the craziest invention of financial capitalism is my pension fund investing in a closed private equity fund that runs private care-homes, in which I may end up one day, and die faster than if we collectively agreed to organise all this through the state

https://twitter.com/DanielaGabor/status/1364120311017443330?s=20

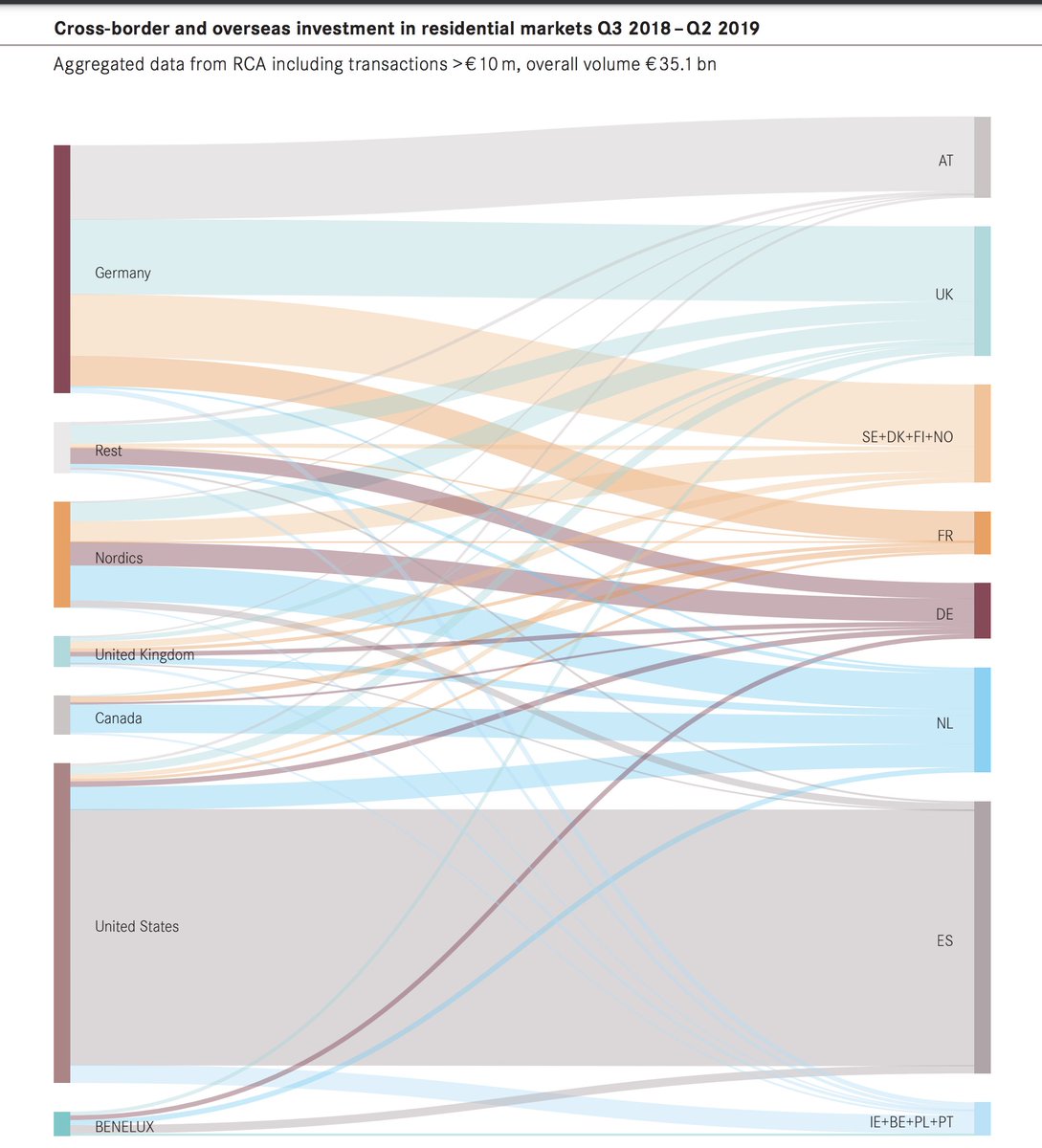

and this after days of reading about the rush for infrastructure assets in Europe, with billions of institutional investment money waiting for mortgage loans to fail...

Housing as an asset class is another gem: US investors gobbling up urban housing to rent it, then tap the EIB for some subsidised loans to 'green' them.

Oh wait, actually I might not be able to go into that private equity care home after all

https://twitter.com/timeshighered/status/1367537580842102786?s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh