The Dow Jones Industrial Average — a 124-year-old index nicknamed “the Dow” — has been one of the biggest market stars this year 💫

So what’s the Dow?

And why is this rag-tag group of older stocks crushing it?

A thread 🧵

So what’s the Dow?

And why is this rag-tag group of older stocks crushing it?

A thread 🧵

First things first, WHAT IS THE DOW?

The Dow is an index of 30 old-school "blue chip" stocks, like industrials and financials.

It contains some of the biggest U.S. companies, and is meant to be a barometer for the health of the stock market.

The Dow is an index of 30 old-school "blue chip" stocks, like industrials and financials.

It contains some of the biggest U.S. companies, and is meant to be a barometer for the health of the stock market.

TBH it’s like the weird uncle of the major indexes.

It’s old, stubborn, and it occasionally makes a scene at family gatherings.

But we listen to it anyways.

It’s old, stubborn, and it occasionally makes a scene at family gatherings.

But we listen to it anyways.

The Dow is price weighted, meaning the index’s weights are based on companies’ share prices, not their market caps (like the S&P 500 is).

It was built this way because in 1896, the index’s daily values were literally calculated by hand.

Old school.

It was built this way because in 1896, the index’s daily values were literally calculated by hand.

Old school.

This price weighting quirk is important to keep in mind when watching the Dow.

Why? Because the stocks that control the index might not be what you’d think.

Here’s a list of the top 10 Dow stocks by weight.

Why? Because the stocks that control the index might not be what you’d think.

Here’s a list of the top 10 Dow stocks by weight.

Wild, right?

UnitedHealth and Goldman Sachs are the biggest weights in the Dow because their share prices are >$300.

Apple may be the biggest weight in the S&P 500, but it’s the 8th *smallest* weighting in the Dow.

🤯

UnitedHealth and Goldman Sachs are the biggest weights in the Dow because their share prices are >$300.

Apple may be the biggest weight in the S&P 500, but it’s the 8th *smallest* weighting in the Dow.

🤯

Another weird quirk of the Dow: it’s sort of outdated.

Tech may be 21% of the index, but many of the mega-cap tech stocks aren’t in the index.

Only one of the FAANG stocks is represented, for example (Apple).

Tech may be 21% of the index, but many of the mega-cap tech stocks aren’t in the index.

Only one of the FAANG stocks is represented, for example (Apple).

This has been a big disadvantage for the Dow recently.

The S&P 500 has posted better returns than the Dow in six out of the last 10 years.

Last year, the S&P 500 outperformed the Dow by 9 percentage points, the widest margin since 1998.

The S&P 500 has posted better returns than the Dow in six out of the last 10 years.

Last year, the S&P 500 outperformed the Dow by 9 percentage points, the widest margin since 1998.

So now that we've had a ~crash course~ on the Dow, let's talk about why the Dow is crushing it.

Because the Dow is leading the S&P 500 and tech-heavy Nasdaq year-to-date.

Because the Dow is leading the S&P 500 and tech-heavy Nasdaq year-to-date.

IMO, there are four big reasons.

1/ THE REOPENING TRADE

Many of the Dow’s top performers this year have been financials and industrials — two “reopening” sectors that could continue to thrive as the pandemic ends and the economy picks up.

Think banks, insurance cos, planes, trains and automobiles ✈️ 🚂 🚗

Many of the Dow’s top performers this year have been financials and industrials — two “reopening” sectors that could continue to thrive as the pandemic ends and the economy picks up.

Think banks, insurance cos, planes, trains and automobiles ✈️ 🚂 🚗

2/ LESS ECONOMIC WORRY, MORE PROFIT TAKING

Stocks in the Dow tend to be more sensitive to the economy’s ups and downs.

The fact that the Dow barely flinched in the market drop shows the selloff might’ve been more about profit taking in hot stocks than worry about the economy.

Stocks in the Dow tend to be more sensitive to the economy’s ups and downs.

The fact that the Dow barely flinched in the market drop shows the selloff might’ve been more about profit taking in hot stocks than worry about the economy.

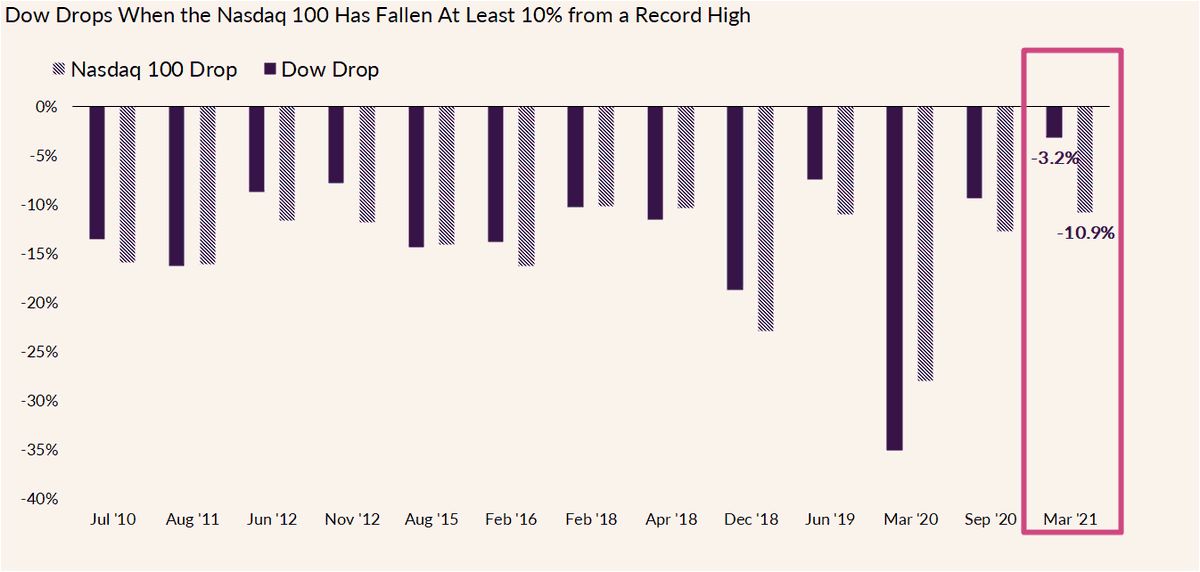

I mean, look how little the Dow fell vs the Nasdaq!

Here's a chart of every 10% Nasdaq drop over the past decade or so.

This time around, the Dow fell ~3% (while the Nasdaq slid ~11%).

Here's a chart of every 10% Nasdaq drop over the past decade or so.

This time around, the Dow fell ~3% (while the Nasdaq slid ~11%).

3/ THE DOGS OF THE DOW ARE HAVING A DAY

Many big, global companies were left out of the market rebound last year. Now, unloved stocks are leading the market higher.

Stocks like Intel and Boeing are up more than 10% this year, still haven’t reached their pre-COVID prices.

🐶

Many big, global companies were left out of the market rebound last year. Now, unloved stocks are leading the market higher.

Stocks like Intel and Boeing are up more than 10% this year, still haven’t reached their pre-COVID prices.

🐶

4/ PRICE WEIGHTING MAKES A DIFFERENCE.

Remember that list of top Dow weights? Here it is with YTD performances.

Look at Goldman Sachs, Caterpillar and Boeing.

The Dow’s quirky price weighting could be part of the story.

Remember that list of top Dow weights? Here it is with YTD performances.

Look at Goldman Sachs, Caterpillar and Boeing.

The Dow’s quirky price weighting could be part of the story.

So what’s the biggest nugget of investing wisdom our elder stocks are teaching us these days?

Markets can change over time.

Stocks are influenced by a bunch of factors: the economy, earnings, emotions, the global picture, demographics, valuations, etc. etc. etc.

Markets can change over time.

Stocks are influenced by a bunch of factors: the economy, earnings, emotions, the global picture, demographics, valuations, etc. etc. etc.

If you don’t want to play the guessing game, it may make sense to ~diversify~ your stock portfolio, i.e. spread your money out across different sectors.

Also, you can’t reach an old dog new tricks, but you may be able to teach an old Dow new tricks.

Okay I’m done now.

If you want to learn more, read this piece from @justLBell and me on the Dow 👇

ally.com/do-it-right/tr…

If you want to learn more, read this piece from @justLBell and me on the Dow 👇

ally.com/do-it-right/tr…

• • •

Missing some Tweet in this thread? You can try to

force a refresh