trying.

That's the problem with Bitcoin having no economic value.

That's the problem with Bitcoin having no economic value.

If $AAPL goes down 80%, Microsoft will buy it all for its underlying business. Not so much with Bitcoin. You can't arbitrage it. Nobody's going to buy it because it's "cheap".

People only buy Bitcoin hoping we're not out of greater fools yet. There's liquidity only on the way up.

People only buy Bitcoin hoping we're not out of greater fools yet. There's liquidity only on the way up.

• • •

Missing some Tweet in this thread? You can try to

force a refresh