I took my own dive into Ark ETFs last week as people came out to the wood-work to bash @CathieDWood and @ARKInvest. Sure there are risks for people to be concerned about but there's also a lot of misinformation out there. Market cap and liquidity of stocks showed no pattern.

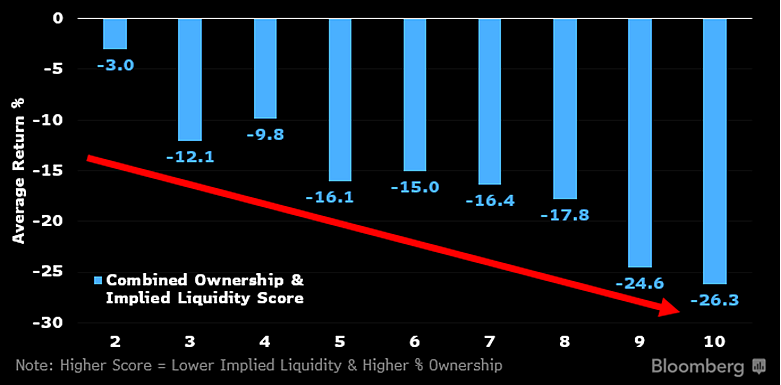

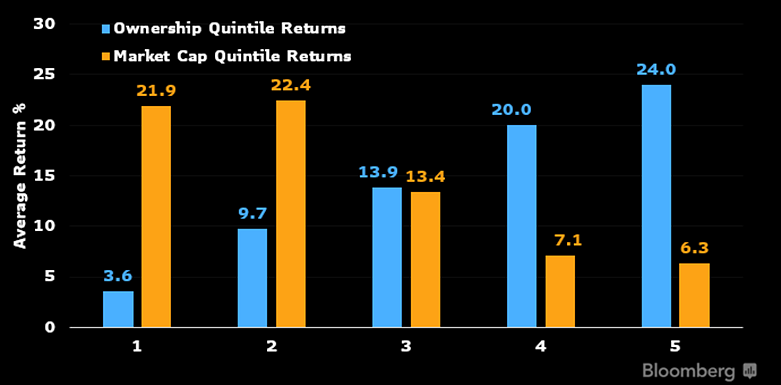

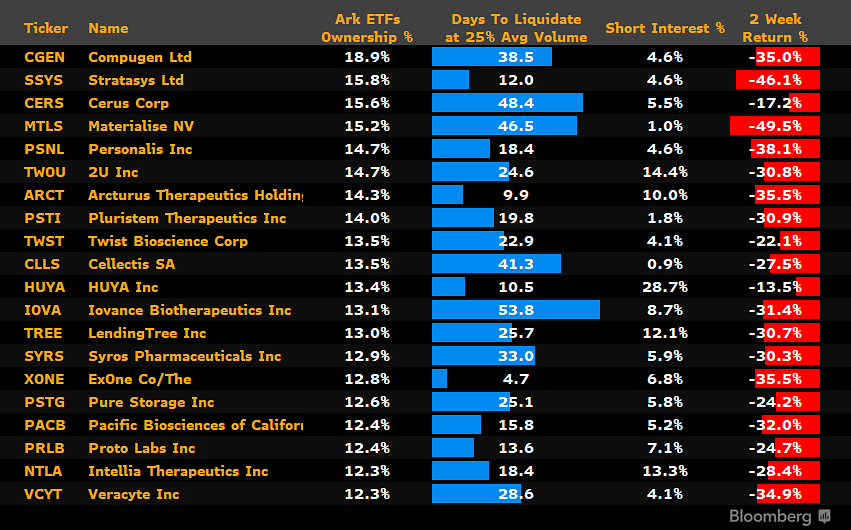

Regression analysis showed nothing in most basic metrics like beta, market cap, liquidity, etc. But taking the firm's stakes in the underlying stocks and their liquidity relative to the size of its position showed a definitive pattern. Heres avg return by quintile in each metric.

When you take both metrics into account, the trend is pretty obvious. But this is just correlation and not necessarily causation in my view. It's possible that Ark's concentrated positions happen to be in stocks most sensitive to other external factors, like rising rates...

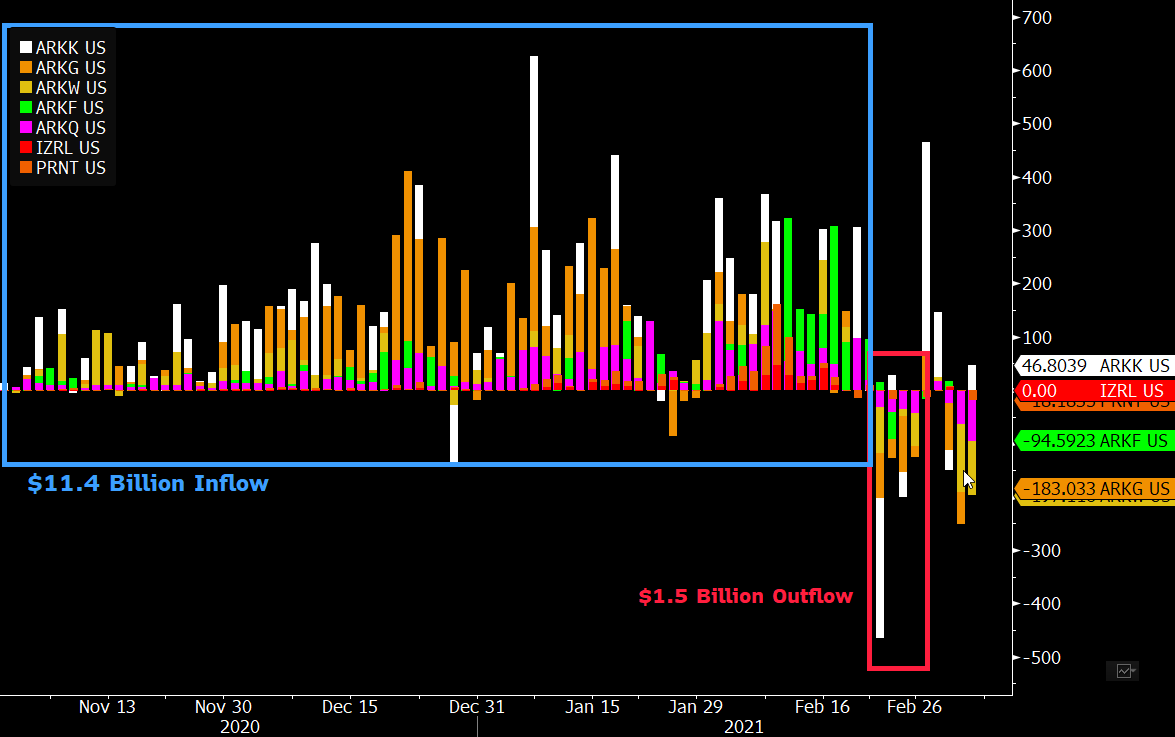

Time period = 2/19 - 3/5. Ownership % was statistically significant for this albeit small sample set. While relative liquidity significance was on the cusp in a simple regression. But for 2/19-2/26 implied liquidity was more indicative. Maybe those outflows played a role?

Rates have gone straight up and companies with minimal or negative cash flow that expect exponential growth will be most affected by rising rates, due to future cash flows being less valuable in today's dollars, while financing costs will be higher. This MAY be skewing things too

So naturally i looked at positive flow and positive return time periods and only ownership% maintained correlation. Market cap was a correlated for 1/1-1/25 alongside Ownership%. But nothing else. Makes sense though because Russell2k small beat Russel1k large by 7% here.

What this comes down to is the stocks driving Ark's performance right now are names they have the most conviction in. Essentially, Ark is swinging for the fences and will live and die by their homerun hitting ability. If you have read anything about them, you should expect this..

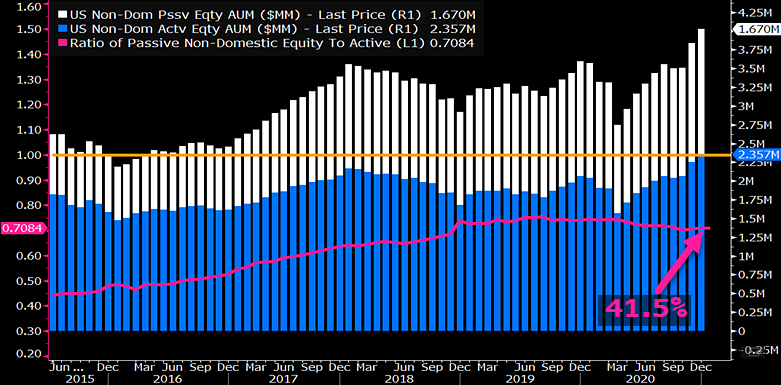

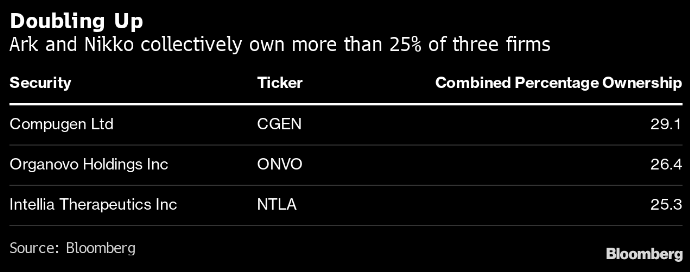

The numbers above only include their ETF stakes. So they exclude SMA assets and exclude assets from Nikko Asset Management which mimics some of Ark's strategies. inclusion would actually increase these numbers. Here's some estimate stats from @cfb_18 & @SarahPonczek

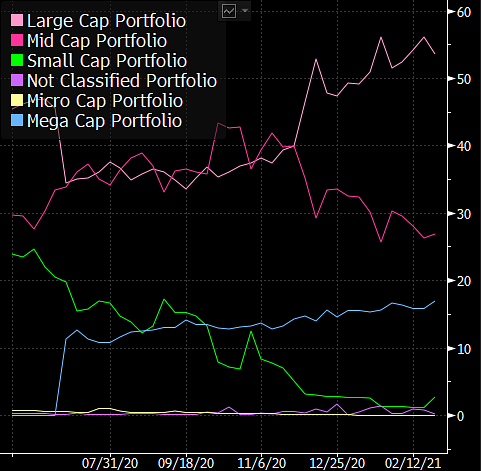

They've been slightly altering their portfolios to handle this by letting big names run and loading up on some large tech stocks they wouldnt normally hold if they were smaller. Essentially making a liquidity moat that allows ARK to buy dips in names they like by selling lrg caps

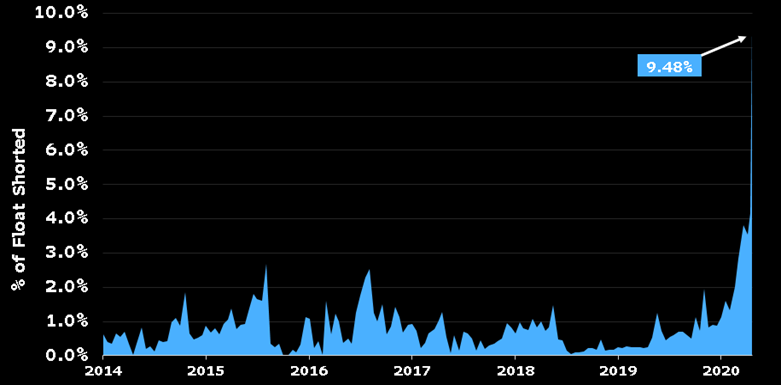

We've seen Cathie do this time and again. Without selling rallies and buying dips Cathie/Ark wouldn't be in the position they are today. Ark is a Highly volatile, high conviction, high activeshare portfolio and Plenty of people are betting against them via shorts and puts on ARKK

That said, we haven't seen even the slightest sign of a hiccup. Not in the form of bid-ask spreads or tracking. Everything has been extremely smooth and fluid on the trading side. The top window here actually has two lines -- the iNAV and the Price.

Corey has done some great work on this as well. With different charts and data over the past couple weeks trying to decipher what may be happening here:

https://twitter.com/choffstein/status/1367945890317664261?s=20

Honestly if you own $ARKK or other Ark etfs and you're concerned about Ark's dip buying .. you probably shouldn't be invested in their funds. This has been the playbook since they started. And they've absolutely shot the lights out. So much jealousy here.

https://twitter.com/EricBalchunas/status/1369028222952824841?s=20

For anyone looking to read all of this and more with more charts and more context than 240 characters per tweet. It can be read here:

blinks.bloomberg.com/news/stories/Q…

blinks.bloomberg.com/news/stories/Q…

• • •

Missing some Tweet in this thread? You can try to

force a refresh