The Covid-19 pandemic will have profound implications for the global financial system.

Drawing on insights from our 2020 #IGWT report, this 20 tweet thread (created by @TheAustrian3) looks back at our past predictions and offers thoughts on what to expect for the decade ahead.👇

Drawing on insights from our 2020 #IGWT report, this 20 tweet thread (created by @TheAustrian3) looks back at our past predictions and offers thoughts on what to expect for the decade ahead.👇

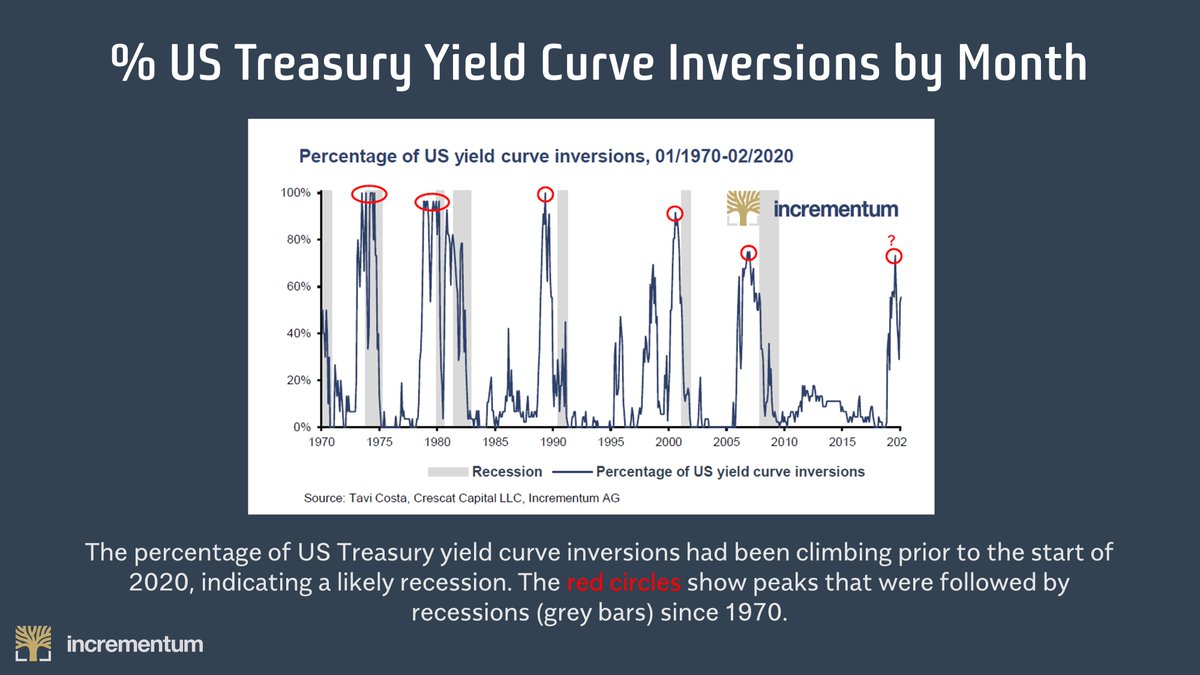

1/ At the start of the Covid-19 outbreak, remarkable things were already happening in the global economy.

The US Treasury yield curve had inverted.

A $12tn market for negative yielding government bonds had emerged, meaning governments were being paid to borrow.

The US Treasury yield curve had inverted.

A $12tn market for negative yielding government bonds had emerged, meaning governments were being paid to borrow.

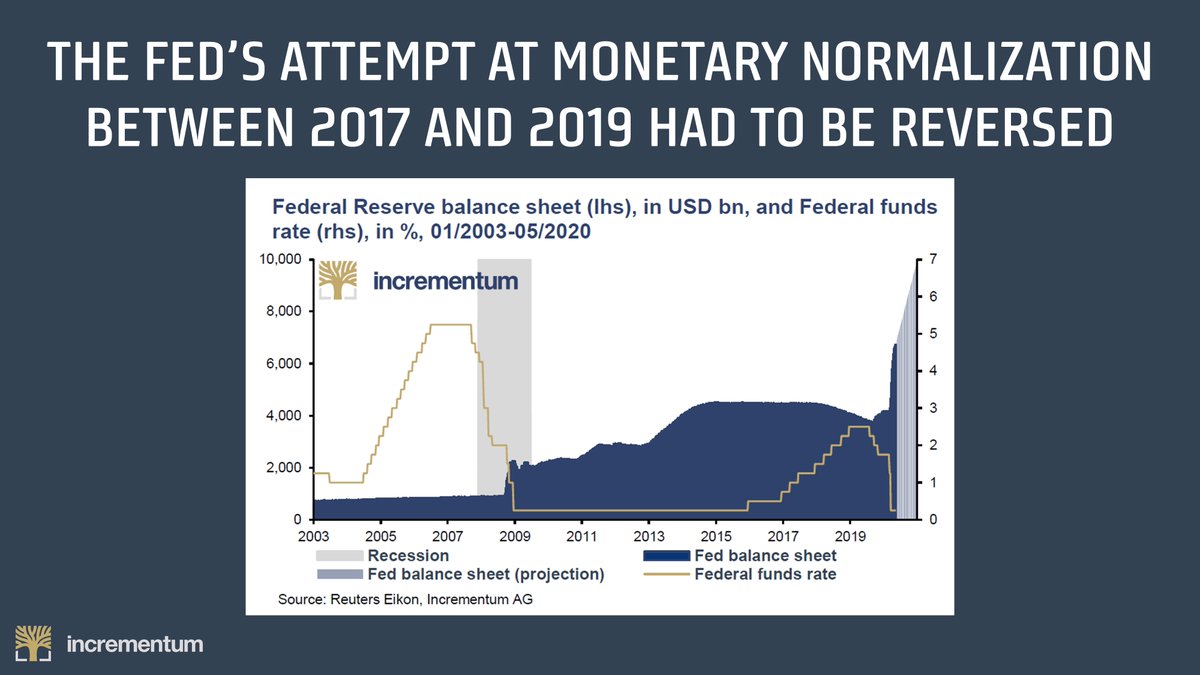

2/ The attempt at monetary normalization by the Federal Reserve between 2017 and 2019 had to be reversed, as we predicted it would in our 2017 #IGWT report.

The Fed cut interest rates three times in the second half of 2019 and resumed quantitative easing.

The Fed cut interest rates three times in the second half of 2019 and resumed quantitative easing.

3/ Covid-19 accelerated a recession that had been long overdue, and we had forecast for 2020 in our 2019 report.

Global GDP fell by 4.4% during the year.

The response of central banks resulted in a surge in money supply growth, with USD M2 rising by a record rate of >25% yoy.

Global GDP fell by 4.4% during the year.

The response of central banks resulted in a surge in money supply growth, with USD M2 rising by a record rate of >25% yoy.

4/ These policies staved off widespread business collapse at the expense of pushing global debt to record levels.

Global public + private debt surpassed 365% of GDP, and government debt in advanced economies grew from 105% to 124% of GDP in a single year.

Global public + private debt surpassed 365% of GDP, and government debt in advanced economies grew from 105% to 124% of GDP in a single year.

5/ As we move into 2021, the consequences of lockdowns coupled with expansionary monetary and fiscal policy are playing out.

In the world of fiat currencies, we are witnessing a battle between the forces of inflation and deflation.

In the world of fiat currencies, we are witnessing a battle between the forces of inflation and deflation.

6/ Lockdowns resulted in consumer spending plunging by 8.6% globally in 2020 which put downward pressure on CPI.

At the same time uncertainty led to a rising demand for cash.

Expansionary policies were introduced by central banks that aimed to offset this deflationary pressure.

At the same time uncertainty led to a rising demand for cash.

Expansionary policies were introduced by central banks that aimed to offset this deflationary pressure.

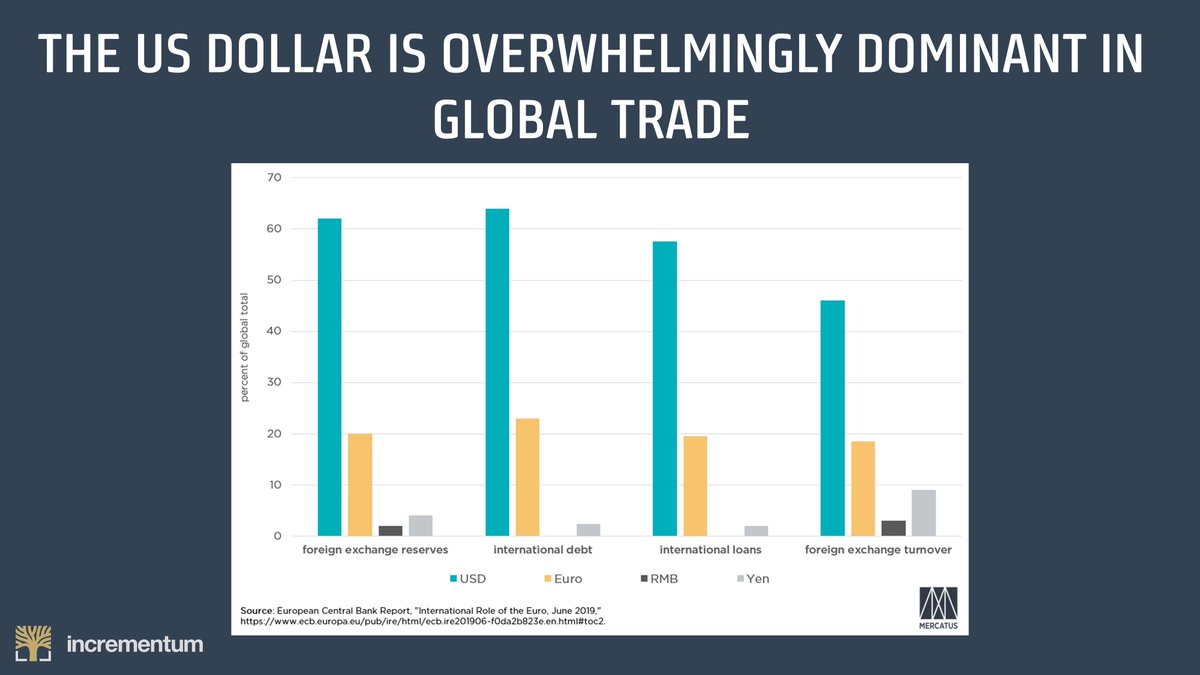

7/ The US dollar saw the greatest money supply growth of any major currency.

But whilst policies such as QE and fiscal stimulus are inflationary, they may not lead to high US CPI rises immediately.

This is in part due to the unique position the USD plays in global trade.

But whilst policies such as QE and fiscal stimulus are inflationary, they may not lead to high US CPI rises immediately.

This is in part due to the unique position the USD plays in global trade.

8/ Since WWII USD has served as the global reserve currency.

No other currency comes close to rivalling it as an international payment network. (@kenbrown12 explains👇)

Today >60% of global debt is denominated in USD.

And the need to pay this back creates USD demand.

No other currency comes close to rivalling it as an international payment network. (@kenbrown12 explains👇)

Today >60% of global debt is denominated in USD.

And the need to pay this back creates USD demand.

9/ Countries around the world are now trying to stimulate their economies by expanding their domestic money supplies.

But their overseas debt remains denominated in USD.

This demand imbalance is serving as a check on US inflation... for now.

@SantiagoAuFund explains:

But their overseas debt remains denominated in USD.

This demand imbalance is serving as a check on US inflation... for now.

@SantiagoAuFund explains:

10/ It remains to be seen how long it will take for US stimulus measures to overcome deflationary pressures and push up CPI.

@RonStoeferle sees higher inflation as increasingly likely.👇

Whatever happens in the short term, the value proposition of #gold remains strong.

@RonStoeferle sees higher inflation as increasingly likely.👇

Whatever happens in the short term, the value proposition of #gold remains strong.

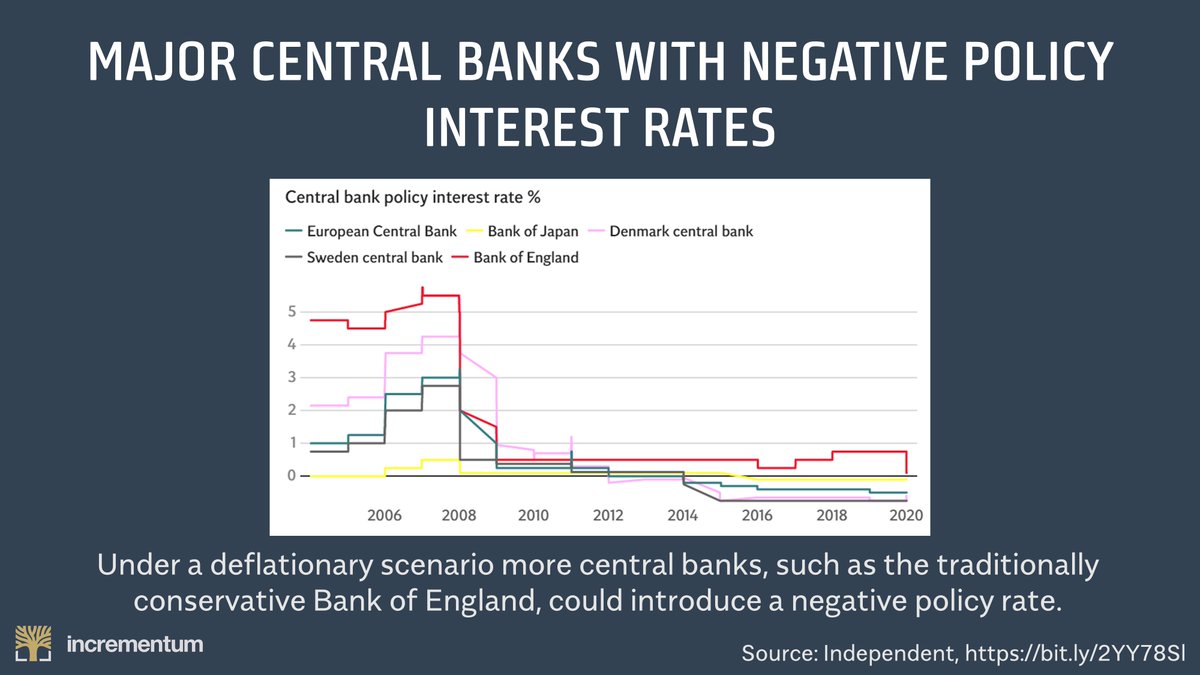

11/ Should we see further deflation, more central banks may respond by pushing interest rates into negative territory.

When cash savings are chipped away at, a hard, supply-restricted monetary asset such as #gold offers an attractive alternative as a savings vehicle.

When cash savings are chipped away at, a hard, supply-restricted monetary asset such as #gold offers an attractive alternative as a savings vehicle.

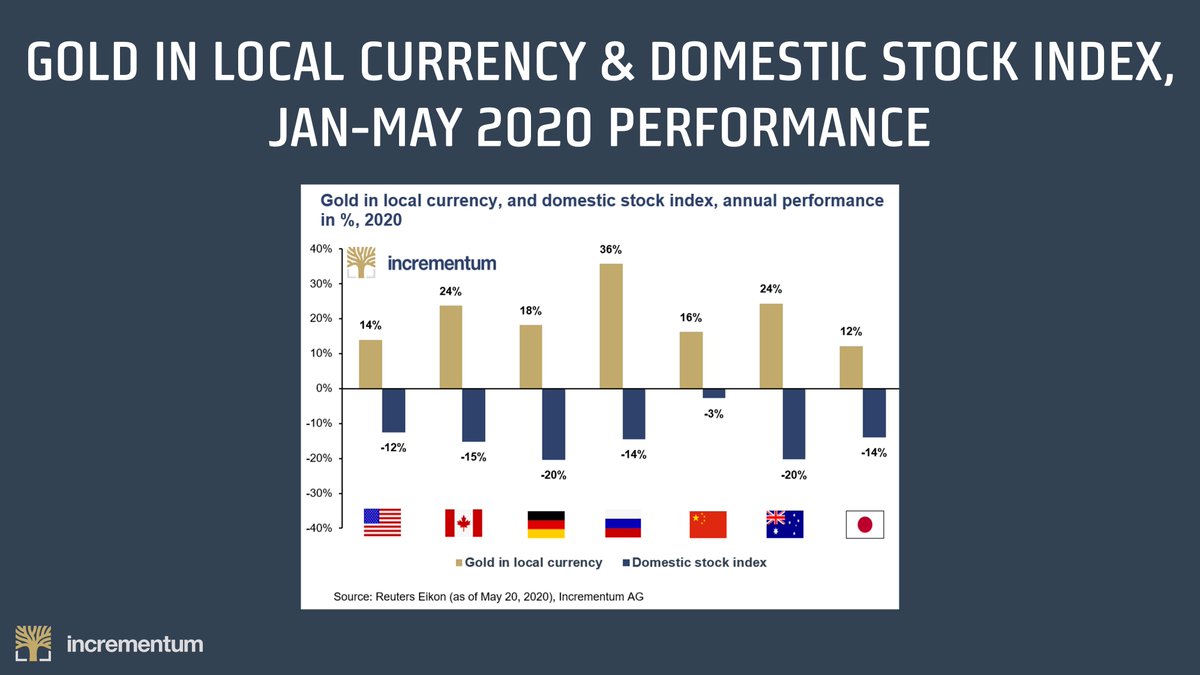

12/ During the second quarter of 2020 when many countries including the US experienced mild deflation or below target inflation, #gold functioned well as a portfolio hedge.

As the graph shows, those who owned gold were able to offset severe losses in the stock market.

As the graph shows, those who owned gold were able to offset severe losses in the stock market.

13/ Under inflation, #gold becomes a still more attractive means of protecting the real value of savings, since it cannot be inflated when currency supply is expanding.

In either scenario, we see a rising demand for gold, which will also have a knock-on effect on mining stocks.

In either scenario, we see a rising demand for gold, which will also have a knock-on effect on mining stocks.

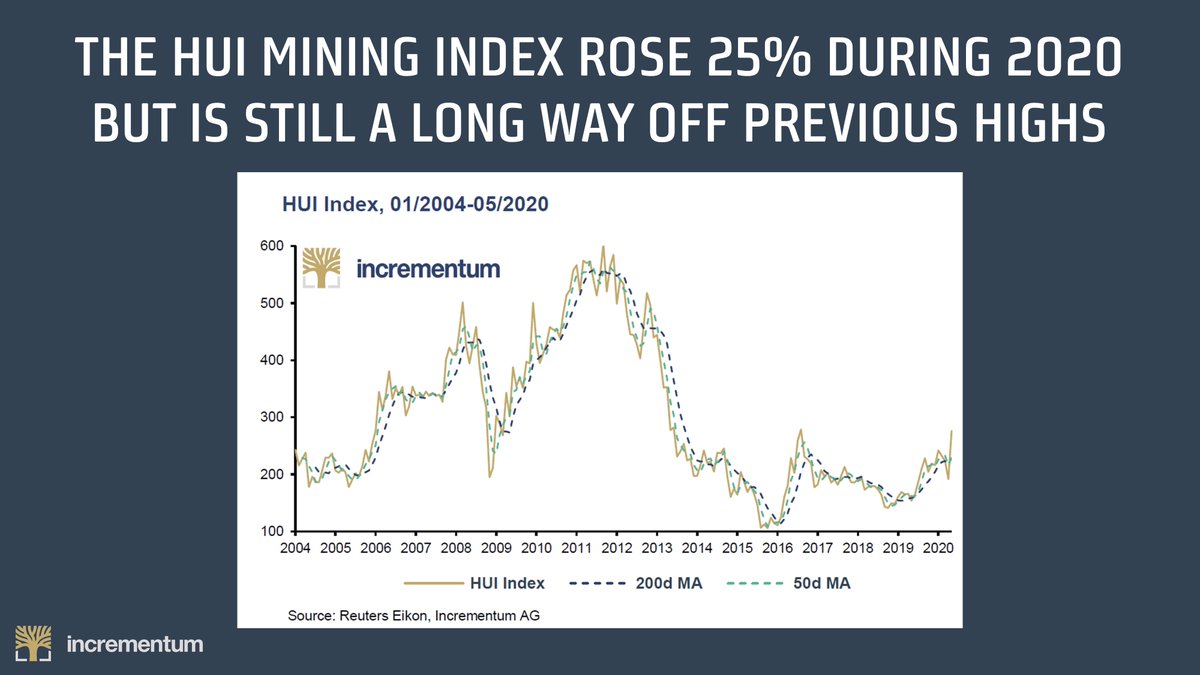

14/ During the recent bear market, mining companies underwent significant reforms.

They reduced debt, became leaner and increased cash flow.

At the same time energy prices (a key input) have fallen.

The strong HUI rises of 2020 are therefore likely to continue.

They reduced debt, became leaner and increased cash flow.

At the same time energy prices (a key input) have fallen.

The strong HUI rises of 2020 are therefore likely to continue.

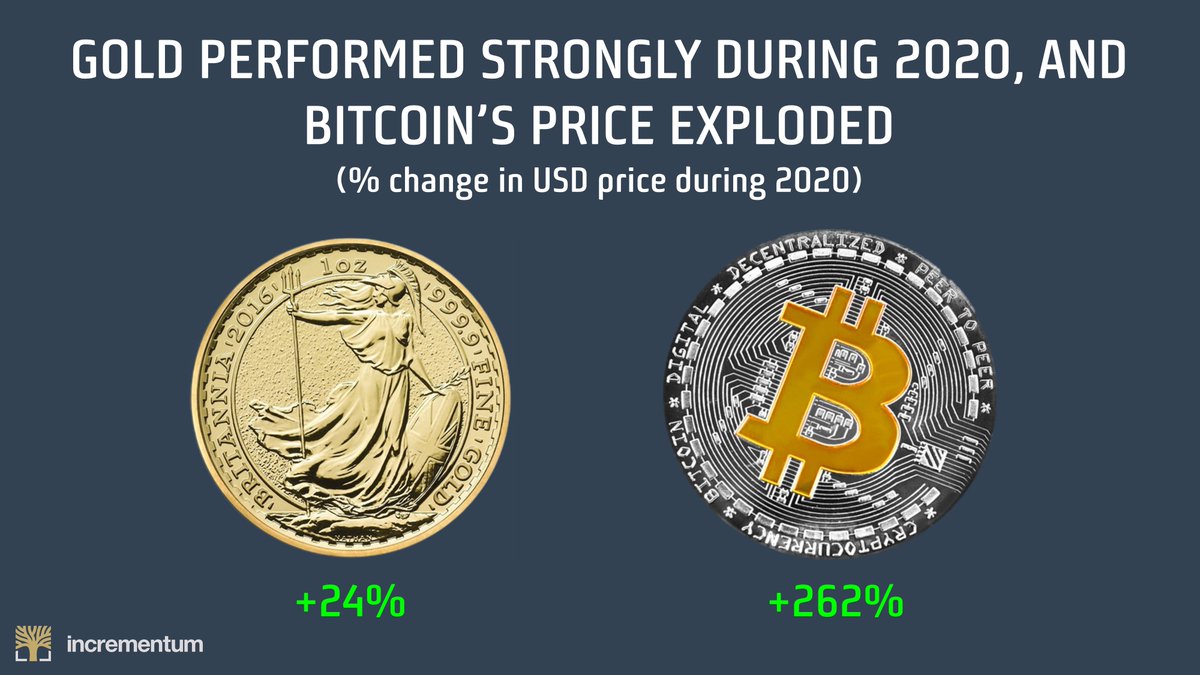

15/ The macroeconomic environment of 2020 proved favourable to #gold, which rose by 24% over the year in USD terms, and saw all-time highs in all fiat currencies.

It was also an explosive year for #Bitcoin, which more than doubled its 2017 USD all-time high.

It was also an explosive year for #Bitcoin, which more than doubled its 2017 USD all-time high.

16/ In the decade ahead, we see great potential for #Bitcoin to grow in use as a store of value alongside #gold.

Incrementum manages a mixed bitcoin-gold portfolio that seeks to offset BTC's volatility, whilst taking advantage of its potential upside.

@MarkValek explains👇

Incrementum manages a mixed bitcoin-gold portfolio that seeks to offset BTC's volatility, whilst taking advantage of its potential upside.

@MarkValek explains👇

17/ In the coming years we anticipate turmoil in the global economy as the fiat monetary system is stretched to its limits.

Our firm Incrementum acknowledges that the world faces a range of risks, and takes a holistic approach to portfolio allocation in order to manage them.

Our firm Incrementum acknowledges that the world faces a range of risks, and takes a holistic approach to portfolio allocation in order to manage them.

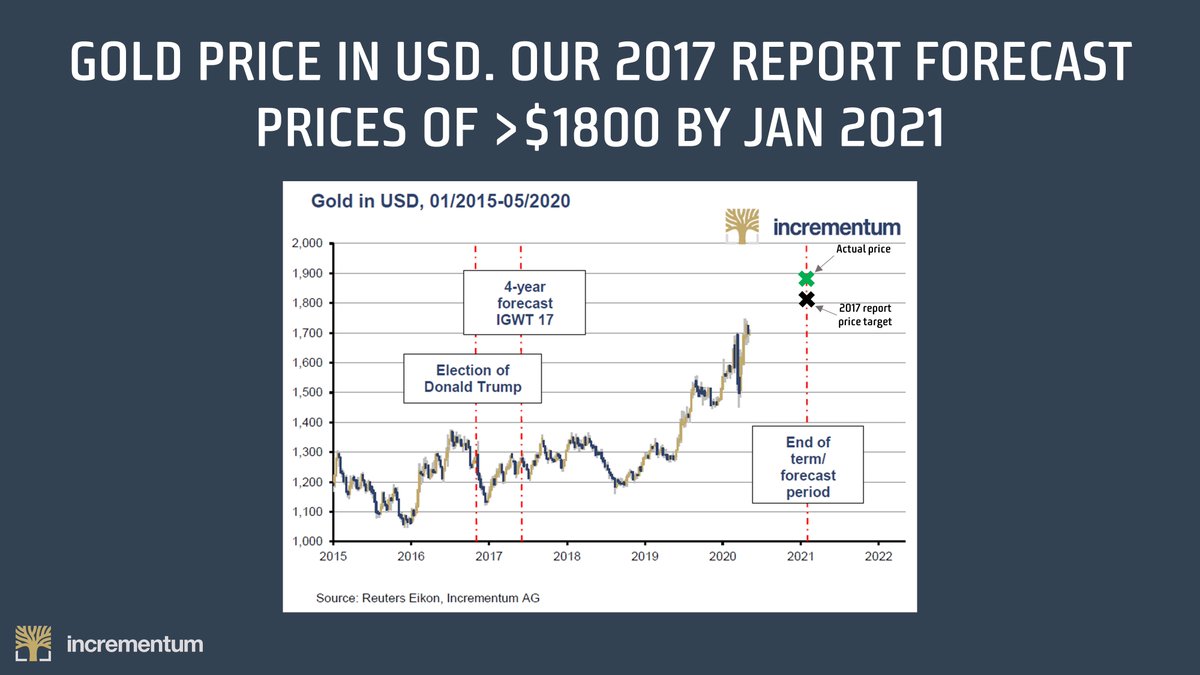

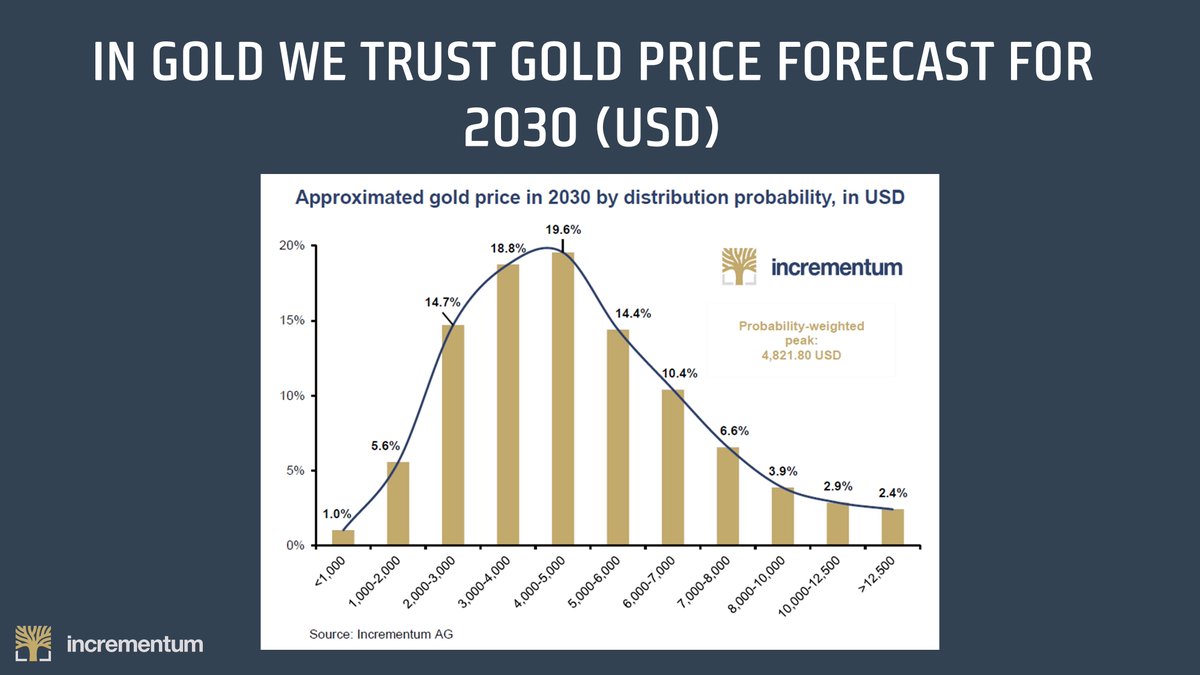

18/ In the past #IGWT has undertaken macroeconomic analysis and drawn on industry insights to make #gold price forecasts.

Our 2017 report (published when gold was trading around $1200/oz) forecast a Jan 2021 price >$1800/oz, and was recently proved accurate.

Our 2017 report (published when gold was trading around $1200/oz) forecast a Jan 2021 price >$1800/oz, and was recently proved accurate.

19/ It is likely that gold will once again come to play an important role in the new monetary order as a stateless reserve currency.

Under conservative assumptions, we foresee a gold price of >$4800/oz by 2030.

We are confident 2020-2030 will be remembered as a "golden decade".

Under conservative assumptions, we foresee a gold price of >$4800/oz by 2030.

We are confident 2020-2030 will be remembered as a "golden decade".

20/ In the turbulent years ahead our #IGWT report will continue to provide world-leading analysis to help readers navigate an uncertain world.

Our new 2021 edition will be published on May 27, and will tell the next chapter of this story.

You can follow @IGWTreport for updates.

Our new 2021 edition will be published on May 27, and will tell the next chapter of this story.

You can follow @IGWTreport for updates.

Thank you for reading.

If you enjoyed this thread please retweet to help its message reach a wider audience.

#IGWT is authored by @RonStoeferle and @MarkValek.

You can sign up to receive the 2021 #IGWT report and a preview chartbook for free here: bit.ly/3rR8H15

If you enjoyed this thread please retweet to help its message reach a wider audience.

#IGWT is authored by @RonStoeferle and @MarkValek.

You can sign up to receive the 2021 #IGWT report and a preview chartbook for free here: bit.ly/3rR8H15

This thread was created by Peter Young (@TheAustrian3)

You can follow his account for more content like this.

More of Peter’s work is available at his Medium page here: theaustrian3.medium.com

You can follow his account for more content like this.

More of Peter’s work is available at his Medium page here: theaustrian3.medium.com

RESOURCES

Listed below by tweet number:

8: WSJ video on US dollar:

9: @SantiagoAuFund’s Dollar Milkshake Theory

10: @RonStoeferle on inflation in 2021:

16: @MarkValek on the gold-bitcoin portfolio:

Listed below by tweet number:

8: WSJ video on US dollar:

9: @SantiagoAuFund’s Dollar Milkshake Theory

10: @RonStoeferle on inflation in 2021:

16: @MarkValek on the gold-bitcoin portfolio:

If you liked this thread you may also enjoy Austrian School for Investors, which provides an overview of the theoretical foundations for investing strategies based on the Austrian School of Economics. 👇

https://twitter.com/TheAustrian3/status/1355446033250209794?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh