To obtain extra credit, please explain the process the buyers used to purchase these Twitter 0% convertible senior notes due 2026 (the "notes").

"Initial conversion price of approximately $130.03 per share."

You must show your work to get full credit. prnewswire.com/news-releases/…

"Initial conversion price of approximately $130.03 per share."

You must show your work to get full credit. prnewswire.com/news-releases/…

"The low interest rate environment, coupled with high equity valuations and high volatility in markets amounts to a 'triumvirate' that leads to very attractive convertible pricing”, he said."

Answering "triumvirate" isn't an acceptable answer. Sorry. google.com/amp/s/amp.ft.c…

Answering "triumvirate" isn't an acceptable answer. Sorry. google.com/amp/s/amp.ft.c…

Is this statement correct? Use example based math to support your answer.

"market volatility also provided hedge funds with an opportunity to profit. They buy the convertible bonds of companies whose stock has soared and hedge their position by shorting." google.com/amp/s/mobile.r…

"market volatility also provided hedge funds with an opportunity to profit. They buy the convertible bonds of companies whose stock has soared and hedge their position by shorting." google.com/amp/s/mobile.r…

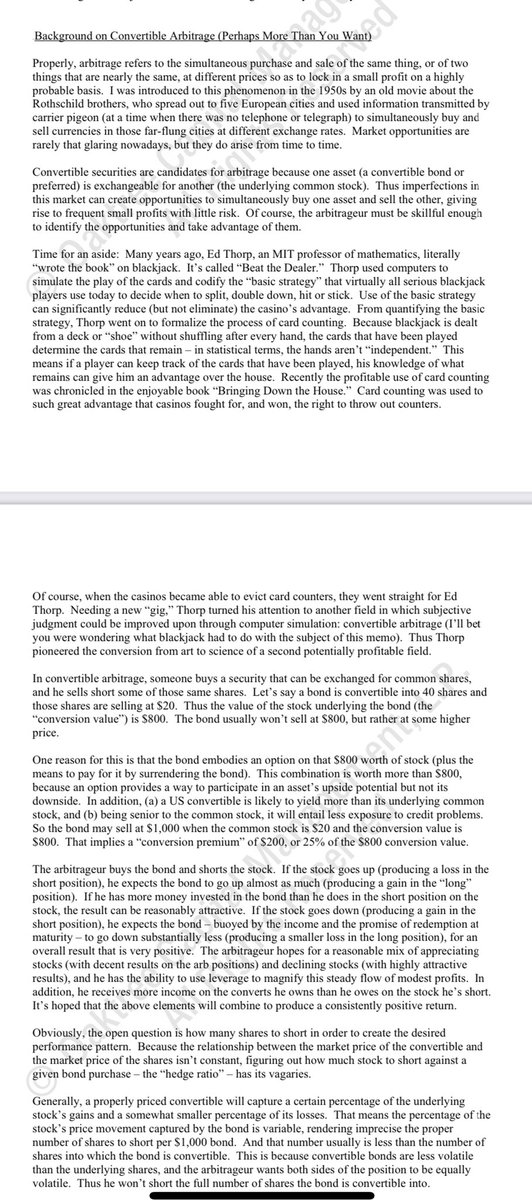

Howard Marks on convertible arbitrage (June 6, 2005) oaktreecapital.com/docs/default-s…

Ed Thorp on convertible arbitrage: google.com/amp/s/25iq.com…

I'm getting DMs asking for some help on doing the math to get full credit for an answer. You might want to use:

Package ‘RQuantLib’ cran.r-project.org/web/packages/R…

Or

Valuing Convertible Bonds Using QuantLib Python gouthamanbalaraman.com/blog/value-con…

You are welcome!

Package ‘RQuantLib’ cran.r-project.org/web/packages/R…

Or

Valuing Convertible Bonds Using QuantLib Python gouthamanbalaraman.com/blog/value-con…

You are welcome!

My Neighbor's Dog: "Twitter is monetizing volatility by selling convertible bonds since long-term call options on volatile stock can be valuable."

Me: "Hmm."

Neighbor's Dog: "No dividends reduces cost of shorts."

Me: "Seems like a lot of work. I put it in the 'too hard' pile."

Me: "Hmm."

Neighbor's Dog: "No dividends reduces cost of shorts."

Me: "Seems like a lot of work. I put it in the 'too hard' pile."

• • •

Missing some Tweet in this thread? You can try to

force a refresh