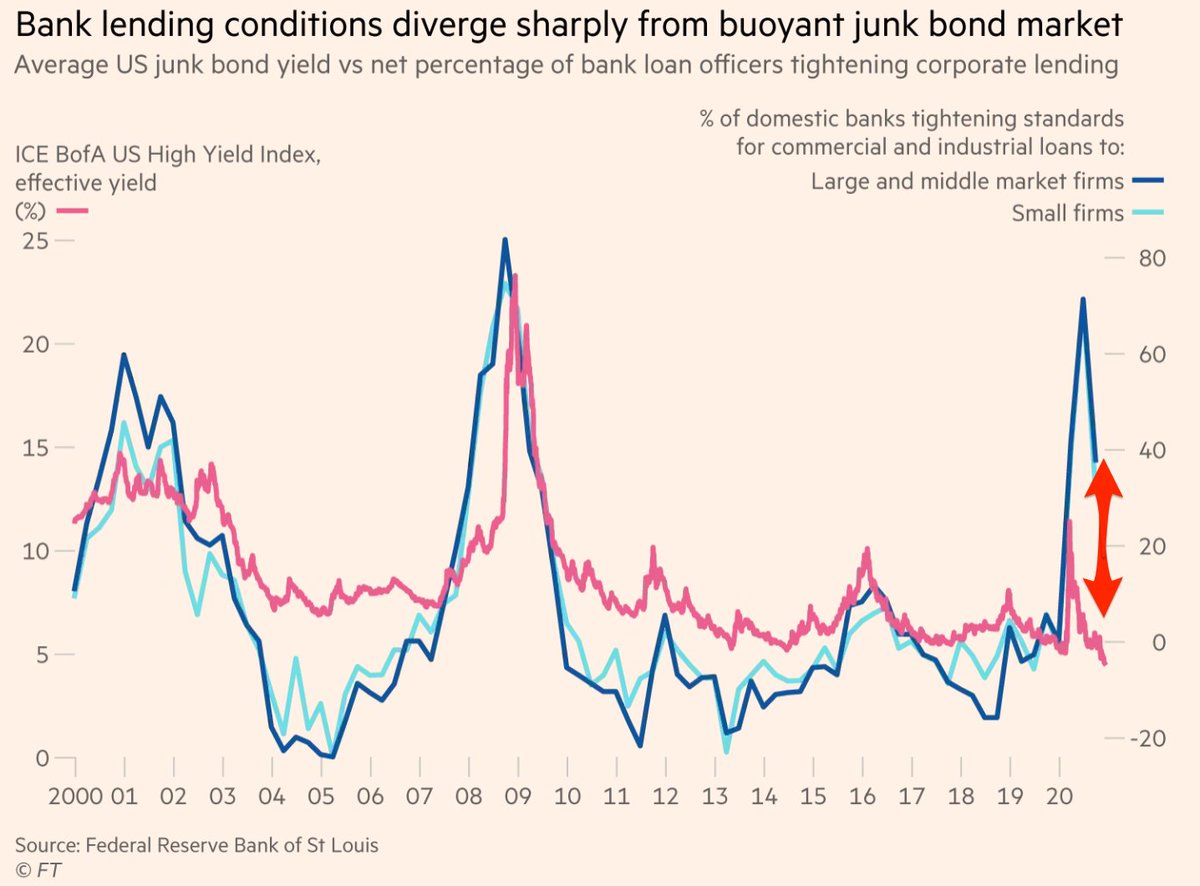

“We’ve created a caste system for credit. It’s significant, because its basis is entirely a function of size, not quality.” Our big read on how is better to be a bad but big company than a good but small one - and what it might mean for the US recovery. ft.com/content/1ae439…

I think the increasingly bifurcated corporate access to credit is a big, underappreciated issue in the US. It is the big downside to the size and vibrancy of the American bond market - if you're too small to tap it, then you're kinda screwed.

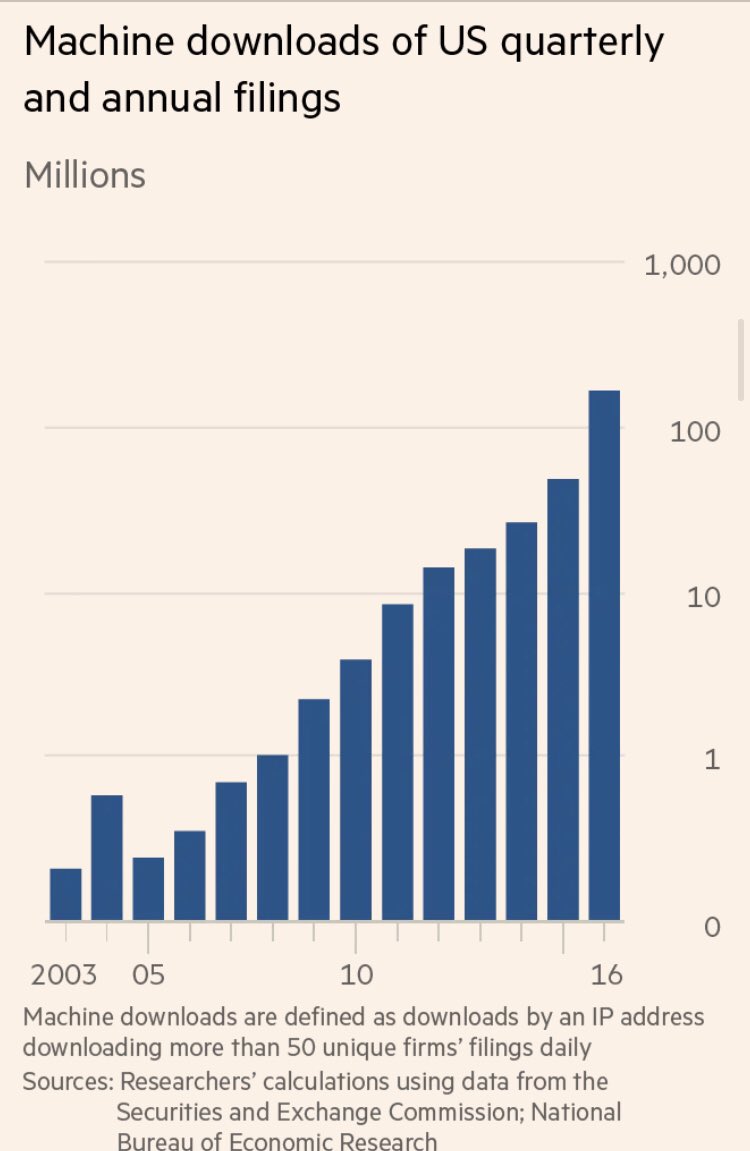

I think the mounting importance of capital markets funding, and the parallel decline of banks' small business lending - which the coronavirus exacerbated massively, but predates it - could help explain why we are seeing big companies just get bigger and bigger and bigger.

Look at how the size of average bond deals have been steadily increasing, on both sides of the Atlantic, but especially in the US.

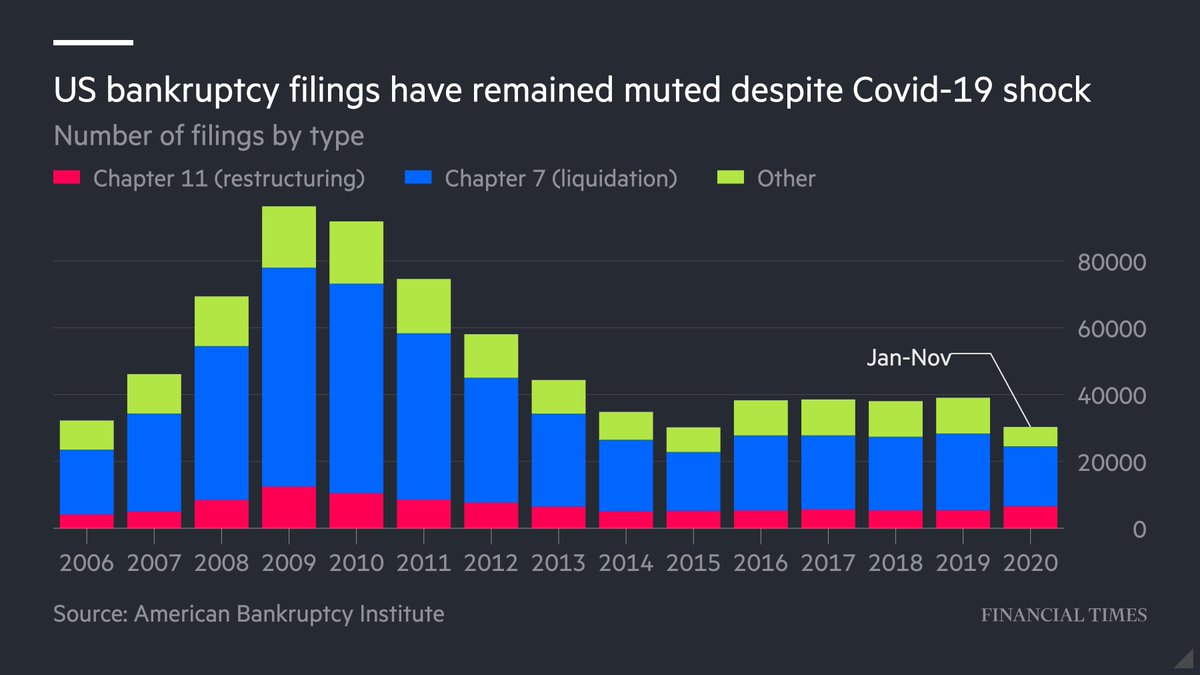

It's notable that corporate bankruptcies have been FAR more muted than feared earlier this year, thanks to stimulus and programmes like PPP. But I worry this pleasant surprise won't endure, as many smaller companies are just going to run out of money before economy recovers.

If one excludes PPP-arranged loans, US banks' corporate lending has actually shrunk this year, as @huwsteenis notes, despite protestations that they would support their customers.

@huwsteenis Private debt industry will undoubtedly help a lot of companies, but the problem is that it is largely set up to service the private equity ecosystem. So once again, companies that are PE-owned have an advantage. And smaller non-PE owned companies are particularly screwed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh