FinTwit Summit 2021

So far, excellent. Big congrats to @SeifelCapital & @dhaval_kotecha. Slick & fantastic!

Speakers are excellent !

@FintwitSummit

So far, excellent. Big congrats to @SeifelCapital & @dhaval_kotecha. Slick & fantastic!

Speakers are excellent !

@FintwitSummit

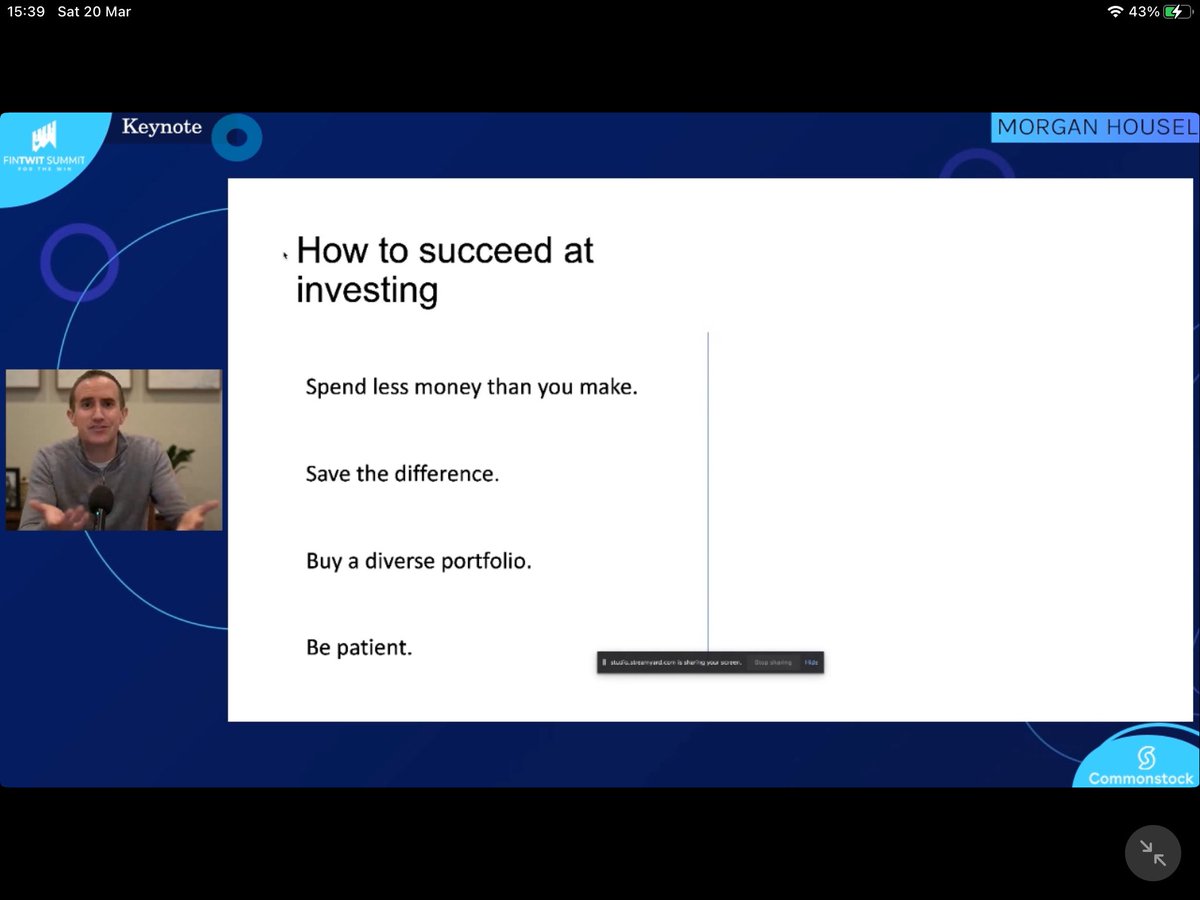

@morganhousel was great!

So much energy & wisdom

Loved the part about the simple & basic stuff that makes the difference in investing. That stuck out for me

If mkts closed for 5/10 yrs, and can only invest in 1 stock, it would be $BRK.A - Berkshire Hathaway. Diversification

So much energy & wisdom

Loved the part about the simple & basic stuff that makes the difference in investing. That stuck out for me

If mkts closed for 5/10 yrs, and can only invest in 1 stock, it would be $BRK.A - Berkshire Hathaway. Diversification

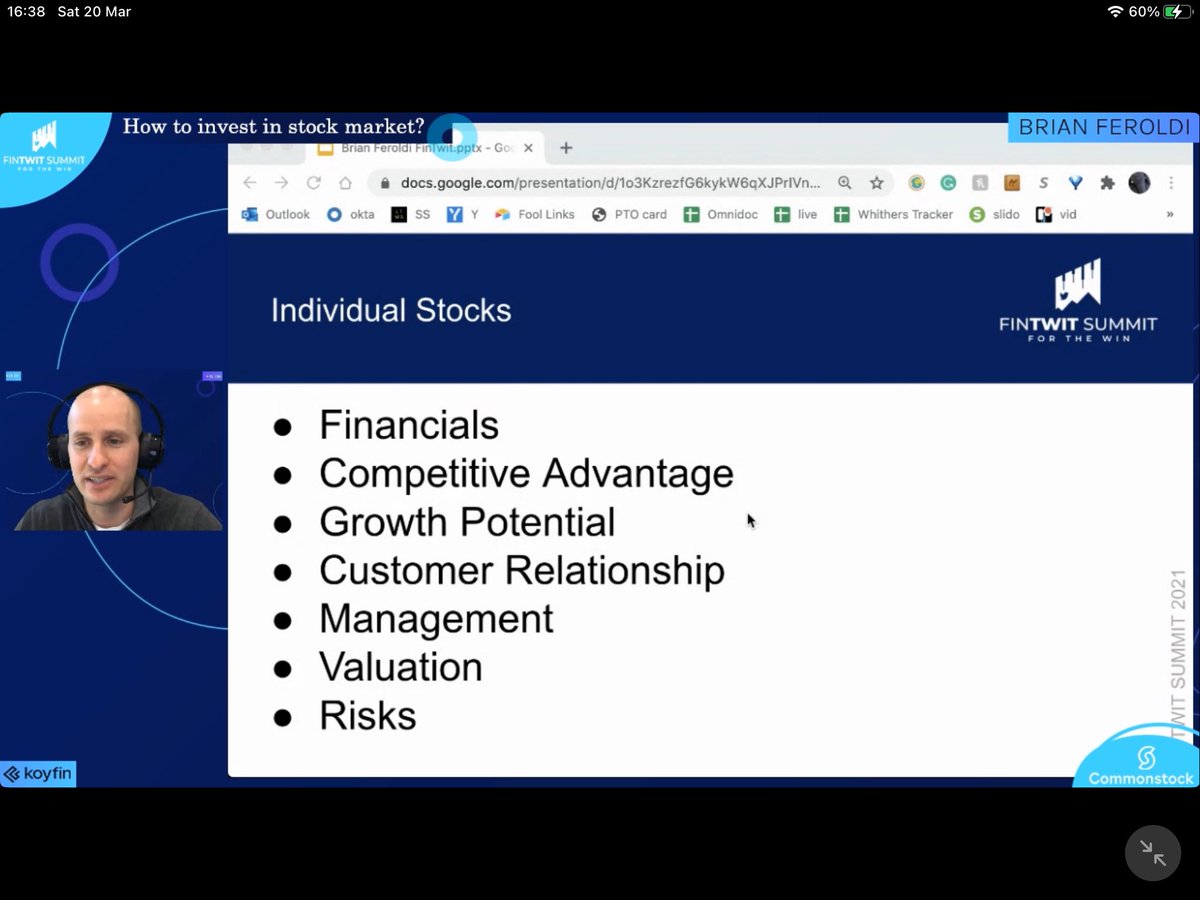

@BrianFeroldi - such passion & enthusiasm

Teaching the basics so well. Perfect sense!

And of course, Brian’s super checklist!

His single stock pick for 5/10yrs if mkts were to be closed - $MA - MasterCard - the commerce tollbooth

Teaching the basics so well. Perfect sense!

And of course, Brian’s super checklist!

His single stock pick for 5/10yrs if mkts were to be closed - $MA - MasterCard - the commerce tollbooth

@7Innovator - Simon Erickson

So well polished and one can see Simon’s passion

The 5 principles of disruption - very well explained with examples

His 5/10yr pick if mkts closed - $AMT - American Tower Corporation. Solidly supporting the operators in the 5G wave

So well polished and one can see Simon’s passion

The 5 principles of disruption - very well explained with examples

His 5/10yr pick if mkts closed - $AMT - American Tower Corporation. Solidly supporting the operators in the 5G wave

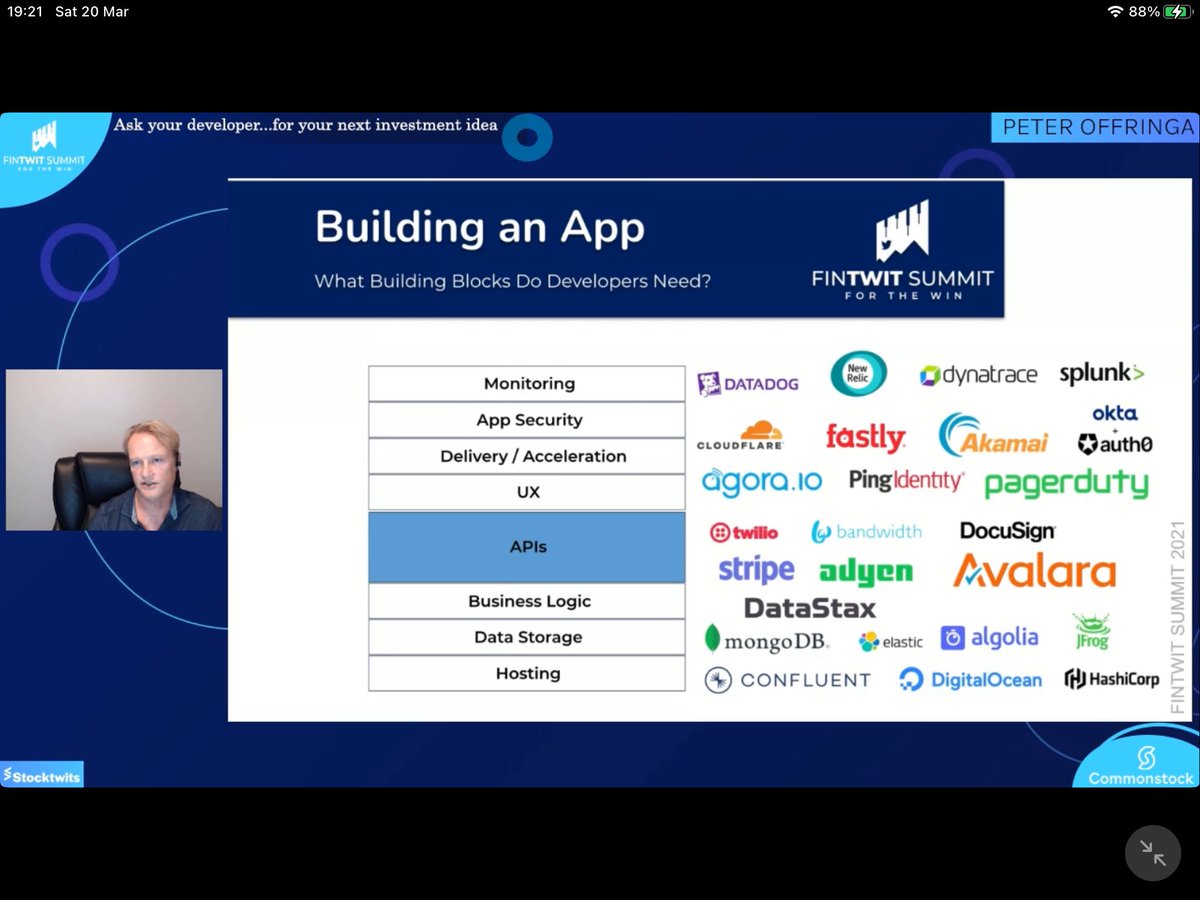

@StackInvesting - Peter Offringa

My word, AMAZING. Crystal clear. You’re a true expert in your field

Developer friendly is the way it’s going

Pay attn to rev g & product release cadence!

His pick for 5/10y if mkts closed - $TWLO - Twilio - Large TAM & culture of the team

My word, AMAZING. Crystal clear. You’re a true expert in your field

Developer friendly is the way it’s going

Pay attn to rev g & product release cadence!

His pick for 5/10y if mkts closed - $TWLO - Twilio - Large TAM & culture of the team

Next up - @danielsparks

Invest in high quality businesses for a long time

Enjoyed the example of $MSFT that still outperformed S&P500 even if bought from the 2000 peak

Invest in high quality businesses for a long time

Enjoyed the example of $MSFT that still outperformed S&P500 even if bought from the 2000 peak

@StockNovice - wow!

What a superb, helpful & practical presentation!

Managing your information on a company is key.

That co tracking spreadsheet is special 👌

His stock for 5/10y if the mkts are closed is $ZM - Zoom video. Platform with lots of potential!

What a superb, helpful & practical presentation!

Managing your information on a company is key.

That co tracking spreadsheet is special 👌

His stock for 5/10y if the mkts are closed is $ZM - Zoom video. Platform with lots of potential!

@OphirGottlieb - ask me anything for an hr

A real spectacle. Seeing Ophir talk live & explain his thoughts was amazing. Gem overload. 💎

Skill & experience sprinkled with fast humor

LOVED his thoughts on Edge Computing

His pick for 5/10y if mkts closed - $ROKU - strong g

A real spectacle. Seeing Ophir talk live & explain his thoughts was amazing. Gem overload. 💎

Skill & experience sprinkled with fast humor

LOVED his thoughts on Edge Computing

His pick for 5/10y if mkts closed - $ROKU - strong g

Closing day 1 was @koyfman from Koyfin on Macros

SUPERB! Rob explained all the main macro issues. Fed policy, stimulus, yield curves, rotation from growth to value

Yield curve slide & explan. was special!

5/10y pick if mkts closed - $UPWK - Upwork - gig Econ & globalization

SUPERB! Rob explained all the main macro issues. Fed policy, stimulus, yield curves, rotation from growth to value

Yield curve slide & explan. was special!

5/10y pick if mkts closed - $UPWK - Upwork - gig Econ & globalization

Forgot to include Daniel's pick for 5/10yrs if mkts were closed...

He picked $COST - Costco

Good mgmnt, high g, internet business doing well

He picked $COST - Costco

Good mgmnt, high g, internet business doing well

Day 2 kicked off with @RamBhupatiraju

What a pleasure to hear an experienced investor like Ram go through his thoughts & process

So many useful resources

Amazing Ram, thank you 🙏

His pick for 5/10y if mkts closed - $MELI - Mercado Libre - big TAM, not huge mkt cap, solid

What a pleasure to hear an experienced investor like Ram go through his thoughts & process

So many useful resources

Amazing Ram, thank you 🙏

His pick for 5/10y if mkts closed - $MELI - Mercado Libre - big TAM, not huge mkt cap, solid

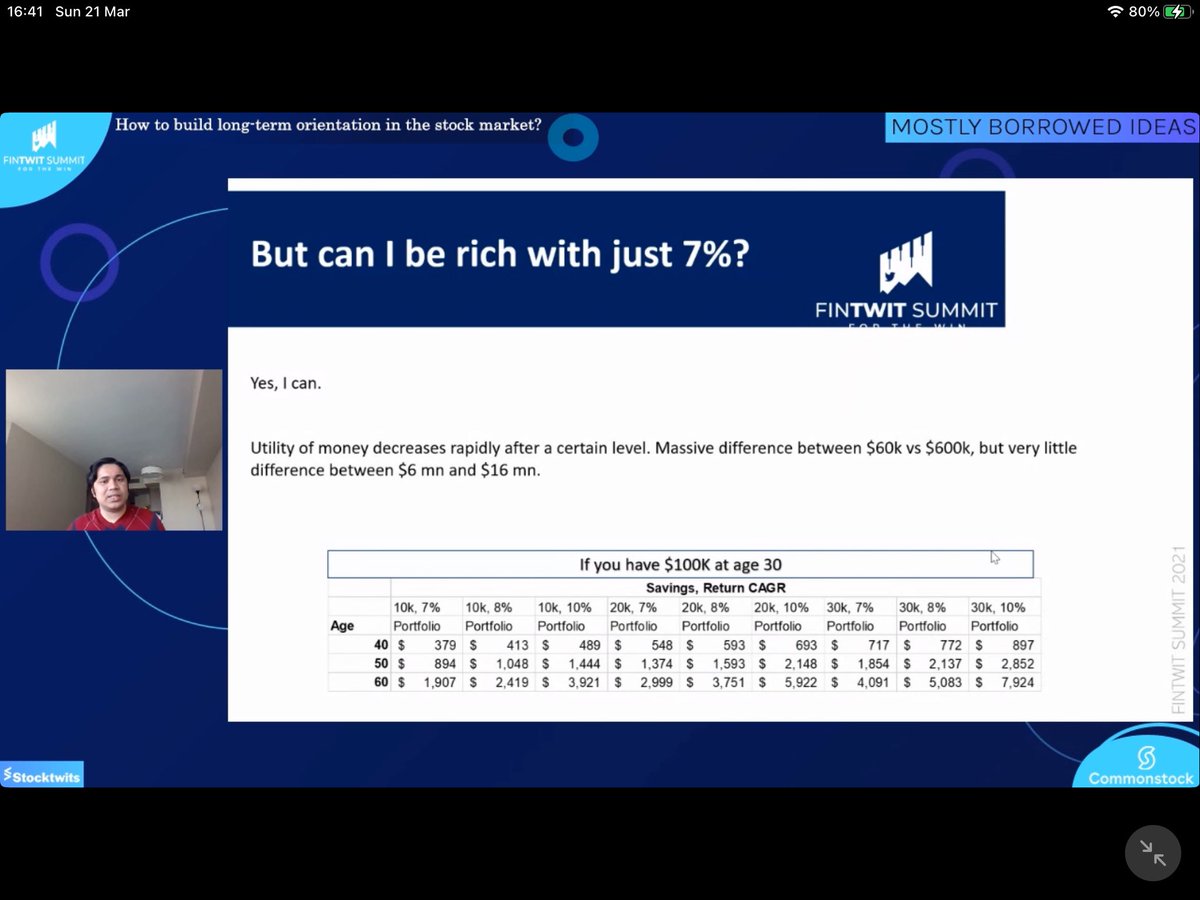

Next up @borrowed_ideas

Practical, sincere & some sobering thoughts

Very thought provoking, thanks MBI

Can I be rich with 7% inv CAGR?

Yes I can!

His pick for 5/10y if mkts closed is $BRK.A - Berkshire Hathaway - likely to beat mkt but if not, -> good dnside protection

Practical, sincere & some sobering thoughts

Very thought provoking, thanks MBI

Can I be rich with 7% inv CAGR?

Yes I can!

His pick for 5/10y if mkts closed is $BRK.A - Berkshire Hathaway - likely to beat mkt but if not, -> good dnside protection

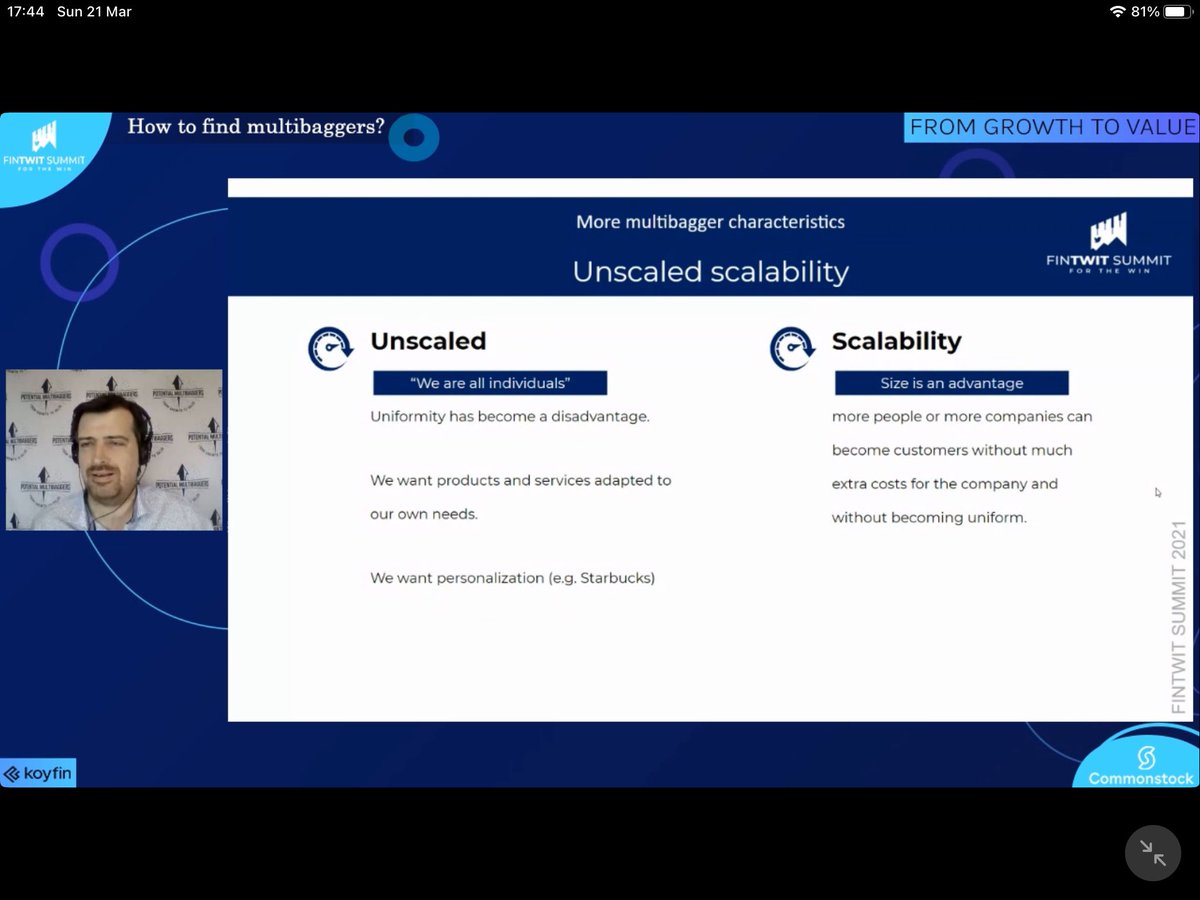

@FromValue - multi baggers

Special. You can see the passion & dedication

A visionary CEO & unscaled scalability are vital in multi baggers

I LOVED this presentation, thank you Kris 💪💎

His pick for 5/10y if mkts closed - $SE - Sea Limited - now a 6-headed monster!

Special. You can see the passion & dedication

A visionary CEO & unscaled scalability are vital in multi baggers

I LOVED this presentation, thank you Kris 💪💎

His pick for 5/10y if mkts closed - $SE - Sea Limited - now a 6-headed monster!

Next up @investing_city - on growing your circle of competence

Valuable tools for studying a new industry. Google, YouTube, Annual Reports...

And Ryan gave us a lovely glimpse into Genomics!

Pick for 5/10y if mkts closed - $SHOP - Shopify - resilient, O/S for entrepreneurs

Valuable tools for studying a new industry. Google, YouTube, Annual Reports...

And Ryan gave us a lovely glimpse into Genomics!

Pick for 5/10y if mkts closed - $SHOP - Shopify - resilient, O/S for entrepreneurs

Muji - @hhhypergrowth

Incredible presentation - Muji generously takes us through the stages of his inv thesis 💎

Looking for scale in execution & the platform

Humbling

Brilliant!

Thank you 🙏

His pick for 5/10y if mkts closed - $NET - Cloudflare - optionality & scale!

Incredible presentation - Muji generously takes us through the stages of his inv thesis 💎

Looking for scale in execution & the platform

Humbling

Brilliant!

Thank you 🙏

His pick for 5/10y if mkts closed - $NET - Cloudflare - optionality & scale!

@richard_chu97 on digital health

Awesome presentation & great insights 🙏

Super overview on Newtopia - small Canadian co

- making people healthier BEFORE they become chronic

His pick for 5/10y if mkts closed - $TDOC - Teladoc - well positioned, dominating the employer space

Awesome presentation & great insights 🙏

Super overview on Newtopia - small Canadian co

- making people healthier BEFORE they become chronic

His pick for 5/10y if mkts closed - $TDOC - Teladoc - well positioned, dominating the employer space

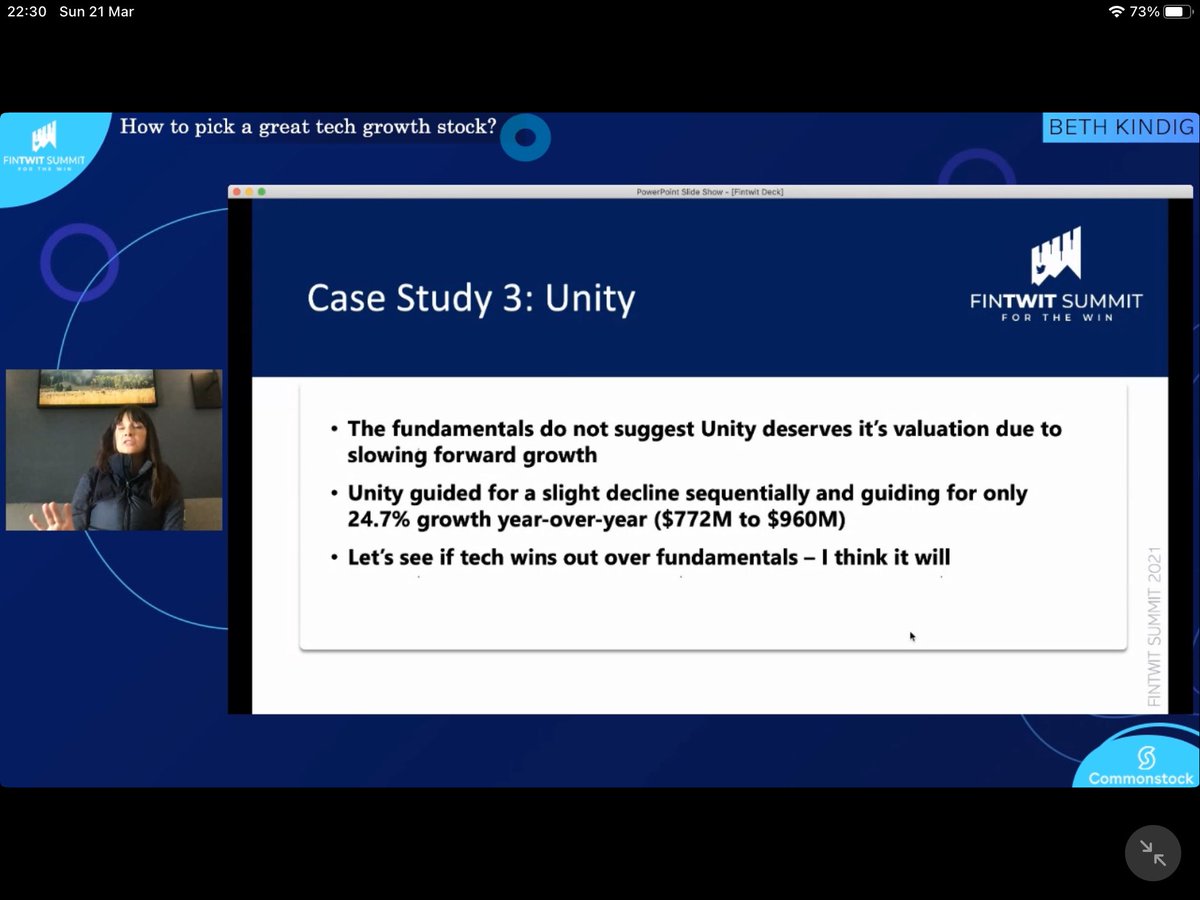

@Beth_Kindig

Wow, Beth has such a deep understanding of the trends & big shifts in tech

Loved her views on Cloud SW, Roku & Unity

Star pres. Beth, thank you🙏

Her pick for 5/10y if mkts closed - $NVDA - Nvidia - could be more valuable than Apple, no worry about dnside

Wow, Beth has such a deep understanding of the trends & big shifts in tech

Loved her views on Cloud SW, Roku & Unity

Star pres. Beth, thank you🙏

Her pick for 5/10y if mkts closed - $NVDA - Nvidia - could be more valuable than Apple, no worry about dnside

Closing FinTwit Summit 2021 - @10kdiver

Big applause 👏

Teaching us useful math models for investing.

Amazing 10K, you explain things so well. Love your style!

His pick for 5/10y if mkts closed - $BRK.A - Berkshire Hathaway. Stable CF, rational behavior, squeaky clean.

Big applause 👏

Teaching us useful math models for investing.

Amazing 10K, you explain things so well. Love your style!

His pick for 5/10y if mkts closed - $BRK.A - Berkshire Hathaway. Stable CF, rational behavior, squeaky clean.

• • •

Missing some Tweet in this thread? You can try to

force a refresh