0/ Last week, @shl and @ArlanWasHere raised $9.3M from 14,937 people.

This was a breakthrough moment, but we're just at the tip of the spear.

In this thread, I'm going to lay out the backstory, data & implications.

Punchline? VC is on the verge of being completely upended:

This was a breakthrough moment, but we're just at the tip of the spear.

In this thread, I'm going to lay out the backstory, data & implications.

Punchline? VC is on the verge of being completely upended:

1/ First, let’s set the stage.

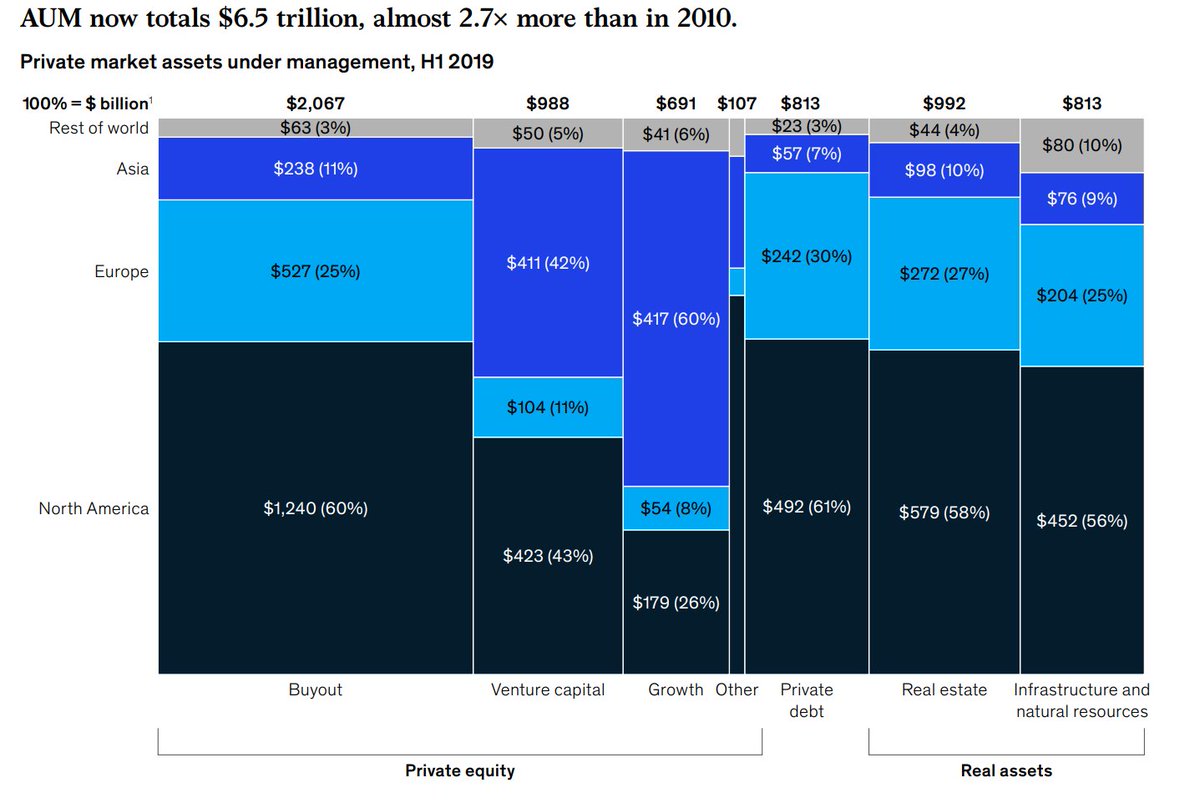

Over the last 10 years, private assets under management (AUM) have risen over 2.7x from ~$2.7T to $6.5T.

Private equity (including venture) alone has grown to $3.9T.

That's 1.3x of ALL private AUM from just 10 years ago.

Over the last 10 years, private assets under management (AUM) have risen over 2.7x from ~$2.7T to $6.5T.

Private equity (including venture) alone has grown to $3.9T.

That's 1.3x of ALL private AUM from just 10 years ago.

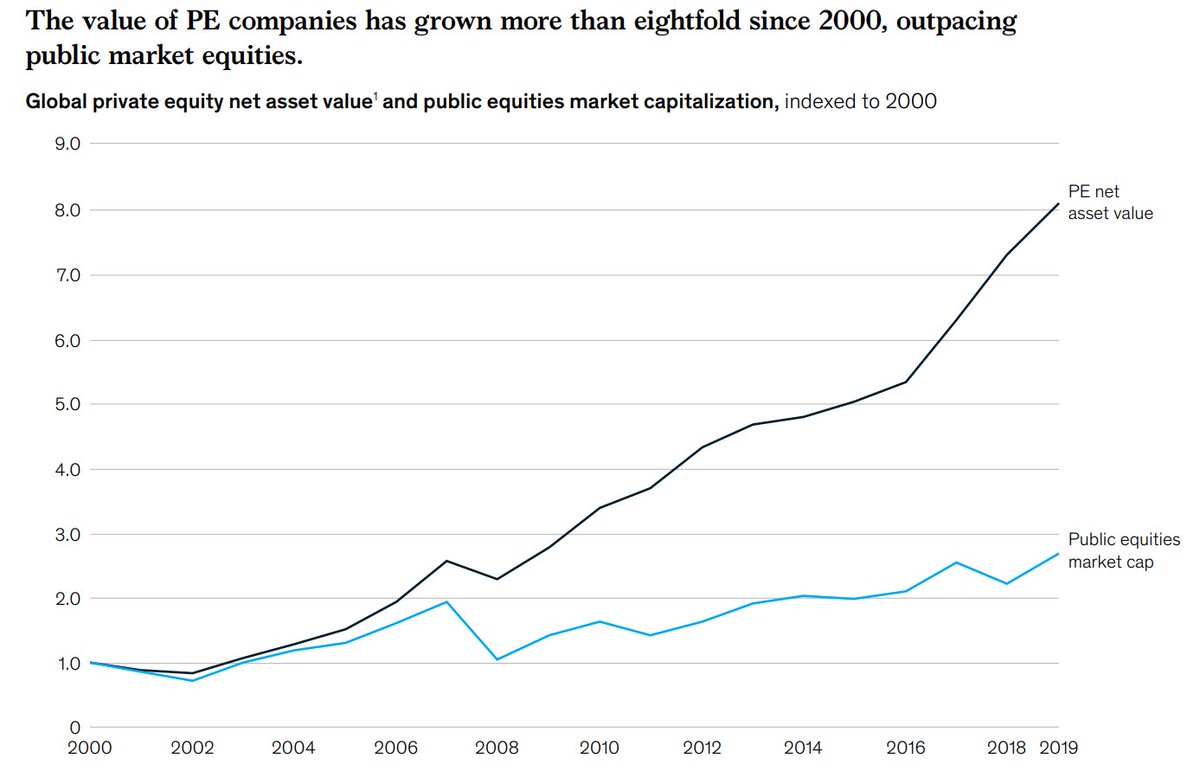

2/ At the same time, private company growth continues to dramatically outpace public equity.

Over the last 20 years, the value of private assets has grown nearly 8x. Meanwhile, public equities have grown by ~3x.

Over the last 20 years, the value of private assets has grown nearly 8x. Meanwhile, public equities have grown by ~3x.

3/ But while the opportunity for private market investing became significant, retail investors have been shut out.

Implication? The gains accrued to a tiny % of people (e.g. rich got richer).

But now, 3 things have changed that are breaking private markets open.

Implication? The gains accrued to a tiny % of people (e.g. rich got richer).

But now, 3 things have changed that are breaking private markets open.

4/ TREND #1: Technology

It’s a non-trivial problem to facilitate investments at scale.

You need: KYC/AML, identity verification, privacy, security, payments, custody and more.

Platforms like @joinrepublic built the "plumbing" and the marketplace to facilitate transactions.

It’s a non-trivial problem to facilitate investments at scale.

You need: KYC/AML, identity verification, privacy, security, payments, custody and more.

Platforms like @joinrepublic built the "plumbing" and the marketplace to facilitate transactions.

5/ TREND #2: Regulatory

In 2016, the SEC passed Reg CF - allowing private companies to raise $1.07M from non-accredited investors.

Last week, they updated Reg CF to now allow companies to raise up to $5M PER YEAR from non-accredited investors.

In 2016, the SEC passed Reg CF - allowing private companies to raise $1.07M from non-accredited investors.

Last week, they updated Reg CF to now allow companies to raise up to $5M PER YEAR from non-accredited investors.

6/ TREND #3A: Culture - Supply Side

In the creator / build in public era, it's now attractive for startups to raise from the crowd:

- Faster validation

- Passionate community

- Instant brand awareness

- Lower fidelity fundraising process (set your own terms)

In the creator / build in public era, it's now attractive for startups to raise from the crowd:

- Faster validation

- Passionate community

- Instant brand awareness

- Lower fidelity fundraising process (set your own terms)

7/ TREND #3B: Culture - Demand Side

Meanwhile, individuals are hungry to deploy capital and want to participate in growth. This is especially the case in a low interest rate environment.

Gamestop, Crypto, NFTs, Collectibles, etc. aren't fads, they're permanent trends.

Meanwhile, individuals are hungry to deploy capital and want to participate in growth. This is especially the case in a low interest rate environment.

Gamestop, Crypto, NFTs, Collectibles, etc. aren't fads, they're permanent trends.

8/ The puzzle pieces are coming together:

Tech - It's now feasible ✅

Regulatory - It's allowed at meaningful scale ✅

Culture - Startups + individuals want to participate ✅

Implication? Change is coming.

Here are the 5 immediate things that come out of this disruption:

Tech - It's now feasible ✅

Regulatory - It's allowed at meaningful scale ✅

Culture - Startups + individuals want to participate ✅

Implication? Change is coming.

Here are the 5 immediate things that come out of this disruption:

9/ FIRST - VC experiences "Innovator's Dilemma"

Top Tier Investors: Get stronger (they provide distinct value add - guidance, support, judgement)

Generic Investors: Totally screwed / most will fold

New Entrants: Equity CF, rolling funds, syndicates, angels will shine

Top Tier Investors: Get stronger (they provide distinct value add - guidance, support, judgement)

Generic Investors: Totally screwed / most will fold

New Entrants: Equity CF, rolling funds, syndicates, angels will shine

10/ SECOND - Reducing financing friction = an explosion of companies.

Common VC statement: "There are only X number of venture backable companies.”

Maybe. But there's a lot of room to run.

Believing we're close = believing we're close to the limit of human creativity

Common VC statement: "There are only X number of venture backable companies.”

Maybe. But there's a lot of room to run.

Believing we're close = believing we're close to the limit of human creativity

11/ THIRD - Individual brands will continue to⬆️

Individuals that have an audience and engage in public will continue to be increasingly attractive early stage partners for startups.

As friction is removed, a lot of the advantages institutions have erodes.

The game changes.

Individuals that have an audience and engage in public will continue to be increasingly attractive early stage partners for startups.

As friction is removed, a lot of the advantages institutions have erodes.

The game changes.

12/ FOURTH - We’re about to see more money than we’ve ever seen.

IPOs are unlocking massive liquidity. So where do the proceeds go? Right back into more companies.

It's completely logical - existing investors keep their chips at the table. New investors put chips to work.

IPOs are unlocking massive liquidity. So where do the proceeds go? Right back into more companies.

It's completely logical - existing investors keep their chips at the table. New investors put chips to work.

13/ FIFTH - Buyer Beware. The grifters are here.

There is going to be excess, euphoria and fluff. It will cause loss and we need to protect against this.

But stopping the analysis there misses the point - this is net positive sum:

⬆️companies = ⬆️growth = ⬆️value creation

There is going to be excess, euphoria and fluff. It will cause loss and we need to protect against this.

But stopping the analysis there misses the point - this is net positive sum:

⬆️companies = ⬆️growth = ⬆️value creation

14/ Republic’s tagline covers the zeitgeist of the moment perfectly: “Invest in the future, YOU believe in.”

The power shift to individuals is well on its way.

VCs say they like disruption. We’re about to find out how much they like it when they’re the ones getting disrupted.

The power shift to individuals is well on its way.

VCs say they like disruption. We’re about to find out how much they like it when they’re the ones getting disrupted.

• • •

Missing some Tweet in this thread? You can try to

force a refresh