An Important Thread 🧵

What are pullbacks and it’s types ?

✅ Shallow Pullback

✅ Sharp Pullback

A detailed thread on pullback theory.

Retweet and Like to help others and Beginners!

What are pullbacks and it’s types ?

✅ Shallow Pullback

✅ Sharp Pullback

A detailed thread on pullback theory.

Retweet and Like to help others and Beginners!

Pullbacks are short term price drops during an uptrend.

There is a small hiccup in the market and that don’t change the underlying trend.

Pullback have dry up volume which can be noticed on the security.

Usually “Buy Low” traders exit after breakout with small profit.

There is a small hiccup in the market and that don’t change the underlying trend.

Pullback have dry up volume which can be noticed on the security.

Usually “Buy Low” traders exit after breakout with small profit.

There are 2 types of pullback.

1- Sharp Pullback

Sharp pullback occurs when there is a flesh/fast drop on the stock price.

Sharp pullback occurs within a short span of time

A sharp pullback has high volatility built into it.

1- Sharp Pullback

Sharp pullback occurs when there is a flesh/fast drop on the stock price.

Sharp pullback occurs within a short span of time

A sharp pullback has high volatility built into it.

2- Shallow pullback

Shallow pullbacks have high profit probability compared to the sharp pullback.

Shallow pullbacks can be assumed that some sophisticated or long term investors have invested into the security.

Shallow pullbacks have high profit probability compared to the sharp pullback.

Shallow pullbacks can be assumed that some sophisticated or long term investors have invested into the security.

Shallow pullback can be seen as first time buyers are in excitement thereby existing the stock by booking the profit.

The image below clearly shows that shallow pullback are more matured than the sharp one

Happy reading!

The image below clearly shows that shallow pullback are more matured than the sharp one

Happy reading!

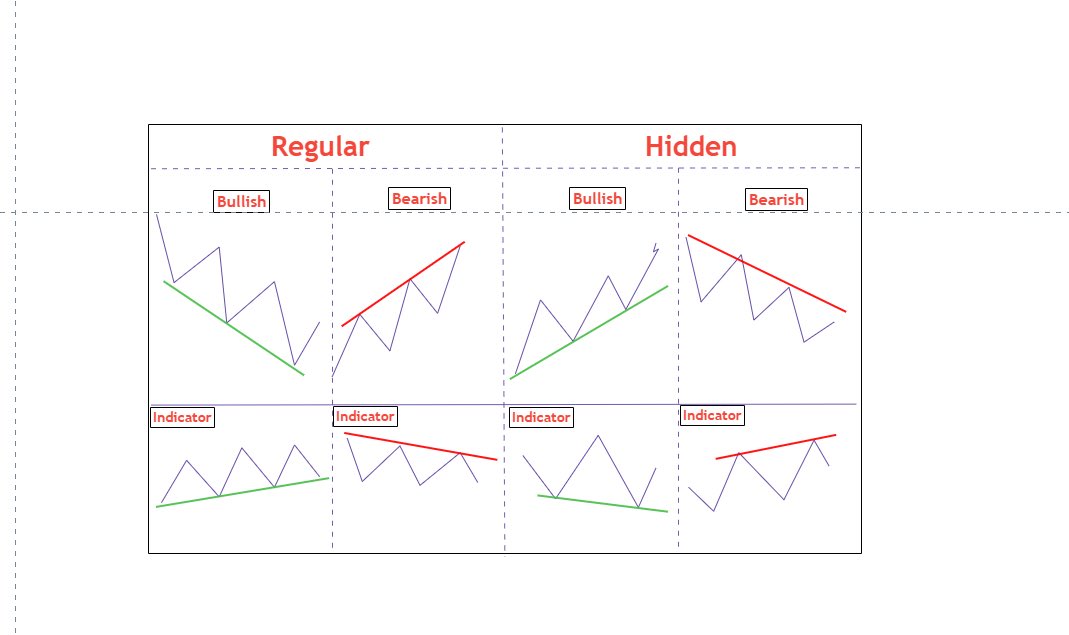

More graphical examples of pullback !

If your find the content worthwhile than do spread the word abt it ! 🙏

@caniravkaria @PAlearner @RajarshitaS @AmitabhJha3 @Rishikesh_ADX @Puretechnicals9 @rohanshah619 @PatilBankNifty @VijayThk @VRtrendfollower

If your find the content worthwhile than do spread the word abt it ! 🙏

@caniravkaria @PAlearner @RajarshitaS @AmitabhJha3 @Rishikesh_ADX @Puretechnicals9 @rohanshah619 @PatilBankNifty @VijayThk @VRtrendfollower

• • •

Missing some Tweet in this thread? You can try to

force a refresh