Short🧵

A few months back, many in Indian stock heard a term maybe for the first time: BAAP (Buy-at-any-price). But, then like many things in life, it had it's own history, though from the infamous NIFTY-FIFTY. Read👇

A few months back, many in Indian stock heard a term maybe for the first time: BAAP (Buy-at-any-price). But, then like many things in life, it had it's own history, though from the infamous NIFTY-FIFTY. Read👇

After the 1969-70 bear market in US, the conventional wisdom was formed that no one was smart enough to time the market. Hence, the "Great" companies were to be owned forever. Thus was born: NIFTY FIFTY

These were often called one-decision stocks: Buy Now and Never Sell. Because their prospects were so bright, many analysts claimed that the only direction they could go was up. So, for an investor to build long-term wealth for meeting their life goals, these were essential.

These were a group of premier growth stocks, Xerox, IBM, Polaroid, & Coke. All of these stocks had proven growth records, decent increases in dividends (virtually none had cut its dividend since World War II), and high market capitalization.

The delusion was that these companies were so good it didn’t matter what you paid for them; their inexorable growth would bail you out. Remember: Growth will take care of everything! OR "so great that nothing bad could ever happen to them."

Just like any bubble. Investors conclude that you can make money by borrowing money to buy into this mania. As @sidd1307 will call about the current IPO saga. “Price doesn’t matter”. "Buy these stocks projected to have above-average earnings growth when they hit new highs "

These were considered the risk of paying too much to be minuscule compared with the risk of NOT buying these shares, even at a low price. Others like Union Carbide or General Motors, were uncertain because of their exposure to business cycles and competition.

Then investors became infatuated with these growth stocks that they pushed the prices of their favorites to unjustified heights. The dividend yields on the Nifty-Fifty averaged less than half the average yield on the 500 stocks in the S&P Index. But who cares about Dividends!

While most Nifty-Fifty did not surpass their 1972 bull-market peak until July 1980. When the Nifty Fifty bubble burst in 1974, mid-sized and smaller capitalisation stocks outperformed for nearly a decade.

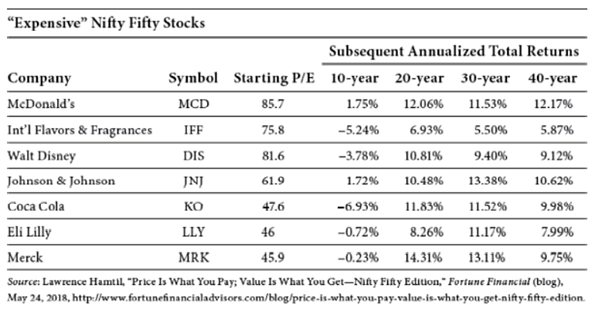

Burger King Fans can see the return of McD👇

Burger King Fans can see the return of McD👇

7 most recognizable tech names on the list—IBM, Texas Instruments, AMP, Xerox, Burroughs, Digital Equipment, and Polaroid—had truly awful returns ~6.4% per year for the 25 years following 1972. But the cheapest 25 by P/E had a return of 14.4% vs a return of 12.9% for S&P 500.

“A great company is not necessarily a great stock.” No matter how good or bad a company’s management, no matter how large or small a company’s profits, no matter how bright or bleak a company’s prospects—the attractiveness of a company’s stock depends on its price.

“Obviously the problem was not with the companies but with the temporary insanity of institutional money managers—proving again that stupidity well-packaged can sound like wisdom.

END NOTE: Go for GARP (Growth-at-reasonable-price), Not BAAP.

END NOTE: Go for GARP (Growth-at-reasonable-price), Not BAAP.

• • •

Missing some Tweet in this thread? You can try to

force a refresh