NEW FROM US: The Lordstown Motors “Mirage”: Fake Orders, Undisclosed Production Hurdles, And A Prototype Inferno

hindenburgresearch.com/lordstown/ $RIDE

(1/x)

hindenburgresearch.com/lordstown/ $RIDE

(1/x)

Lordstown is an EV SPAC with no revenue and no sellable product, which we believe has grossly misled investors on both its demand and production capabilities. $RIDE

$RIDE has consistently pointed to its book of 100,000 pre-orders as proof of demand for its proposed EV truck.

Our extensive research reveals that the company’s orders appear largely fictitious and used as a prop to raise capital and confer legitimacy.

Our extensive research reveals that the company’s orders appear largely fictitious and used as a prop to raise capital and confer legitimacy.

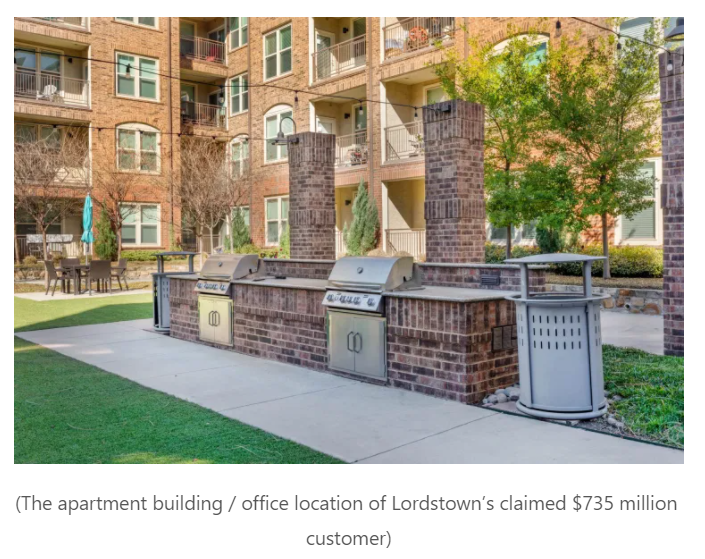

Example 1: $RIDE recently announced a 14,000-truck deal with E Squared Energy, supposedly representing $735 million in sales.

E Squared is based out of a small residential apartment in Texas that doesn't operate a vehicle fleet.

E Squared is based out of a small residential apartment in Texas that doesn't operate a vehicle fleet.

Example 2: Another 1,000-truck, $52.5 million “order" comes from a 2-person startup that operates out of a Regus Virtual Office w/ a UPS Store address.

The owner said it won’t actually order any vehicles, instead describing the “pre-order” as a mere marketing relationship. $RIDE

The owner said it won’t actually order any vehicles, instead describing the “pre-order” as a mere marketing relationship. $RIDE

Example 3: Yet another firm supposedly set to buy 500 trucks from $RIDE said:

“…The letters of interest are non-binding. It’s not like you’d obligate yourself to a pre-order or that you would contractually bind yourself to buying this truck. That’s not what they are.”

“…The letters of interest are non-binding. It’s not like you’d obligate yourself to a pre-order or that you would contractually bind yourself to buying this truck. That’s not what they are.”

Our research details more than a half dozen other supposed non-binding "orders", with some customers describing them as "impossible" and others who said they "[weren't] committed to anything".

Many “customers” don’t even operate fleets. $RIDE

Many “customers” don’t even operate fleets. $RIDE

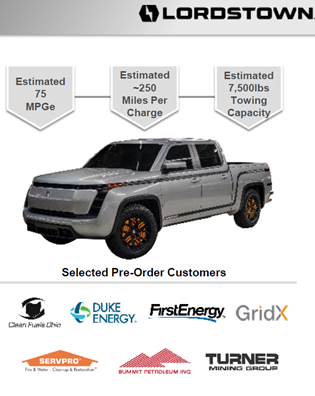

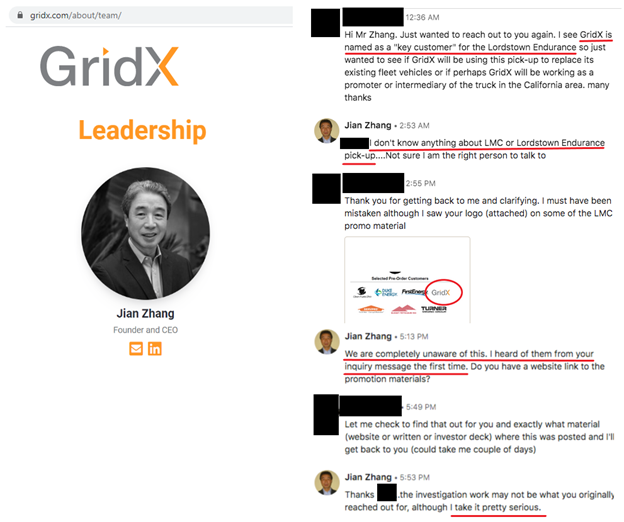

$RIDE has only disclosed selected pre-orders. Of those disclosed in promotional materials many appear false or misleading.

Grid-X’s CEO (listed as a “selected" customer) had not even heard of Lordstown when we contacted him.

Grid-X’s CEO (listed as a “selected" customer) had not even heard of Lordstown when we contacted him.

$RIDE CEO Steve Burns has called these arrangements “very serious orders” despite extensive evidence to the contrary.

Here is a video montage of Burns touting these non-binding agreements repeatedly on national television as "pre-sold" and "orders".

Here is a video montage of Burns touting these non-binding agreements repeatedly on national television as "pre-sold" and "orders".

Former employees and litigation records reveal that in order to raise capital and confer credibility, Steve Burns began PAYING consultants for truck pre-orders as early as 2016 while he was serving as CEO at Workhorse. $RIDE

Heading into $RIDE's go-public transaction in 2020, a small consulting group called Climb2Glory was paid $50 per truck for pre-orders. C2G said:

“the faster the pre-orders arrived, the greater investors’ confidence would be in the company and the faster funds would flow in.”

“the faster the pre-orders arrived, the greater investors’ confidence would be in the company and the faster funds would flow in.”

One company rep that agreed to 40 $RIDE trucks through Climb2Glory told us: “…I’m not committed to anything, not to buying a single vehicle. I committed to consider buying vehicles. I’d have a lot of questions before I commit to anything."

Others had similar remarks. “The commitment of that size (15) is totally impossible,” a representative for the City of Ravenna told us about its pre-order.

We document numerous other "customers" that disclaim an intent to actually purchase vehicles.

We document numerous other "customers" that disclaim an intent to actually purchase vehicles.

Multiple formers who worked with $RIDE Founder & CEO Steve Burns openly described him as a “con man” or a “PT Barnum” figure. One senior employee told us that, while working with Steve, they saw more questionable & unethical business practices than they had seen in their career.

Despite claims that $RIDE will be producing vehicles by September, a former employee explained how the company is experiencing delays and making "drastic" design modifications, putting them an estimated 3-4 years away from production.

Former employees also shared that $RIDE has completed none of its needed testing or validation, including cold weather testing, durability testing, and Federal Motor Vehicle Safety Standards (FMVSS) testing required by the NHTSA.

In January 2021, $RIDE's first street road test resulted in the vehicle bursting into flames 10 minutes into the test drive. We share copies of the 911 call and a police report we received through FOIA requests.

$RIDE only went public in October 2020, but in that brief time, executives and directors have unloaded ~$28 million in stock.

We think it bodes poorly when executives unload stock in a company with no actual product that claims to be on the cusp of mass-production.

We think it bodes poorly when executives unload stock in a company with no actual product that claims to be on the cusp of mass-production.

$RIDE's story has brought hope to investors and a hard-hit local community, but we don't think the company has been transparent.

We pose 21 questions at the end of our piece that we think stakeholders deserve the answers to.

We are short shares of $RIDE

We pose 21 questions at the end of our piece that we think stakeholders deserve the answers to.

We are short shares of $RIDE

• • •

Missing some Tweet in this thread? You can try to

force a refresh