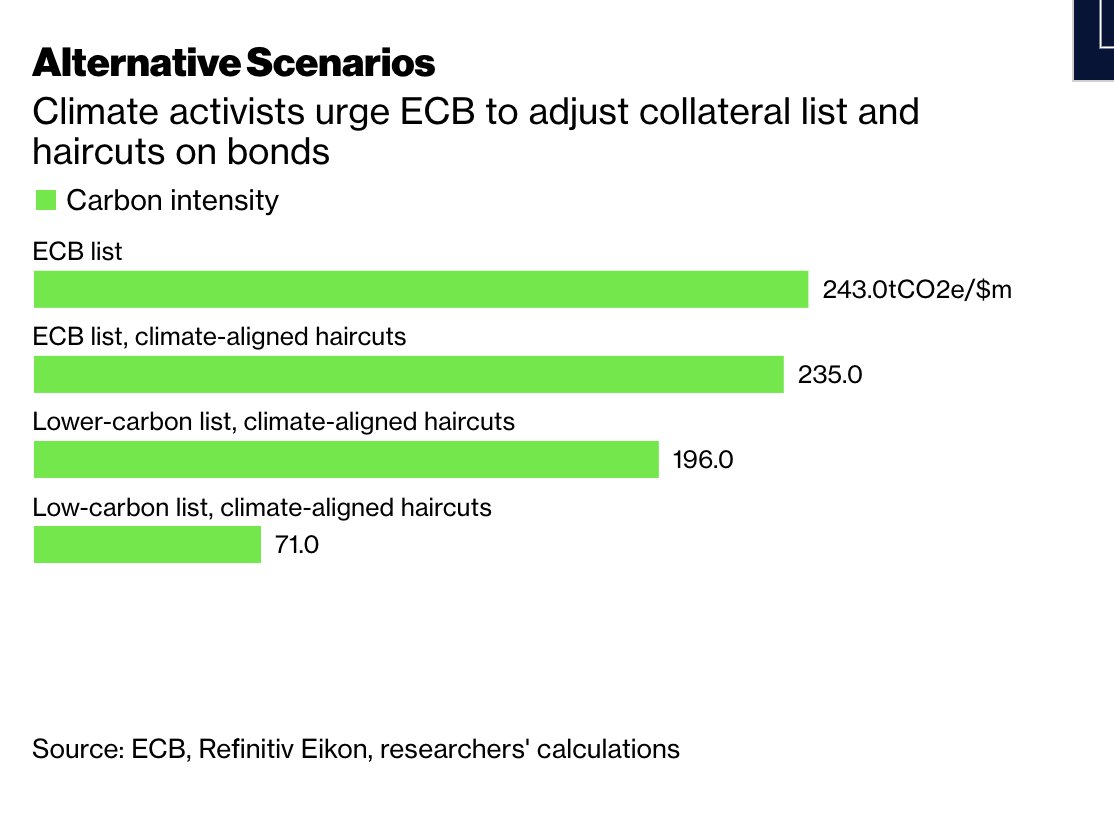

Our new @Greenpeace @NEF report on how @ecb can decarbonise monetary policy - collateral it accepts in both regular and unconventional loans - is out!

within the mandate, this is necessary action to eliminate carbon bias, legacy of market neutrality.

bloomberg.com/news/articles/…

within the mandate, this is necessary action to eliminate carbon bias, legacy of market neutrality.

bloomberg.com/news/articles/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh