Very interesting charts from @MacroCharts & @MacroOps.

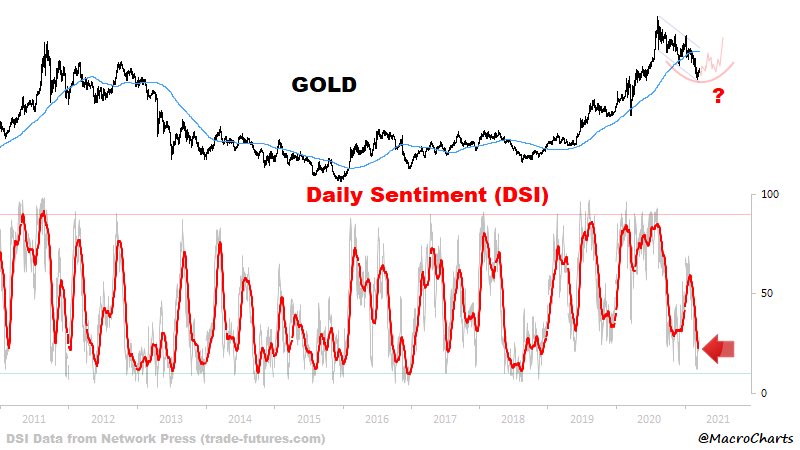

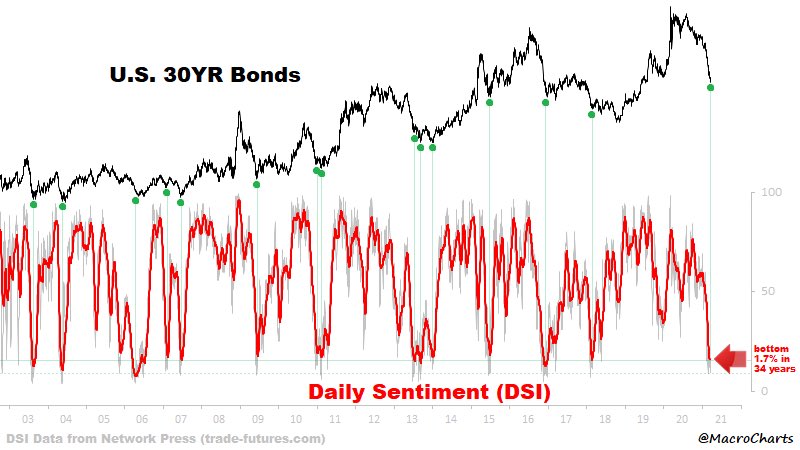

Investors sentiment has become very bearish on Treasuries & Gold, while the price of Copper is in a blow off top.

To us, this indicates the reflation trade has become consensus & risks are high it’s about to reverse.

Investors sentiment has become very bearish on Treasuries & Gold, while the price of Copper is in a blow off top.

To us, this indicates the reflation trade has become consensus & risks are high it’s about to reverse.

Yes, it’s ironic that Gold often correlates positively with Treasuries as a deflation trade,

and has inverse correlation to stocks & commodities like Copper & Oil (both of which look overextended now).

Copper vs Gold and Stocks vs Treasuries ratios are important to watch.

and has inverse correlation to stocks & commodities like Copper & Oil (both of which look overextended now).

Copper vs Gold and Stocks vs Treasuries ratios are important to watch.

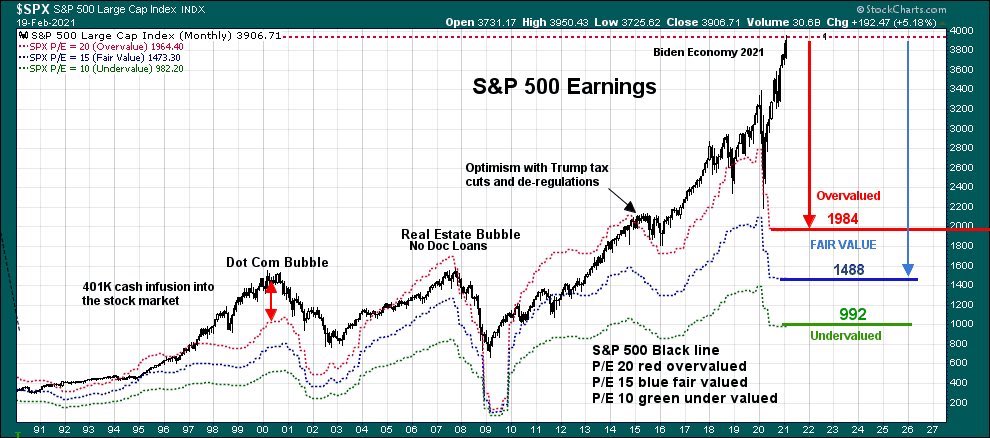

The chart above, and the one in this tweet (by @BittelJulien), show overwhelming bullish consensus on the stock markets.

Every man and his dog is expecting higher prices ahead — usually occurs near peaks just before corrections & crashes.

Every man and his dog is expecting higher prices ahead — usually occurs near peaks just before corrections & crashes.

Bloomberg recently posted a series of articles discussing imminent inflation risks.

When everybody is thinking the same thing, chances are no one is thinking.

Naturally, as a contrarian, we are now leaning more into market surprising with deflationary trend outcome.

Let’s see.

When everybody is thinking the same thing, chances are no one is thinking.

Naturally, as a contrarian, we are now leaning more into market surprising with deflationary trend outcome.

Let’s see.

• • •

Missing some Tweet in this thread? You can try to

force a refresh