There's outright feeding frenzy going on for value ETFs rn, which have taken in about $5b in past week (that's a good month) and $20b YTD (nearly an ann record 10wks in). All in all 80 value ETFs have taken in cash. Here's a look at where the money is going $EFV $VTV $VLUE $IWN

Interesting (and yet kinda predictable) most of the cash is going to the watered down value ETFs even tho the pure stuff is popping WAY MORE. Here's a look at the Top 4 Value ETFs in our "intensity rank" vs $IWD & $VTV which rank near bottom.

Gotta say our BI factor intensity rank f-ing nailed it. The YTD returns (prev tweet) exactly match the ranking (which was done ahead of time using combo of volatility, # of holdings and loading). Nice work @tpsarofagis

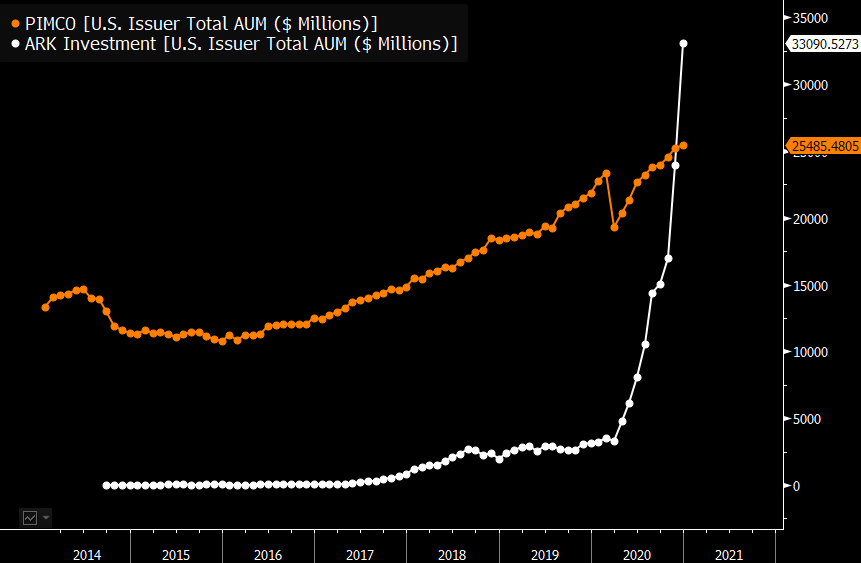

That said, if this value comeback is real and not the 28th head fake, then watch for one (maybe two) of those 4 ETFs above to be the next era's $ARKK. Calling it now.

• • •

Missing some Tweet in this thread? You can try to

force a refresh