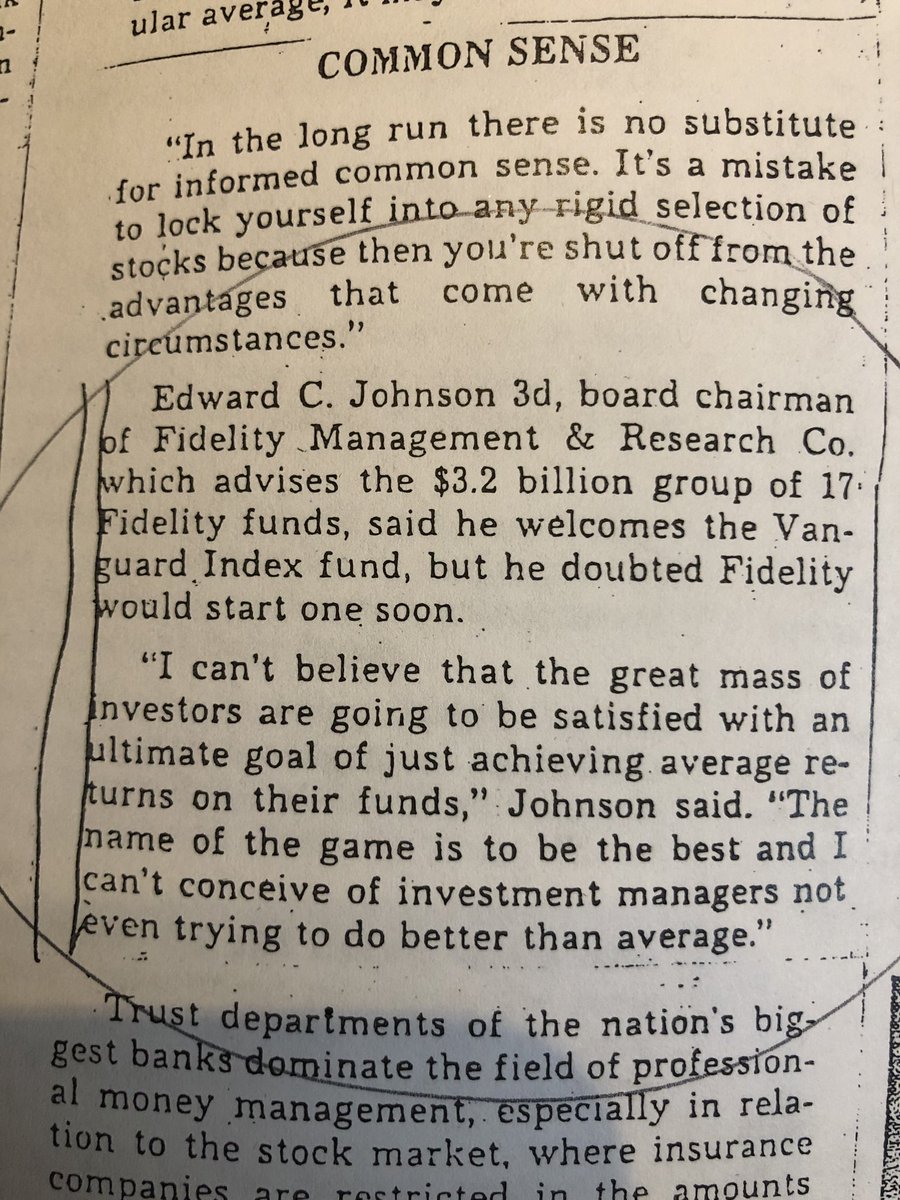

“Indexing doesn’t constitute any real threat to professional managers because its goal is mediocre performance.” Cleaning up some of my book research notes, and there are some 👀 quotes there.

(From the Boston Globe, august 24, 1976)

If you like this, then pretty-please pre-order my book! amazon.com/dp/0593087682

• • •

Missing some Tweet in this thread? You can try to

force a refresh