So interesting to have Mark Zuckerberg, Daniel Ek and Tobi Lutke on Clubhouse at the same time.

Would've been hard--impossible?--to do in a regular panel.

Would've been hard--impossible?--to do in a regular panel.

Zuck on FB:

- 1m active shops

- more than 250m people interacting with them per month

- Next few years will be explosive

- 1m active shops

- more than 250m people interacting with them per month

- Next few years will be explosive

Daniel Ek:

Not only does Apple get 30%, which is more than Spotify gets, but they also control our communication with our users even outside the app

Not only does Apple get 30%, which is more than Spotify gets, but they also control our communication with our users even outside the app

Zuck:

We created a subscription service for publishers, and said we would take no revenue share, and it took a lot of back-and-forth with Apple to convince them not to take the 30% fee.

"30% tax before Apple backed down was particularly tough"

We created a subscription service for publishers, and said we would take no revenue share, and it took a lot of back-and-forth with Apple to convince them not to take the 30% fee.

"30% tax before Apple backed down was particularly tough"

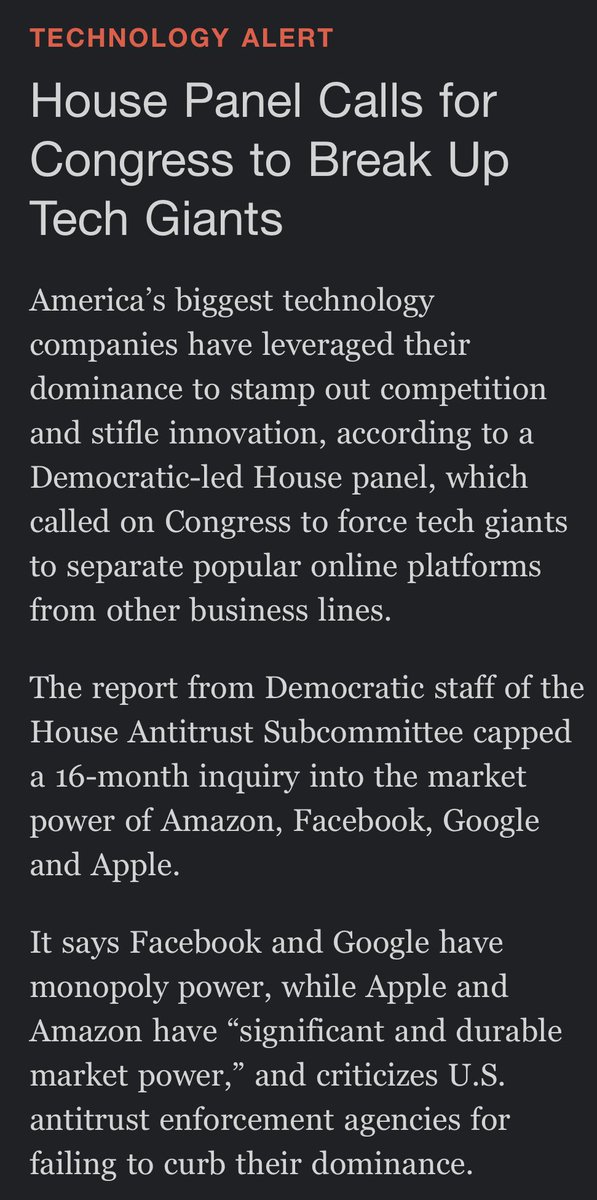

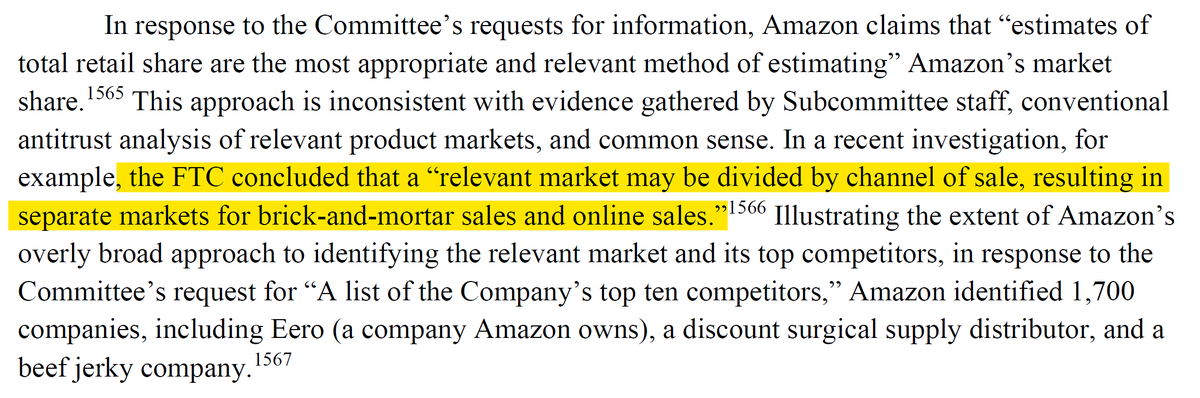

Basically, Apple is *BY DEFINITION* blocking innovation and commerce.

A restraint of commerce, by making it harder for folks to make business decisions lest they ignore the 30% Apple tax.

It's usurious and bad for everyone (but Apple).

A restraint of commerce, by making it harder for folks to make business decisions lest they ignore the 30% Apple tax.

It's usurious and bad for everyone (but Apple).

Zuck:

If you ask people if they want personalized ads, they say YES. We know because that's what we built after GDPR.

But if you ask people "Would you like to be tracked everywhere" they're going to say no.

If you ask people if they want personalized ads, they say YES. We know because that's what we built after GDPR.

But if you ask people "Would you like to be tracked everywhere" they're going to say no.

Pebble's founder now talking about the huge problems he had working with Apple, how Apple's private APIs give it an advantage.

Zuck: iOS 14 changes not the biggest concern I have with Apple--it's the private APIs. Both on hardware and software side.

Zuck: iOS 14 changes not the biggest concern I have with Apple--it's the private APIs. Both on hardware and software side.

Zuck: Can't make Messenger default SMS client on iOS. Their apps start with notifications turned on.

The differential between iOS and Android is massive.

On hardware side, integrating devices with iOS is really difficult and I think they do that on purpose. 🔥🔥🔥

The differential between iOS and Android is massive.

On hardware side, integrating devices with iOS is really difficult and I think they do that on purpose. 🔥🔥🔥

Zuck: They can sell AirPods at a massive profit because it's easy to pair, in 1/2 a second and everything else in 8 seconds.

If you're trying to build a watch, which we're exploring (neural interface), if you want that to integrate with the phone, it's much easer on Android.

If you're trying to build a watch, which we're exploring (neural interface), if you want that to integrate with the phone, it's much easer on Android.

Zuck: The private APIs make it hard to have a healthy ecosystem.

Daniel Ek: I personally want to see an internet where every single piece of the stack is competitive.

Simple solution for antitrust enforcers: force Apple to use the same APIs as everyone else.

Tobi: Shout out to the web browser, it's incredible that it exists.

If the web browser had to be invented today, it wouldn't get through any app store. 🔥🔥🔥

If the web browser had to be invented today, it wouldn't get through any app store. 🔥🔥🔥

@JoshConstine thanks for doing this

Here’s the full audio and transcript:

https://twitter.com/joshconstine/status/1372808819110146056

• • •

Missing some Tweet in this thread? You can try to

force a refresh