Financial historian Russell Napier has been forecasting deflation for decades, but recent events have caused him to change his mind.

He now predicts a sustained period of higher inflation.

This thread, drawing on his recent interview with @RonStoeferle & @JilNik, explains why👇

He now predicts a sustained period of higher inflation.

This thread, drawing on his recent interview with @RonStoeferle & @JilNik, explains why👇

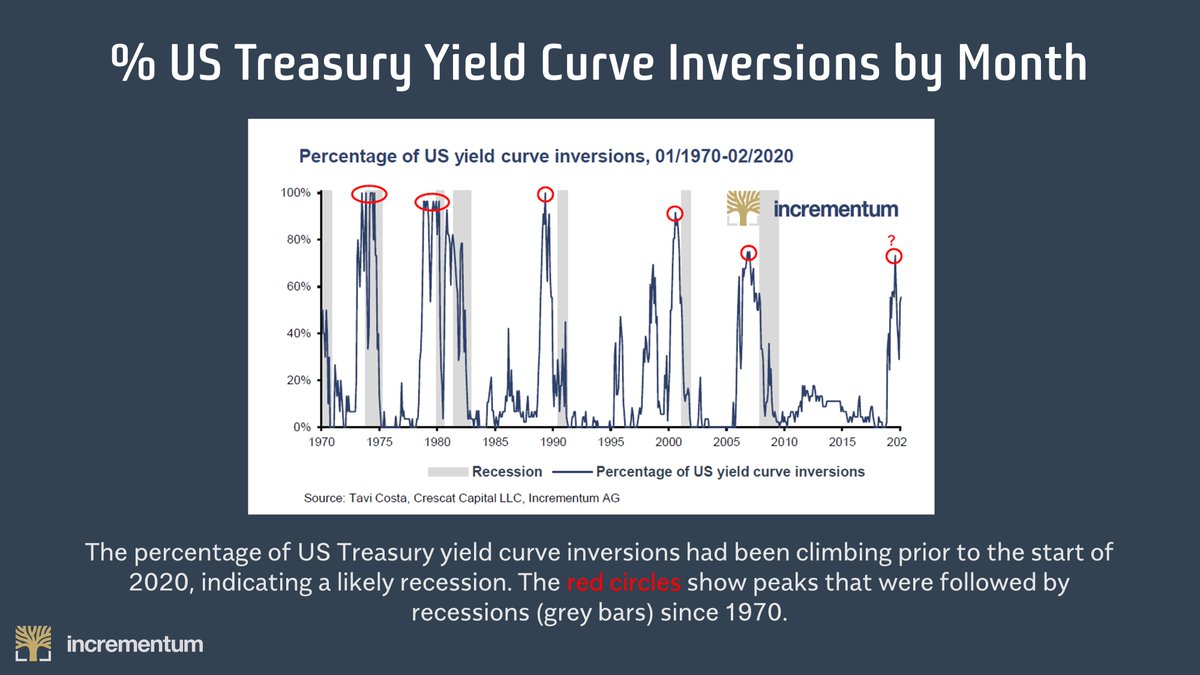

1/ Recent debate on inflation has focussed on the impact of short-term phenomena such as the US stimulus package and economic contraction due to COVID.

But Russell sees more important changes taking place beneath the surface.

These changes are not cyclical, but structural.

But Russell sees more important changes taking place beneath the surface.

These changes are not cyclical, but structural.

2/ The impact of demographics and technology are important in forecasting inflation, but the most significant factor is the allocation of money and credit.

Inflation is always and everywhere a monetary phenomenon, and we are seeing fundamental monetary changes take place.

Inflation is always and everywhere a monetary phenomenon, and we are seeing fundamental monetary changes take place.

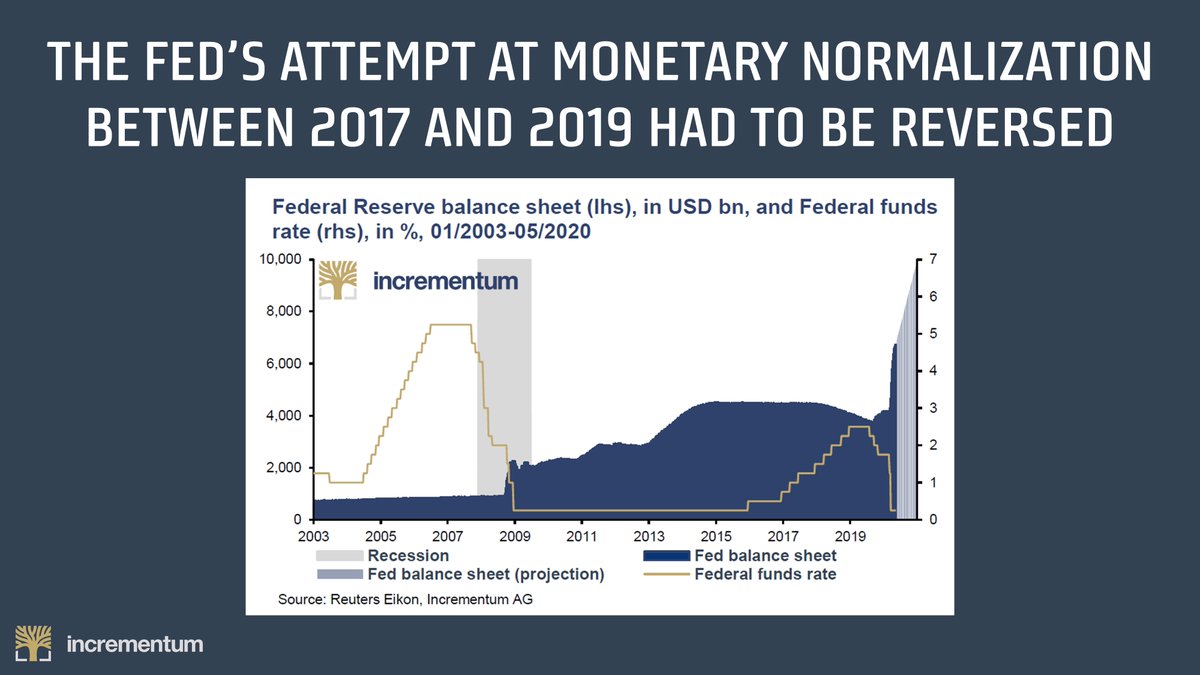

3/ What has changed is that, since the COVID outbreak, governments have started to provide credit guarantees to the banking system.

Over the past decade, despite repeated rounds of QE, increases in base money had not translated into rapid broad money supply growth... until now.

Over the past decade, despite repeated rounds of QE, increases in base money had not translated into rapid broad money supply growth... until now.

4/ This is because, while central banks can create bank reserves, it is ultimately commercial banks that expand the broad money supply: the digital money we exchange when we buy things with our bank cards.

It is this broad money growth that ultimately pushes up CPI inflation.

It is this broad money growth that ultimately pushes up CPI inflation.

5/ Since the Global Financial Crisis, despite high levels of QE, commercial banks have been unwilling to lend due to perceptions of risk.

But since the unprecedented interventions of the past year have kicked in, broad money supply growth has soared.

But since the unprecedented interventions of the past year have kicked in, broad money supply growth has soared.

6/ Russell thinks credit guarantees are here to stay.

The world, especially the developed world, has huge levels of debt (>300% GDP).

Historically, when debts have been this high, the answer has always been to inflate them away, as Britain did after WWII.

The world, especially the developed world, has huge levels of debt (>300% GDP).

Historically, when debts have been this high, the answer has always been to inflate them away, as Britain did after WWII.

7/ At the same time, we have seen indications from major western central banks, such as the ECB, that yields on government bonds will be capped below inflation. (See speech below by Fabio Panetta.)

This capping means that bond holders will be forced to take real losses.

This capping means that bond holders will be forced to take real losses.

8/ The need for governments to manage their huge debts, and their willingness to limit bond yields to help with this, is a recipe for sustained inflation.

This inflation will also be exacerbated by geopolitical trends such as the potential for a new US-China "cold war".

This inflation will also be exacerbated by geopolitical trends such as the potential for a new US-China "cold war".

9/ If trade relations worsen and protectionist policies prevail, this will serve to further exacerbate inflation.

Indeed, the supply of cheap goods that China has provided to the world since its 1980s liberalization, has been one of the key factors keeping global inflation low.

Indeed, the supply of cheap goods that China has provided to the world since its 1980s liberalization, has been one of the key factors keeping global inflation low.

10/ As we move into a period of inflation, Russell predicts that financial repression and central planning by governments will increase.

Measures will include the introduction of Central Bank Digital Currencies, which will grant authorities "absolute control" (see👇) over money.

Measures will include the introduction of Central Bank Digital Currencies, which will grant authorities "absolute control" (see👇) over money.

11/ Russell paints a bleak picture, but views gold as one of the better ways to hedge against inflation by storing one’s wealth outside of the financial system.

Do you agree with Russell's analysis? Let us know in the comments below.👇

Do you agree with Russell's analysis? Let us know in the comments below.👇

Thank you for reading.

If you enjoyed this thread make sure to check out the full interview with Russell via this link 👇

If you enjoyed this thread make sure to check out the full interview with Russell via this link 👇

This thread was produced by Peter Young (@TheAustrian3) as a partnership with investment firm Incrementum.

Peter specializes in creating threads related to the Austrian School of Economics.

You can view more of his material via his Medium page here👇 theaustrian3.medium.com

Peter specializes in creating threads related to the Austrian School of Economics.

You can view more of his material via his Medium page here👇 theaustrian3.medium.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh