Position Trader, Entrepreneur, Family Man, Fullfilled. Omnia mea mecum porto.

10 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/BobLoukas/status/1539241492644077570

"IF" correct, Silver will put in a classic bear trap.

"IF" correct, Silver will put in a classic bear trap.

https://twitter.com/BobLoukas/status/1068127618636107776?s=20

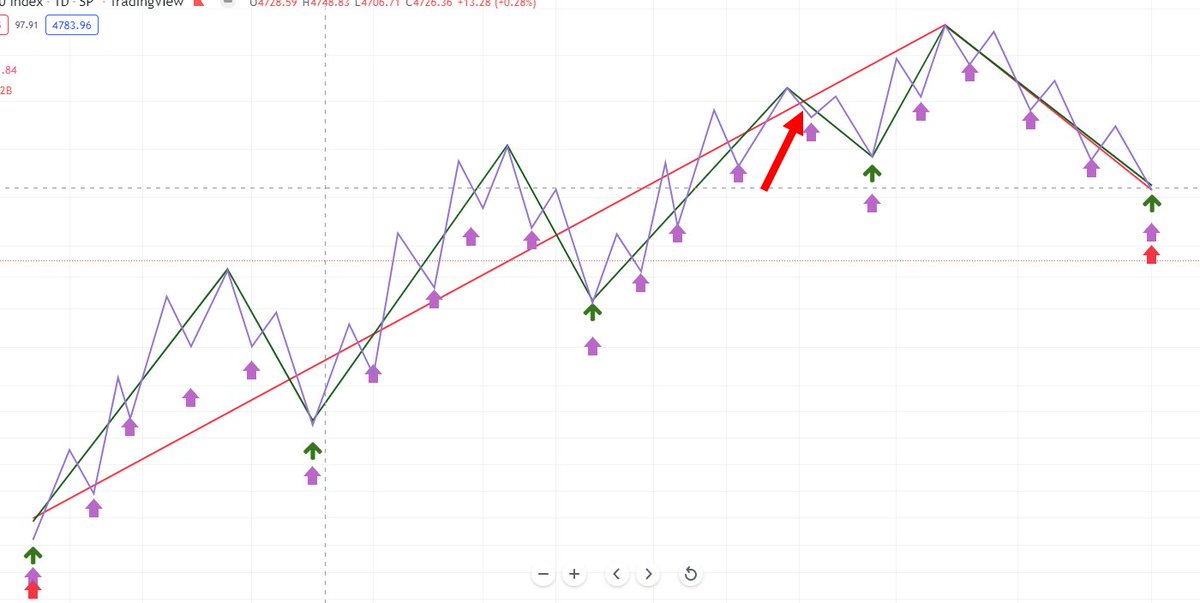

But price always one's challenge. Same chart, but notice where top of the Cycle is below, it's already occurred. Both are VALID Cycles

But price always one's challenge. Same chart, but notice where top of the Cycle is below, it's already occurred. Both are VALID Cycles

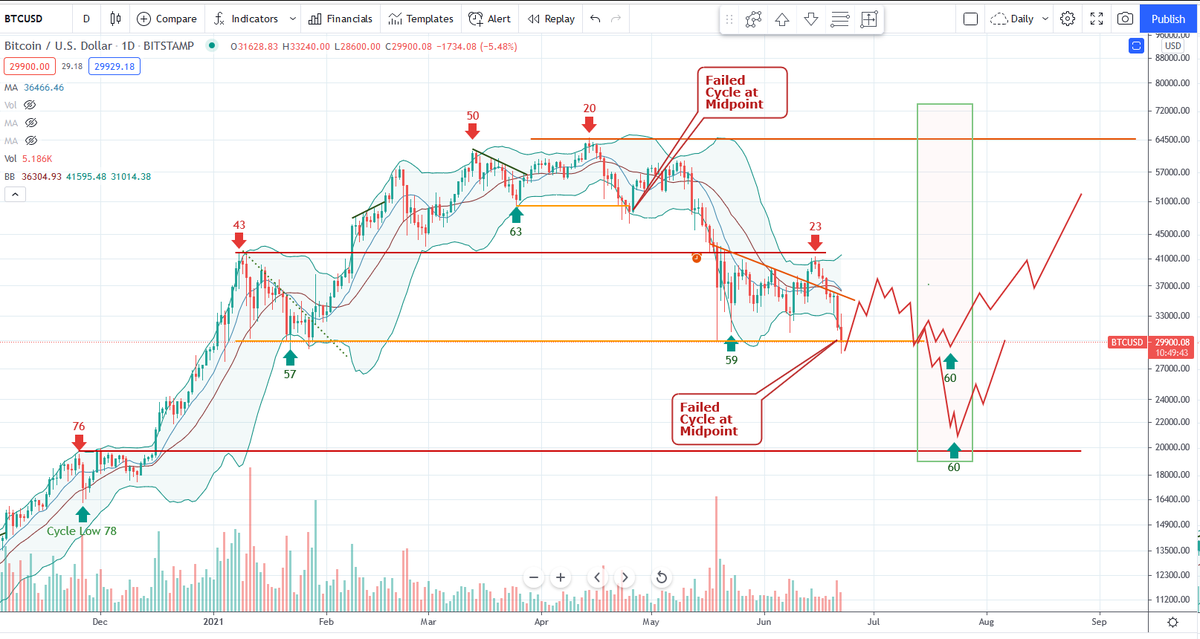

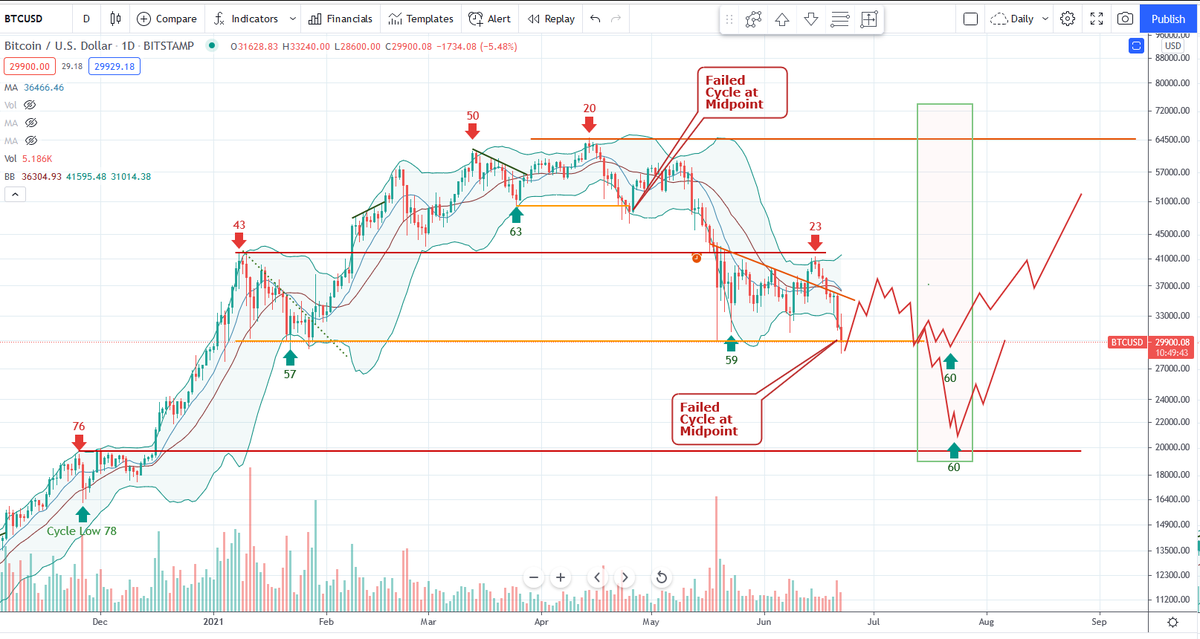

https://twitter.com/BobLoukas/status/1407326136552542212"IF" we're on Day 2 of a new Cycle, then we can start to look forward another 60-days.

Sorry I don't make the cycle rules, this is just the reality. Sometimes the cycle picture isn't clean and it's more of a guess. In this case, the Cycles are very clean.

Sorry I don't make the cycle rules, this is just the reality. Sometimes the cycle picture isn't clean and it's more of a guess. In this case, the Cycles are very clean.