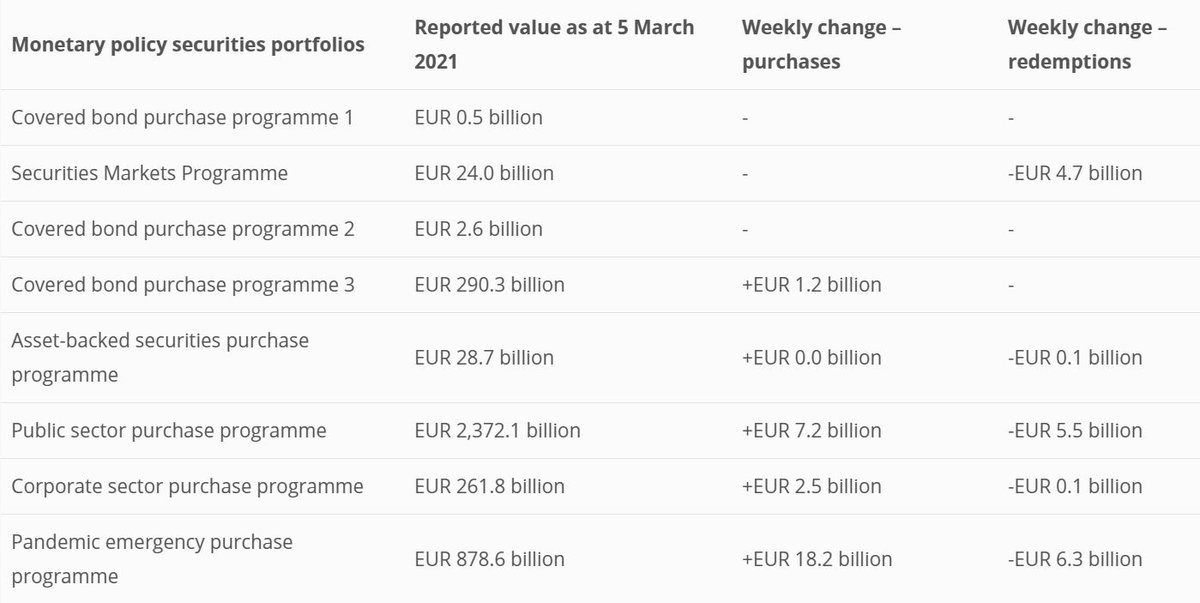

For those of you looking at weekly #PEPP purchase numbers, let me give you a brief explainer how to read our numbers. For PEPP, there are three types of publications: weekly, monthly and bimonthly. #NerdyThread #ECBWatchers #Servicetweet @ecb 1/11 ecb.europa.eu/mopo/implement…

On Mondays at 15:45 CET, we publish the Eurosystem’s PEPP holdings (at amortised cost), as of the previous Friday, on our website: 2/11

By taking the difference to the previous week, one obtains the *net* purchases for the previous trading week. This is the difference between gross purchases *settled* in that week (i.e. traded two trading days earlier, so from THU to WED) and redemptions (from MON to FRI). 3/11

It may be misleading to infer from the weekly data how large monthly net purchases are likely to be. One reason is the varying number of trading days across months, which implies that identical monthly volumes may go along with different weekly volumes. 4/11

A second reason is the volume of redemptions. Maturing holdings are normally reinvested in the same month but not necessarily in the same week, especially if they are large. High redemptions early in the month tend to go along with higher *net* purchases towards the end. 5/11

On Tuesdays at 15:00 CET, we publish the Eurosystem’s consolidated financial statement. In the commentary we report *gross* purchases & redemptions of the previous trading week for each programme. The difference corresponds to the net purchases above: 6/11 ecb.europa.eu/press/pr/wfs/h…

At the beginning of each month, typically on the first Monday, we publish monthly net purchases for the previous month as well as the cumulative net purchases since the beginning of the programme: 7/11

Every two months, we publish the detailed breakdown of our asset purchases across asset classes for the previous two months (including quarter-end amortisation adjustments and redemptions of coupon strips as reported below): 8/11

… and across member states and supranationals, including weighted average maturities in comparison with those of the eligible universe for public sector securities: 9/11

… and across primary and secondary market purchases for the private sector purchase programmes: 10/11

Conclusion: Do not read too much into weekly purchase data under the PEPP. An extrapolation from weekly data to overall monthly data may lead to misleading conclusions about our monthly purchase behaviour. 11/11

• • •

Missing some Tweet in this thread? You can try to

force a refresh