This past year has been one of the most difficult and challenging years on record for Jamaica, for Jamaicans, and for all of humanity. #Budget2021

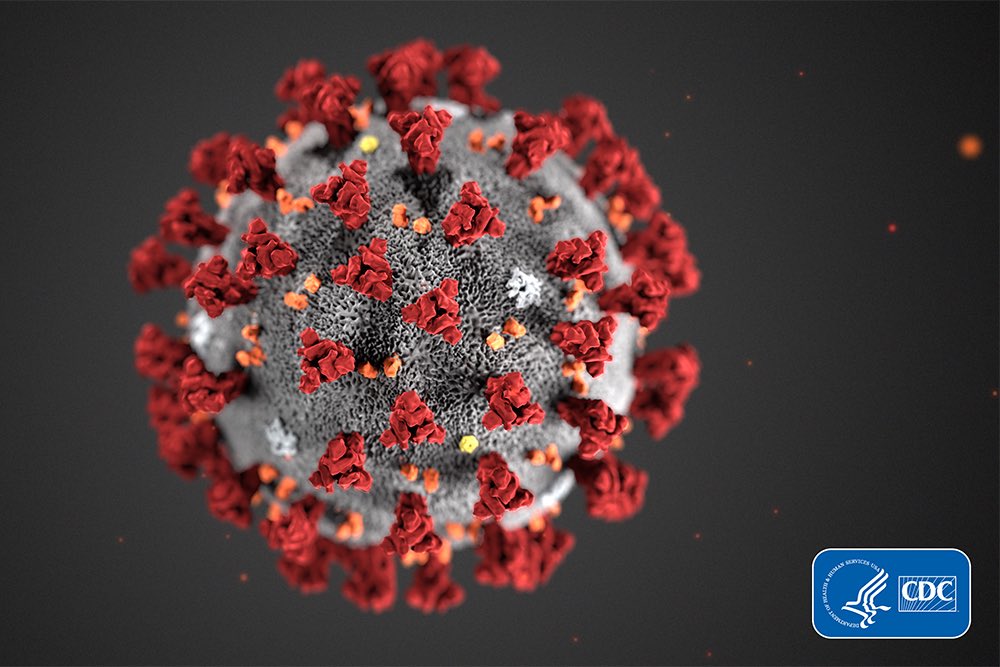

The coronavirus, a living organism incapable of life on its own, has sought hosts in the human population at great damage to our health, and with the skillful ability to hop, unnoticeably, from one human to another through respiratory activity.

I pause to express solidarity with all the individuals and families who have been impacted by this deadly disease, with those who have lost loved ones, those still in hospital, and with others in isolation.

And just when normality seemed to be gradually returning, the Government found it necessary to impose restrictive measures over a three-week period as COVID-19 case volume mounted, hospitalisations surged to worrying levels; intensive care capacity approached its breaking point.

The toll on mental health caused by isolation and social distancing, especially for the elderly and school aged children is as yet, unaccounted for and the lost school time among global student populations will likely have an impact into the future.

I want to use this opportunity publicly to let the people of Jamaica know that we hear you, we understand your concerns, we share your pain, and we will remain steadfast in our commitment to acting in the best interests of all Jamaicans -

as we seek to balance the competing interests of protecting both lives and livelihoods.

Though it is often darkest right before dawn, from all we can see, it certainly looks like we are about to enter the phase of the health crisis that can be described as the beginning of the end.

For the economic crisis, however, we may only be at the end of the beginning.

Our objectives and our goals are to have a faster economic recovery than we have ever had before and to recover stronger than before.

We will achieve this through disciplined policy choices, prioritizing within priorities, maintaining a keen awareness of risk, and by modernizing our economy.

The economic impact of the COVID-19 pandemic on Jamaica can be expressed in a staggering set of numbers that boggle the mind.

This is, by far, the worst economic contraction in Jamaica’s history. No previous economic decline comes even close.

The closest comparison to the 12% economic contraction we expect this year are the economic decline of 6.5% in 1975, 5.7% in 1980, 4.6% in 1985, 3.9% in 1974 and 3.2% in 2009.

In the biggest economic crisis in 90 years, where the economy declined in a way no Jamaica has ever experienced before now, we had the largest number of new company registrations and new business registrations in our history.

Government Revenues are expected to decline by $70 billion or 12% in this fiscal year 2020/21 as compared with the previous year.

It took four years between 2016 and 2020 for the Jamaican economy to add 100,000 jobs to the Jamaican economy and in the first four months of the COVID pandemic over 130,000 jobs were lost.

It took four years between 2016 and 2020 for the Jamaican economy to add 100,000 jobs to the Jamaican economy and in the first four months of the COVID pandemic over 130,000 jobs were lost.

COVID-19 has decimated Jamaica’s foreign exchange inflows from tourism. And again, there is no parallel in Jamaica’s history for what has occurred.

As a result of the COVID-19 pandemic, Jamaica’s foreign exchange inflows from tourism are projected to fall by 74% or US$2.5 billion in 2020/21.

The last time our foreign exchange inflows were this low was approximately thirty (30) years ago in 1992/93.

Jamaica’s diaspora rose to the challenge, and although they face their own COVID-19 related challenges faithful Jamaicans abroad sent US$600 million more to their family members and friends in Jamaica, which is 23% more than the previous year.

The current account deficit is our foreign exchange deficit with the rest of the world before you add foreign direct investment.

So we have had the worst economic crisis in our history where tourism revenues fall by US$2.5 billion and the current account has remained well within the bands of sustainability.

Prior to this experience no one would have thought that Jamaica could have withstood a US$2.5 billion collapse in tourism receipts while retaining macro-economic stability.

This Government has pursued a prudent policy of building up our cash reserves to pay down debt. Because of these decisions, we opened the fiscal year with cash reserves of approximately $90 billion, or more than 4% of GDP.

As a result, when the COVID-19 pandemic came we were able to finance a 3.5% fiscal deficit while keeping nominal debt flat.

Policy matters and good policy matters even more.

Good policies expand opportunities and provide flexibility when we need to respond to crisis.

Good policies pay dividends Madam Speaker.

Between 2016 and 2019, we increased our non-borrowed reserves by US$1 billion, which put us in a good position when the crisis hit.

Suppose we had buckled under the pressure, and deviated from policy and it ended up that the central bank spent its precious reserves when there was hollering and shouting in 2018 and 2019, as we transitioned to exchange rate flexibility and inflation targeting.

What would have happened to us when our earnings from tourism collapsed by US$2.5 billion dollars? Where would we be now?

My fellow Jamaicans, policy matters, good policy matters even more and the discipline to stick to good policy when the going get rough is priceless and pays huge dividends.

There is a proverb that says “preparation is better than good luck.”

Good policies expand opportunities and provide flexibility when we need to respond to crises.

But good policies require that we think about tomorrow as well as today.

Although our nominal debt remained flat, due to the significant decrease in our GDP, because of COVID-19, Jamaica’s debt-to-GDP ratio jumped a staggering 16 points, from 94% to a projected 110%.

Our economic policy response sought to maintain the previously elusive macro-economic stability for which the Jamaican people have sacrificed so much, provide social economic and social support to households and businesses, and also to finance the health response.

We launched a $25 billion stimulus.

Along with 100 other countries around the world we applied for access to the IMF’s Rapid Fund Facility and were approved for the maximum amount of 100% of our quota or US$500 million in a matter of weeks.

We suspended our fiscal rules, which enabled us to run a fiscal deficit of 3.5% of GDP as opposed to the pre-pandemic targeted surplus of 0.5% of GDP.

The Government of Jamaica responded with the $20 billion CARE Programme which quickly became the largest social programme in Jamaica’s history.

I would like to recognize the hard-working and dedicated ladies and gentlemen of several agencies and departments.

First, the committed and dedicated staff at the Ministry of Finance and the Public Service who coordinated the CARE Programme.

Second, e-GOV Jamaica, who developed and managed the portal. The young men and women there worked weekends and did not sleep in order to launch on time, maintain the application, respond to queries and to update as required.

Third, the Accountant General’s Department who administered the payments. We had challenges with the number of persons without bank accounts and those with accounts that were invalid at the time of applying, and the Department worked hard to address and overcome those challenges.

Fourth, Tax Administration Jamaica, who played a critical role in validating applicants.

Fifth, I must personally recognize Mr. John Thompson, the project manager, who was a calm, organized and dedicated leader.

This core team worked with the Ministry of Local Government, the Ministry of Transport and Mining, the Ministry of Tourism, the Ministry of Education, the Ministry of Industry, Commerce Agriculture and Fisheries(as it was then).

As well as the Ministry of Culture, Gender, Entertainment and Sport, the Ministry of Labour and Social Security and the EXIM Bank in the delivery of the CARE Programme.

We also need to recognize the remittance companies, in particular Western Union and Lasco Moneygram who accepted much less than their usual fee to handle huge volumes of transactions. We had some hitches, which we were able to resolve.

On behalf of the people of Jamaica, I have to also thank the Auditor General’s Department. The AGD provided the service of audit assurance which was important to its success.

In the execution of the CARE Programme, we did something novel.

We asked the Auditor General to perform concurrent audits of the We CARE programme. That is to audit while the programme was being executed and BEFORE each batch of payments was made.

We asked the Auditor General to perform concurrent audits of the We CARE programme. That is to audit while the programme was being executed and BEFORE each batch of payments was made.

So applications for each We CARE grant type were validated, and then processed and batched for payment, subject to audit.

Prior to the files being transferred to the Accountant General’s Department for payment, the Auditor General’s Department, which had access to the system and all of its data, audited the eligibility, validation...

... and other processes and produced reports allowing for any errors to be identified and corrected prior to payment.

Those reports were tabled in Parliament for the people’s representatives to review and ask questions and for the world to see.

This caused some delays and some backlash but the transparency of this process, and the openness of the programme to the highest level of immediate scrutiny, provided the public confidence that allowed the programme to scale to $20 billion.

In this programme, similarly situated Jamaicans had equal access to Government benefits, which, importantly, did not depend on race, class, gender or political affiliation.

Your CARE benefit did not depend on who you voted for. Whether you were PNP, JLP or No P. If you were eligible, and your identity could be established and you met the criteria you could receive this benefit from the Government.

There was no paperwork, no human interface. You applied online or on your mobile phone, tablet or computer and eventually you collected your benefit from the Jamaican State at the remittance company or the bank.

In the end over 440,000 Jamaicans were able to benefit from one of a number of CARE grants through the We CARE digital portal.

Madam Speaker, I will be the first to admit that it was not perfect. There were glitches that we had to overcome and areas that could be improved.

Some lessons:

▪ Digital means of processing and delivery offer the opportunity for quick, efficient, rules-based, and scalable programmes.

▪ Digital means of processing and delivery offer the opportunity for quick, efficient, rules-based, and scalable programmes.

▪ The MPs and Cllrs have a legitimate and important role to play in assisting the citizen to navigate the State bureaucracy to access benefits offered by the State.

▪ Openness and transparency in the use of public resources, and open, transparent and equitable processes for the distribution of the resources of the State, ultimately empower the State to do more for the people.

Madam Speaker, when we learn, we grow. So it is always good to distill the “lessons learned” from our significant or important experiences. This is true at the level of the individual and it is also true at the level of the country.

For a young nation experiencing a painful economic shock of historic proportions, it is useful to take stock and distill some of the main economic lessons thus far.

One lesson, at the policy level, is the importance of having buffers that result from an awareness of risk. Economic shocks happen. Sometimes, huge economic shocks happen.

From time to time we experience economic shocks arising from commodity price volatility, geopolitical tension, social tensions, natural disaster and yes epidemics and pandemics. Sometimes, unfortunately, we experience more than one of these shocks at the same time.

As a small, open, developing and relatively undiversified economy, Jamaica is particularly vulnerable to a variety of economic shocks. This is our reality.

What has happened to us in the past is that economic shocks have set us back years, even decades.

The economic shock in 1970’s led to 6 years of economic decline between 1974 and 1980 and it took us 14 years to recover to pre-crisis levels of economic output.

The economic shock arising from the global financial crisis 2008/2009 led to 3 years of economic decline, where the economy contracted for 11 out of 12 quarters and it took us 10 years to recover to pre-crisis levels of economic output.

Our recoveries have taken too long. They have fit on a generational timescale. We are determined to change that. That is our goal and our mission.

The biggest hurdle on our development path since independence has been that our periods of economic expansion have been too short, while our experiences of economic declines have been too long.

Proverbially, moving two steps forwards, and one step back.

The economic cycle of expansion and decline is an eternal condition of humankind.

We will always have periods of economic decline.

But we want the periods of economic decline and recovery to be shorter and shorter, with our periods of our economic expansion longer and longer.

That is, we want to ensure we have quick economic recoveries.

We have made it our mission from the very outset of this crisis to defy our history and, relative to this history, to have the quickest recovery from our worst economic crisis.

So how do we ensure that our economic expansions last longer and our declines are shorter?

First, our policies must incorporate the reality of the economic risks we face. We must ensure that we are always adequately prepared.

For the foreseeable future we will remain vulnerable to the economic impact of commodity price shocks, geopolitical tensions, and natural disaster events. We must ensure that we always have buffers.

We should never, ever, have the cupboard empty.

The most powerful lesson is that through disciplined policy choices, and effective implementation, we have the capacity to bring into reality the Jamaica we want.

Jamaica’s history includes hundreds of years of colonization and domination. Through the persistent forces of history we sometimes subtly adopt, embrace, internalize and pass on an identity where our existential frame is a world where things happen to us: A just so it go.

That is, we sometimes act as if we are not in control of our destiny. As is there are forces at work that are too big for us to confront.

Marcus Garvey did not think like that. Norman Manley did not think like that. Alexander Bustamante never thought like that. Neither did any of our National Heroes.

And it was Jesus himself who warned us with the parable of the talents. Jesus rejected the man in the parable who was given one talent, but who lacked vision and was too afraid and thought he could not transform his environment.

So far, we have weathered this crisis better than others in the past, though it’s the worst economic crisis in our history, not by magic, but because of the policy choices we as an independent people have made.

With that as my reference, and in the spirit of the parable I referred to you, I say to my fellow Jamaicans that, with God’s help, and with disciplined policy choice, we, as a nation, can bend the future to our will.

We can win. And we will win.

That is our goal and our mission.

We are modernizing and building our institutional framework with greater transparency in monetary policymaking, fiscal policymaking, and public investment execution that will empower the State to deliver more for the people of Jamaica.

While our peers are scrambling to finance budgets, we have been looking ahead to build and strengthen institutions that safeguard our economic stability, lengthen the economic cycle, and shorten periods of economic recovery.

• • •

Missing some Tweet in this thread? You can try to

force a refresh