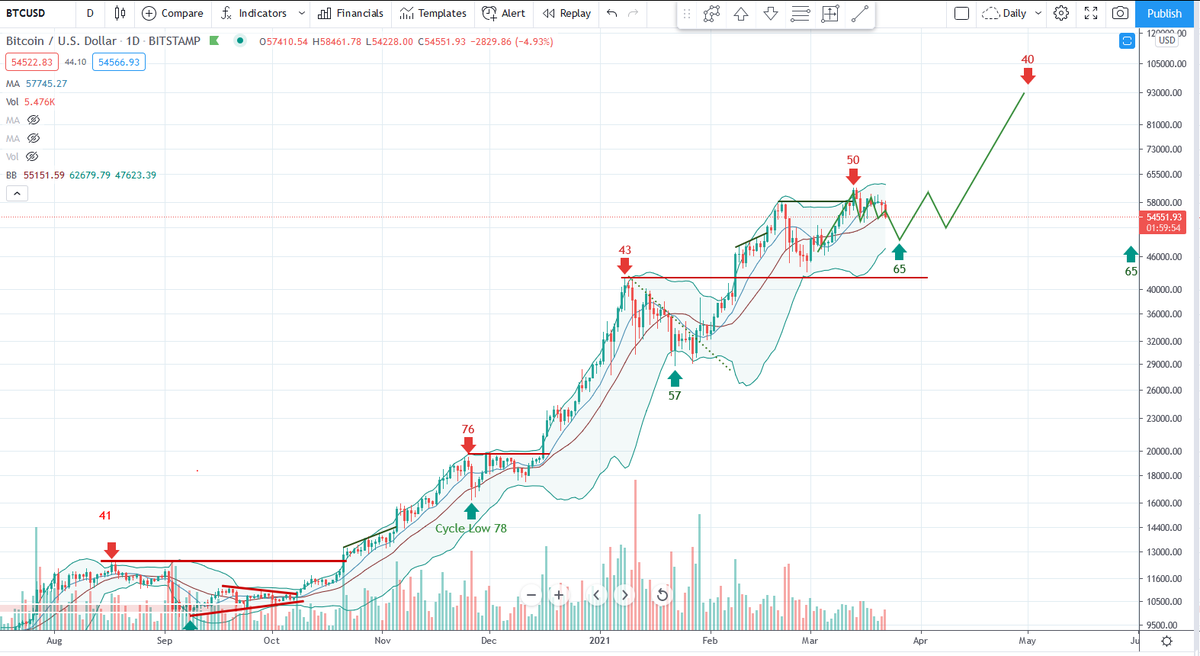

Waiting patiently. Day 59 of the #Bitcoin Cycle with a looming Cycle Low in focus. Day 50 bull trap behind us.

This is my preferred look at what's possibly coming up.

Lows can dip further than expected, and to be bought. Otherwise buy ATH break. (Traders)

This is my preferred look at what's possibly coming up.

Lows can dip further than expected, and to be bought. Otherwise buy ATH break. (Traders)

"IF"

If we get another 60-day Cycle that continues Oct-20 trend to $80k-$100k, then I believe we're going top with sizable 40-50% correction, that takes MANY (4-6) months to consolidate.

The entire 60-day cycle gain would be erased. Prefer 60-day consolidation from this point

If we get another 60-day Cycle that continues Oct-20 trend to $80k-$100k, then I believe we're going top with sizable 40-50% correction, that takes MANY (4-6) months to consolidate.

The entire 60-day cycle gain would be erased. Prefer 60-day consolidation from this point

Target hit, cycle on Day 64.

Now we can begin looking for Cycle Lows. "Lows can dip further than expected"

Not convinced until the fat lady sings.

Now we can begin looking for Cycle Lows. "Lows can dip further than expected"

Not convinced until the fat lady sings.

Interestingly, the 20-week moving average is at $36k, will be $39k within 2 weeks.

That level would certainly reveal who is swimming naked.

Yeah I know, institutions would never allow that. 😉

That level would certainly reveal who is swimming naked.

Yeah I know, institutions would never allow that. 😉

Progression of a cycle. Patience.

#Bitcoin

This is a new cycle. Question is does it take the same form (as the prior 3).

#Bitcoin

This is a new cycle. Question is does it take the same form (as the prior 3).

Still tracking this Cycle outlook. #bitcoin

12hr bollinger bands tightest since rally Oct2020 started. VOL down. Volumes low.

This 6-month rally has re-fueled (8th consolidating week at $1T mcap zone). Time to reveal intentions. Close below $53k get worried.

12hr bollinger bands tightest since rally Oct2020 started. VOL down. Volumes low.

This 6-month rally has re-fueled (8th consolidating week at $1T mcap zone). Time to reveal intentions. Close below $53k get worried.

#bitcoin Cycle progression, going to plan. They're not always this neat.

Nothing more one can do, but sit tight and wait. No stress, out of your control. $BTC

Nothing more one can do, but sit tight and wait. No stress, out of your control. $BTC

• • •

Missing some Tweet in this thread? You can try to

force a refresh